Different Order Types in Spot Trading

2023/05/25 17:38:05

Spot trading supports the following 4 order types: Limit order, Market order, Stop-Limit order, and Trailing Stop order.

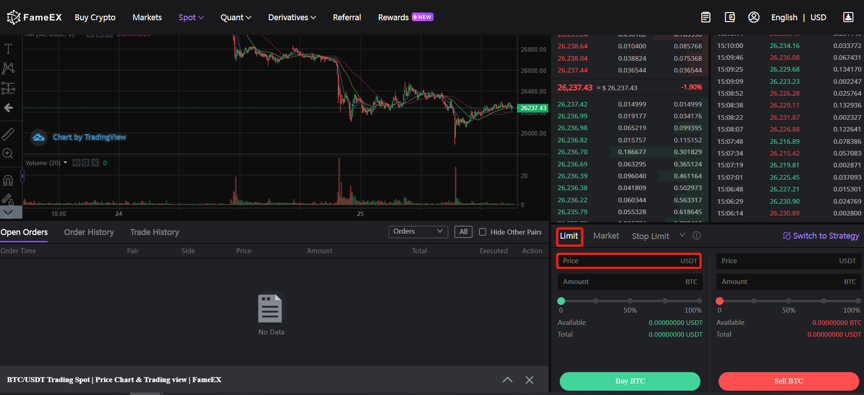

1. Limit Order

A limit order refers to a user-defined order in which they specify the quantity and maximum bid or minimum ask price. The order will only be executed when the market price falls within the designated price range.

• The buy limit price must not exceed 110% of the last price.

• The sell limit price must not be 90% less than the last price.

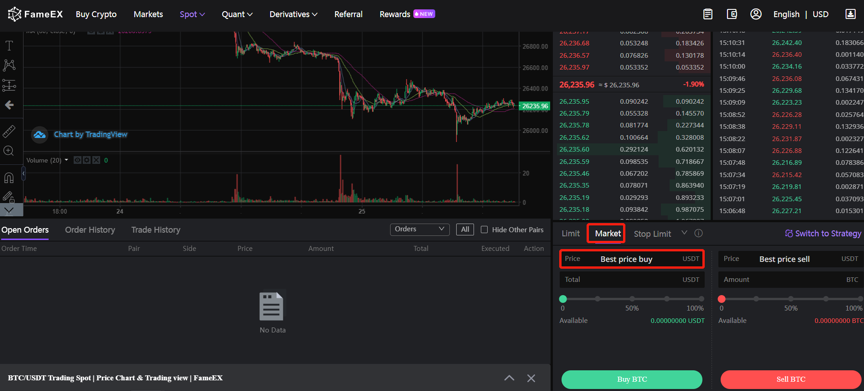

2. Market Order

A market order refers to a user executing buy or sell orders instantly at the prevailing best market price in the current market, aiming for a swift and fast transaction.

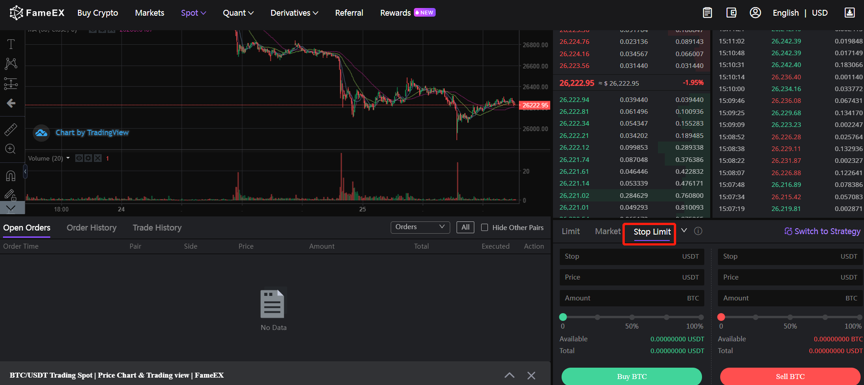

3. Stop-Limit Order

Stop-Limit orders involve the user pre-setting the trigger price, order price, and quantity of orders. When the market price reaches the trigger price, the system will automatically execute orders based on the pre-determined order price and quantity, assisting the user in preserving profits or minimizing losses.

• The buy stop-limit price must not exceed 110% of the trigger price.

• The sell stop-limit price must not be less than 90% of the trigger price.

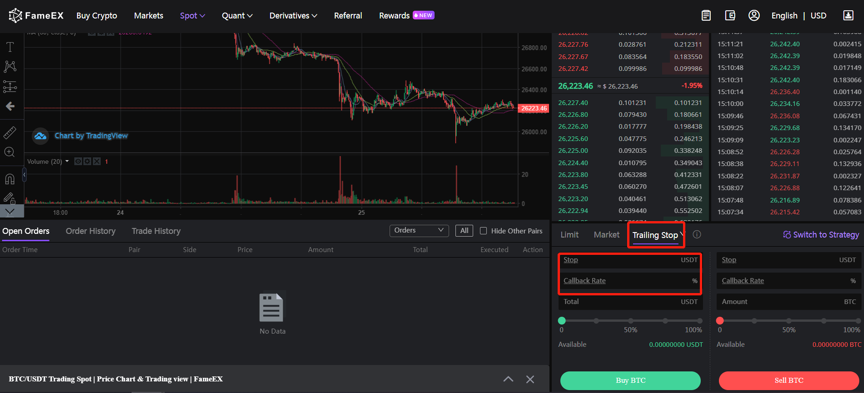

4. Trailing Stop Order

In the case of a significant market callback, a Trailing Stop Order will be activated and sent to the market at the current market price once the last filled price hits the specified trigger price and the required callback ratio is satisfied.

To put it simply, when executing a buy order, the last filled price must be less than or equal to the trigger price, and the callback range must be higher than or equal to the callback ratio. In this case, the buy order will be made at the market price. For a sell order, the last filled price must be higher than or equal to the trigger price, and the callback range must be higher than or equal to the callback ratio. The sell order will then be executed at the market price.

To prevent users from inadvertently placing orders that could result in avoidable losses, FameEX has implemented the following restrictions on Trailing Stop order placement:

1) For a buy order, the trigger price cannot be higher than or equal to the last filled price.

2) For a sell order, the trigger price cannot be less than or equal to the last filled price.

3) The callback ratio limitation: it can be set within a range of 0.01% to 10%.