Stella(ALPHA)

Stella(ALPHA)

ALPHA (Stella) Token Price & Latest Live Chart

2024-06-04 09:35:30

Discover the latest ALPHA price with FameEX's ALPHA/USD Price Index and Live Chart. Keep up-to-date with the current market value and 24-hour changes, as well as delve into Stella's price history. Start tracking ALPHA price today!

What is ALPHA (Stella)?

ALPHA is a DeFi protocol designed to offer leveraged trading strategies and lending services without the traditional costs associated with borrowing. Launched in 2020 and rebranded from Alpha Venture DAO, Stella aims to enhance the decentralized finance (DeFi) ecosystem by enabling users to amplify their yield farming returns and provide liquidity with greater efficiency. The protocol is underpinned by its innovative Pay-As-You-Earn (PAYE) model, which eliminates the upfront cost of borrowing and instead charges fees only when leveraged positions generate profits. This model incentivizes responsible leverage and ensures that both borrowers and lenders benefit from successful trading strategies.

Stella's architecture comprises two main components: Stella Strategy and Stella Lend. Stella Strategy allows users to engage in leveraged trading without incurring borrowing costs, thereby potentially increasing their yields from DeFi protocols. The strategy component is further enhanced by the Hypernova upgrade, which introduces Hyper and Standard strategy types, catering to both high-risk, high-reward seekers and those preferring a more conservative approach. On the other hand, Stella Lend enables users to lend their assets to liquidity pools, earning real yields that are directly linked to the success of the leveraged strategies employed by borrowers. This symbiotic relationship is designed to incentivize lending and contribute to the overall liquidity and stability of the DeFi market.

The ALPHA coin is central to the Stella ecosystem, serving as more than just a utility token. It is deeply integrated into the protocol, providing holders with benefits such as protocol security, governance rights, and a share of protocol fees and yields. The tokenomics of ALPHA are structured to support the protocol's development, incentivize ecosystem participation, and reward stakeholders. With a maximum supply of 1 billion tokens, ALPHA is distributed across various categories, including liquidity mining, team and advisors, and ecosystem initiatives. The cross-chain functionality of ALPHA extends its utility across multiple blockchain networks, making it a versatile asset for users engaging with Stella's offerings on platforms like Ethereum, BNB Smart Chain, Avalanche C-Chain, and Arbitrum. Stella's innovative approach to leveraged DeFi, combined with the multifaceted utility of the ALPHA coin, positions it as a forward-thinking solution within the rapidly evolving DeFi landscape.

How does ALPHA (Stella) work?

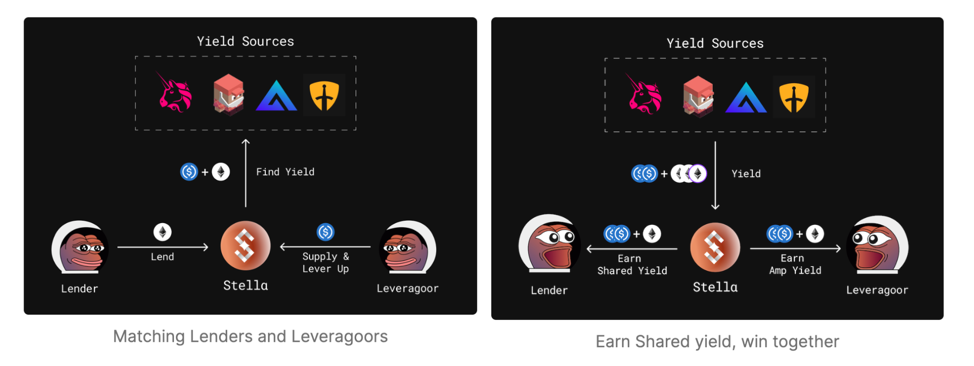

ALPHA operates on a unique financial model that differentiates it from traditional DeFi lending platforms. At its core, Stella's mechanism is designed to optimize leveraged yield farming strategies without the conventional overhead of borrowing interest rates. This is achieved through the implementation of the PAYE model, which aligns the incentives of leveragoors and lenders in a symbiotic relationship.

The protocol is made up of two parts: Stella Strategy and Stella Lend, source: ALPHA whitepaper

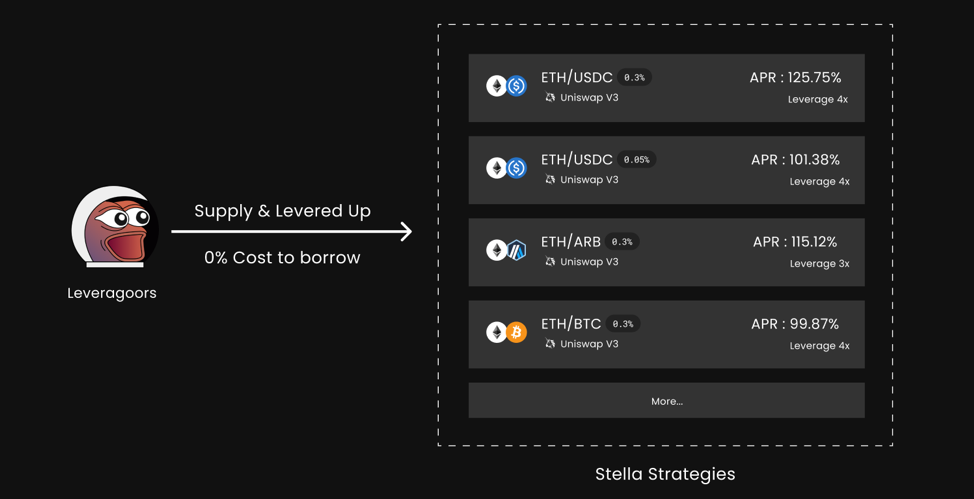

Stella Strategy

The Stella Strategy component of the protocol allows leveragoors to engage in leveraged yield farming without the upfront cost of borrowing interest. Instead, leveragoors agree to share a portion of the profits they realize from their strategies when they close their positions. This means that if a leveragoor does not make a profit, they do not owe anything to the lenders, adhering to the principle of "No gain = No pay." This risk-sharing approach encourages leveragoors to participate in various DeFi strategies with the potential for high returns, as they only pay out from their earnings.

Stella Strategy offers various type of strategies built on top of multiple DeFi protocols for leveragoors to find yield, source: ALPHA whitepaper

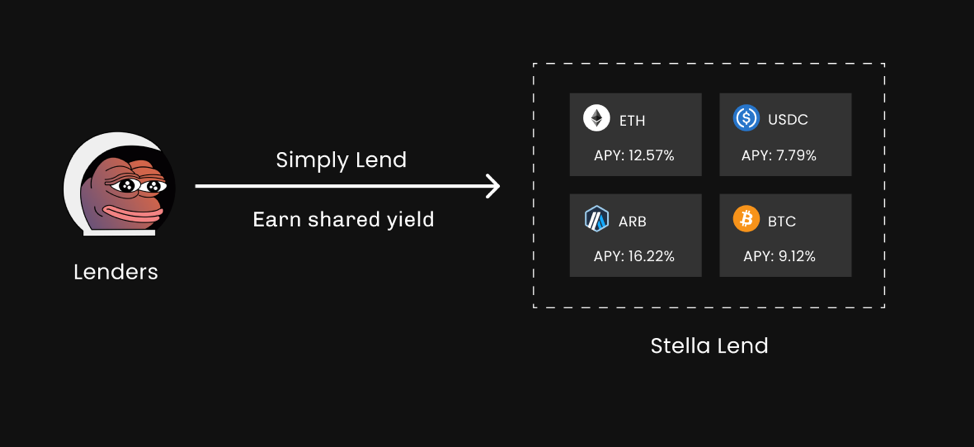

Stella Lend

On the lending side, Stella Lend enables users to deposit assets into lending pools, which are then utilized by leveragoors. Lenders benefit from this arrangement by earning a real yield, which is a share of the profits generated by the leveraged strategies. Unlike traditional lending protocols that cap the lending APY, Stella's model ensures that lenders can earn yields without a maximum cap, as the APY is directly tied to the success of the leveraged strategies. This creates an attractive opportunity for lenders to earn higher returns compared to other platforms where returns are often limited by predetermined interest rates.

Stella Lend offers multiple assets for Lenders to earn passive yield, source: ALPHA whitepaper

The Synergy of PAYE

The PAYE model is the cornerstone of Stella's protocol, fostering a cooperative environment where both leveragoors and lenders prosper. Leveragoors are incentivized to pursue profitable strategies, as their success translates to higher earnings for lenders. Conversely, lenders are incentivized to provide capital to the protocol, knowing that their returns are linked to the actual performance of the leveraged positions. This performance-based approach to DeFi lending and borrowing is designed to ensure that all parties are fairly compensated based on the tangible results of the leveraged strategies, creating a dynamic and efficient marketplace within the Stella ecosystem.

ALPHA (Stella) market price & tokenomics

ALPHA, the native token of the Stella protocol, plays a pivotal role in the ecosystem's operations and governance. The total supply of ALPHA tokens is capped at 1,000,000,000. The distribution of these tokens is meticulously planned to serve the platform's diverse stakeholders.

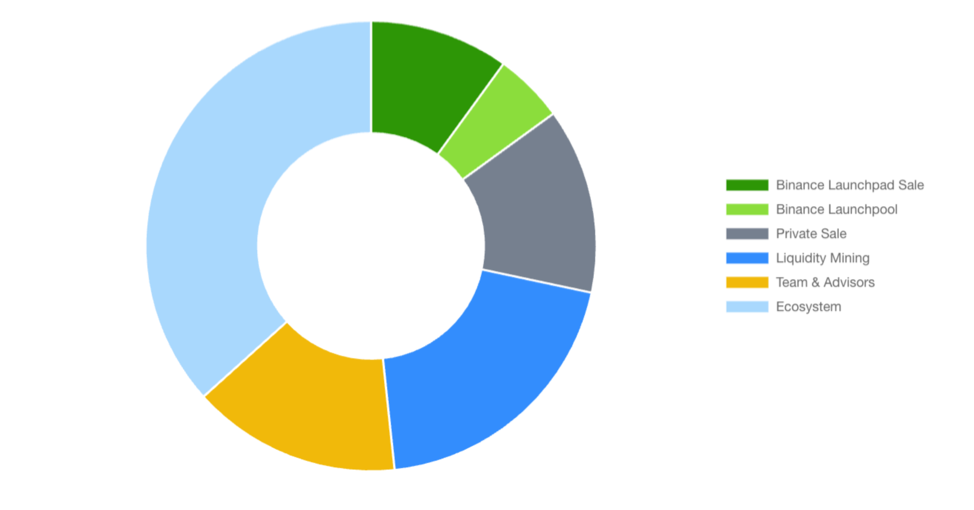

ALPHA token supply distribution, source: ALPHA whitepaper

ALPHA serves multiple functions within the Stella ecosystem, including governance, staking, and as a medium of exchange. Token holders can participate in the governance of the protocol by voting on proposals that shape the future of the platform. This democratic process ensures that the community has a say in key decisions, fostering a decentralized and community-driven approach. Additionally, ALPHA can be staked to earn rewards, providing an incentive for users to hold the token and contribute to the security and liquidity of the protocol. The integration of ALPHA within the Stella platform's various features and services enhances its utility and can positively impact its market valuation over time. As of now, ALPHA (Stella) is ranked #445 by CoinMarketCap with market capitalization of $103,839,810 USD. The current circulating supply of ALPHA coins is 870,000,000.

Why do you invest in ALPHA (Stella)?

Investing in ALPHA can be appealing for several reasons, each reflecting the protocol's innovative approach to DeFi and its potential for growth within the sector. The primary attraction for investors is Stella's Pay-As-You-Earn (PAYE) model, which disrupts traditional lending by eliminating upfront borrowing costs and instead charging fees based on the success of leveraged positions. This model not only encourages responsible leverage but also fosters a symbiotic relationship between borrowers and lenders, potentially leading to a more sustainable and equitable DeFi ecosystem.

For yield-oriented investors, Stella's leveraged strategies offer an opportunity to amplify returns through Stella Strategy, which enables leveraged trading without the burden of interest payments. This feature is particularly enticing for those looking to capitalize on market movements with potentially higher rewards. Complementing this, Stella Lend provides a platform for users to earn passive income by contributing to lending pools, where yields are generated from the success of leveraged strategies, ensuring a dynamic and performance-linked income stream for lenders.

The ALPHA token itself is a key component of the Stella ecosystem, offering more than just a speculative asset. It serves as a means for investors to engage with the protocol's governance, contribute to its security by staking, and benefit from a share of protocol fees and yields. The token's cross-chain functionality further enhances its appeal by allowing users to seamlessly access Stella's services across multiple blockchains, thus catering to a broader market and providing greater flexibility for token holders.

Investors may also be drawn to Stella's strategic partnerships and its commitment to innovation, which could signal robust growth potential and an expanding user base. The prospect of gaining early access to new projects incubated by Stella is another incentive for investors looking to be at the forefront of emerging opportunities in the DeFi space.

Is ALPHA (Stella) a good Investment?

Determining whether ALPHA is a good investment depends on various factors, including an individual's investment goals, risk tolerance, market conditions, and the project's fundamentals. Stella's innovative PAYE model offers a potentially sustainable approach to leveraged yield farming and trading, which could attract users and investors, increasing demand for the ALPHA token. The Total Value Locked (TVL) in Stella is an indicator of platform adoption and success, suggesting a growing traction that might positively impact the value of ALPHA. Additionally, the ALPHA token's utility within the Stella ecosystem, such as governance, staking rewards, and access to new projects, adds value and could incentivize long-term holding. Strategic partnerships with other DeFi projects and blockchain networks, along with cross-chain capabilities, further enhance its potential user base and use cases, contributing to the token's long-term viability and price appreciation.

However, it is crucial for potential investors to recognize the risks associated with investing in cryptocurrencies and DeFi projects, including market volatility, regulatory uncertainties, and technical risks related to smart contracts. Stella's risk management strategies, like strategy-specific borrowing caps and robust smart contracts, can influence investor confidence by mitigating some concerns associated with DeFi investments. The evolving regulatory environment for cryptocurrencies and DeFi platforms can also significantly affect investment outcomes. While the long-term sustainability of Stella's zero-cost borrowing and its ability to consistently deliver attractive yields are critical for its success, investors should perform due diligence, consider their investment horizon, and diversify their investments to manage risk effectively. Ultimately, the decision to invest in ALPHA should be based on a comprehensive evaluation of these factors and a clear understanding of one's own risk tolerance and investment objectives.