The Solana (SOL) Price Is Declining, Yet Network Operation Indicates Strength

2024-02-02 19:17:30

Solana's native token, SOL, has encountered volatility in the past two weeks, with a 9.8% decline observed between Jan. 30 and Feb. 1.

Source: www.theblock.co

Despite multiple attempts, SOL has been unable to surpass the $104 resistance, marking the fifth unsuccessful attempt in four weeks. Looking at a broader perspective, SOL has experienced a 10.7% drop over a 30-day period, contrasting with Ether (ETH) and BNB, which exhibited declines of 1.2% and 2.6%, respectively, during the same timeframe. Despite the price challenges, the network's user activity continues to rise, raising questions among investors about the reasons behind SOL's underperformance, particularly considering the robust fundamentals of the Solana network.

Regional Banks In The US Are Risky For The Markets, Especially Cryptocurrency

On a broader scale, the cryptocurrency market has been facing challenges following the U.S. Federal Reserve's decision on Jan. 31 to maintain unchanged interest rates at 5.25%. The central bank emphasized that this target range would persist until there is greater confidence that inflation is moving sustainably toward 2%. Concerns have arisen among investors about the potential acceleration of the crisis in U.S. regional banks, particularly due to the considerable pressure on these institutions stemming from fixed-income portfolios yielding below the current interest rate.

Shares of New York Community Bancorp (NYCB), which acquired the collapsed crypto-friendly Signature Bank in 2023, have experienced a 42% decline since Jan. 30, following the reporting of a $260 million loss in the fourth quarter of 2023. The collapse of Signature Bank in March 2023 and its subsequent takeover by the New York Department of Financial Services (NYDFS) have heightened contagion risks, drawing attention from traders and investors, including exchange co-founder Arthur Hayes.

Hayes anticipates an initial negative impact on Bitcoin if the Fed does not swiftly implement a bailout. However, the aftermath for cryptocurrencies could turn positive as investors heighten their inflation expectations. Whether the stimulus takes the form of a renewed Bank Term Funding Program (BTFP) or a cash injection through the NYDFS, the overall effect would entail more money flowing into the monetary system.

Why Is The Price of SOL Lower?

The inquiry into the significance of the $104 resistance for Solana prompts an exploration beyond its ecosystem, pointing to a comparable market capitalization with its direct competitor, BNB. At this level, Solana holds a market capitalization of $45 billion, aligning with BNB's valuation. However, when considering the total value locked (TVL), BNB Chain surpasses Solana, with a TVL of $3.54 billion, more than double Solana's $1.6 billion, as reported by DeFiLlama.

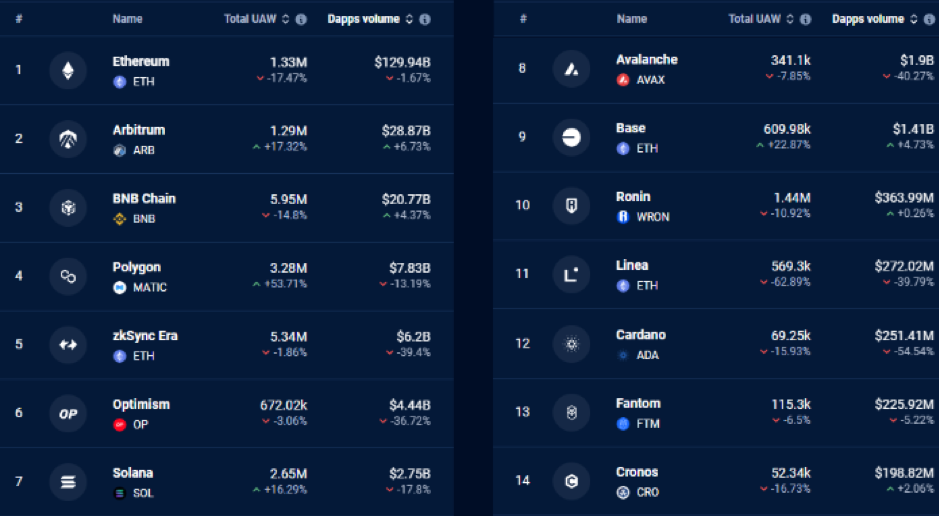

Leading blockchains based on 30-day DApp volume. Source: DappRadar

Solana faces a notable discrepancy in decentralized applications (DApps) activity compared to BNB Chain. BNB Chain's total active addresses engaging with DApps (UAW) reached 3.3 million in 30 days, a figure significantly exceeding Solana's 2.65 million. Similarly, the 30-day volume for BNB Chain's DApps amounted to $20.8 billion, in stark contrast to Solana's $2.75 million.

Recent attention on the Solana network has centered around the Jupiter (JUP) airdrop on Jan. 31, currently holding an $800 million market capitalization. The successful launch of the Jupiter decentralized exchange (DEX) aggregator received acclaim from Solana Foundation members, processing millions of transactions seamlessly. Over 438,000 addresses have claimed their JUP airdrop, with 9,391 of them receiving over 5,000 JUP, equivalent to $3,000 at current prices.

Excluding the inflated numbers attributed to Jupiter's airdrop, it's evident that several Solana DApps are witnessing significant user growth. Notable examples include MeanFi, MarginFi, Wormhole, Drift Protocol, Kamino Finance, and Jito. This surge in activity underscores the strength of Solana's network and suggests there are no signs of weakness. As for the possibility of SOL surpassing $104 and eventually rivaling BNB, this remains an unanswered question. Solana must demonstrate its capability to compete among the top three networks in terms of TVL and trading volumes to make such a leap.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.