DOJ and SEC to Investigate SVB Collapse and Insider Stock Trades According to a Report

2023-03-15 17:27:35

Although the investigations are independent of one another, they will both examine Silicon Valley Bank's failure and the shares that executives sold before it did.

Source: www.ekoturk.com

The Securities Exchange Commission (SEC) and the US Justice Department are apparently looking into the abrupt demise of Silicon Valley Bank (SVB), which was shut down by authorities last week amid an unprecedented bank run.

The Wall Street Journal reported on March 14 that the investigations will examine both the stock transactions that SVB finance managers made in the weeks before the bank's liquidation, and the circumstances that led to the bank's failure.

A few onlookers were outraged to learn from securities filings that the bank's CEO Greg Becker and CFO Daniel Beck sold shares two weeks before the bank's demise.

According to Newsweek, Becker sold $3.6 million worth of shares on February 27 while Beck sold $575,180 worth of stock on the same day. During the previous two years, SVB executives and directors have sold $84 million worth of shares, according to CNBC. But, the investigations are still in their early stages and could not result in any charges or accusations of misconduct, the persons added.

NPR cited another source who had firsthand knowledge of the matter when reporting that the Justice Department will likely make a formal statement soon. The SEC and the Justice Department were contacted by Cointelegraph, but neither party responded right away.

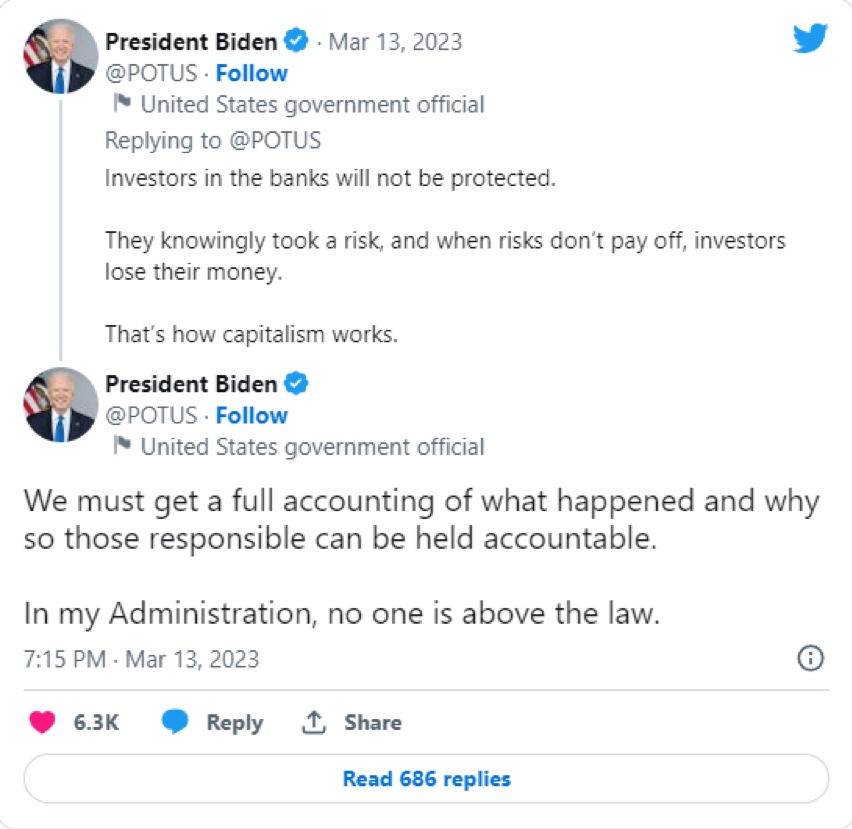

Tweet by President Biden

Gary Gensler, the chairman of the SEC, issued a stern warning just two days after Silicon Valley Bank failed, saying that the regulator will be on the watch for anybody breaking American securities rules.

We will investigate and launch enforcement proceedings if we uncover breaches of the federal securities laws, Gensler stated, without mentioning any specific entities or people.

The Silicon Valley Bank Was Only the Tip of The Financial Iceberg

The U.S. Federal Reserve is also investigating the bank's failure in its own particular way, focusing on the supervision and regulation it provided the now-defunct financial institution.

In the meanwhile, SVB Financial Group and two executives are allegedly being sued on March 13 by shareholders who claim they were misled about how rising interest rates would make the bank "especially susceptible" to a bank run.

For SVB stockholders from June 16, 2021 to March 10, 2023, damages are sought in the complaint.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.