FameEX Weekly Market Trend | February 24, 2025

2025-02-24 17:54:45

1. Key Insights on Crypto Market Trends

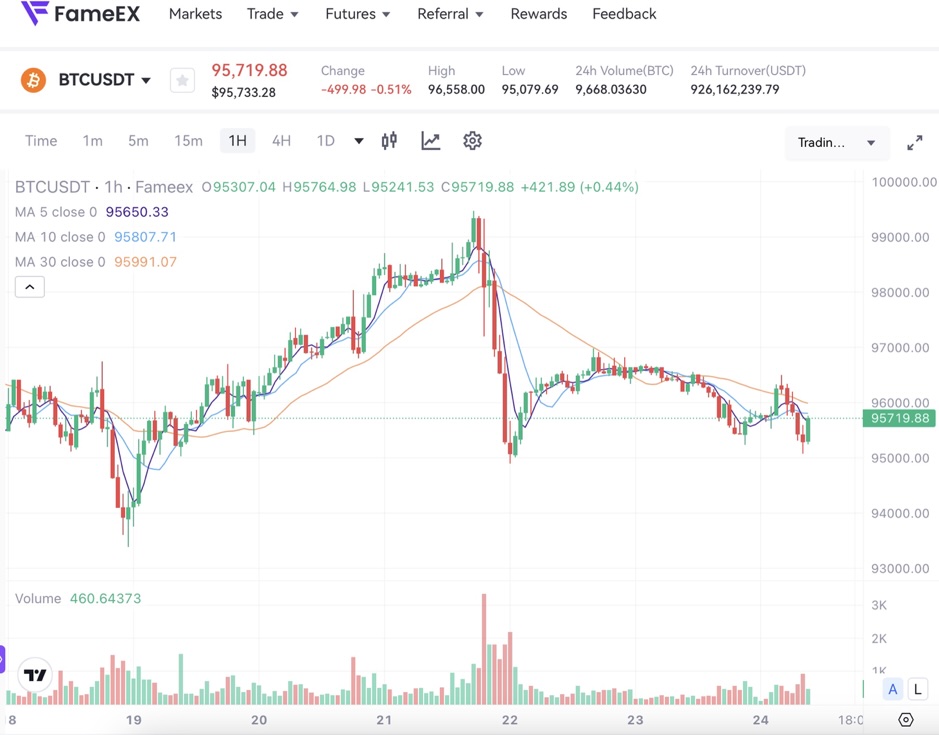

From February 20 to February 23, the BTC spot price swung from $94,897.44 to $99,294.4, a 4.63% range. Over the past four days, key statements from the Federal Reserve(Fed) and the European Central Bank (ECB) were as follows:

1) On February 21st, Fed official Goolsbee stated that if tariffs lead to higher inflation, the Fed will take this into consideration, and that PCE data is unlikely to be as concerning as CPI data.

Bostic mentioned that two rate cuts are still expected this year, but there is considerable uncertainty.

Koogler projected that the January PCE inflation rate would be 2.4%, still some distance from the 2% target, with the core PCE inflation rate at 2.6%.

2) On February 21st, ECB official Stournaras indicated that interest rates could fall to around 2% by 2025, while Simkus expressed support for the expectation of three more rate cuts in 2025 and saw no reason not to lower rates in March.

Fed officials expressed overall uncertainty regarding rate cuts this year, which could be bearish for the crypto market in the short term. On the other hand, ECB officials’ statements support continued rate cuts, which could be bullish for the crypto market in the short term.

According to sources, the U.S. Marshals Service (USMS) is unable to confirm the current amount of Bitcoin it holds, and it’s even difficult to provide a rough estimate. This management gap could impact the U.S. government’s cryptocurrency reserve plan proposed by White House crypto chief David Sacks. This plan could change the way the government handles seized crypto assets, potentially even involving the purchase of cryptocurrency. Currently, USMS still relies on Excel records and manual operations, limiting management efficiency. External experts have warned that the agency could lose billions of dollars due to operational errors at any time.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

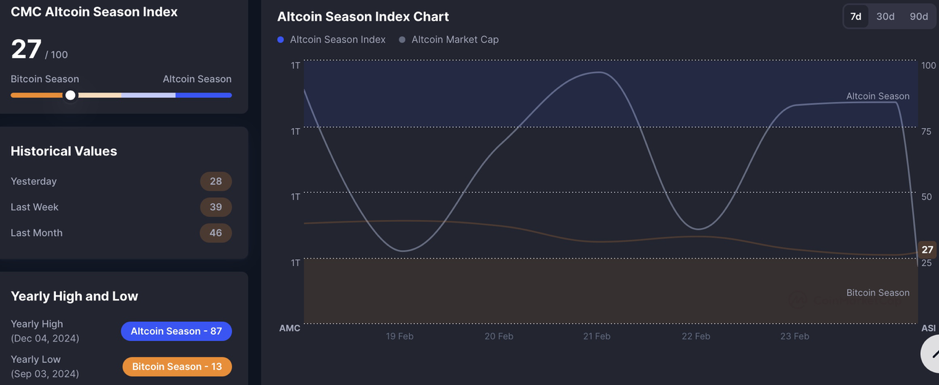

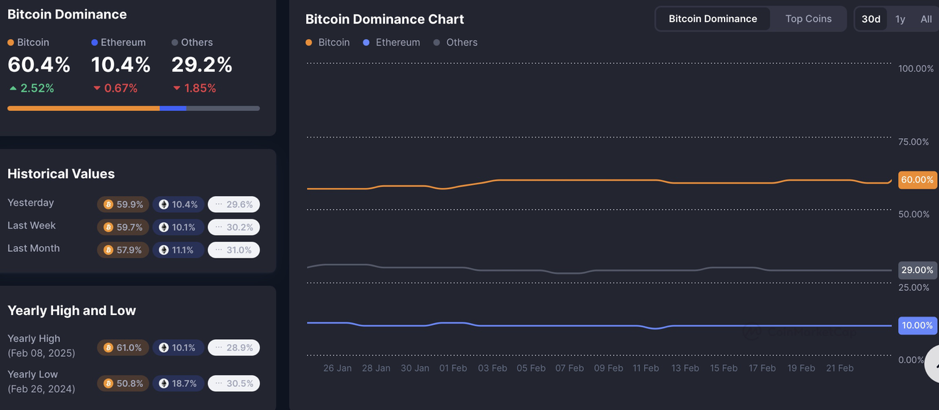

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

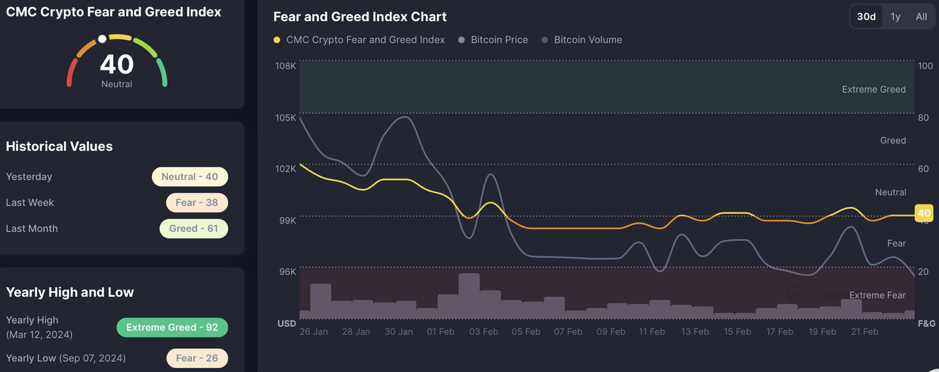

Fear & Greed Index, source: https://coinmarketcap.com/charts/

The total market capitalization and trading volume of cryptocurrencies have continued to shrink recently, leading to a decrease in market activity. The altcoin season index shows that altcoins are following the market sentiment of short-term traders, with significant volatility. Meanwhile, Bitcoin’s market dominance has shown little change. ETF funds are still experiencing a consistent net outflow, indicating a lack of market confidence. The prices of mainstream coins and large-market-cap altcoins have shown little change compared to the previous week. Currently, the Fear and Greed Index is at 40, still in the lower range of recent levels.

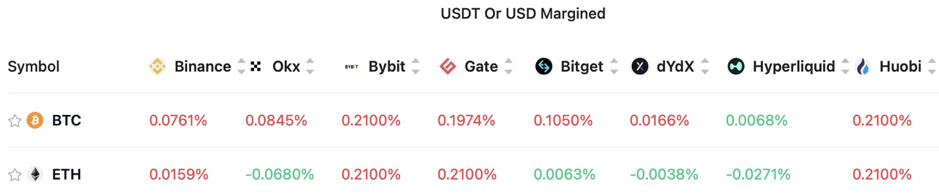

3. Perpetual Futures

The 7-day cumulative funding rates for BTC and ETH on the top 8 exchanges are 0.89% and 0.54%, respectively, indicating that the overall market sentiment is relatively bullish, and the market is still in a bull phase.

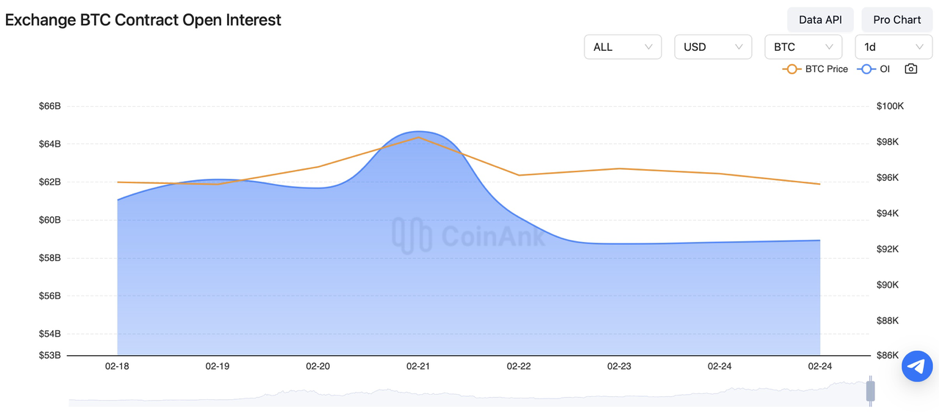

Exchange BTC Contract Open Interest:

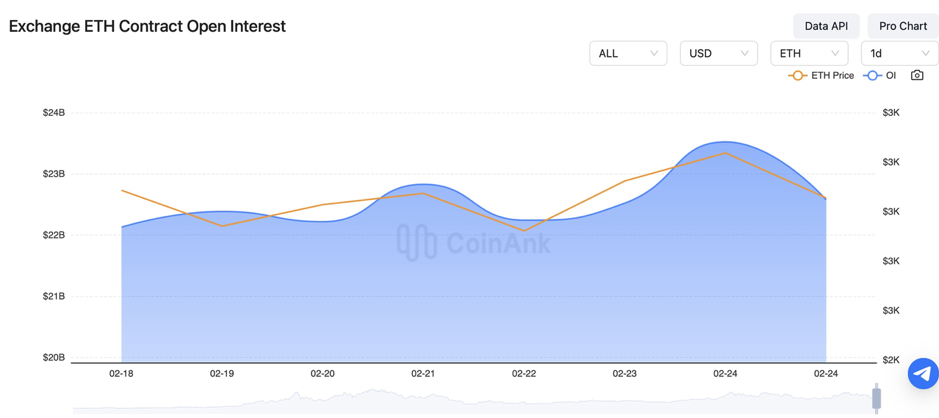

Exchange ETH Contract Open Interest:

In the past four days, the BTC contract open interest has dropped sharply, while ETH has seen a slight rise. This suggests that market participants with a higher risk appetite have lowered their short-term expectations for a continued surge in the price of BTC, the leading coin of the bull market. Investors are beginning to gradually shift some of their positions to ETH and altcoins, anticipating a potential major rally in altcoins during March and April.altcoins.

4. Global Economic and Crypto Sector Developments

Macroeconomic Data:

1) On February 20, the number of initial jobless claims in the U.S. for the week ending February 15th was 219,000, higher than the expected 215,000. The previous value was revised from 213,000 to 214,000.

2) On February 20, U.S. Treasury Secretary Scott Bessent stated that there are no plans to reassess the gold reserves, and he has not seen any proposal from Europe to reduce car tariffs. He also reiterated that the rate cut by the Fed in September of last year was too large.

3) On February 21, Japan’s core CPI for January showed a year-on-year increase of 3.2%, above the expected 3.1%, and up from the previous value of 3.0%.

4) On February 23, next Wednesday, Fed officials Bullard and Barkin will deliver speeches. The G20 Finance Ministers and Central Bank Governors’ meeting will be held, continuing until February 27.

5) On February 23, next Thursday, Fed officials Bostic and Schmid will deliver speeches. The ECB will release the minutes from the January monetary policy meeting. The G20 Finance Ministers and Central Bank Governors’ meeting will continue until February 27.

6) On February 23, next Friday, Canada’s December GDP monthly rate and the U.S. January Core PCE Price Index year-on-year and month-on-month will be released.

Cryptocurrency Industry Updates:

1) On February 20, BNB Chain announced the upcoming Pascal hard fork.

2) On February 20, data showed that 95% of cryptocurrency users in Latin America plan to increase their holdings by 2025.

3) On February 20, FTX creditors’ representative stated that regions including China are currently unable to participate in the bankruptcy distribution. SBF, in his first interview from prison, changed his political stance to support Trump in an attempt to seek a pardon.

4) On February 21, the U.S. SEC announced the creation of a new division for networks and emerging technologies to protect retail investors, focusing on combating cryptocurrency asset fraud.

5) On February 21, Galaxy CEO called on global leaders to take action against the hacker group Lazarus Group.

6) On February 21, Ethereum core developers stated that transaction rollbacks are nearly impossible and could lead to a chain reaction that would be difficult to fix.

7) On February 22, popular artist Kanye West’s X account deleted previous tweets related to cryptocurrency. Crypto KOLs analyze that Kanye West may have transferred ownership of his X account.

8) On February 22, eXch refused to intercept stolen funds from Bybit. SlowMist’s Yuxian suggested that all platforms increase their risk control level for funds from eXch.

9) On February 23, VanEck announced it has modeled U.S. strategic Bitcoin reserves to offset Treasury bonds and released related tools.

10) On February 23, Franklin Templeton introduced tokenized U.S. Treasury bond funds to Europe. The EU’s MiCA approved 10 stablecoin issuers, but Tether was not included.

Regulatory Updates:

1) On February 20, the U.S. Senate Banking Subcommittee on Digital Assets decided to hold its first hearing next week.

2) On February 20, the ECB expressed its desire to establish a blockchain-based payment system.

3) On February 21, the Hong Kong Securities and Futures Commission stated that legislative preparations for virtual asset custodians are expected to be completed by the end of 2025.

4) On February 21, the Governor of the Bank of Japan reiterated the commitment to stabilize the market, hinting at potential intervention in the bond market. He stated that if there is abnormal market volatility, they are ready to take flexible measures, such as market operations, to smooth out fluctuations.

5) On February 22, the Governor of the Bank of Japan, Kazuo Ueda, stated that if base prices rise, the Bank of Japan will adjust its monetary policy. Raising interest rates to 0.5% would increase the interest payments on reserves by 1 trillion yen.

6) On February 23, it was reported that the Russian Supreme Court is pushing to classify cryptocurrencies as property in criminal cases.

7) On February 23, the U.S. SEC dropped its investigation into the NFT platform OpenSea.

Other News:

1) On February 20, it was reported that OpenAI GPT-4.5 could be released as early as next week, with GPT-5 potentially launching in late May. U.S. media reports that OpenAI’s weekly active users have reached 400 million.

2) On February 20, President Trump terminated all affirmative action policies within the U.S. federal government and reinstated the death penalty. Trump’s

“Stargate” project is expected to support 75% of OpenAI’s computing power.

3) On February 21, Trump stated that the U.S. is about to strike a mineral agreement with Ukraine. Russia may agree to use $300 billion of frozen funds to help rebuild Ukraine, but insists that a portion of the funds be allocated to Russian-controlled regions.

4) On February 21, Musk’s xAI announced that Grok 3 would be available for free until the servers can no longer handle the load.

5) On February 22, Baidu launched the DeepSeek entry on its homepage, with over 10 million users in just one hour. The DeepSeek app reached over 100 million downloads within a month of its launch.

6) On February 22, European Commission Vice President Maroš Šefčovič stated that the EU and the U.S. exchanged trade dispute lists. Overall, U.S. tariffs are slightly higher than those of the EU, but the U.S. has shown some openness to reducing tariffs.

7) On February 23, U.S. Treasury Secretary Scott Bessent stated that sanctions on Russia would be lifted if necessary.

8) On February 23, the China National Financial Regulatory Administration announced that Hong Kong and Macau banks’ mainland branches are now allowed to offer foreign currency card services.

5. Market Outlook

From February 24 to February 26, the medium-term trading strategy will still be applied: for the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900, respectively.

The ETH sell order at $5,125, along with the buy orders at $2,040 and $1,730, should remain active.

Risk Reminder: The cryptocurrency market is highly volatile, and investors are advised to control their positions and implement stop-loss strategies. The above content is for reference only and does not constitute specific investment advice from this exchange.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.