FameEX Weekly Market Trend | February 6, 2025

2025-02-07 16:02:45

1. BTC Market Trend

From February 3 to February 5, the BTC spot price swung from $91,169.75 to $102,615.92, a 12.56% range.

In the past three days, the Federal Reserve (Fed) and the European Central Bank (ECB) have made the following important statements:

1) On February 4, Fed’s Bostic expressed the readiness to remain patient for a period before considering rate cuts. Further rate cuts depend on seeing housing inflation start to slow.

Collins indicated that there is no immediate urgency for further rate cuts. The Fed should remain patient and cautious with its policy and doesn't need to rush to adjust rates. At some point in the future, further normalization of rates is expected.

2) On February 5, Fed Vice Chairman Jefferson stated that there is no need to rush into further rate cuts, indicating that caution is the appropriate approach.

Barkin is still inclined toward rate cuts this year, with no signs of an overheated economy.

3) On February 3, ECB Governing Council member Villeroy stated that if U.S. President Trump imposes tariffs on the EU, we should not rule out the possibility of the EU retaliating; the ECB may further reduce rates.

Council member Knot highlighted that the need for restrictive policies has decreased; there are no winners in the trade war.

Council member Simkus supported a 25 basis point rate cut in March.

The U.S. Securities and Exchange Commission (SEC) has released a work list for its cryptocurrency working group, which includes the following main points:

1) Status of Securities: The status of crypto assets under securities law forms the basis for resolving many other issues, and the working group is focused on studying the different types of crypto assets.

2) Determining Scope: The working group will work to identify areas that fall outside the SEC’s jurisdiction. As a first step, the staff welcomes requests for “no-action” letters.

3) Token and Its Issuance: The working group is considering recommending that the SEC take action to provide temporary prospective and retroactive relief for tokens or token issuances, offering specific information to issuing entities or other parties willing to take responsibility, and encouraging further disclosure of information.

4) Registration of Offerings: The group will consider working with staff to recommend that the SEC modify existing registration routes to provide a feasible path for those interested in registering token offerings.

5) Special Purpose Brokers: The working group will explore potential updates to “no-action” letters for special purpose brokers, as the current letter has not been successful.

6) Custody Solutions for Investment Advisors: The working group will collaborate with investment advisors to develop an appropriate regulatory framework that allows advisors to safely and legally manage client assets either independently or through third-party custodians.

7) Cryptocurrency Lending and Staking: There is a need to clarify whether cryptocurrency lending and staking programs are subject to securities laws, and if so, how they should be regulated.

8) Cryptocurrency Exchange-Traded Products: The SEC has received rule changes proposed by SROs to list new types of cryptocurrency exchange-traded products. The working group will work with staff to clarify the approach used when approving or rejecting these applications.

9) Clearing Agencies and Transfer Agents: The working group also plans to examine the intersection of cryptocurrency with clearing agencies and transfer agent rules.

From February 6 to February 9, keep monitoring ETH spot trading opportunities. The sell order at $5,125, along with the buy orders at $2,040 and $1,730, should remain active. For the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900.

2. CMC 7D Statistics Indicators

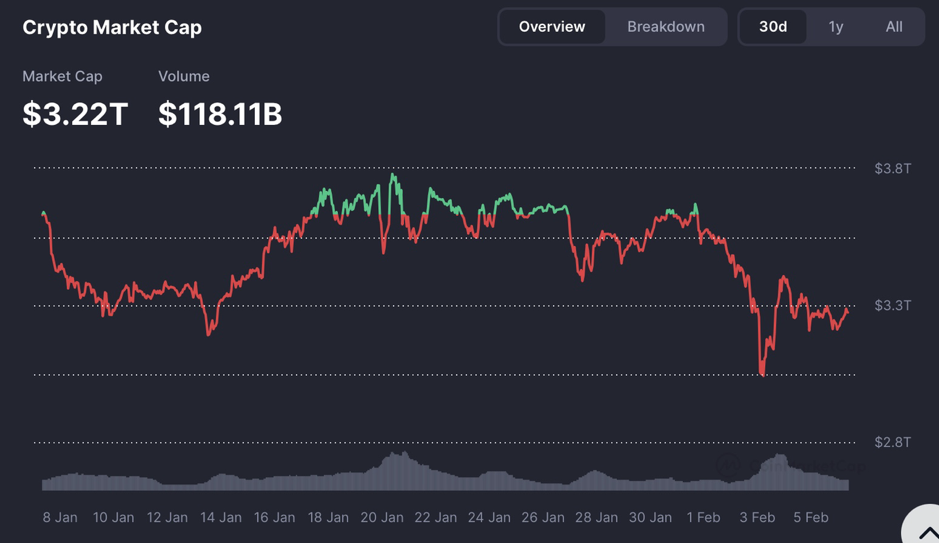

Overall market cap and volume, source: https://coinmarketcap.com/charts/

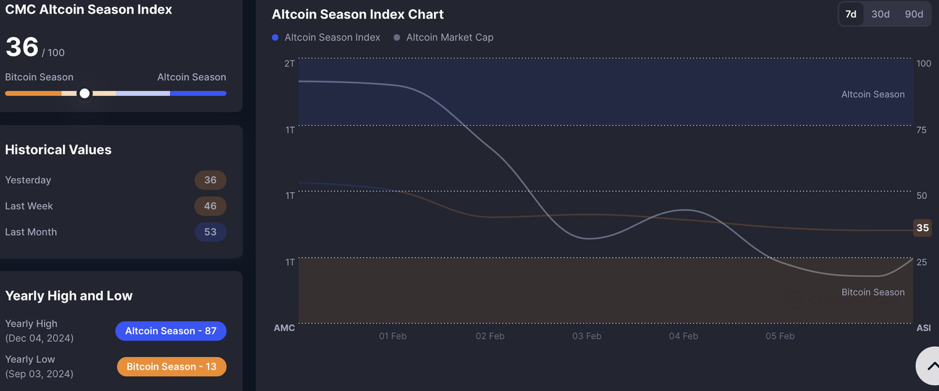

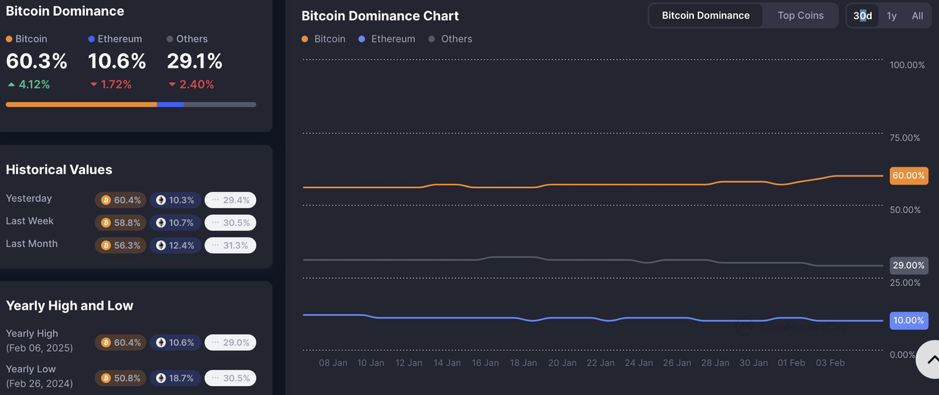

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

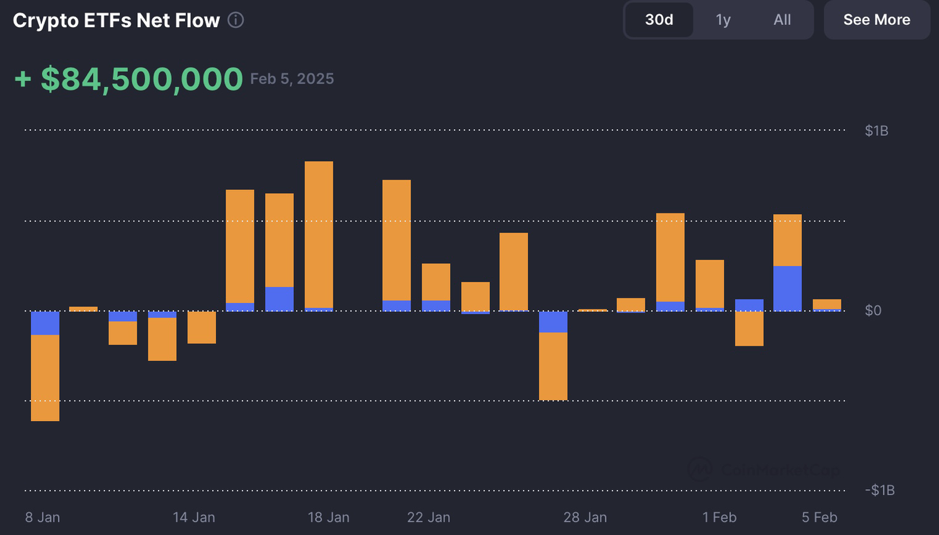

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

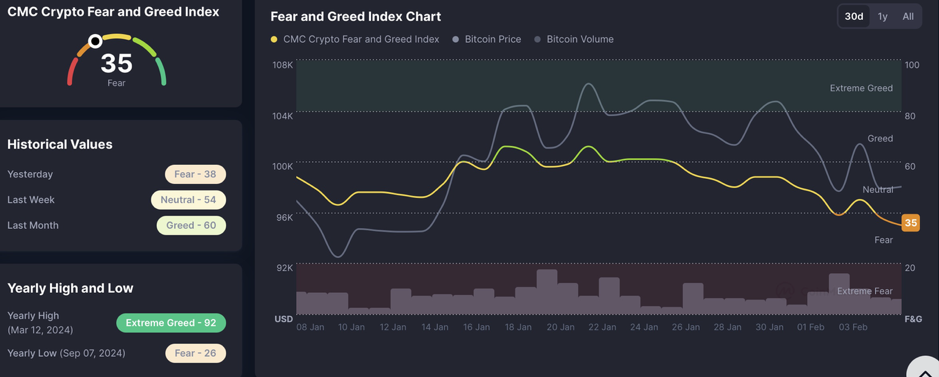

Fear & Greed Index, source: https://coinmarketcap.com/charts/

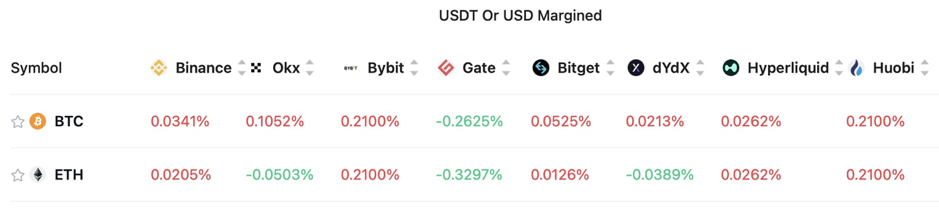

3. Perpetual Futures

The 7-day cumulative funding rates for major exchanges’ mainstream cryptocurrencies are generally positive, indicating that long leverage is currently higher.

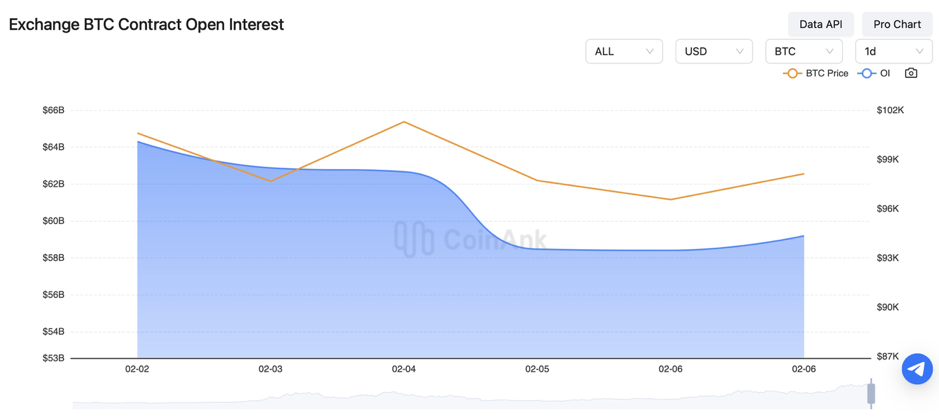

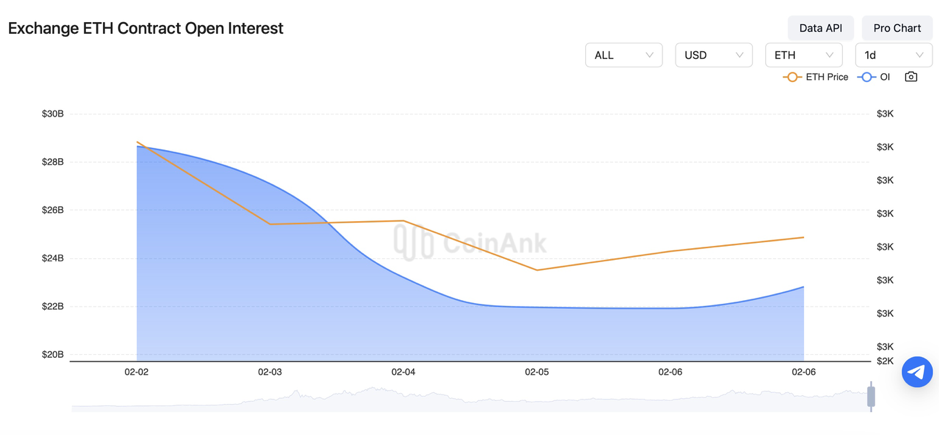

In the past three days, the BTC contract open interest has gradually decreased, while the ETH contract open interest has experienced a significant drop.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On February 3, the preliminary data for the Eurozone’s January CPI annual rate came in at 2.5%, slightly above the expected 2.4% and matching the previous value of 2.40%. Meanwhile, the preliminary CPI monthly rate for January showed a decline of 0.3%, compared to the previous month’s increase of 0.4%.

2) On February 3, Thailand cut off electricity supply at the border to combat the operations of cryptocurrency scam centers in Myanmar.

3) On February 3, Iran supported a unified BRICS currency. It was reported that the U.S. might impose a 100% tariff in response.

4) On February 3, Tether Treasury minted 1 billion USDT on the TRON network.

5) On February 3, according to data sources, FTX’s first repayment will start on February 18, 2025.

6) On February 3, Reuters reported that India is reassessing its stance on cryptocurrency due to global policy changes.

7) On February 3, Russia planned to establish a mandatory registration agency for cryptocurrency mining equipment.

8) On February 3, Trump’s tariff increase prompted traders to seek refuge, causing the cryptocurrency market to plummet.

9) On February 4, Coinbase’s director claimed Trump made over $800 million in profits from his launched memecoin.

10) On February 4, U.S. lawmakers formed working groups in both the House and Senate to draft cryptocurrency and stablecoin legislation.

11) On February 4, U.S. President Trump signed a memorandum to reinstate the “maximum pressure” policy against Iran to prevent its nuclear weapons program and limit oil sales.

12) On February 4, U.S. President Trump signed an executive order to establish a sovereign wealth fund.

13) On February 4, Bank of Japan Governor Ueda Kazuo stated that the BoJ’s goal is to achieve a sustainable 2% inflation rate, with overall CPI as the benchmark.

14) On February 4, U.S. President Trump stated that the U.S. would take control of the Gaza Strip.

15) On February 4, U.S. President Trump announced new tariffs on the EU and cuts to future funding for South Africa; EU Commission President Von der Leyen stated that the EU would prepare for tough negotiations with the U.S. while firmly safeguarding its interests.

16) On February 4, Coinbase urged U.S. regulators to clarify that banks can provide services to crypto businesses.

17) On February 5, according to Ukrainska Pravda, Ukraine’s President Zelensky announced the extension of the martial law and mobilization order until May 9; Meanwhile, U.S. President Trump expressed his hope that Ukraine would exchange rare earth minerals for aid.

18) On February 5, U.S. January ADP employment was 183,000, expected 150,000, previous value of 122,000.

19) On February 5, the Eurozone’s December Producer Price Index (PPI) monthly rate was reported at 0.4%, slightly below the expected 0.5%. The previous value was revised upward from 1.60% to 1.7%.

20) On February 5, the BoJ officials stated that if underlying inflation accelerates toward the 2% target, the BoJ will continue to raise interest rates.

21) On February 5, the Trump administration took the first step to loosen cryptocurrency regulations, with the U.S. SEC planning to reduce its cryptocurrency enforcement team; the SEC’s crypto task force signaled a major regulatory shift aimed at allowing projects to issue tokens legally.

22) On February 5, U.S. CFTC Acting Chairman stated that the enforcement department has been reorganized, refocusing on fighting fraud.

23) On February 5, spot gold reached a new high, briefly touching $2845 per ounce.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.