FameEX Weekly Market Trend | December 16, 2024

2024-12-16 19:01:10

1. BTC Market Trend

From December 12 to December 15, the BTC spot price swung from $98,774.83 to $105,582.5, a 6.89% range. The key recent statements from the European Central Bank (ECB) over the past four days are as follows:

1) On December 12, the ECB cut rates by 25 basis points as expected, removing the commitment to a “restrictive” rate policy and avoiding precommitments to a specific path.

2) On December 12, ECB Governing Council member Müller stated: “We expect the European economy to recover slowly.”

3) On December 13, ECB Governing Council member Holzmann said that interest rates could drop to around 2%.

4) On December 13, ECB Governing Council member Escriva noted that further rate cuts in upcoming monetary meetings would be logical.

5) On December 14, ECB Governing Council member Villeroy indicated that there would be further rate cuts in the future.

Key Highlights from ECB President Lagarde's Latest Remarks

1) Trade Tensions: Affordable credit should boost consumption if trade tensions do not escalate.

2) Economic Outlook: The economy is expected to strengthen over time, though slower than previously anticipated.

3) Future Rate Path: The goal is to stabilize inflation at the 2% medium-term target. Monetary policy decisions will be data-driven and reviewed meeting by meeting. Rate adjustments will be guided by economic and financial data, underlying inflation dynamics, and the effectiveness of policy transmission. No specific rate path has been committed to.

4) Current Economic Situation: Economic growth is losing momentum.

5) Core Inflation: Overall, core inflation trends are consistent with a steady return to the target inflation rate.

6) Growth Risks: Risks to economic growth remain tilted to the downside.

7) Inflation Outlook: Inflation is expected to fluctuate around current levels in the short term before stabilizing near 2%.

8) Trade Risks: Intensified global trade tensions could suppress exports and weaken the global economy, pressuring eurozone growth.

9) Inflation Target: Inflation is projected to reach 2% by 2025, as reflected in forecasts.

10) Rate Cut Discussions: A 50-basis-point cut was considered, but consensus deemed 25 basis points the right decision.

11) Two-Way Risks: Inflation risks are now more balanced than before.

12) Inflation Composition: A shift in inflation composition is needed to confirm progress toward the target.

13) Neutral Rates: Neutral rates were not discussed in recent meetings.

14) Inflation Risks: Upside risks to inflation stem from escalating geopolitical tensions, which could drive up energy prices and shipping costs, disrupting global trade. Additionally, extreme weather events and the growing climate crisis may push food prices higher than expected. Conversely, downside risks include weaker consumption and investment due to low confidence and geopolitical concerns, monetary policy suppressing demand more than anticipated, or an unexpected deterioration in global economic conditions.

From December 16 to December 18, continue monitoring trading opportunities for ETH spot orders. Focus on sell orders placed at $8,510, $7,840, and $5,040, as well as buy-the-dip orders at $2,040 and $1,730. For the BTC spot, maintain sell orders at $169,400, along with buy-the-dip orders at $73,970, $59,935, and $45,900. It is recommended to continue increasing the allocation of altcoin spot positions!

2. CMC 7D Statistics Indicators

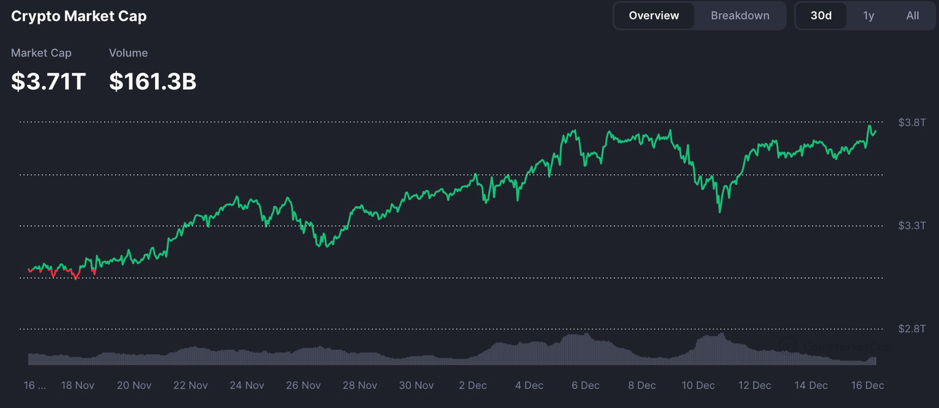

Overall market cap and volume, source: https://coinmarketcap.com/charts/

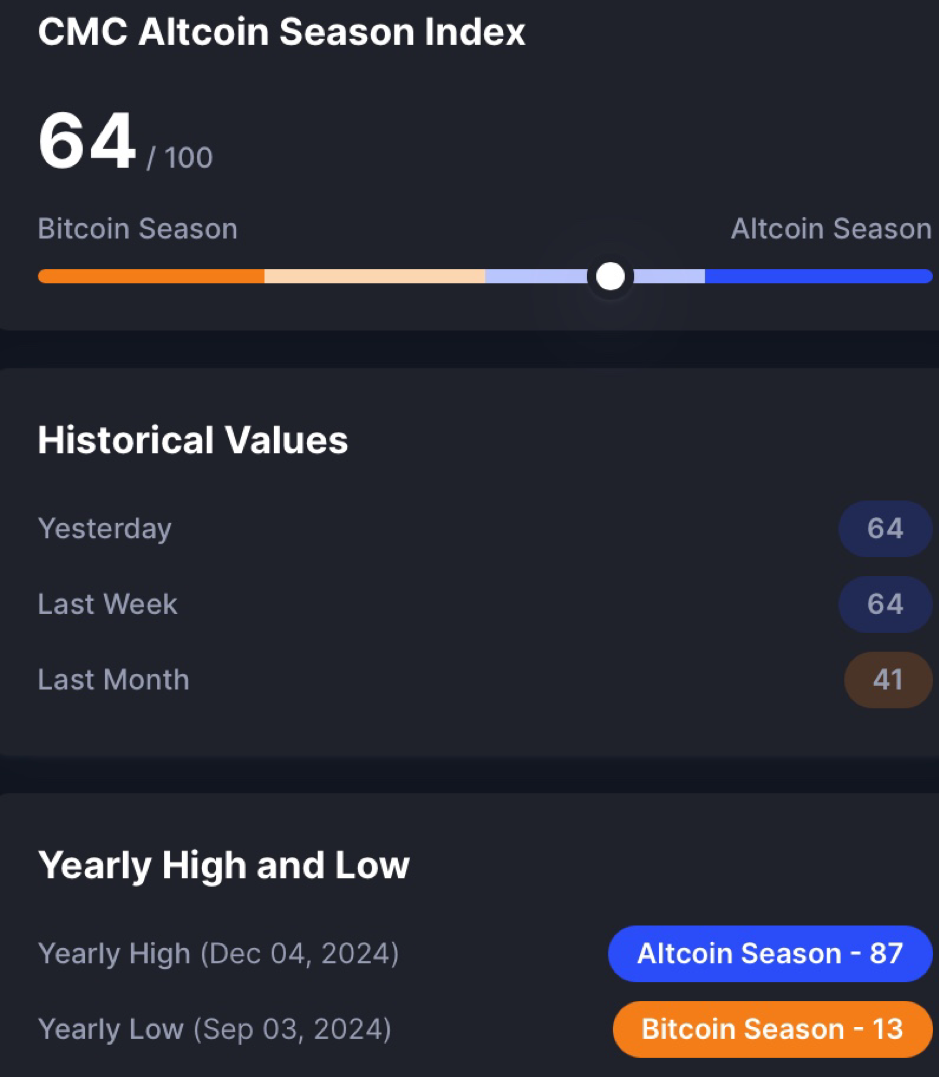

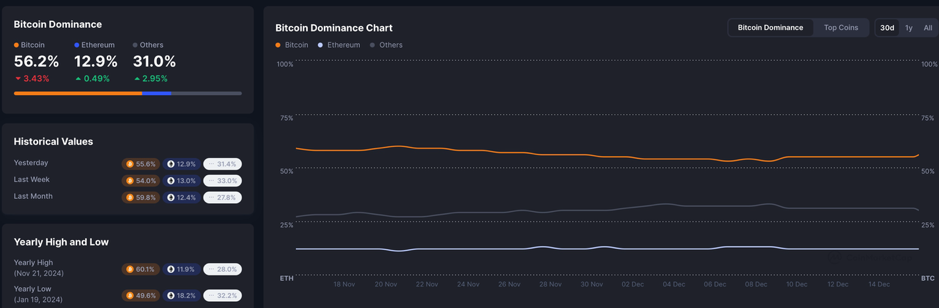

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

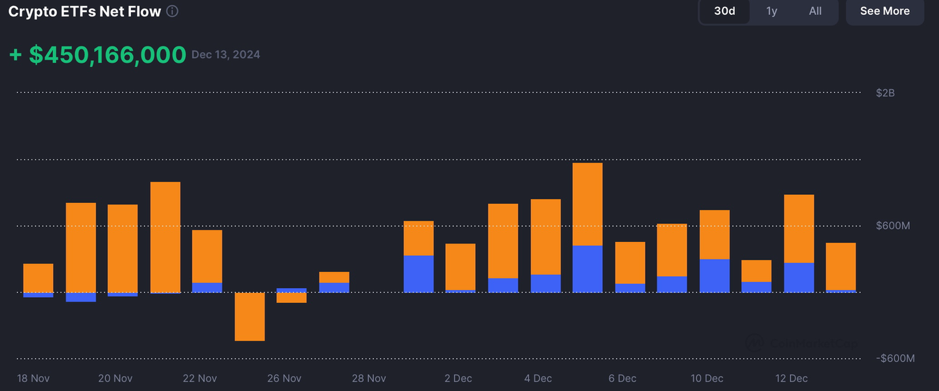

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

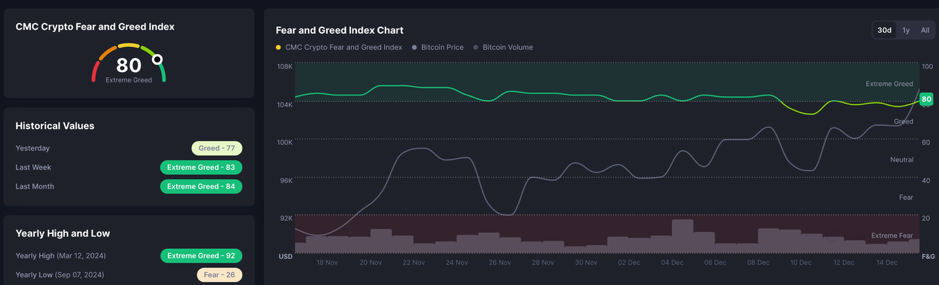

Fear & Greed Index, source:https://coinmarketcap.com/charts/

3. Perpetual Futures

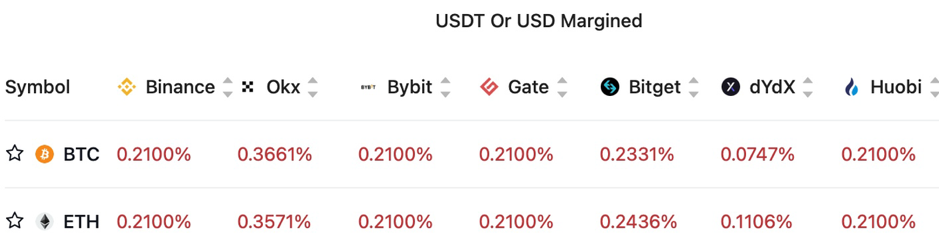

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

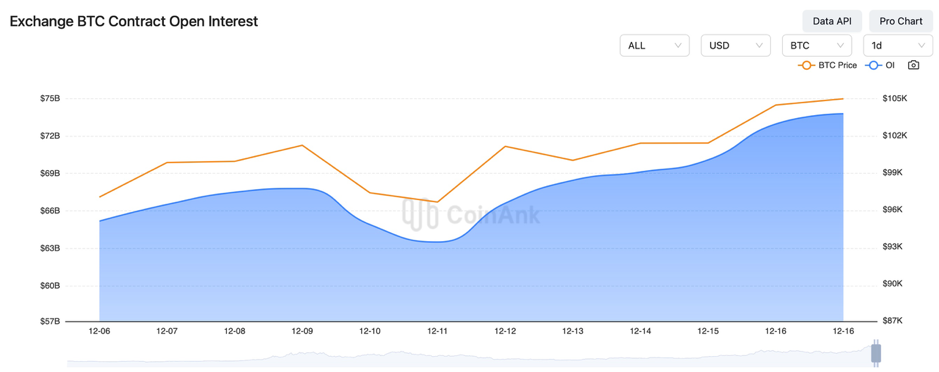

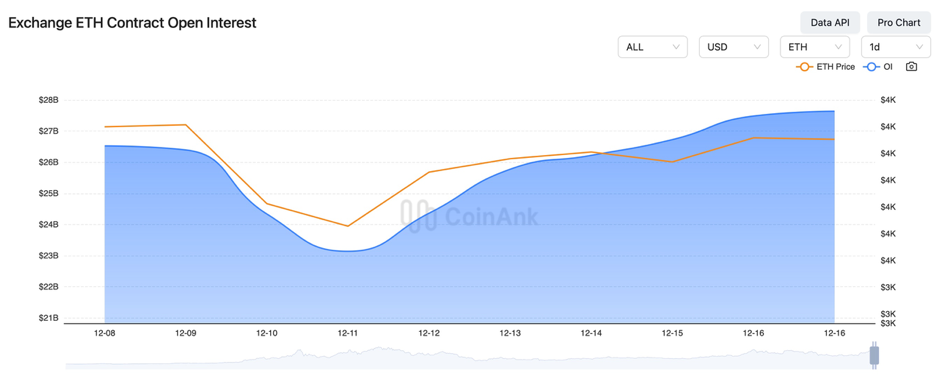

In the past three days, the open interest in BTC and ETH contracts has increasingly risen.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On December 12, U.S. initial jobless claims for the week ending December 7 were 242,000, above the expected 220,000, with the previous week’s figure revised from 224,000 to 225,000.

2) On December 12, the Bank of Canada cut interest rates by 50 basis points as expected, signaling a slower pace of rate cuts; the swaps market anticipates a 70% chance of further rate cuts in January 2024.

3) On December 12, the Nasdaq Index broke the 20,000-point mark for the first time, setting a new record.

4) On December 12, the U.S. November CPI rose 2.7% year-over-year, in line with market expectations.

5) On December 12, Elon Musk became the first person in the world with a net worth exceeding $400 billion.

6) On December 12, the former team of the crypto data platform, Non-Fungible Token (NFT), publicly disputed brand ownership with a buyer.

7) On December 13, the UK’s three-month GDP growth for October was 0.1%, in line with expectations and the previous value.

8) On December 13, Trump stated that the U.S. should create a crypto strategic reserve, and that great things would happen in the cryptocurrency space.

9) On December 13, Ukraine announced plans to legalize cryptocurrency by early 2025 but would not offer tax incentives.

10) On December 13, the new chairman of the U.S. House Financial Services Committee said they would consider the value of Bitcoin reserves for the U.S.

11) On December 13, BlackRock’s Bitcoin spot ETF surpassed its gold ETF in size.

12) On December 13, Hong Kong Customs held the first international forum on combating money laundering and transnational organized crime, promoting research on virtual assets and blockchain.

13) On December 14, South Korean President Yoon Suk-yeol suspended presidential powers, and the government’s economic team entered “crisis management” mode.

14) On December 14, a Japanese lawmaker proposed creating a national Bitcoin reserve.

15) On December 14, the U.S. think tank NCPPR proposed that Amazon include Bitcoin in its financial reserves.

16) On December 14, Argentine President Milei announced plans to implement a free currency circulation program next year, possibly including Bitcoin.

17) On December 14, the Hong Kong Securities and Futures Commission released its quarterly report, revealing that the market value of virtual asset spot ETFs has increased by over 70% from April to November.

18) On December 14, China’s Central Economic Work Conference called for a moderately loose monetary policy, including potential rate cuts and reserve requirement ratio reductions.

19) On December 15, the U.S. SEC sought public comments on the Bitwise Bitcoin and Ethereum ETFs listed on the NYSE.

20) On December 15, Li Kaifu stated that ChatGPT has sparked the “era of large models” and that all the scenes in sci-fi novels will occur in the next five years.

21) On December 15, CryptoQuant’s founder stated that Bitcoin will not be cracked by quantum computers in this decade or the next.

22) On December 15, South African regulators granted 248 cryptocurrency licenses and rejected 9 applications.

23) On December 15, former Thai Prime Minister Thaksin suggested that Phuket could pilot Bitcoin use.

24) On December 15, next week will see major token unlocks for ARB, APE, QAI, ADA, PIXEL, ENA, PRIME, EIGEN, and others.

25) On December 15, next Thursday, the U.S. will release the Federal Reserve’s rate decision for December 18, U.S. initial jobless claims for the week ending December 14, Japan’s central bank’s target interest rate for December 19, and the U.K.’s central bank rate decision for December 19.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.