FameEX Weekly Market Trend | October 7, 2024

2024-10-07 19:52:51

1. BTC Market Trend

From October 3 to October 6, the BTC spot price swung from $59,893.54 to $62,865.71, a 4.96% range. In the last four days, important statements from the Federal Reserve (Fed) and the European Central Bank (ECB) were as follows:

1) On October 3, Fed’s Barkin noted the Fed is monitoring the impact of low interest rates on housing and car sales to gauge potential demand risks. If the economy follows expectations, two more 25bp rate cuts this year are a "reasonable path." Unemployment and inflation should remain stable, with inflation staying above the 2% target next year.

2) On October 4, Fed’s Goolsbee emphasized that reaching neutral rates within 12 months matters more than a 25 or 50 basis-point cut, noting signs that inflation may fall below target.

3) On October 4, ECB Governing Council Member Vasle indicated that the ECB cannot rule out or commit to a rate cut in October. There will likely be more rate cuts, but this will depend on the data.

According to The Block, the discounted token sales from FTX’s bankruptcy assets continue to attract investor interest. Investors have snapped up millions of tokens from various projects, betting that these assets are undervalued and may offer long-term growth potential.

FTX’s largest asset holding is 41 million locked Solana (SOL) tokens, currently valued at around $6 billion. The asset managers sold these tokens in batches between April and May at discounted prices ranging from $64 to $110. With SOL now trading around $142, investors such as Pantera Capital, Galaxy Trading, and Figure Markets have already seen paper gains.

FTX’s asset managers also plan to auction off 22.3 million locked Worldcoin (WLD) tokens, valued at approximately $38 million. Despite concerns over the lockup period, the auction saw strong competition, with WLD selling for “slightly over $1”. WLD is currently trading at about $1.78.

FTX’s asset managers have also sold Metaplex (MPLX) tokens, which several crypto funds later bought at discounted prices from Wave Digital Assets. Investors are focusing on high-quality assets and projects led by visionary founders. Despite the risks, the appeal of discounted tokens and potential returns has led many to consider these investment opportunities.

Among Us CEO and co-founder Zac Townsend stated that U.S. Vice President Harris’s proposed unrealized capital gains tax would harm cryptocurrency investors. The core of the unrealized capital gains tax requires individuals to pay taxes on the increased value of their cryptocurrency holdings, even if they haven’t made any sales. Zac noted that this proposal differs significantly from traditional tax principles, which apply only to realized gains from asset sales. He believes this plan would have devastating consequences for cryptocurrency investors and the broader economy, undermining the intrinsic value of cryptocurrencies as a store of value not controlled by any single government. It would also incentivize large investors to sell assets to pay taxes, leading to a drop in cryptocurrency prices and affecting returns for everyday investors, including those investing small amounts to improve their financial situations.

CoinMarketCap (CMC) Research, a division of CoinMarketCap, released its Q3 market research report, stating that Bitcoin’s bull cycle is accelerating, ahead of the typical four-year cycle by 100 days. Multiple factors suggest that Bitcoin may be entering a supercycle, driven by institutional adoption, Bitcoin ETF developments, and changing market dynamics. CMC Research predicts this bull run could peak between mid-May and mid-June 2025. While early acceleration is evident, signs of infrastructure growth slowing down suggest broader market dynamics may be shifting.

The UAE has amended its VAT regulations to exempt the transfer and conversion of virtual assets, including cryptocurrencies. PwC noted that the new rules also include VAT exemptions for additional services, such as managing investment funds and transferring and converting virtual assets.

From October 7 to October 9, keep the sell orders for the ETH spot at $3,425 and $5,040, and the buy orders for bottom fishing at $1,730 and $2,040. For the BTC spot, keep the sell orders at $67,900, $79,870, and $96,820, and the buy orders for bottom fishing at $36,720 and $44,370. There is no need to cancel these orders. For other cryptocurrencies, continue to focus on short-term selling opportunities.

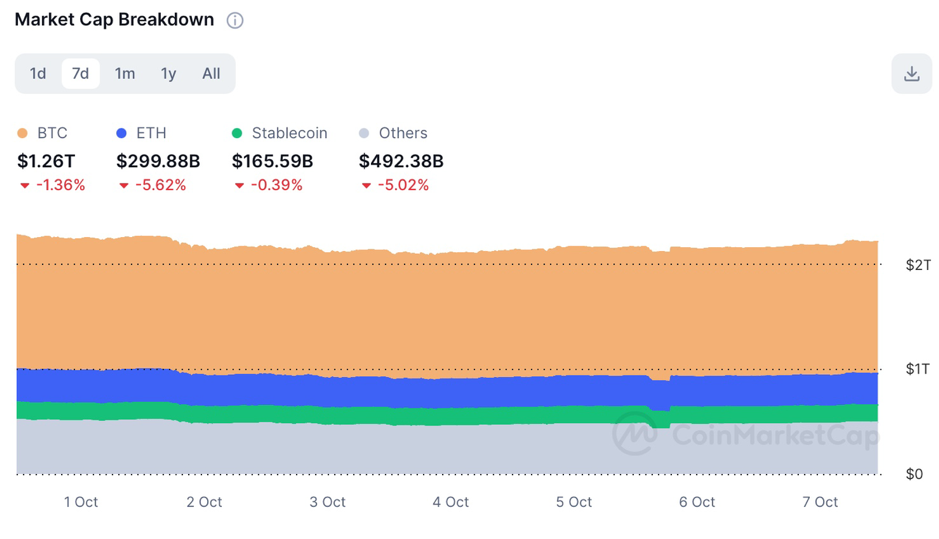

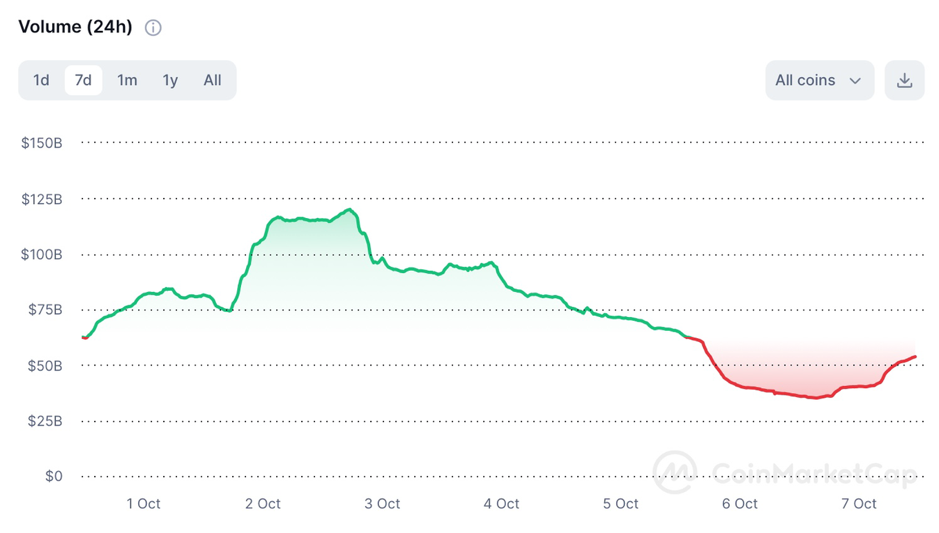

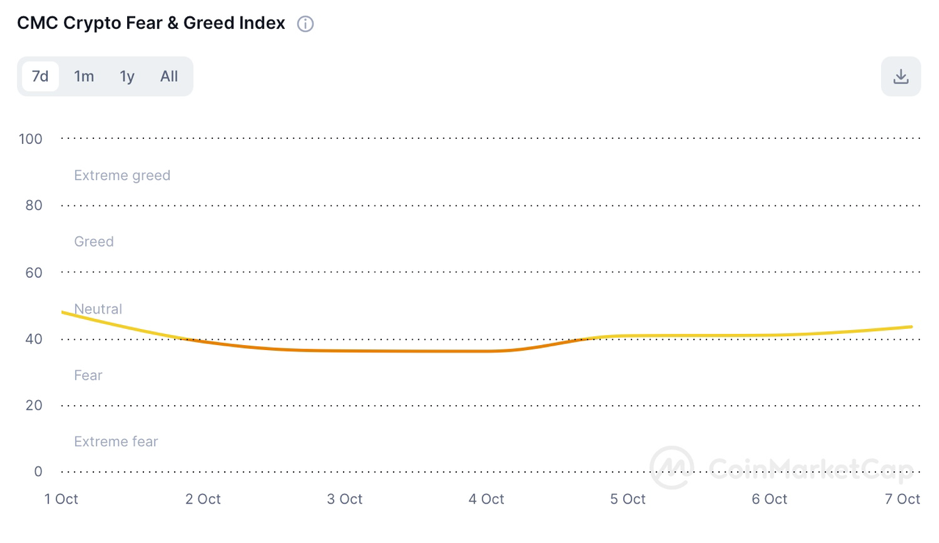

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

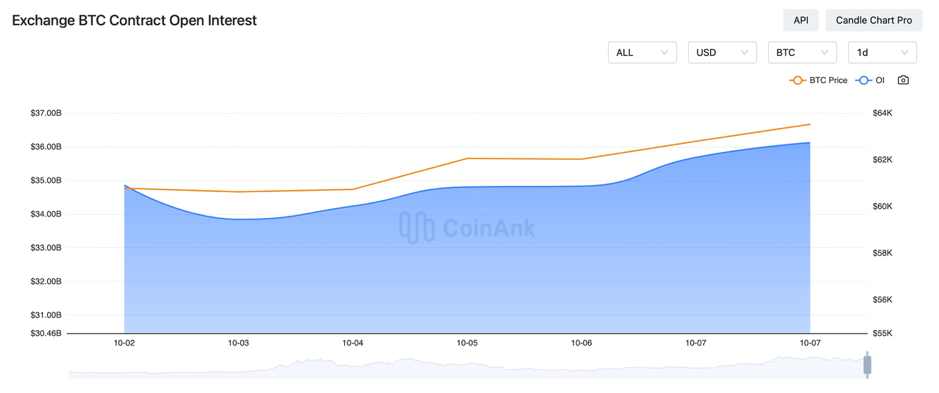

3. Perpetual Futures

The 7-day cumulative funding rates for mainstream cryptocurrencies across major exchanges are generally positive, indicating that the long-leverage positions currently gain the upper hand.

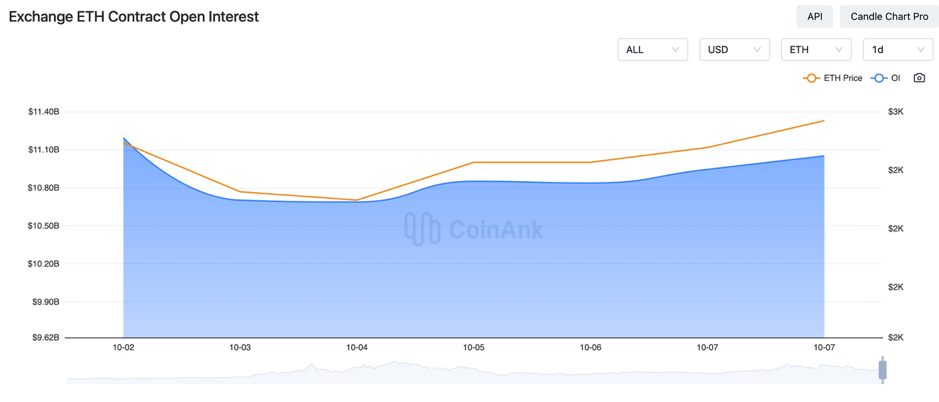

In the past four days, the open interest for BTC and ETH contracts has slowly risen.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On October 3, Bank of England Governor Bailey expected the possibility of larger rate cuts, closely monitoring the situation in the Middle East. The pressure from the cost of living is not as persistent, and the economy is proving more resilient than expected. Insiders indicated that Crypto payment company BCB Group was once the subject of a Financial Conduct Authority investigation in the UK.

2) On October 3, Japanese Prime Minister Shigeru Ishiba stated that the current situation is not suitable for further rate hikes. The USD/JPY surged 2% during the day. According to the Polish Central Bank Governor, Poland’s gold reserves have reached 420 tons, and the country will continue to purchase more gold.

3) On October 3, the Israeli military announced the killing of Hezbollah communications network head Mohammad Rashid Sakafi. Media reports suggested that Iranian missile strikes destroyed two Israeli F-35 squadrons. Iran’s Supreme Leader Khamenei stated that while they will respond to Israel, they will neither rush nor delay their actions.

4) On October 3, U.S. Initial Jobless Claims for the week ending September 28 stood at 225,000, against a forecast of 220,000. The previous figure was revised from 218,000 to 219,000.

5) On October 3, Eurozone August PPI (month-over-month) was 0.6%, above the expected 0.3%. The previous value was revised from 0.80% to 0.7%.

6) On October 3, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) indicated that starting next year, banks in North America, Europe, and Asia will begin real-time trials of digital asset and currency transactions via its global messaging network, which serves over 11,500 financial institutions.

7) On October 3, Uruguay passed a cryptocurrency law; Spain’s BBVA bank plans to partner with Visa next year to launch a stablecoin business.

8) On October 4, a report indicated that if Iran chooses to pursue a nuclear bomb, it could spark a nuclear arms race across the region. Saudi Crown Prince Mohammed bin Salman said that if Iran makes a nuclear weapon, Saudi Arabia will have no choice but to do the same. Meanwhile, the Turkish President warned that after attacks on Lebanon and Gaza, Israel may turn its attention toward Turkey.

9) On October 4, it was reported that Brazil is developing its central bank digital currency, Drex. Brazil’s digital bank Nubank has reduced cryptocurrency trading fees. Ripple partners with the Brazilian exchange Mercado Bitcoin to offer enterprise payment solutions.

10) On October 4, it was reported that El Salvador is building a new capital market based on Bitcoin. The IMF is pressuring El Salvador to amend its Bitcoin regulations.

11) On October 5, U.S. Nonfarm Payrolls for September showed an increase of 254,000 jobs, the largest rise since March 2024. The unemployment rate unexpectedly dropped to 4.1%; the forecast was 4.2%, with the previous value at 4.2%.

12) On October 5, Ross Ulbricht was sentenced to life in prison 12 years ago for drug trafficking, computer hacking, and money laundering. Trump said if elected president, he would reduce Ulbricht’s sentence on his first day in office. Media reported that venture capitalist Horowitz plans to donate a “large sum” to support Harris’s campaign and will no longer support Trump.

13) On October 5, IntoTheBlock indicated that after the Dencun upgrade, Ethereum’s mainnet fees hit an all-time low, and ETH turned inflationary. Telegram launched the “Gifts” feature, with limited edition gifts that can be redeemed for NFTs based on the TON network.

14) On October 5, Trump returned to the site of an assassination attempt to hold a campaign rally, with Elon Musk attending. Musk announced on X (formerly Twitter) that he had created a PAC (Political Action Committee) to support Trump’s re-election. Musk also updated his X profile picture with an image featuring U.S. election elements and his own photo.

15) On October 5, Tether released a documentary celebrating the 10th anniversary of USDT. MicroStrategy announced a job opening for a “Bitcoin Advocacy Manager”.

16) On October 5, Vietnamese police dismantled a cryptocurrency network fraud gang. Australian authorities seized $6.4 million worth of cryptocurrency. Argentina’s wealthiest individual praised Bitcoin’s ability to withstand government intervention.

17) On October 5, Visa launched its tokenized asset platform, VTAP, to assist banks in issuing fiat-backed tokens.

18) On October 5, U.S. Congressman Ro Khanna became the first Democrat to support the Bitcoin Reserve Act. The U.S. government sought to confiscate 200,000 USDT linked to a Bitcoin theft case in Ohio.

19) On October 6, following Israel’s detonation of electronic devices like pagers and walkie-talkies in Lebanon, Emirates Airlines announced a ban on these items aboard flights.

20) On October 6, the LEGO website was hacked to promote a cryptocurrency scam called “LEGO Coin”. The company has since removed any references to the token from its homepage.

21) On October 6, RootData reported that total crypto financing in Q3 2024 exceeded $2.4 billion, a 15% decline from the previous quarter. Robot Ventures emerged as the most active investor with 22 investments this quarter.

22) On October 6, Auradine’s CEO stated that Bitcoin decentralization is crucial for national security. DeFi advocates revealed that the industry may face long-term regulatory scrutiny. Lamborghini partnered with Animoca Brands to bring its supercars to a metaverse platform.

23) On October 6, EigenLayer reported that a $5.7 million hack was an “isolated” incident, with no vulnerabilities found in the protocol. The founder of IcomTech was sentenced to nearly 10 years in prison for involvement in a cryptocurrency Ponzi scheme.

24) On October 6, reports indicated that projects including APT, EIGEN, NEON, ADA, XAI, MODE, IO, ENA, HFT, and GLMR are set to undergo token unlocks next week, amounting to over $200 million in total value.

25) On October 6, next Monday, China will release its foreign exchange reserves for September. On Thursday, the U.S. will publish its September CPI data, initial jobless claims for the week, and the Fed’s monetary policy meeting minutes. On Friday, the U.K. will release its three-month GDP growth rate for August, while Canada will announce its September employment figures and the U.S. will release its September PPI data. Finally, next Sunday, China’s September CPI and PPI data will be released.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.