FameEX Weekly Market Trend | August 19, 2024

2024-08-19 19:35:35

1. BTC Market Trend

From August 15 to August 18, the BTC spot price swung from $56,101.23 to $60,246.83, a 7.39% range. In the past four days, key statements from the Federal Reserve (Fed) were as follows:

1) On August 15, Bostic emphasized that the Fed cannot be “late” in easing monetary policy and expressed openness to a rate cut in September.

2) On August 15, Goolsbee stated the economic situation would dictate rate cuts, with growing concern over employment rather than inflation.

3) On August 16, Moussalem noted that monetary policy is in a moderately tight stance, suggesting that the time for a policy rate change may be approaching, and predicting that a recession is unlikely in the coming quarters.

4) On August 16, Bostic reiterated that the Fed cannot delay in implementing easing policies.

5) On August 16, Goolsbee warned that some leading recession indicators are flashing warning signals.

The blockchain research organization NEBRA is launching a so-called universal proof aggregation technology. This technology allows multiple independent zero-knowledge proofs to be combined into a single compact proof to reduce blockchain verification costs. The system will be launched on Ethereum, attempting to lower the high costs of proof settlement. Due to the highly complex computations involved, the implementation costs of zero-knowledge technology can be significant. According to an estimate on the Ethereum.org blog, verifying zk-rollups’ zk-SNARK proofs on Ethereum requires approximately 500,000 gas. These costs are eventually passed on to users who pay rollup operator fees to subsidize the computational costs.

On August 16, according to Cointelegraph, the Dubai Court of First Instance recognized the legality of paying salaries in cryptocurrency within employment contracts as part of a significant update to the UAE judicial system regarding cryptocurrencies. Irina Heaver, a partner at UAE law firm NeosLegal, explained that the ruling in Case No. 1739 of 2024 indicates a shift in the court’s stance. In 2023, the court rejected a similar request due to the lack of precise valuation of the involved cryptocurrency at that time. Heaver believes this shows that the country is taking a “progressive approach” in integrating digital currencies into its legal and economic frameworks.

Elon Musk shared his views on U.S. inflation on X (formerly Twitter), stating that inflation is caused by federal government spending exceeding revenue, as they simply print more money to make up the difference. To address inflation, wasteful government spending needs to be reduced. A crypto exchange CEO responded by saying that people are trying hard to explain the causes of inflation, but the main reason is that the government spends more than it has and needs to print more money. By offsetting this, most inflation issues would disappear. Bitcoin acts as a hedge against excessive inflation, and buying it is essentially a vote against inflation.

The sell order for the BTC spot at $92,000 can have half of its position moved to a sell order at $72,500. The sell order at $77,500, the bottom-fishing buy order for BTC at $42,950, and the sell order for the ETH spot at $4,700, as well as the bottom-fishing buy order at $1,850, should all remain in place.

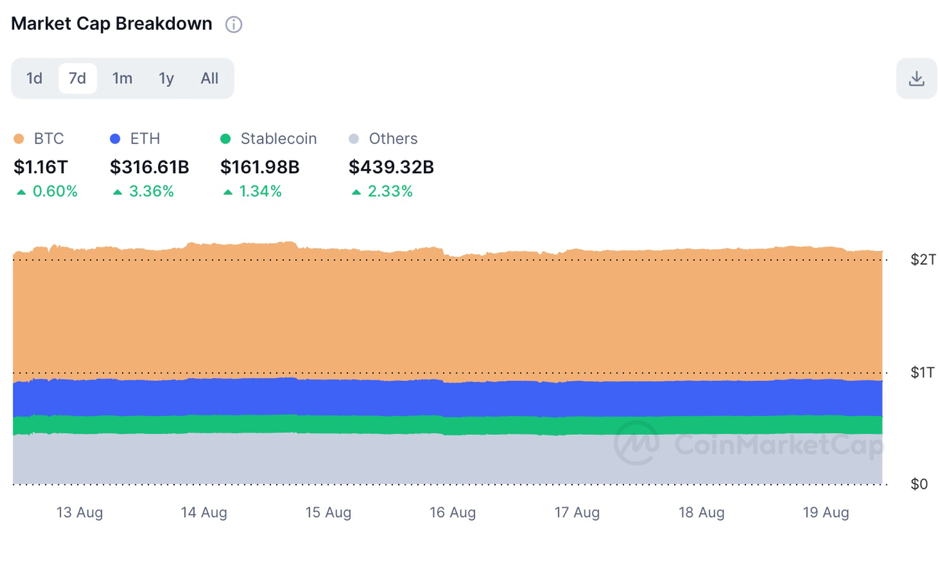

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are slightly high.

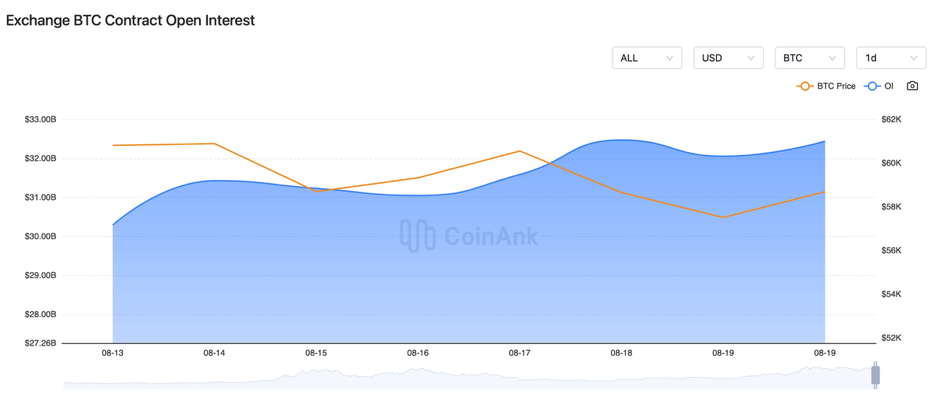

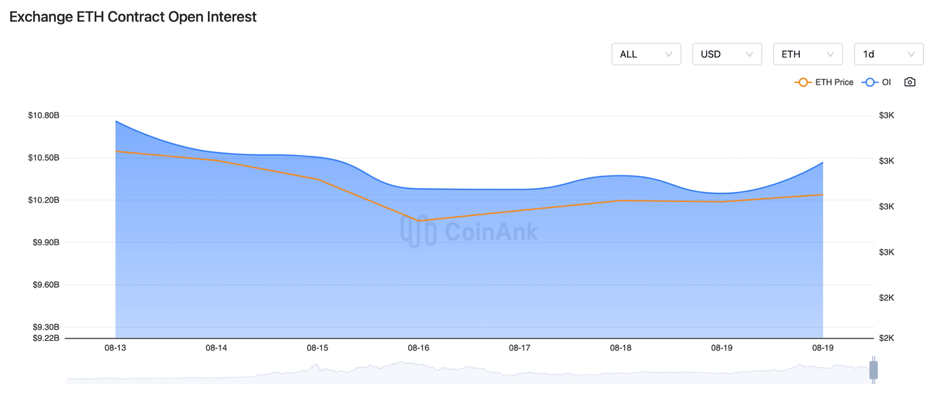

In the past four days, the BTC contract open interest has slightly increased, while the ETH contract open interest has remained nearly unchanged.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On August 15, the U.S. initial jobless claims for the week ending August 10 were 227,000, below the expected 235,000. The previous value was revised from 233,000 to 234,000

2) On August 15, President Biden stated that more effort is needed on the issue of inflation, though significant progress has been made; large corporations have not done enough to lower prices.

3) On August 15, Iranian officials announced that Iran and Russia would soon sign a comprehensive cooperation agreement. Iran also suffered its largest-ever cyberattack, which crippled the banking system.

4) On August 15, The UK’s three-month GDP growth rate for June was 0.6%, matching expectations. The previous value was revised from 0.9% to 0.8%. The second-quarter GDP annual growth rate was revised to 0.9%, in line with expectations, up from the previous 0.3%.

5) On August 15, Harris led Trump in 5 out of 7 swing states in the U.S.; Harris’s digital ad spending was ten times that of Trump’s, focusing on tech platform campaigns. Trump requested the postponement of his “hush money” case trial until after the election.

6) On August 15, the gift card company Raise partnered with Wallet Connect to introduce crypto payment options.

7) On August 15, In Yixing, Jiangsu Province, China, a virtual currency theft case resulted in a loss of over 900,000 RMB for the victim. India’s Enforcement Directorate arrested suspects involved in a $144 million crypto crime case linked to kidnapping and extortion.

8) On August 15: Switzerland launched a public consultation on sharing crypto tax information. The number of companies applying for crypto licenses in Turkey increased to 76.

9) On August 15, the U.S. SEC approved the first leveraged long MicroStrategy ETF.

10) On August 16, Reserve Bank of Australia (RBA) Governor Lowe stated that it was too early to consider rate cuts, with no immediate conditions for such a move. Deputy Governor Hauser noted that Australia faces similar inflation challenges to many other countries. Assistant Governor Silk said a cautious approach to rate cuts is appropriate, while Assistant Governor Kent mentioned that while markets have calmed, there may still be volatility.

11) On August 16, the Korean National Pension Fund increased its indirect exposure to Bitcoin by acquiring MicroStrategy shares.

12) On August 16, according to a Forbes journalist, there is still skepticism in the industry about Harris’s stance on crypto, due to her team’s absence from the “Crypto4Harris” event.

13) On August 16, negotiations for a new Gaza ceasefire took place in Doha, Qatar, with significant differences remaining among the parties. Talks will continue on Friday. White House spokesperson Kirby stated that differences can be overcome and that the negotiations must conclude quickly.

14) On August 16, the Central Bank of Ghana proposed a new regulatory framework for cryptocurrencies.

15) On August 16, PwC and NTT Digital announced their intention to create “digital public goods” by leveraging Web3 and blockchain innovations.

16) On August 16, a Chinese businessman in Thailand was robbed and forced to transfer $2 million in cryptocurrency. Malaysian police thwarted a kidnapping case involving a Chinese citizen, where a ransom of over $1 million was paid in cryptocurrency, orchestrated by the victim’s personal driver.

17) On August 17, Brazilian banks began accepting cryptocurrency payments for private pension plans, with Brazil’s second-largest retail bank leading the way.

18) On August 17, Norway’s sovereign wealth fund increased its indirect Bitcoin holdings by investing in tech companies with crypto exposure.

19) On August 17, Google was sued over a malicious crypto wallet app on the Play Store that stole $5 million in crypto assets from users.

20) On August 17, OP Labs released an upgrade proposal to fix security vulnerabilities identified in a third-party audit.

21) On August 18, the World Health Organization urged the increased production of monkeypox vaccines, while the European CDC raised the infection risk level.

22) On August 18, Nigeria’s tax authority proposed a comprehensive rollout of cryptocurrency; its court froze $38 million in cryptocurrency used to support protests in the country.

23) On August 18, the Guangzhou Internet Court in China revealed plans to launch a “Guangdong-Hong Kong Data Security and Privacy Protection Joint Laboratory” dedicated to blockchain and AI research.

24) On August 18, it was announced that next week will see significant token unlocks for AVAX, ROSE, PIXEL, ID, ENA, and GAL, totaling over $200 million in value.

25) On August 18, next Thursday, the Fed and the European Central Bank will release minutes from their latest monetary policy meetings. The Jackson Hole Global Central Bank Annual Symposium will begin, with Fed Chair Powell and Bank of England Governor Bailey scheduled to speak on economic outlooks on Friday and Saturday, respectively.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.