FameEX Weekly Market Trend | August 15, 2024

2024-08-15 18:43:50

1. BTC Market Trend

From August 12 to August 14, the BTC spot price swung from $57,669.08 to $61,631.25, a 6.87% range. In the past three days, key statements from the Federal Reserve (Fed) were as follows:

1) On August 12, Fed Governor Collins stated that if data progresses as expected, a rate cut could come soon.

2) On August 12, Fed Governor Bowman mentioned that the cooling of the labor market might be exaggerated and maintained a cautious stance on rate cuts.

3) On August 14, the Fed Bank of Atlanta President Bostic indicated that a rate cut is imminent but hoped to see more data, noting that the current situation is a turning point with inflation approaching the target.

On August 12, El Salvador received a $1.62 billion investment from Turkey’s Yilport to support the construction of the “Bitcoin City”. On August 14, El Salvador’s president announced $1.61 billion in private investment for the country’s third phase of economic reform.

On August 13, Trump and Musk had a more than two-hour live discussion on social media platform X (formerly Twitter), covering topics such as assassination attempts, Biden’s withdrawal, immigration issues, inflation, education, federal spending, corporate investment, electric vehicles, oil and gas industry, the Russia-Ukraine conflict, and FDA approvals. Musk indicated that if Trump wins a second term, he would seek a role in helping reduce federal spending.

Trump announced his imminent return to X, planning to sue the Department of Justice for $100 million over the Mar-a-Lago search. Musk also welcomed another U.S. presidential candidate, Kamala Harris, to have a live conversation on X Space.

The Wall Street Journal reported that Musk’s team plans to mobilize 800,000 swing state voters to support Trump.

The U.S. CPI for July rose 2.9% year-over-year, marking the fourth consecutive month of decline. Nick Timiraos, often referred to as the “Fed’s mouthpiece”, wrote that July’s CPI data clears the way for the Fed to start cutting rates at its next meeting. Due to recent signs of potential weakness in the labor market, the debate at the Fed’s September meeting will focus on whether to cut rates by 25 bps in the traditional manner or by a larger 50 bps. The inflation data released on Wednesday did not resolve this debate, which may hinge on labor market reports, including initial jobless claims and the August non-farm payroll report due on September 6. While Wednesday’s inflation report was relatively mild, strong housing cost increases might temper enthusiasm for the data. Nevertheless, Fed leaders have suggested they are prepared to start rate cuts next month, partly due to the much milder inflation data in May and June.

On August 14, Brazilian Central Bank President Neto stated that a slowdown in the U.S. economy is beginning to be observed but that a more pronounced slowdown is unlikely; global inflation seems to be at a slower stage; Japan has entered a different monetary policy process than what has been seen in the long term, leading to increased recent market volatility; the market is anticipating a rate hike in Brazil.

From August 15 to August 18, it is viable to keep an eye on the ETH spot trading. Sell orders for the ETH spot at $4,700 and buy orders at $1,850, as well as sell orders for the BTC spot at $72,500, $77,500, and $92,000, and buy orders at $42,950, can still be kept.

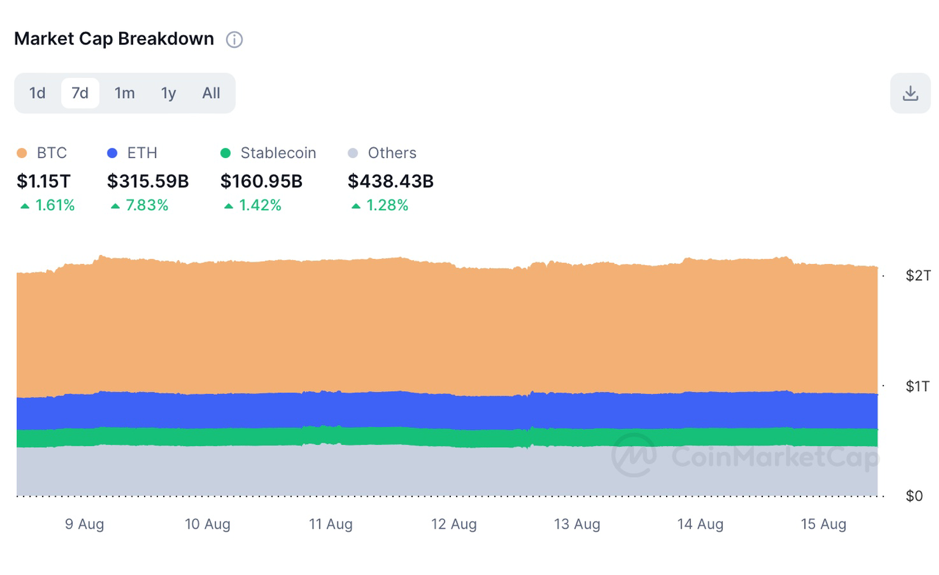

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

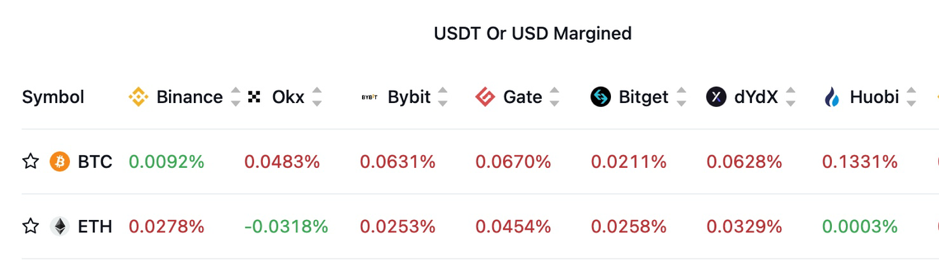

3. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

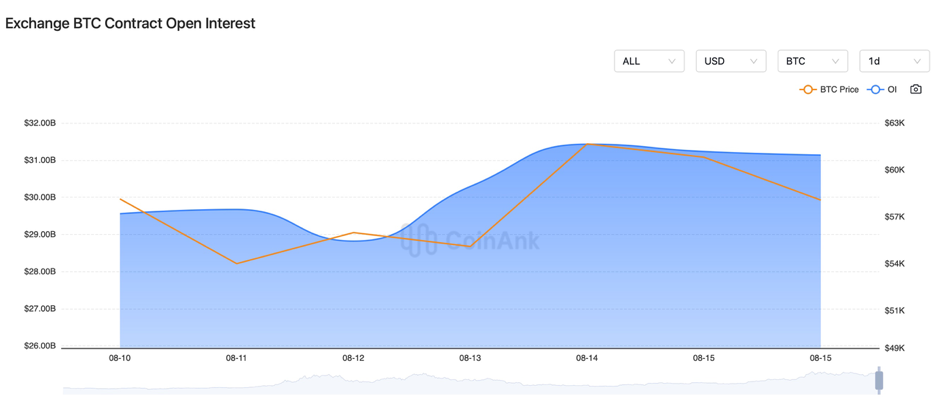

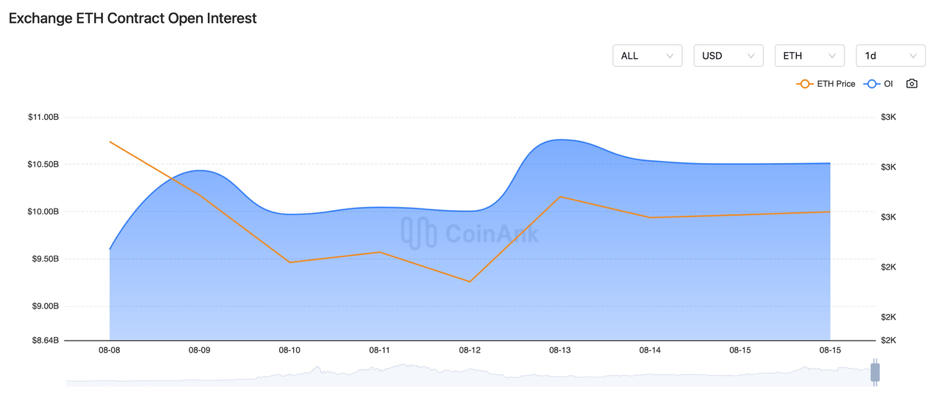

In the past three days, the open interest in both BTC and ETH contracts has sharply increased.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On August 12, U.S. Vice President Harris stated that she is completely opposed to Trump’s views on the Fed’s independence and would never interfere with its decisions as President. Recently, Trump has suggested that the President should have some say in monetary policy.

2) On August 12, Bitcoin reserves on centralized exchanges fell to their lowest level since November 19, 2018, with $5.96 billion withdrawn in the past 30 days.

3) On August 12, Zhang Li, Executive Director of New Huo Tech, stated that payment, investment, and Web3 are the three main application needs currently validated by Web3 users.

4) On August 12, China’s Ministry of Foreign Affairs responded to questions about the Ukrainian military entering Russia’s Kursk region: China will continue to communicate with the international community and play a constructive role in promoting a political resolution to the crisis. U.S. officials indicated that Russia is withdrawing some of its military forces from Ukraine to address Ukraine’s offensive into Russian territory.

5) On August 13, the UK’s unemployment rate for July was 4.72%, up from the previous 4.40%. The number of unemployment benefit claims in July was 135,000, revised from the previous value of 32,300 to 36,200.

6) On August 13, the SEC charged NovaTech and its executives and founders with cryptocurrency fraud involving $650 million.

7) On August 13, Fitch Ratings downgraded Ukraine’s rating to “RD” (Restricted Default) and downgraded Israel’s rating from “A+” to “A” with a negative outlook, citing the ongoing conflict with Hamas potentially lasting until 2025 and the risk of expanding to other fronts.

8) On August 13, an attacker who stole $2 million in Solana from Pump.fun pleaded guilty in London and could face over 7 years in prison.

9) On August 13, PitchBook reported that venture capital funding for Q2 totaled $2.7 billion, with DePIN being one of the standout industries of this cycle.

10) On August 14, Bank of America’s August Global Fund Manager Survey revealed that the U.S. economic recession has replaced geopolitical conflicts as the biggest potential risk, with 76% of respondents believing that a soft landing remains the most likely outcome for the global economy.

11) On August 14, the People’s Bank of China reported preliminary statistics showing that as of the end of July 2024, the broad money (M2) balance was 303.31 trillion yuan, up 6.3% year-on-year; the narrow money (M1) balance was 63.23 trillion yuan, down 6.6% year-on-year.

12) On August 14, the Eurozone’s adjusted employment rate for Q2 was 0.2%, meeting expectations of 0.3%, and down from the previous value of 0.3%. The revised annual GDP growth rate for Q2 was 0.6%.

13) On August 14, Iran’s banking system suffered a large-scale cyberattack; Iranian officials said that if a ceasefire agreement is reached for Gaza, retaliatory plans might be canceled.

14) On August 14, the Reserve Bank of New Zealand unexpectedly cut rates by 25 bps, marking the first rate cut since March 2020.

15) On August 14, data from the People’s Bank of China showed that the social financing scale stock at the end of July grew by 8.2% year-on-year; the M2 balance at the end of July grew by 6.3% year-on-year, compared to an expected 6% and a previous value of 6.20%.

16) On August 14, the U.S. PPI for July was 2.2% year-on-year, compared to an expected 2.30% and a revised previous value of 2.7%.

17) On August 14, the UK’s CPI for July was -0.2% month-on-month, compared to an expected -0.10% and a previous value of 0.10%.

18) On August 14, the U.S. Department of Defense announced that the Secretary of State approved the sale of F-15IA and F-15I+ fighter jets to Israel for $18.82 billion. The U.S. also lifted restrictions on bomb sales to Saudi Arabia and will deliver over $75 billion worth of bombs in the coming months.

19) On August 14, BlackRock’s Chief Investment Officer predicted that the Fed would cut rates in its September meeting.

20) On August 14, data showed that the number of active addresses on Solana grew by 151% over seven months.

21) On August 14, Bloomberg ETF analysts stated that whether the SOL ETF passes next year depends on whether there is a change in government.

22) On August 14, MetaMask announced plans to launch a blockchain debit card.

23) On August 14, New Jersey regulators urged cryptocurrency investors to withdraw funds from Abra; Fireblocks received a cryptocurrency custody license in New York; the Wisconsin Investment Board increased its holdings in BlackRock’s Bitcoin ETF.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.