FameEX Weekly Market Trend | August 5, 2024

2024-08-06 07:00:25

1. BTC Market Trend

From August 1 to August 4, the BTC spot price swung from $57,271.06 to $65,468.42, a 14.31% range. The main reason for the decline during this period was likely the market’s concern over the escalating conflict between Iran and Israel, potentially leading to a new war in the Middle East. This situation could also be a trigger for a larger-scale war involving NATO and its allies against countries like Russia and Iran. (Last month, Trump stated at the 2024 BTC Conference: “We are now closer to World War III than ever before.”) Additionally, Japan ended nearly thirty years of “zero inflation” with an interest rate hike, and the sell-off of ETH profit positions contributed to the decline.

In the past four days, key statements from the Federal Reserve (Fed) and the European Central Bank (ECB) were as follows:

1) On August 1, Fed Chairman Powell indicated that a rate cut in September is “possibly on the agenda”.

2) On August 3, Fed’s Goolsbee stated that do not overreact to one month’s data. When it comes time to cut rates, it often doesn’t happen just once. Barkin suggested that the job market is still generally healthy. The figure of 114,000 non-farm jobs, while not ideal, is still a “reasonable number”.

3) On August 1, ECB Governing Council Member Stournaras still expected two rate cuts in 2024.

Summary of the Fed FOMC statement and Powell’s press conference:

FOMC Statement:

1. Interest rate decision: Unanimously agreed to keep the interest rate unchanged at 5.25%-5.5% for the eighth consecutive time, in line with market expectations.

2. Interest rate outlook: Reaffirmed that a rate cut will not occur until there is greater confidence in controlling inflation.

3. Inflation situation: Changed the description of inflation from “still high” to “somewhat elevated”. The description of progress in reducing inflation was updated to “further progress”, removing the term “modest”.

4. Labor market: Added the statement “unemployment rate has risen”, and changed the description of employment growth to “has slowed”. Changed “highly attentive to inflation risks” to “highly attentive to risks associated with the dual mandate”.

Powell’s Press Conference:

1. Interest rate outlook: We are gradually approaching the time when a rate cut might be possible, but we have not yet reached that point. If inflation decreases as expected and the labor market remains stable, a rate cut could occur as early as September. There was indeed a thorough discussion about rate cuts at this meeting. A 50 basis point cut is not currently being considered. Various scenarios, from no rate cuts to multiple rate cuts, are possible. We will either maintain rates or act sooner based on economic conditions.

2. Inflation outlook: There is no need to focus solely on inflation. We are confident in achieving the 2% target. The range for inflation to decrease has broadened, and long-term inflation expectations appear well anchored. The risk of rising inflation has diminished.

3. Impact of elections: If a rate cut occurs in September, it should be non-political. Any decisions made before, during, or after the election will be based on data and a balance of risks, and will not be influenced by the yet-to-be-determined election results.

4. Economic conditions: The data does not show signs of economic weakness or overheating, although there are some signs of softness. Overall conditions are not bad. We are capable of handling economic weakness. The unemployment rate remains low, the labor market has become more balanced, and there are genuine downside risks facing the current job market.

5. Market reaction: Following the announcement and Powell’s remarks, gold initially declined but then surged, reaching a high of $2,438. U.S. stock indices fluctuated upwards, with the Nasdaq rising over 3% at one point. The dollar weakened, and 2-year U.S. Treasury yields fell by 6 basis points.

6. Latest expectations: As of the report, futures markets are pricing in a total of 72 basis points in rate cuts by the Fed this year (equivalent to nearly three rate cuts), which is more than 4 basis points higher than before the meeting.

The following is the recent key information on the Middle East situation:

On August 2, Israel announced the elimination of three high-ranking enemy leaders within 48 hours: Lebanese Hezbollah commander Shukr, Palestinian Hamas leader Haniya, and Hamas military chief Dave. An Israeli airstrike targeting Hamas commander Dave resulted in 90 deaths and 300 injuries. Hamas has indefinitely frozen ceasefire and prisoner exchange negotiations. The Chinese Representative Office in Palestine and the UN Relief and Works Agency for Palestine Refugees signed a donation agreement.

Iran's Supreme Leader Khamenei has ordered direct strikes against Israel in retaliation for the killing of Hamas leader Haniya in Tehran. According to the Iranian Student News Agency (ISNA), Iran is evaluating various methods of retaliation against Israel. The Iranian Intelligence Minister stated that Israel had U.S. approval before assassinating Haniya. Former senior diplomat Zarif has been appointed as Strategic Vice President. U.S. intelligence indicated that Iran would attack Israel in the coming days, similar to April 13 but potentially on a larger scale. An Israeli government spokesperson warned that Israel would impose a high cost on any acts of aggression. Israel has urged its citizens abroad to remain vigilant due to threats from Iran, Hamas, and Hezbollah.

During a “very direct” conversation with Netanyahu, President Biden urged him to accept a ceasefire with Hamas, with the White House growing increasingly frustrated with the ongoing Gaza war. The relationship between Biden and Netanyahu has become strained due to this conflict. Despite Biden’s commitment to supporting Israel against threats from Iran and its allies, he has expressed frustration over the worsening regional consequences of the nearly 10-month-long war. According to U.S. policy insiders, the U.S. government has warned Iran, Hezbollah, and Yemen’s Houthis through intermediaries not to escalate the situation further.

U.S. officials expected Iran to launch an attack on August 5. U.S. Central Command Chief has arrived in the Middle East to finalize defense plans against Iran. On August 4, U.S. Deputy National Security Advisor Jon Finer urged American citizens to leave Lebanon, preparing for potential regional developments. The U.S. is deploying the USS Lincoln carrier strike group to the Middle East purely for defensive purposes, aiming to de-escalate the regional situation.

ETH Market Analysis:

To return to $4,000, Ethereum needs to boost institutional investor interest, improve network scalability, and sustain the growth of the decentralized application (DApp) ecosystem. Since Ethereum last exceeded $4,000 on March 14, traders have been skeptical about a sustained rise. Despite the SEC approving an Ethereum spot ETF on May 23, market performance and Ethereum’s relative price decline compared to Bitcoin have affected investor sentiment.

The Fed’s successful strategy in curbing inflation without triggering a recession has reduced the appeal of alternative assets. Ethereum’s total locked value (TVL) remains at 17.8 million ETH, indicating potential stagnation in ecosystem growth. Additionally, scalability improvements, including sharding and miner extractable value (MEV) mitigation strategies, need to be addressed for Ethereum’s price to potentially reach $4,000 in 2024.

Our recommended spot trading strategy aims for a relatively large and controllable price range to achieve the most stable and reliable profits. While the approach may seem straightforward, it ensures that all users placing orders on FameEX can secure tangible gains from each trade. Our commitment to maximizing clients’ profits is a core reflection of our values.

The spot buy orders for ETH at $2,500 have been filled. From August 5 to August 7, you can place additional buy orders at $1,850 for ETH. It is viable to keep the sell orders for ETH at $4,700, and the sell orders for BTC at $72,500, $77,500, and $92,000. Also, retain the buy orders at $42,950.

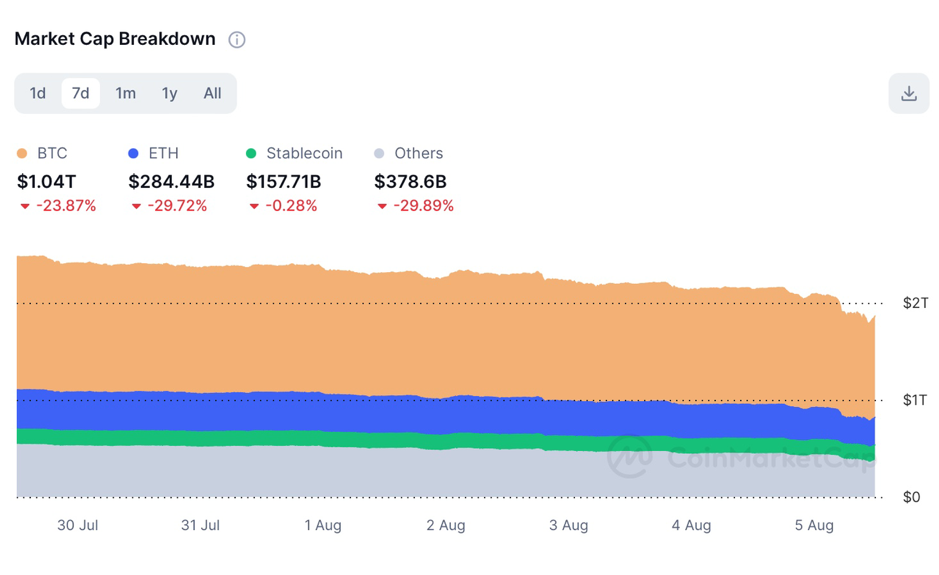

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

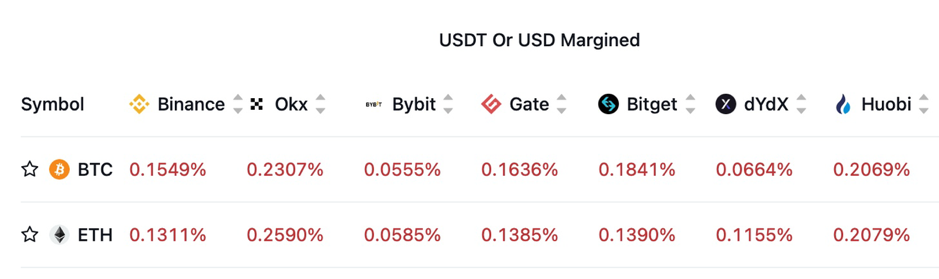

3. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high. Recently, the scale of liquidation for long positions is expected to increase.

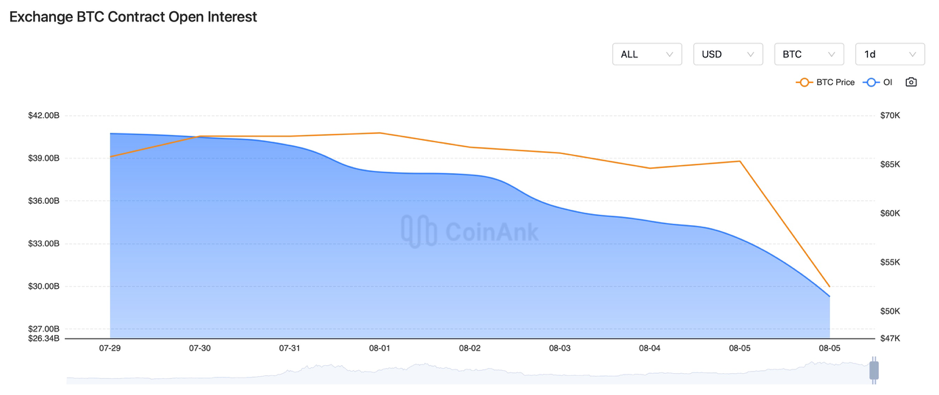

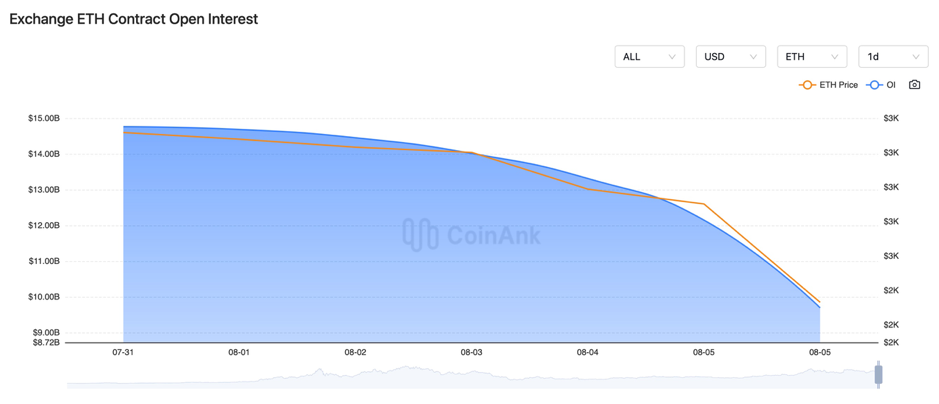

In recent days, both the BTC and ETH contract open interest has sharply decreased, likely due to a substantial number of long contracts being liquidated.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On August 1, U.S. initial jobless claims for the week ending July 27 were 249,000, higher than the expected 236,000 and the previous value of 235,000.

2) On August 1, the Eurozone unemployment rate for June was 6.5%, above the expected 6.4% and the previous value of 6.4%.

3) On August 1, the Bank for International Settlements and the Bank of England planned to regulate stablecoin balance sheets.

4) On August 1, the Bank of Japan raised interest rates by 15 basis points. Several Japanese crypto organizations submitted a request to the government for tax reform related to virtual currencies in 2025.

5) On August 1, a report indicated that 54% of institutional investors and 64% of retail investors plan to increase their allocation to digital assets.

6) On August 1, according to CME FedWatch, the probability of a 25 basis point rate cut by the Fed in September is 90.5%, while the probability of a 50 basis point cut is 9.5%.

7) On August 2, Johnber Kim was detained and prosecuted for allegedly manipulating a “fraud coin” with a market value of $58.6 million.

8) On August 2, the SEC charged BitClout’s founder with running a fraudulent crypto asset scheme.

9) On August 2, the total funding for the crypto market in July was $1.018 billion, a 37% increase month-over-month.

10) On August 2, Pakistani Prime Minister Shahbaz Sharif announced that Pakistan would implement a visa-free policy for Chinese citizens starting August 14.

11) On August 2, EU regulators warned about the risks of offshore cryptocurrencies under the MiCA regulations.

12) On August 2, a report showed that the total market capitalization of cryptocurrencies has increased by approximately 44% this year, with Bitcoin’s market dominance rising to over 55%.

13) On August 2, the Bank of England voted 5-4 to cut interest rates by 25 basis points, marking its first rate cut since March 2020. Market bets are increasing on further rate cuts this year.

14) On August 3, a Hong Kong legislative council member proposed the establishment of a Web 3.0 industry committee.

15) On August 3, Vitalik Buterin said that the low point for cryptocurrency utility has passed.

16) On August 3, the FBI warned about scammers posing as crypto exchange employees to illegally siphon funds.

17) On August 3, a Forbes reporter indicated that Harris’s campaign team would meet with crypto industry leaders in Washington on August 5.

18) On August 3, it was reported that Coinbase plans to launch a crypto index fund, Coinbase 500.

19) On August 4, Wall Street brokerage Benchmark raised MicroStrategy’s (MSTR) target price to $2,150. MSTR currently holds 226,500 Bitcoins.

20) On August 4, Senator Lummis’s “Bitcoin Strategy Reserve” bill received support, with 2,200 letters, and officially submitted to Congress for review by the Senate Banking Committee.

21) On August 4, Trump suggested using Bitcoin to repay $35 trillion in national debt and hoped to debate Harris on Fox News on September 4, while Harris insisted on a debate on ABC News on September 10.

22) On August 4, XRP on-chain transaction volume decreased by 65.6% in Q2 2024.

23) On August 4, the New York District Attorney’s office announced the recruitment of a full-time cryptocurrency analyst for its cybercrime division

24) On August 4, the U.S. Department of Justice launched a whistleblower reward program targeting corporate crimes, including crypto-related activities.

25) On August 4, next Thursday, the U.S. will release initial jobless claims numbers, and the Bank of Japan will publish the summary of opinions from its July monetary policy meeting.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.