FameEX Weekly Market Trend | June 20, 2024

2024-06-21 00:03:30

1. BTC Market Trend

From June 17 to June 19, the BTC price swung from $64,036.87 to $67,237.53, with a volatility of approximately 5%. The following are important recent statements from the Federal Reserve (Fed) and the European Central Bank (ECB):

1) On June 17, Fed officials expressed their opinions:

· Harker indicated one rate cut is appropriate in 2024 based on the current prediction and estimated that there could be either two or zero rate cuts this year, with uncertainty.

· Minneapolis Fed President Kashkari expected the FOMC to cut rates towards the end of the year and suggested that Bank of America’s prediction of a rate cut in December this year is reasonable.

2) On June 19, Williams, known as the “top three in the Fed”, indicated that the path of rate cuts depends on data, inflation would continue to fall, and rates would decline in the coming years. Richmond Fed President Barkin believed that the scenario of one rate cut followed by maintaining rates is reasonable. Boston Fed President Collins warned that we should not overreact to one or two months of optimistic data. Fed Governor Goolsbee stated that tariffs and de-globalization ‘come at a cost’. Fed Governor Kugler indicated that long-term neutral real rates are not particularly helpful for policy-making; a rate cut later this year is appropriate. Dallas Fed President Logan said that a ‘few more months’ are needed to be confident that inflation is moving towards 2%. St. Louis Fed President Bullard indicated that it might take 'several quarters' to see data supporting a rate cut.

3) On June 19, ECB officials gave some key points:

Vice President de Guindos indicated rate decisions would depend on data. The best time to make rate decisions is every three months, coinciding with the release of macroeconomic forecasts. The next forecast will be released in September. ECB Governing Council member Knot said that inflation might rise again.

The European Economic Area (EEA) will implement the Markets in Crypto-Assets (MiCA) regulatory framework on June 30.

According to Token Unlocks’ June 2024 report on the top 15 largest unlocking events, the following projects are included:

· WLD unlocked the highest value this month, totaling $476 million, accounting for 44.68% of the current circulating supply.

· SOL ranked second with an unlocking of $397 million, accounting for 0.5% of the current circulating supply.

· ARB ranked third, unlocking $122 million, accounting for 4.05% of the current circulating supply.

· AVAX unlocked $122 million, also accounting for 4.05% of the current circulating supply.

· APT unlocked $101 million, accounting for 2.6% of the current circulating supply.

· NEAR unlocked $99.16 million, accounting for 1.15% of the current circulating supply.

· SUI unlocked $96.51 million, accounting for 3.71% of the current circulating supply.

· DOT unlocked $89.67 million, accounting for 0.88% of the current circulating supply.

· STRK unlocked $77.44 million, accounting for 5.61% of the current circulating supply.

· DYDX unlocked $70.10 million, accounting for 12.46% of its current circulating supply.

· DOGE unlocked $67.25 million, accounting for 0.28% of the current circulating supply.

· OP unlocked $64.50 million, accounting for 2.22% of the current circulating supply.

· IMX unlocked $64.33 million, accounting for 1.72% of the current circulating supply.

· UNI unlocked $63.51 million, accounting for 0.91% of the current circulating supply.

· ID unlocked $59.83 million, accounting for 18.23% of the current circulating supply.

Recently, leading global asset classes like the US stock indices have repeatedly reached new highs. The Nasdaq index has shown a stronger correlation with BTC trends, providing significant support amid declines in BTC spot daily candle trends.

From June 20 to June 23, without major bullish or bearish stimuli, it is expected that the spot price volatility of BTC will remain unlikely to exceed 10%. Sell orders for ETH are set at $4,700, with buy orders for bargain hunting at $2,500. Similarly, sell orders for BTC are placed at $72,500 and $77,500, with buy orders for bargain hunting at $54,050. It is advisable not to cancel these orders

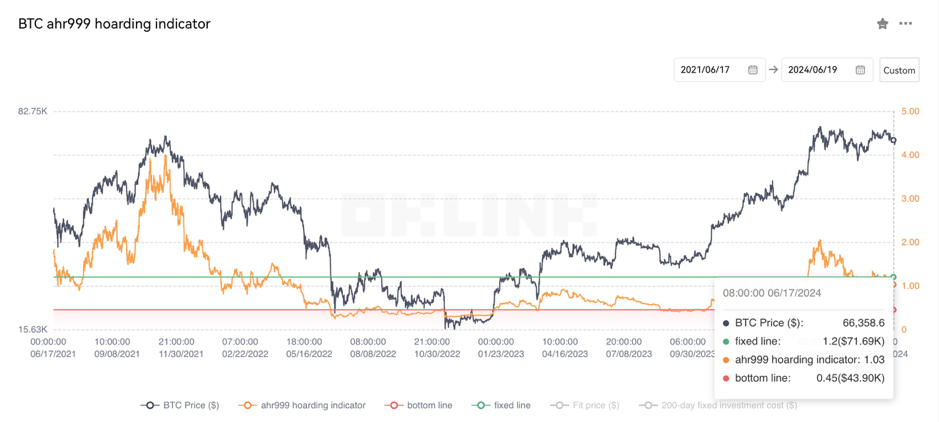

According to the ahr999 coin hoarding indicator, the current indicator value for BTC is 1.03, which is below the DCA level ($71,690) but above the buy-the-dip level ($43,900). Therefore, it is advisable to continue dollar-cost averaging into top cryptocurrencies.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

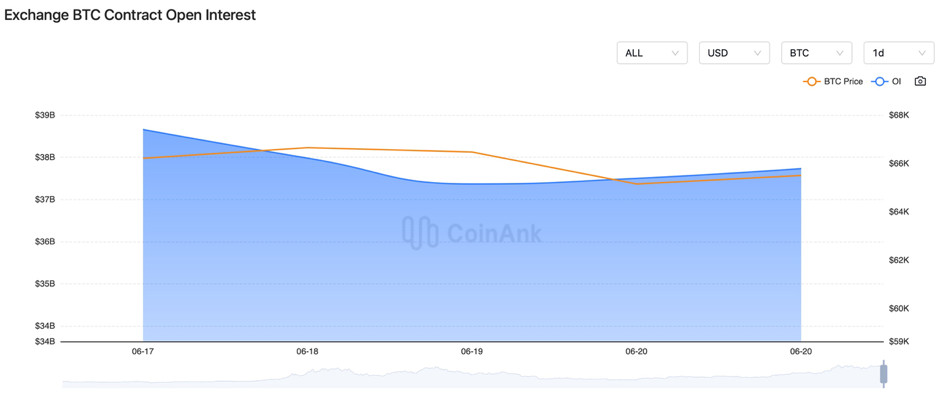

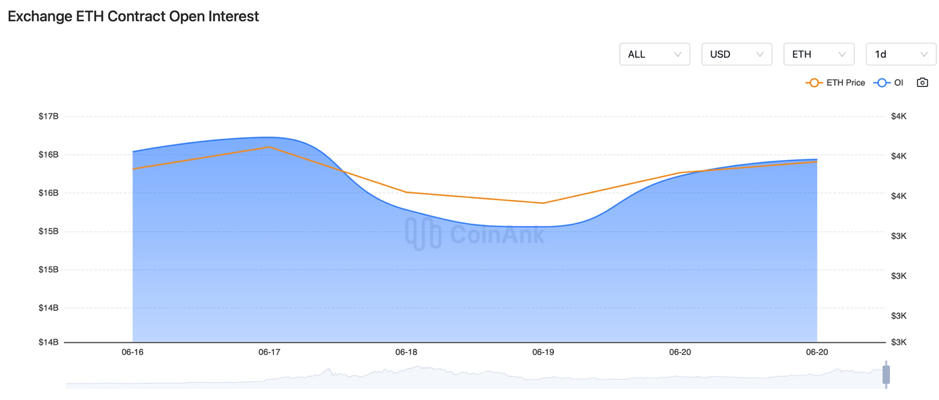

Recently, both the BTC and ETH contract open interest has slowly declined.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On June 17, according to the market news, the U.S. Supreme Court agreed to hear a case regarding Nvidia’s cryptocurrency mining income

2) On June 17, the market news revealed that the head of SEC’s Division of Crypto Asset and Cyber Unit resigned.

3) On June 17, South Korean prosecutors found new evidence suggesting Do Kwon initially intended to deceive investors with false transactions.

4) On June 17, South Korea’s New Reform Party pledged stricter measures to combat cryptocurrency fraud.

5) On June 17, the Web3 Innovation Festival was scheduled to take place at the Singapore Expo Center.

6) On June 17, South Korea launched a $14.5 million blockchain support plan involving CBDC projects; local exchanges’ listing of 600 cryptocurrencies to undergo reassessment, proposing enhanced scrutiny.

7) On June 17, the U.S. cryptocurrency industry saw a 14% decline in talent over the past five years, urgently needing regulatory clarity.

8) On June 17, the Salvadoran government proposed to integrate Bitcoin and other cryptocurrencies into its investment banking sector.

9) On June 18, the Hong Kong Securities and Futures Professionals Association Chairman stated that the SAR government should establish a Virtual Asset Regulatory Committee and negotiate cooperation with mainland China authorities.

10) On June 18, SlowMist warned of on-chain false news impersonating Coinbase officials.

11) On June 18, FTX victims applied to recover nearly $8 billion in confiscated assets, rejecting handling under bankruptcy procedures.

12) On June 18, South Korea’s FSC indicated it will not directly engage in token inspection and delisting processes; instead, the FSC’s new Virtual Asset Science proposal has been approved by the Cabinet.

13) On June 18, Uphold announced it would cease support for various stablecoins such as USDT and DAI from July 1.

14) On June 18, 10x Research stated that dumping pressure from large-scale altcoin unlocks is dragging down Bitcoin.

15) On June 18, Signal CEO criticized the EU’s “upload moderation” surveillance strategy, stating it will undermine encrypted communications.

16) On June 18, the CEO of X indicated that the platform is moving towards becoming an “application of everything”, with payment features set to launch soon and potential future support for cryptocurrency payments.

17) On June 19, Trump reaffirmed the commitment to end Biden’s “cryptocurrency war” at a Wisconsin rally, stating cryptocurrency policies will “create opportunities for young people”, pledging to repeal Bidenomics on his first day in office if elected president.

18) On June 19, the SEC concluded its investigation into Ethereum 2.0, not charging Ethereum sales as securities transactions.

19) On June 19, Putin and Kim Jong Un signed a comprehensive strategic partnership treaty between Russia and North Korea.

20) On June 19, Hong Kong SFC released its 2023-24 annual report, conducting 234 on-site inspections of licensed virtual asset institutions and related entities.

21) On June 19, Renowned trader GCR stated that we are still in a bull market phase, noting the current structure resembles the aftermath of the DeFi summer collapse in late summer 2020.

22) On June 19, Velocore launched a ZK airdrop claiming, compensating all affected users from previous security incidents with full protocol airdrops.

23) CertiK announced the discovery of a vulnerability in the Kraken deposit system, and funds were returned to exchange during the vulnerability bounty dispute.

24) A Pendle user lost $1.4 million due to phishing signature fraud.

25) On June 17, tokens such as ID, PIXEL, and APE were scheduled to unlock next week, with ID unlocking approximately $44 million.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.