FameEX Weekly Market Trend | June 17, 2024

2024-06-17 19:14:10

1. BTC Market Trend

From June 13 to June 16, the BTC price swung from $65,029.83 to $69,105.57. As expected, BTC spot prices fell, with a volatility of approximately 6.27%. Recent important statements from the Federal Reserve (Fed) and the European Central Bank (ECB) are as follows:

1) On June 13, the Fed’s dot plot expected only one rate cut in 2024. The Fed made “slight further progress” towards the 2% inflation target.

2) On June 13, Fed Chairman Powell said that confidence in inflation slowing enough to cut rates has not yet increased, and rate cuts would need to wait longer.

3) On June 16, Fed’s Kashkari expressed that more evidence of cooling inflation is needed, and a rate cut may occur at the end of the year.

4) On June 13, ECB Governing Council Member Muller suggested interest rates might remain above average levels for some time.

5) On June 16, ECB Governing Council Member Kazaks indicated that the ECB would certainly not allow inflation to remain above 2% in 2026.

In recent days, dozens of major countries have issued a joint statement aimed at assuring the public that these jurisdictions agree on a set of cryptocurrency tax rules developed by the OECD, known as the Crypto-Asset Reporting Framework (CARF). These countries have expressed their intention to swiftly incorporate CARF into domestic law and promptly initiate exchange agreements so that exchanges can begin operations by 2027. Jurisdictions that have signed the Common Reporting Standard (CRS) will also implement amendments to this standard, which will discourage financial institutions and large asset holders from trading cryptocurrencies, posing a medium- to long-term bearish outlook for the crypto market.

On the international front, Biden approved $50 billion in aid to Ukraine and expanded sanctions against Russia, signaling unwavering U.S. and ally support for Kyiv. At a June 13 press conference in Italy, Biden stated, “We will stand with Ukraine until they win this war,” emphasizing the importance of these measures as the conflict enters its third year.

Meanwhile, Biden reiterated his decision not to deploy U.S. troops to fight in Ukraine and has no intention of allowing Ukraine to use U.S. weapons to target deeper into Russian territory. Biden stated that the best help the U.S. can offer is “not to send American troops to fight in Ukraine, but to provide weapons and ammunition, expand intelligence sharing, continue training the brave Ukrainian military,” and “invest in Ukraine’s defense industrial base”.

At the G7 summit, leaders reached a breakthrough agreement to use profits generated from frozen Russian sovereign assets to provide an upfront loan to Ukraine, with funds expected to start flowing into Ukraine by the end of the year. Under a U.S.-led multilateral mediation effort, Israeli forces have paused their offensive, and Hamas has proposed a ceasefire. However, it will take some time for this round of conflict to be completely resolved.

From June 13 to June 16, there was no clear trend in the global major asset classes’ price movements. France experienced a “Black Friday” with both stocks and bonds plummeting, which also affected the Euro Stoxx 50 index. Caution is advised as BTC spot prices could reach around $72,500 before the end of June, potentially leading to a period of decline on the daily candlestick chart. Without significant positive news, such as a U.S. interest rate cut or substantial inflows into the Ethereum U.S. ETF, there is little to support the current BTC price.

For ETH spot trading, it is viable to place sell orders at $4,700 for positions bought at $3,460. Keep buy orders at $2,500 in case of a significant price drop for automatic buying. Similarly, maintain the BTC sell orders at $72,500 and $77,500, and the buy order at $54,050 according to the same strategy. Avoid frequent order placement and cancellation.

According to the ahr999 coin hoarding indicator, the current indicator value for BTC is 1.09, which is below the DCA level ($70,950) but above the buy-the-dip level ($43,440). Therefore, it is advisable to continue dollar-cost averaging into top cryptocurrencies.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

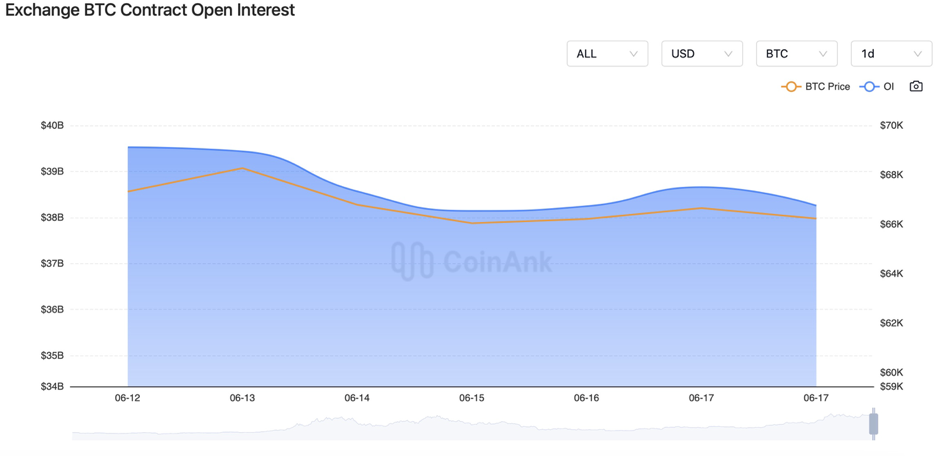

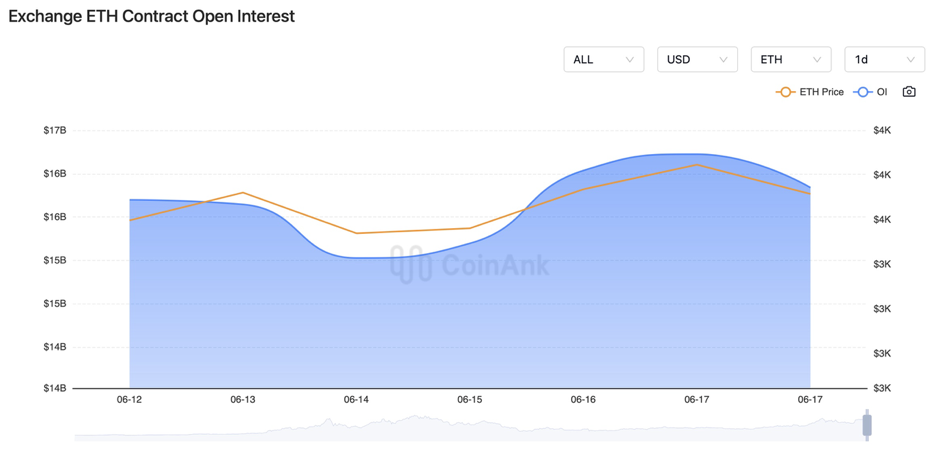

Recently, both the BTC contract open interest has declined, while the ETH contract open interest has slowly increased.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On June 13, the U.S. initial jobless claims for the week ending June 8 recorded 242,000, the highest since the week ending August 12, 2023. The U.S. May PPI month-on-month recorded -0.2%, the largest decline since October 2023. Both are positive for gold, silver, and cryptocurrencies.

2) On June 13, South Korea’s Supreme Court upheld the conviction of a former Coinone executive for abuse of power.

3) On June 13, Taiwan established a cryptocurrency industry association, with members completing anti-money laundering registration.

4) On June 13, a user lost nearly $250,000 due to a phishing signature on Uniswap’s Permit2.

5) On June 13, Biden’s campaign team was negotiating to accept cryptocurrency donations through Coinbase Commerce.

6) On June 13, the market share of the Turkish lira in the cryptocurrency market reached a new high.

7) On June 13, the U.S. SEC maintained its uncertain stance on ETH’s status, while the CFTC confirmed ETH’s status as a “commodity”. The SEC chair commented on whether the CFTC is suitable for regulating cryptocurrencies: the CFTC has not yet established an adequate disclosure system.

8) On June 14, Swiss regulators closed the cryptocurrency-related FlowBank and initiated bankruptcy proceedings.

9) On June 14, a U.S. lawmaker proposed including a ban on U.S. crypto platforms from trading with Russia in the National Defense Authorization Act.

10) On June 14, Malaysia contributed 2.5% of the global hash rate, making it one of the top 10 countries.

11) On June 14, the UK advanced its position as a global leader in fintech and digital assets.

12) On June 14, the U.S. and Ukraine signed a bilateral security agreement, clarifying long-term U.S. support for Ukraine. The G7 agreed to provide a $50 billion loan to Ukraine using interest from frozen Russian assets.

13) On June 14, a U.S. judge approved a $4.5 billion settlement between Terraform and the SEC.

14) On June 15, a mining company lost over 400,000 USDT due to a scam involving transfers with similar ending digits.

15) On June 15, two men were charged with operating the dark web market Empire Market, with $75 million in cryptocurrency and other assets seized.

16) On June 15, the state of New York recovered $50 million for victims of the Gemini Earn program.

17) On June 15, the U.S. SEC required Ripple to pay $102.6 million in settlement fees, opposing its appeal for a $10 million fine.

18) On June 15, Tether Treasury issued 1 billion USDT on the Tron network, authorized but not yet issued.

19) On June 15, the Odisha High Court in India ruled that cryptocurrency trading is not illegal.

20) On June 16, the rules for the first television debate between Biden and Trump were announced, with topics including the economy and inflation.

21) On June 16, Tether’s CEO stated that over 300 million people worldwide use USDT and that Tether is a major purchaser of U.S. Treasury bonds.

22) On June 16, Biden was scheduled to attend a Bitcoin roundtable meeting aimed at developing strategies to maintain “Bitcoin and blockchain innovation in the US”.

23) On June 16, the crypto-staking company OkayCoin expanded its services to South Korea.

24) On June 16, Forbes reported that central banks worldwide have begun cutting interest rates, which can support cryptocurrency prices.

25) On June 16, APE, NYM, MANTA, PIXEL, and ID would unlock next week.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.