FameEX Weekly Market Trend | February 29, 2024

2024-02-29 19:40:15

1. Market Trend

From Feb. 26 to Feb. 28, the BTC price swung from $50,939.60 to $64,000.00, with a volatility of 25.64%. The prior analysis report mentioned: BTC broke $50,000 on Feb. 13, no pullback since. Bulls showed strong support near $50,500 (noticed from volume and quick price recovery at $50,500), which is very similar to the market situation after breaking through $40,000. On the 26th, at 10:00 PM (UTC+8), BTC’s upward trend started, soaring all the way. Investors who are still in a cash position at this time should not enter the market rashly. All moving averages are far from the current price with a high candlestick slope, risking a stampede. A prudent approach is to wait for BTC to retreat to $58,000 before entering the market. Currently, the uptrend of BTC remains strong, adopting a step-by-step upward pattern with volume (a trend that only appears when the bulls are strong, minimal pullbacks during ascent). Hence, hodlers can still hold and wait for further rise, following the trend.

Source: BTCUSDT | Binance Spot

From Feb. 26 to Feb. 28, the price of ETH/BTC fluctuated between 0.05473 and 0.06014, a 9.88% range. The previous report stated that if the daily closing price remains above 0.06000, a third increment in ETH/BTC can be considered the next day. In recent days, ETH/BTC approached the 0.06000 mark, but the daily closing price didn’t stabilize, resulting in a rebound after hitting highs and missing the opportunity for further increments. The decline in ETH/BTC this time is due to BTC’s excessive strength, rather than any inherent issue with ETH/BTC. It’s believed that ETH/BTC will recover in the coming days. Those who have already incremented twice need not panic; holding is advised. Cash investors can consider incrementing near 0.05450.

Based on overall analysis, currently, BTC has broken out of its range-bound pattern and entered a unilateral uptrend. As mentioned earlier, altcoins are expected to take turns surging, so positioning quality but dormant altcoins before BTC’s direction is crucial. In recent days, MEME coins like PEPE, MEME, and DOGE, and tokens in the metaverse sector like ORDI and SATS, have all surged one after another, with significant gains. With BTC surpassing the $60,000 mark, accompanying risks emerge. Investors entering the market must strictly set stop-loss and take-profit orders to prioritize capital protection. At present, overall market funds continue to see significant net inflows daily, and BTC’s upward momentum remains steady. Therefore, it’s not advisable to be overly bearish now; the overall trend is bullish. It’s essential to maintain a mentality of holding for further rises. Investors who haven’t entered the market should also refrain from shorting blindly and instead wait for pullbacks, focusing on buying low.

2. Perpetual Futures

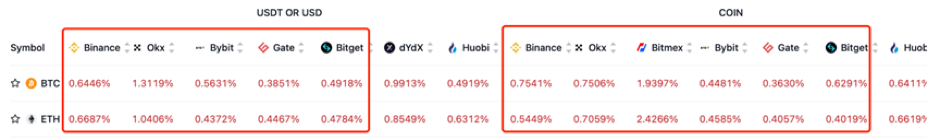

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

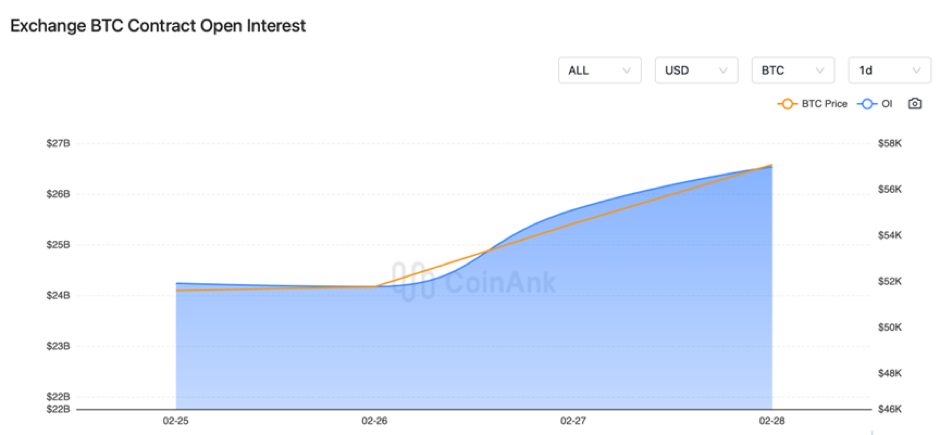

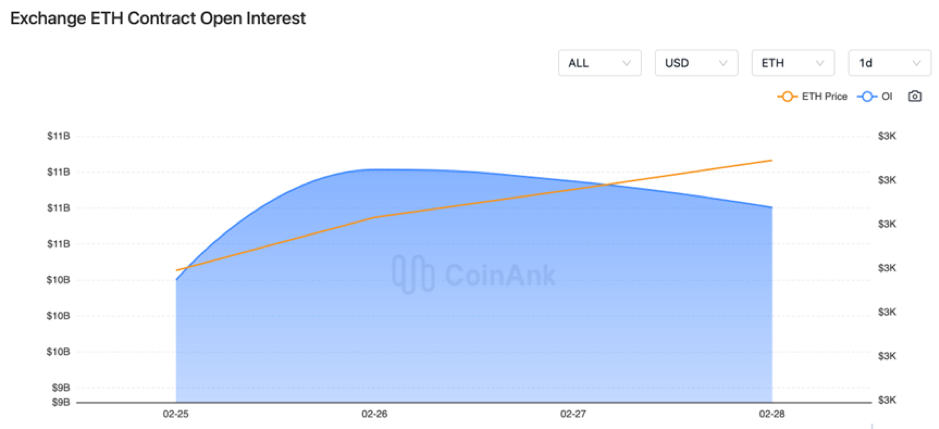

In the recent period, there has been a marked rise in BTC contract open interest, contrasted with a slight dip in ETH.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On February 26, FSB stated that cryptocurrencies, tokenization, and artificial intelligence are priority areas for monitoring.

2) On February 26, the probability of the Fed keeping rates unchanged in March is 97.5%.

3) On February 26, this week will see token unlocks for DYDX, OP, PRIME, among others.

4) On February 27, the stablecoin market cap reached $140 billion for the first time since late 2022.

5) On February 27, BlackRock’s Bitcoin ETF surpassed $1 billion in daily trading volume, ranking first among all ETFs.

6) On February 27, Grayscale’s GBTC circulating shares fell below 500 million.

7) On February 28, Hong Kong SFC announced that virtual asset trading platforms must submit license applications by February 29 or cease operations in Hong Kong by May 31.

8) On February 28, a total cryptocurrency market cap surpassed $2.3 trillion.

9) On February 28, Bitcoin reached all-time highs against multiple fiat currencies.

10) On February 28, according to the Hong Kong Financial Secretary, phase one of the currency bridge project is expected to launch this year.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.