FameEX Weekly Market Trend | January 15, 2024

2024-01-15 19:10:40

1. Market Trend

From Jan. 11 to Jan. 14, the BTC price swung from $41,500.00 to $48,969.48, with a volatility of 17.99%. The prior analysis indicated an unstoppable trend, with the imminent breakthrough of $48,000. Upon breaching, a new upward channel is expected, and attention is on funds flowing into the Nasdaq-listed ETF. BTC recently peaked at $49,000 but retraced to $41,500 with increased turnover and an 18-point amplitude. ETF approval didn’t lead to the expected rising or sideways market, contrary to conventional predictions. Still, the current market is declining. The rationale lies in the approval of 11 Bitcoin spot ETFs by the SEC, altering dynamics for early BTC participants who previously bought GBTC through Grayscale. GBTC lost its monopoly, and less favorable rates led to more options for investors, increasing the demand to switch platforms and boosting BTC’s selling volume. Coupled with GBTC’s high yield, there’s a demand for profit-taking, explaining recent market trends.

Technically, the pullback broke the crucial $43,000 support level, where numerous long positions are concentrated in the core area of recent oscillation. The current price is hovering around $42,000, repeatedly touching $43,000 but failing to stabilize. At this moment, $43,000 has become a turning point in the market. To move upwards, there must be a substantial breakthrough and stabilization above $43,000. If the trend continues downward, it is likely to trigger a trampling event to test the support strength at $40,000. The current recommendation is to enter long positions at $42,000-$42,500 with a stop loss at $41,500. Investors who have already purchased are advised to hold and wait for the rise.

Source: BTCUSDT | Binance Spot

Between Jan. 11 and Jan. 14, the price of ETH/BTC fluctuated within a range of 0.05217-0.06117, showing a 17.25% fluctuation. The previous analysis report mentioned that between 0.04790 and 0.05432, there was no significant pullback, and the price has been consistently rising. For those looking to enter this market, it is advisable to patiently wait for a pullback. Around 0.05350 seems to be a good entry point. In recent market corrections, the price touched the 0.05350 level. Investors who entered at this point likely gained relatively good profits. It’s currently recommended to continue holding and consider partial profit-taking. ETH/BTC reached a peak of 0.06 to 0.061, followed by a temporary pullback. The overall trend remains positive, especially if it stabilizes above the key level of 0.06. Looking at the 4-hour and 1-day charts, there’s a need for correction as the price is away from the moving average with a steep slope. There are two probable correction scenarios: 1. Gradual decline to around 0.05600. 2. Time-based consolidation around 0.05800. If the second scenario occurs, consider adding positions around 0.05800. In the first scenario, consider adding positions around 0.05500-0.05600.

Based on the overall analysis, the current market is in a declining state, but it is essential to approach this decline rationally (facilitating the analysis of the reversal probability and the duration of the trend continuation). In the past few days, with the continuous decline in BTC prices, most cryptocurrencies in the market have also experienced significant retracements. Personally, the continuity and intensity of this decline will be released to a considerable extent in the next week. The market will re-embrace a positive outlook. Therefore, it is advisable to look for high-quality cryptocurrencies and consider gradually building positions.

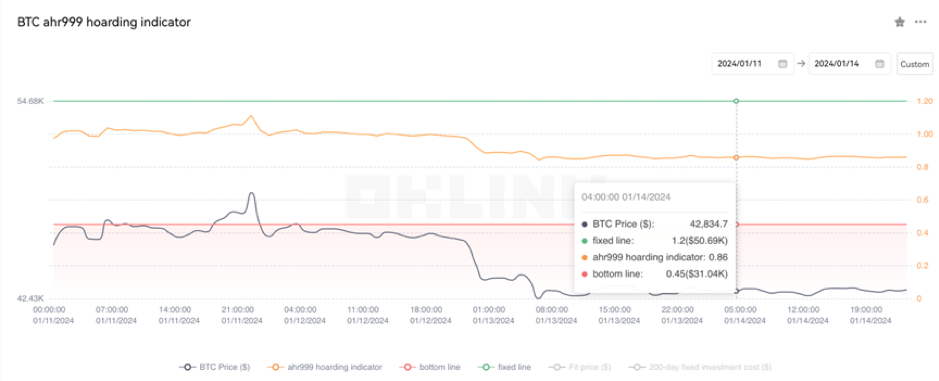

The Bitcoin Ahr999 index of 0.86 is between the buy-the-dip level ($31,040) and the DCA level ($50,690). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

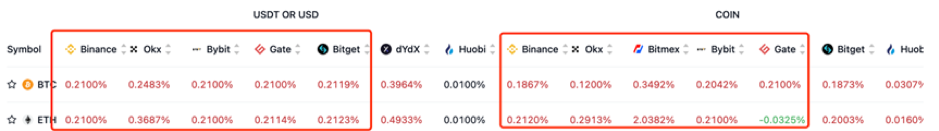

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

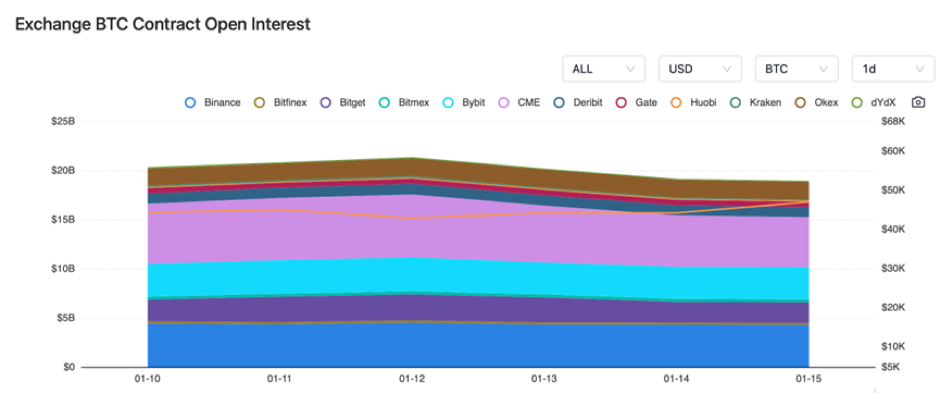

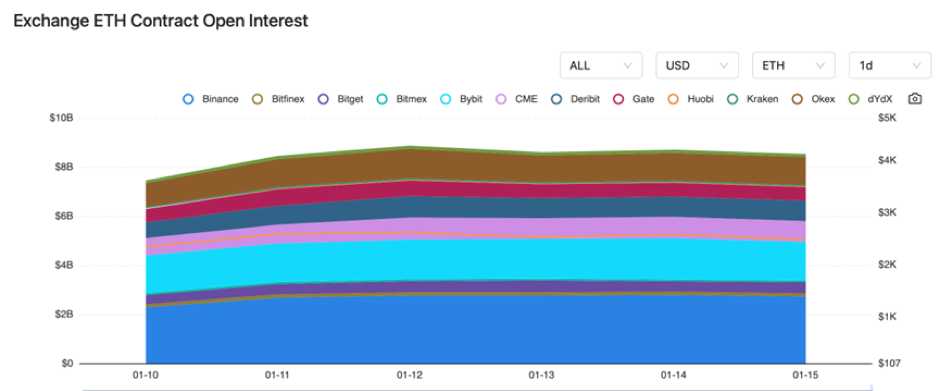

The BTC contract open interest experienced a slight decline, but the contract open interest for ETH stayed constant.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On January 11, SkyBridge founder stated the plan to purchase a Bitcoin spot ETF.

2) On January 11, according to Bloomberg analysts, BlackRock’s Bitcoin ETF reached a trading volume of $2 million.

3) On January 11, the South Korean Financial Commission announced its commitment to maintaining regulations that restrict financial institutions from issuing crypto ETFs.

4) On January 12, USDT market capitalization surpassed $96 billion, setting a new historical record.

5) On January 12, GBTC’s negative premium narrowed to near zero for the first time since February 2021.

6) On January 12, the CEO of BlackRock expressed the value of launching an Ethereum ETF.

7) On January 13, the SEC Chairman said Grayscale’s legal victory is crucial for the approval of a Bitcoin spot ETF.

8) On January 13, the SEC Chairman pointed out that the contradiction with Satoshi Nakamoto’s decentralized mission is the irony of a spot Bitcoin ETF.

9) On January 14, the UK Bank Governor indicated that cryptocurrencies like Bitcoin have not become a means of payment.

10) On January 14, the South Korean financial regulatory agency decided to allow continued trading of overseas Bitcoin ETFs.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.