FameEX Weekly Market Trend | December 18, 2023

2023-12-18 19:21:26

1. Market Trend

From Dec. 14 to Dec. 17, the BTC price swung from $41,400.00 to $43,475.25, with a volatility of 5.01%. The previous analysis report mentioned that this round of market cleansing probably has ended, forming a triple bottom trend and demonstrating favorable strength and speed in rebounding from the decline. Theoretically, investors holding long positions can feel secure with a $40,500 stop-loss. In recent days, BTC has followed the anticipated upward trajectory after market cleansing, surpassing the $43,000 threshold twice. However, a notable absence of continuous upward momentum has led to considerable retracements. After a rebound, it approached $41,800, indicating the current weakness in the bullish trend. In the trend on Dec. 17, BTC prices did not reach $43,000 before experiencing a pullback during the upward movement, further indicating the overall weakness of the current market.

With three previous bottoms near $40,500, if the price approaches this level again, it may indicate a risky situation. In the event of no relatively quick and voluminous recovery from the decline, BTC will probably go south to around $38,500 for support. Investors who’ve entered positions are advised to set a stop-loss at $40,500, as multiple bottom formations (over 3 times) are common in prior upward trends. If such formations do not harm the structural adjustment and appear multiple times, they can bring stronger support for the subsequent trend.

Looking at the 4-hour chart, the current trend shows a less healthy candlestick pattern, breaking below the MA99 moving average (trend line). However, as long as $40,500 remains intact, traders should wait for the moving average to decline, utilizing time to create space for fixing the current situation. This report advocates holding positions and anticipating an upward movement, aligning with the mainstream trend perspective.

Source: BTCUSDT | Binance Spot

Between Dec. 14 and Dec. 17, the price of ETH/BTC fluctuated within a range of 0.05245-0.05402, showing a 2.99% fluctuation. The last analysis suggested gradually entering long positions around 0.05200–0.05250, with a potential attempt to chase the rise if it breaks 0.05350. Recently, the market has not provided sufficient opportunities, with the lowest point reaching 0.05245 before an upward move. Investors can take their time, and it’s recommended to wait patiently for entry points around the predetermined levels. The ETH/BTC pair has exhibited relatively small fluctuations recently, indicating a healthy trend. However, it has faced strong resistance around 0.05350, and attention should be focused on the breakthrough at this level, considering the speed and volume of the breakthrough. The investment perspective for ETH/BTC remains consistent with the previous analysis.

Based on overall analysis, the current market is relatively subdued compared to the recent past, mainly due to BTC’s stagnation. $43,000 has become a major recent resistance, as BTC’s attempts to surge have been repeatedly thwarted. Altcoins, facing the instability of BTC, have exhibited significant volatility, posing challenges for investors’ entries and increasing the risk factor at this stage. Simultaneously, the recently heated NFT market has become a new trend for many investors, with minting NFTs gaining popularity. However, caution is advised, and it’s recommended to invest primarily in leading projects in the NFT sector, avoiding being swayed by short-term high returns, as it may lead to more losses than gains. Overall, the current market trend remains intact, and the suggested investment approach is to hold positions and wait for an upward movement, following the trend.

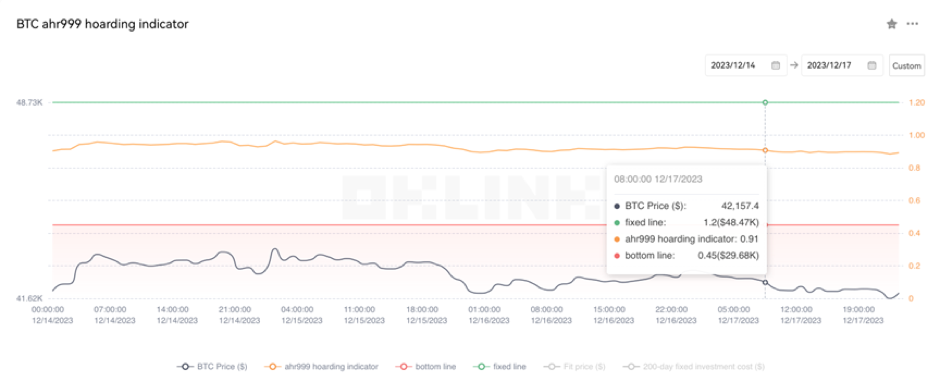

The Bitcoin Ahr999 index of 0.91 is between the buy-the-dip level ($29,680) and the DCA level ($48,470). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

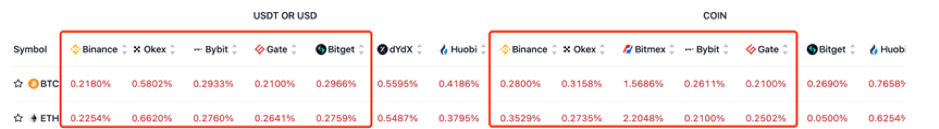

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

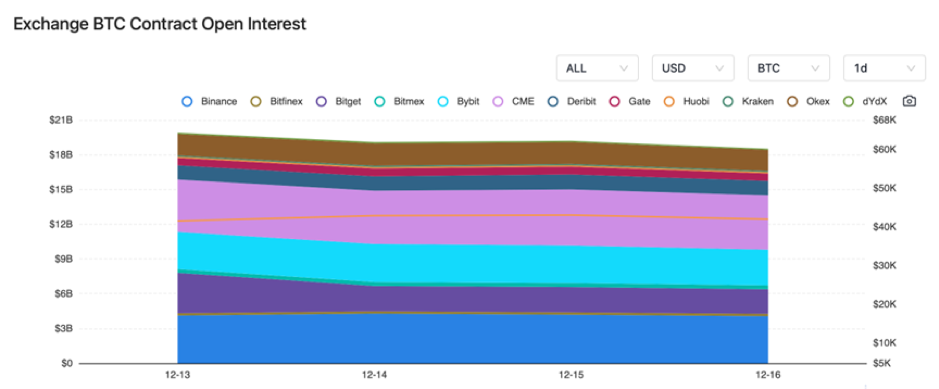

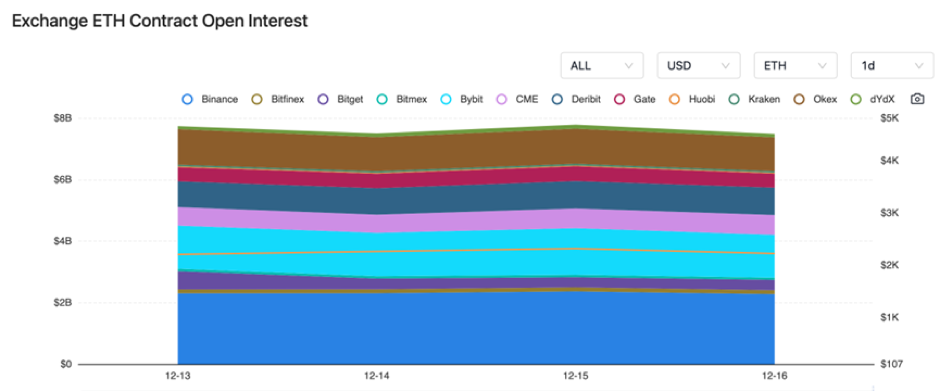

The BTC contract open interest experienced a slight decline, while the ETH contract open interest remained unchanged.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) December 14 marks the first anniversary of the creation of Bitcoin Ordinals.

2) On December 14, the market priced in the expectation that the Federal Reserve would cut interest rates six times next year.

3) On December 14, South Korea would consider implementing market discipline regulations for ICOs and distributions starting in July next year.

4) On December 15, the Governor of the Bank of Korea stated that unregulated stablecoins are unstable in value.

5) On December 15, USDT market capitalization surpassed $910 billion, reaching a new historical high.

6) On December 16, Base announced that node operators are required to upgrade their nodes by January 11, 2023.

7) On December 16, according to a SEC commissioner, the SEC should have approved a spot Bitcoin ETF five years ago.

8) On December 17, Tether has included the FBI and the U.S. Secret Service on its platform.

9) On December 17, NFT sales exceeded $500 million this week, with Bitcoin accounting for over half.

10) On December 17, FTX debtors submitted a restructuring plan.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.