FameEX Weekly Market Trend | November 13, 2023

2023-11-13 20:31:45

1. Market Trend

From Nov. 9 to Nov. 12, the BTC price swung from $35,600.00 to $37,972.24, with a volatility of 6.66%. The prior analysis stated that BTC, after several oscillations, consistently held above $34,000, with the bottom price steadily rising. The 99-day MA, climbing continuously on the 4-hour timeframe, implied a likely breakthrough above $35,000 in the coming days. On Nov. 9, this was confirmed as BTC surged past $35,000, reaching a peak near $37,900, just below $38,000. After hitting $37,900, BTC retraced deeply to $35,600, with the retracement staying above $35,000, affirming the effectiveness of the upward movement. Subsequently, BTC underwent a new oscillation phase between $36,500 and $37,200, aligning with the typical upward progression in a bull market. Presently, BTC’s trends across levels maintain a healthy trajectory along MAs, with no disruptive changes to the existing structure. The recommendation is to hold for a potential rise. In the current market, it is advised not to switch positions unless a significant disruption to the trend occurs. Exercise caution amid bearish sentiments without actively shorting. It is presumed that most investors have already engaged in the current market conditions. For those yet to catch up, consider an entry between $36,800 and $37,200, with a stop-loss point set at $35,500 (for reference only).

Source: BTCUSDT | Binance Spot

Between Nov. 9 and Nov. 12, the price of ETH/BTC fluctuated within a range of 0.05105-0.05821, showing a 14.02% fluctuation. In the prior analysis, avoiding this cryptocurrency was advised due to a lack of volume at the bottom, raising doubts about the rebound’s effectiveness despite recovery signals. On the evening of November 9, ETH/BTC initiated a rebound with a significant increase in volume at the bottom, solidifying the rebound behavior and enhancing its effectiveness. If investors can monitor this real-time situation in conjunction with the previous analysis of this currency pair, it should yield favorable returns. Currently, ETH/BTC, after a strong surge, is consolidating near 0.05500 (around the 25-day MA on the 4-hour timeframe). The upward structure remains intact, indicating a healthy operation. It is viable to place a position at this point and hold for a potential rise, with a suggested stop-loss point set at 0.05450 (for reference only).

Based on overall analysis, the current market environment is following the pattern of a bull market, with prices displaying a staircase-like ascent, multiple retracements maintaining within a healthy range, a noticeable increase in on-chain inflows, and significantly amplified trading volumes across various currency pairs—all validating this viewpoint. In recent days, apart from BTC, some mainstay currencies that experienced significant declines due to negative news and an unfavorable overall market situation, such as SOL, have seen substantial rebounds. Similar coins abound in the market, resembling SOL. Actively pursuing such opportunities during favorable market conditions (especially for coins previously labeled as securities by the SEC) as part of strategic asset allocation can maximize returns. In the current overall investment environment, it is recommended to avoid frequent portfolio turnover.

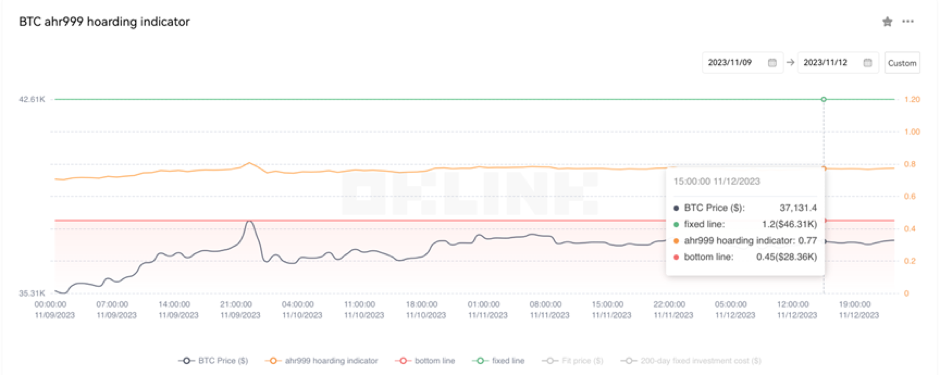

The Bitcoin Ahr999 index of 0.77 is between the buy-the-dip level ($28,360) and the DCA level ($46,310). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

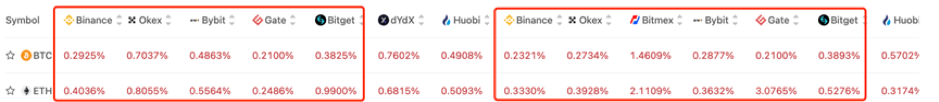

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

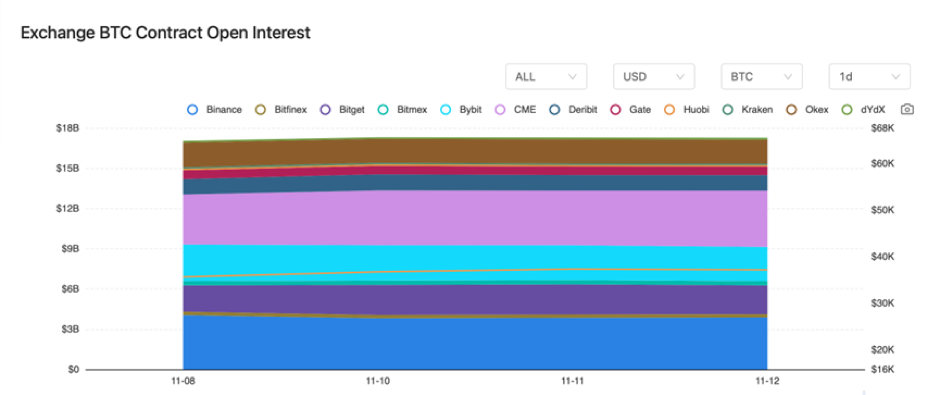

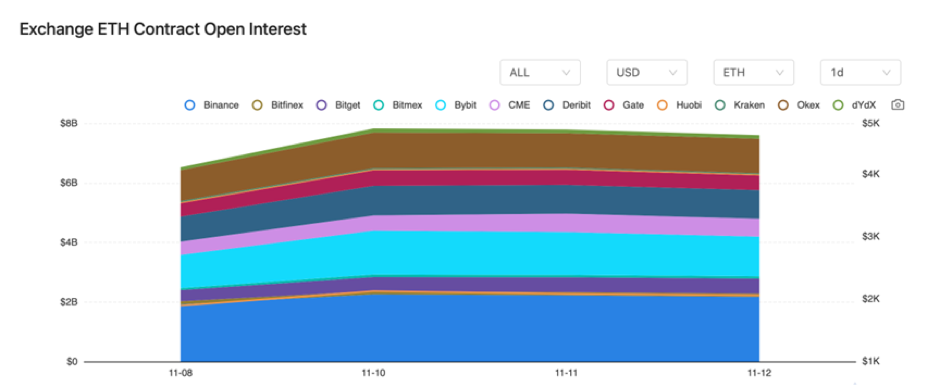

BTC contract interest remained relatively unchanged, whereas ETH contract interest experienced a surge from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On November 9, the total market capitalization of cryptocurrencies surpassed $1.4 trillion, with a daily increase of 3.1%.

2) On November 9, the Prime Minister of Thailand would announce a digital wallet plan on Friday.

3) On November 9, the cryptocurrency sector in the U.S. stock market experienced a comprehensive increase.

4) On November 10, Tether issued an additional 1 billion USDT on the Ethereum network, with the issuance authorized but not yet completed.

5) On November 10, Serena, a French investment firm, launched a €100 million fund to invest in blockchain and other technologies.

6) On November 10, JPMorgan initiated programmable payments using blockchain technology.

7) On November 11, data showed that Bitcoin investment funds hold over 860,000 BTC, reaching a historical high.

8) On November 11, data revealed that investors have poured over $1.07 billion into cryptocurrency funds this year.

9) On November 12, Bithumb had a plan to launch an IPO in 2025, with Samsung Securities as the underwriter.

10) On November 12, data indicated that Uniswap’s front-end transaction fee income exceeded $900,000.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.