Crypto Lender BlockFi Has Filed for Bankruptcy | FAMEEX

2022-11-29 14:57:15

Top Trending Crypto News Today

FTX's new CEO 'misrepresented' actions taken by Bahamian authorities, says country's AG

https://www.theblock.co/post/190129/ftxs-new-ceo-misrepresented-actions-taken-by-bahamian-authorities-says-countrys-ag

Bahamas Attorney General and Minister of Legal Affairs Ryan Pinder stated that it was "extremely regrettable" that FTX's new CEO John Ray III "misrepresented the timely action taken by the Securities Commission and used inaccurate allegations". Pinder also defended the steps the country’s regulators took in the aftermath of the exchange's collapse.

Putin calls for blockchain-based international payment system

https://cointelegraph.com/news/putin-calls-for-blockchain-based-international-payment-system

During the event organized by Sberbank, the largest Russian bank and a major lender to the government, he stated: “The technology of digital currencies and blockchains can be used to create a new system of international settlements that will be much more convenient, absolutely safe for its users and, most importantly, will not depend on banks or interference by third countries. I am confident that something like this will certainly be created and will develop because nobody likes the dictate of monopolists, which is harming all parties, including the monopolists themselves.”

Crypto Lender BlockFi Has Filed for Bankruptcy Citing FTX Bankruptcy as Reason

https://www.fameex.com/en-US/news/crypto-latest-news-2022112901

BlockFi, the crypto lender that was earlier "rescued" by FTX following the collapse of the LUNA stablecoin, filed for Chapter 11 bankruptcy protection and seeks to collect all liabilities due by its counterparties, including FTX. The FTX contagion has just affected another crypto firm.

Daily Crypto Market Analysis - Growing and Forecast

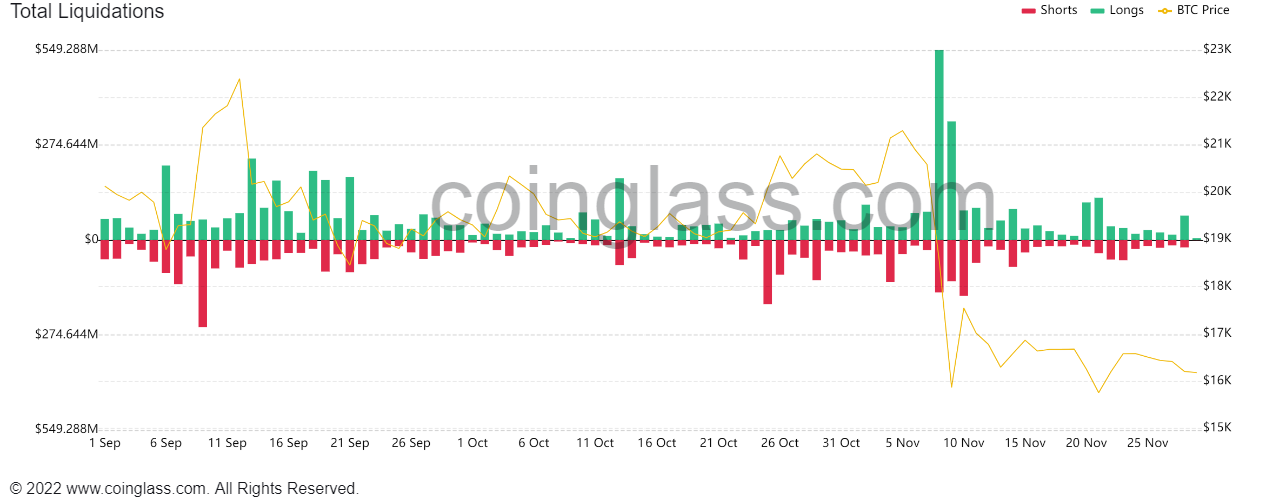

In the last 24 hours, the liquidated longs was 70.66M USDT and liquidated shorts was 21.3M USDT, so the net liquidations was 49.36M USDT in longs. It’s worth our attention that the liquidated longs has been the highest one of the last week, proving that the market players is about to see a more clear tendency.

The Fear & Greed Index dropped down to 26. The number has been under 30 for multiple days, revealing investors’ negative attitude towards the market tendency. But there’s no conclusion yet for the short term tendency.

Today’s Bitcoin Ahr999 is 0.3, still below the bottom line 0.45 and line DCA line 1.2. Numbers shows that the bear market will last.

Yesterday, The DJI fell by 1.45%, S&P 500, 1.54% and NASDAQ, 1.58% the smallest one. Crypto prices experienced a downfall too, with BTC falling by 1.27% and ETH, 1.77%. But LINK went against the tendency, up by 5.82%.

The announcement made by the Hawk in the Fed gave rise to a more volatile market. The America stock market saw numbers dropping down in the last 24 hours, including DJI falling by 500, SPX and NDX by 1.5% and SOX by 2.6%.

Investors will make new decision according to the upcoming indicators like PCE and NFP. More fluctuations are expected in the future market.

Most of the mainstream crypto fell yesterday. Prices changed from -3.19% to 5.82%. ZEC fell by 3.19%, the largest loser and the LINK was the largest winner, up by 5.82%. BTC was down by 1.27% and the ETH was down by 1.77%.

In terms of the four-hour timeline, shorts gained the upper hand. The price failed to breakthrough MA99 and was losing momentum. The slowly-increasing long liquidation also revealed a hint that the short would gain the upper hand.

Disclaimer: The information provided in this section is for informational purposes only, doesn't represent any investment tips or FAMEEX's official position.