Are Ethereum ETFs the Next Bull Opportunity in Crypto Market?

2024/03/07 14:55:50

Key points:

The potential SEC approval of Ethereum ETFs signifies a major turning point for broader institutional acceptance of cryptocurrencies, spurred by recent optimism following the approval of Bitcoin ETFs.

Ethereum ETFs differentiate from direct ETH investments by offering regulated, secure exposure to Ethereum's value on traditional stock exchanges without the complexities of direct digital currency management.

Anticipated technological upgrades like the Dencun upgrade, coupled with the potential SEC approval for Ethereum ETFs, are poised to significantly enhance Ethereum's market appeal and institutional investment potential.

Introduction

The cryptocurrency sector is abuzz with anticipation that the United States Securities and Exchange Commission (SEC) might soon green-light Ethereum exchange-traded funds (ETFs), buoyed by the recent approval of spot Bitcoin ETFs that many believe paves the way for similar endorsements for Ethereum ETFs. This speculation has grown especially after the SEC postponed its ultimate decision on Ethereum ETFs, signaling a possible approval within the next 45 days.

Amid this backdrop, one SEC commissioner's views on the matter, suggesting a potential nod for Ethereum ETFs in 2024 May, have caught the industry's attention. Additionally, the delay in the SEC's final verdict on these applications has sparked curiosity about the underlying reasons. Meanwhile, the Ethereum network's native cryptocurrency, Ether (ETH), witnessed a significant milestone by surpassing the $3,400 mark for the first time in nearly two years. This is attributed to the growing excitement over the potential approval of spot Ethereum ETFs. This surge in ETH's price not only underscores its appeal to a broader spectrum of investors, including the more conservative institutional ones but also highlights its recent performance, which has outshined that of Bitcoin and other cryptocurrencies.

What is an Ethereum ETF?

An Ethereum ETF is a type of investment fund that aims to replicate the performance of Ethereum, allowing investors to trade shares on traditional stock exchanges. It serves as a regulated method for investors to gain exposure to the cryptocurrency sector without the need to directly handle digital currencies. By reflecting Ethereum's value, the ETF simplifies the process of investing in this cryptocurrency, bypassing the need for direct ownership.

Operating under the regulatory safeguards of traditional financial systems, Ethereum ETFs offer a secure and compliant way for investors to explore cryptocurrency investments. The presence of regulatory oversight boosts investor confidence by ensuring adherence to well-established financial protocols. Ethereum ETFs are beneficial for their regulatory protection, ease of transaction, and the opportunity they provide to broaden investment portfolios. These funds are available on leading stock exchanges, offering ease of access and liquidity, making them an appealing option for investors entering the cryptocurrency domain.

» Further Reading: What Is a Bitcoin Spot ETF? And How Can Investors Buy It?

Benefits of Ethereum ETFs

The launch of Future Ethereum ETFs marks a significant development in the cryptocurrency sphere. These ETFs offer an easier and more regulated channel for traditional investors to engage with the Ethereum markets, possibly drawing in more capital and enhancing market liquidity. This influx of investment can lead to more stable prices and less fluctuation, thanks to the introduction of institutional investors through these ETFs.

Moreover, Spot ETFs focused on Ethereum play a crucial role in the broader acceptance and integration of cryptocurrencies into the established financial ecosystem. By incorporating cryptocurrencies into the realm of traditional finance, these ETFs help in legitimizing and promoting their adoption on a larger scale. The direct holding of the actual cryptocurrencies by Spot ETFs also opens up avenues for long-term investment strategies in these digital assets.

Ethereum (ETH) vs. Ethereum ETF: What’s the difference?

When considering cryptocurrency investments, many are drawn to Ethereum (ETH), one of the leading digital currencies known for its robust platform that enables smart contracts and decentralized applications. However, with the advent of Ethereum ETFs, investors now have an alternative way to gain exposure to Ethereum's value without directly owning the cryptocurrency. Here are several differences between the two products:

Direct Ownership vs. Indirect Exposure: Investing in Ethereum (ETH) grants investors direct ownership of the digital currency. This means that investors hold ETH in their digital wallets, providing them full control over their investments. On the contrary, an Ethereum ETF offers indirect exposure to Ethereum's price movements. Investors in an ETF own shares in a fund that, in turn, holds Ethereum directly or invests in derivatives tied to Ethereum's price. This distinction is crucial for those who prefer having direct control over their crypto assets versus those who are comfortable with indirect exposure through a regulated financial product.

Fee Structure:One of the tangible differences between Ethereum and Ethereum ETF investments lies in the fee structure. ETH investors are subject to gas fees—transaction fees paid to miners to process and validate transactions on the Ethereum blockchain. These fees can fluctuate significantly with network activity. In contrast, Ethereum ETFs come with management fees, annual charges applied by the fund to cover operational costs. Additionally, buying or selling ETF shares incurs brokerage fees, similar to other stock market transactions.

Trading Hours in Flexibility vs. Structure: Ethereum's digital nature allows for trading around the clock, offering flexibility to investors who wish to trade outside traditional stock market hours. In contrast, Ethereum ETFs adhere to the trading hours of the stock exchanges they are listed on, typically from Monday to Friday during specific hours. This can be a limitation for those looking to capitalize on price movements that occur during weekends or outside stock market hours.

Liquidity and Market Access: Liquidity, or the ease of buying and selling an investment without causing significant price movements, is another critical factor. Ethereum enjoys high liquidity, thanks to its global, 24/7 trading environment. Ethereum ETFs, while generally liquid during market hours, depend on the trading volume of the ETF and the stock market's operational hours, which may not match the flexibility and liquidity levels of direct ETH trading.

Regulatory Environment: The regulatory environment for Ethereum and Ethereum ETFs presents another point of contrast. Direct investments in ETH operate in a less regulated space, which can introduce both opportunities and risks. The evolving regulatory landscape for cryptocurrencies may impact investors differently based on their jurisdiction and the nature of their investments. Ethereum ETFs, being part of the regulated financial market, offer a layer of investor protection and compliance with stringent reporting requirements, making them a potentially safer option for those concerned with regulatory clarity and security.

Comparing Ethereum and Ethereum ETFs

Direct ETH investment offers more control and flexibility but comes with its own set of challenges, including managing security and navigating the complex landscape of cryptocurrency regulations. On the other hand, Ethereum ETFs provide a more structured and potentially safer investment vehicle, with trade-offs in terms of direct control and flexibility. By understanding these key differences, investors can make more informed decisions tailored to their investment strategy and outlook on the future of Ethereum and the broader cryptocurrency market.

Is the Ethereum ETF Approval Possible?

The possibility of an Ethereum ETF receiving approval from the SEC remains uncertain. In a recent discussion onYahoo Finance, Ryan Rasmussen highlighted the growing interest from institutional investors in ETFs, especially with the looming potential approval date. This anticipation has positively influenced Ethereum's performance, showcasing notable gains compared to Bitcoin (BTC). Rasmussen voiced concerns about the market's readiness for an Ethereum ETF in alignment with the SEC's standards. Despite previous setbacks for spot Bitcoin ETFs, which only saw progress after Grayscale's legal challenge against the SEC, Rasmussen believes that Ethereum ETFs may not require such drastic measures. However, he estimates the chances of approval in May as uncertain, likening it to a 50-50 possibility. Moreover, Rasmussen pointed to upcoming Ethereum updates, specifically the March Dencun upgrade, aimed at reducing transaction costs and promoting wider adoption, as key factors driving the cryptocurrency's growth. JPMorgan's Nikolaos Panigirtzoglou also shared a similar cautious optimism, noting the necessity for the SEC to classify Ethereum as a commodity for an ETF to be approved, a challenging endeavor within a short timeframe.

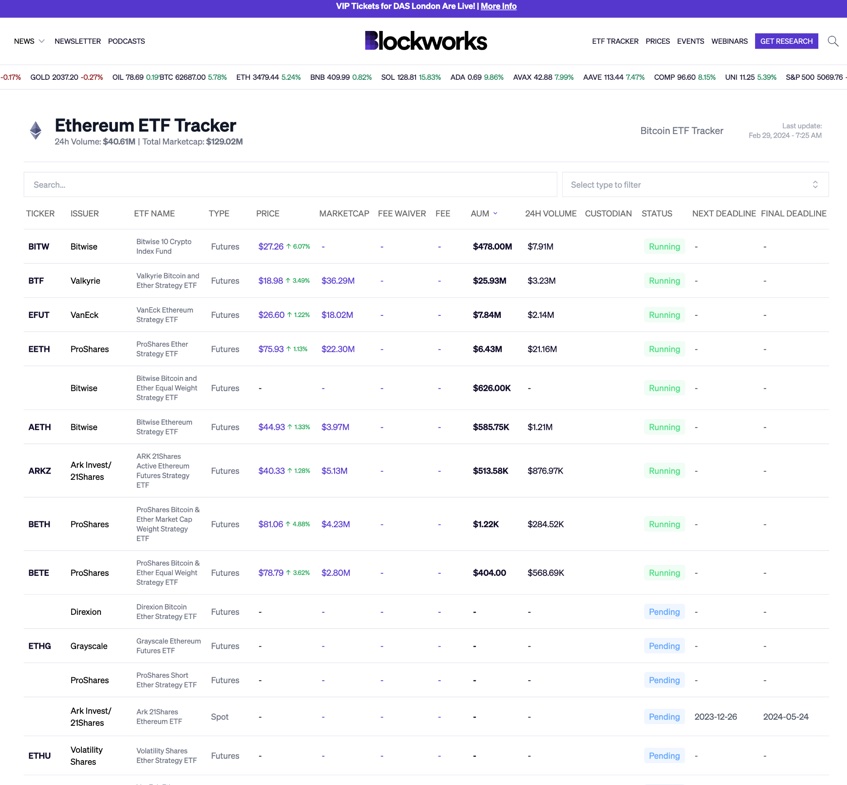

Awaiting approval in Ethereum ETF, Source: Blockworks

The SEC has extended its timeline for a decision on BlackRock’s application for a spot ETH ETF, moving the decision date back by 45 days from its original deadline of January 25. The delay comes as the SEC seeks additional public input on the proposed rule changes associated with the BlackRock ETH ETF. The regulatory body has stated that the extension is to allow adequate time for a thorough review of the proposed rule changes and the concerns raised. Consequently, the SEC has set a new deadline of March 10, 2024, to either approve, deny, or initiate proceedings to further evaluate the proposed rule change, as outlined under Section 19(b)(2) of the Act.

This postponement follows a similar delay for Fidelity Investments’ spot Ethereum ETF, which the SEC moved to March 5. The crypto community is keenly anticipating May, eager to discover whether the SEC will give the green light to BlackRock’s crypto ETF. Approval of an ETH ETF in the U.S. could significantly boost ETH adoption. Additionally, the VanEck spot Ethereum application, set for a decision by the SEC on May 23, symbolizes a critical moment for Ethereum and similar ETF applications, drawing parallels to the journey of spot Bitcoin ETFs.

The Possible Bull Run Reasons for ETH

The upcoming 2024 and the Ethereum ETF, coupled with the anticipated Dencun upgrade, present a compelling narrative for the next bull market in the cryptocurrency space. With institutions poised to deepen their engagement with Ethereum, the landscape is ripe for significant movement, catalyzed by potential ETF approval and technological advancements.

Ether's performance, outstripping Bitcoin with a 4.12% rise, further illustrates its growing institutional allure. The anticipation of a U.S. SEC approval for a spot Ethereum ETF in May, buoyed by the interest of financial behemoths like Franklin Templeton, Blackrock, and Fidelity, marks a significant milestone. This potential approval is seen as a harbinger of increased institutional investment and broader acceptance of Ether as a legitimate and valuable asset class.

The Dencun upgrade, set for March 13th, adds another layer of optimism to Ether's outlook. Leveraging cutting-edge Danish slicing technology, this upgrade aims to enhance transaction efficiency and scalability, addressing key challenges in the cryptocurrency ecosystem. The crypto community's enthusiasm for the Dencun upgrade is palpable, as it promises to bolster Ether's position by making it more accessible, affordable, and scalable.

Conclusion

The cryptocurrency market is at a pivotal moment with the potential SEC approval of Ethereum ETFs on the horizon. This signals a significant shift towards broader institutional acceptance and investment in digital currencies. Ethereum ETFs represent a bridge between traditional finance and the cryptocurrency sector, offering a regulated, secure, and accessible investment vehicle that could attract a wider spectrum of investors. Meanwhile, technological advancements like the Dencun upgrade promise to enhance Ethereum's appeal by improving transaction efficiency and scalability. As the SEC deliberates on Ethereum ETF applications and the cryptocurrency community awaits key technological upgrades, the stage is set for Ethereum to possibly enter a new era of growth and institutional adoption.

FAQ

Q: Is There a Likelihood of ETH ETFs Receiving Approval?

A: The approval of ETH ETFs by regulatory authorities remains uncertain with ongoing speculation and anticipation in the financial community. The decision hinges on various factors, including regulatory scrutiny and market readiness, making the outcome difficult to predict at this time.

Q: What Advantages Do Ethereum ETFs Offer to Investors?

A: Ethereum ETFs allow investors to tap into the potential of Ethereum's market performance through a regulated, secure platform, avoiding the direct management of digital currencies. They facilitate easier entry into the cryptocurrency market under the safeguard of traditional financial regulatory frameworks, making Ethereum more accessible to a wider range of investors.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.