Impact of Tether (USDT) on Crypto Market: Driving Bull Market Force or Major Risk?

2024-01-17 17:09:41

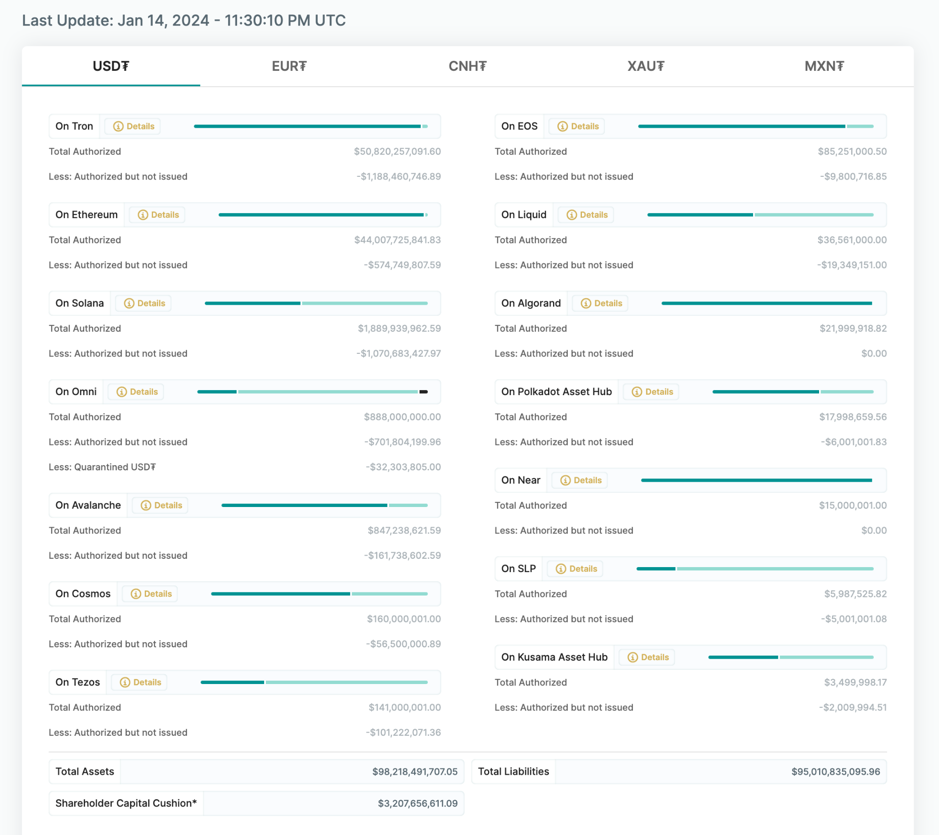

In the crypto market, stablecoin Tether (USDT) surpassed Bitcoin and Ethereum to top the trading list with a 24-hour trading volume of $50,757,412,596. Its 24-hour trading volume to market capitalization ratio is as high as 57.66%. This data indicates that Tether (USDT) is not only one of the most popular tokens but also unrivaled in the field of crypto circulation.

Key points:

Tether (USDT), a stablecoin, has surpassed Bitcoin and Ethereum in trading volume, reaching a 24-hour trading volume of $50,757,412,596.

In the past 24 hours, Tether (USDT) recorded a total of 1,980,304 transactions. This includes two big transactions exceeding $100 million each, and a total of 150 transactions over $10 million. The number of transactions for Tether in this 24-hour period was higher than any of Bitcoin, Ethereum, and BNB coins.

At the capital level, Tether (USDT) faces a potential redemption risk. This is because Tether Limited Inc., the company managing user funds, might not deposit all the received US dollars into the bank in their original form.

In the crypto market, the stablecoin Tether (USDT) has overtaken Bitcoin and Ethereum to top the trading list, recording a 24-hour trading volume of $50,757,412,596. Its 24-hour trading volume-to-market value ratio is as high as 57.66%, while most other currencies are below 5%. This data not only signifies that Tether (USDT) is one of the most popular stablecoins but also indicates that no other cryptocurrency can compete with it in terms of circulation. Crypto investors generally believe that its staggering trading volume and increasing daily transactions position Tether (USDT) as a major driving force potentially leading the crypto market towards a bull market. However, conversely, should Tether (USDT) encounter risks, it could also become the biggest 'black swan' event in the crypto market.

1. What is Tether (USDT)? An Introduction to This Stablecoin

Tether (USDT) is a cryptocurrency issued by Tether Limited Inc. company on multiple public blockchain networks. For every USDT token issued, Tether Limited Inc. claims to reserve 1 US dollar or equivalent assets in a reserve. Thus, in theory, Tether's market value should be less volatile by pegging to the US dollar which maintains a 1:1 ratio. This aims to make Tether (USDT) as a highly stable stablecoin.

In addition to the typical concept of cryptocurrencies such as security, anonymity, flexibility, borderless nature, and low cost, Tether (USDT) also offers the price stability of traditional fiat currencies. This combination has led to Tether (USDT) becoming one of the most widely adopted and circulated cryptocurrencies within just a few years.

In the long term, Tether (USDT) features like low costs, global cross-border free circulations, and safe anonymity could position USDT as a new favorite in the circulation and payment sectors. It is poised to lead the stablecoin market into significant growth, potentially expanding from a market worth hundreds of billions to a place worth trillions of dollars. This makes it another strategically important sector in the crypto market.

» Further Reading: How to Buy Tether (USDT) With Credit Card & Debit Card Instantly

2. Basic Information About Tether (USDT)

The basic information about Tether (USDT) can be found in the table below:

The table above provides a comprehensive overview of the basic information about Tether (USDT). Let us now delve into a more detailed explanation of the project team's profile.

3. Introduction to Tether(USDT) Team

3.1. Reeve Collins as the First Tether CEO

Reeve Collins was a long-standing entrepreneur in the advertising industry. In 2014, he co-founded a cryptocurrency project called Realcoin, along with Brock Pierce and Craig Sellars, serving as the CEO. In November 2014, Collins announced the renaming of Realcoin to Tether (USDT), a digital currency pegged to the US dollar. Public records indicate that in 2015, Collins sold his stake in Tether, left the management team, and went on to found BLOCKv, a shared protocol platform for blockchain developers.

3.2. Former Co-Founder of Tether: Brock Pierce

Brock Pierce was one of the original evangelists in the cryptocurrency space. Before entering this field, he was a Disney child actor and later founded the video game company Internet Gaming Entertainment alongside his new hire, Steve Bannon. Following the emergence of Bitcoin, he leveraged his advanced sensitivity and outstanding personal abilities to become the chairman of the Bitcoin Foundation. He was also a co-founder of the first blockchain investment fund, Blockchain Capital, as well as EOS, Block.one, and Mastercoin. Importantly, he is recognized as one of the founders of Realcoin, the former of Tether (USDT). In 2014, Brock Pierce, together with Giancarlo Devasini and others, co-founded Tether Holdings Ltd. in the British Virgin Islands. However, he soon departed from the Tether team.

3.3. Former CEO of Tether: Jean-Louis van de Velde

In 2013, Jean-Louis van de Velde became the CEO of the cryptocurrency exchange Bitfinex and was the co-founder of Bitfinex's holding company, DigFinEx. After leading DigFinEx's acquisition of Tether, several members of the Tether startup team departed, and Jean-Louis took over as the second CEO of Tether (USDT), at one point holding 15% of its shares. Notably, Jean-Louis van de Velde simultaneously served as the CEO of both Bitfinex and Tether. Under his leadership, Tether grew to become one of the top three cryptocurrencies by market capitalization and the most traded in terms of volume. This achievement not only brought him fame but also led to increased scrutiny and questions about Tether's (USDT) involvement in potential Bitcoin price manipulations.

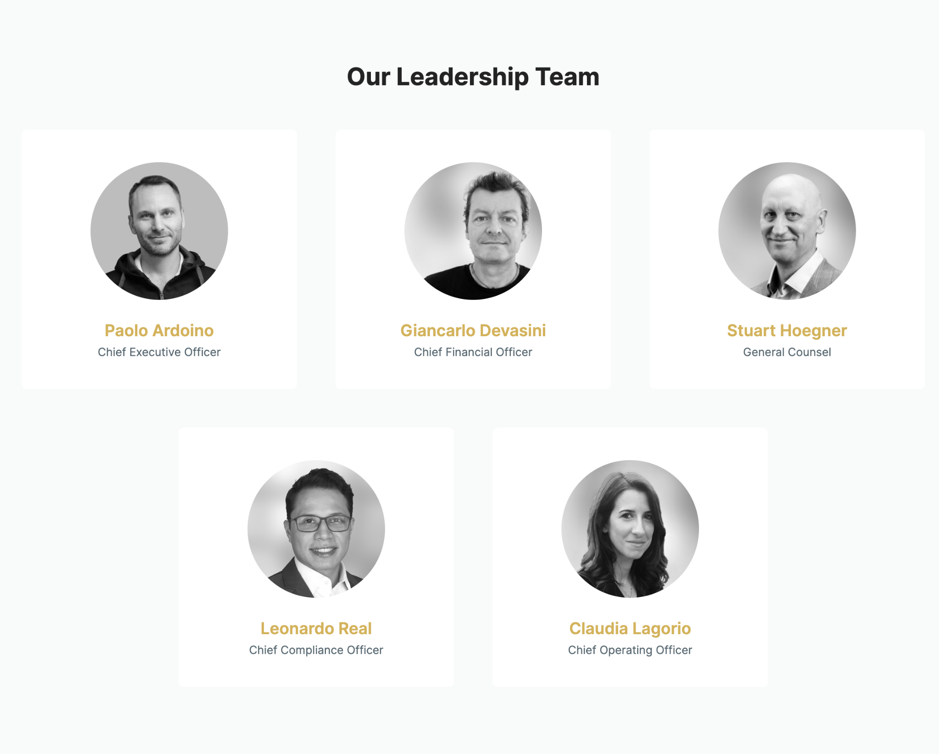

3.4. Tether’s Current CEO: Paolo Ardoino

In December 2023, Jean Louis van der Velde stepped down as Tether's CEO and appointed the company's Chief Technology Officer (CTO), Paolo Ardoino, as the concurrent CEO. Paolo Ardoino also assumed the role of CEO of the Bitfinex exchange.

This leadership change at Tether coincided with the SEC's prosecution of Binance's Changpeng Zhao CZ and FTX. Consequently, Paolo Ardoino's appointment as CEO of Tether was widely interpreted as a strategic move in response to the increasingly stringent regulatory environment, aligning with Tether's comprehensive compliance strategy in fund management, supervision, auditing, and banking. It also underscored the complex legal challenges faced by cryptocurrency executives.

Tether Leadership Team in 2024, source: Tether.to

3.5. Tether CFO: Giancarlo Devasini

Giancarlo Devasini, a partner at Bitfinex, was part of the initial team in the early development of Tether, working closely with Brock Pierce at Tether Holdings Ltd. He has been a key decision-maker for both Tether and Bitfinex since 2013, serving as the dual Chief Financial Officer (CFO) and playing a crucial role in their growth. As of 2018, Giancarlo Devasini owned approximately 43% of Tether (USDT), making him one of its largest shareholders.

3.6. Tether OGC: Stuart Hoegner

Stuart Hoegner, owning 15% of Tether's shares, is its third-largest shareholder. He also holds the dual role of General Counsel (OGC) for both Tether and Bitfinex. Joining Bitfinex in 2014, he has been a prominent expert on cryptocurrency aspects, engaging with international securities commissions, regulators, the Department of Finance, the Canadian Intellectual Property Office, and the Senate Standing Committee on Banking, Trade, and Commerce. Additionally, Stuart Hoegner is the editor of "Bitcoin Laws," a comprehensive book on cryptocurrency laws and regulations.

3.7. Tether’s Fourth Largest Shareholder: Christopher Harborne

Christopher Harborne, a businessman with dual British and Thai citizenship, owns approximately 13% of Tether (USDT) shares, making him its fourth-largest shareholder. He has made significant political donations, including £14.8 million to British political parties and £1 million to former British Prime Minister Boris Johnson, marking the largest donation to a single politician in British history.

4. The Company Behind Tether (USDT)

Tether Limited Inc. also owns the Bitfinex cryptocurrency exchange. Tether Limited Inc., established in Hong Kong in 2014, is responsible for launching and operating the Tether platform, as well as issuing Tether tokens. Tether Operations Limited and Tether International Limited are subsidiaries of Tether Holdings Limited. Tether tokens are issued and redeemed on various blockchains, including Ethereum and Tron, and exist on different token protocols such as ERC-20 and TRC-20. Tether Limited, as the issuer of Tether tokens, maintains that they are pegged on a 1-to-1 basis to fiat currencies or gold, and claims that they are backed 100% by its reserves.

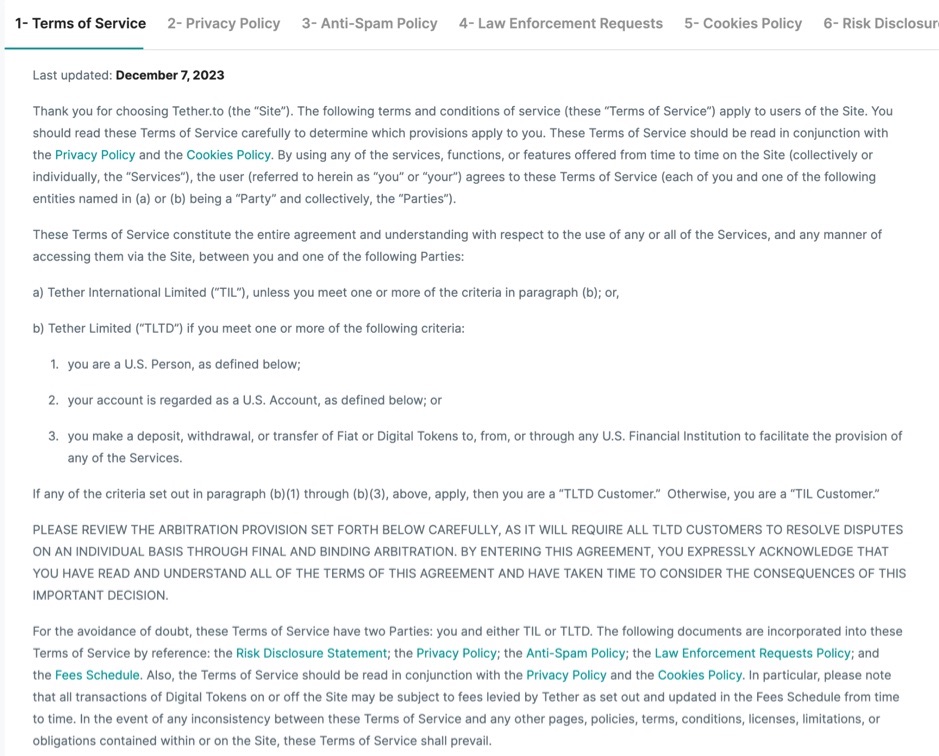

Data source: Tether.to

According to official information from the United States Commodity Futures Trading Commission, it has been revealed that Tether is associated with several companies, including Tether Holdings Limited, Tether Limited, Tether Operations Limited, Tether International Limited, among others. Furthermore, public documents on the website of the New York State Attorney General's Office indicate that Tether Limited is the issuing company of Tether (USDT).

As the issuer and operator of Tether (USDT), 83% of the shares in Tether Limited are owned by Giancarlo Devasini, Stuart Hoegner, and Christopher Harborne separately. Moreover, Christopher Harborne and Jean Louis are the actual controllers and largest shareholders of Tether (USDT).

It is important to note that Tether Limited is a subsidiary of iFinex Inc., which also owns the Bitfinex cryptocurrency exchange.

5. How Does Tether (USDT) Work?

When someone puts fiat money into Tether's reserve by exchanging it for USDT, Tether creates an equivalent amount of digital tokens. These USDT tokens can then be transferred, stored, or traded. For instance, if someone deposits $100 into the Tether reserve, they will get 100 Tether tokens, reflecting the 1-to-1 dollar to token ratio. When users choose to convert their Tether tokens back into fiat currency, those specific Tether coins are taken out of circulation.

5.1. How Does Tether (USDT) Operate on the Blockchain?

Like many other digital currencies, Tether operates across different blockchains. As mentioned earlier, Tether (USDT) operates on multiple blockchain platforms including Algorand, Avalanche, Bitcoin Cash's Simple Ledger Protocol (SLP), Ethereum, EOS, Liquid Network, Omni, Polygon, Tezos, Tron, Solana, and Statemine. In these public blockchain networks, the corresponding transmission protocols facilitate the issuance and redemption of Tether (USDT).

During the actual issuance process, Tether Limited, the issuing company of Tether (USDT), issues or adds USDT tokens in multiple public chain networks based on actual needs. These newly added USDT are in the "authorized but not issued" status and are stored uniformly in the Tether reserves. They do not circulate in the market. When a user deposits US dollars with Tether Limited, the company creates an account for the user, withdraws the corresponding number of USDT tokens from the reserves, transfers them to the user's account, and then these tokens enter the secondary market.

In addition, users can purchase USDT tokens with fiat currency on secondary markets, like the FameEX exchange.

>> Click here to buy USDT directly <<

Similarly, users can sell USDT on the secondary market to obtain fiat currency or other cryptocurrencies.

>> Click here to trade USDT <<

Tether Limited offers an official process for the redemption of USDT tokens. Users need to repay the USDT tokens to Tether. Tether will then destroy the USDT tokens and return the US dollars to the user's designated bank. This creates a full cycle of issuance, trading, circulation, redemption, and destruction in order to ensure that Tether (USDT) is pegged with fiat currency equivalents.

5.2 Available Tether (USDT) Network

Tether Limited is now deployed mainly in the ERC20-standard USDT tokens on several blockchain platforms. These include the Ethereum, Avalanche, Polygon, and Cosmos blockchains (through Kava), as well as on Omni, Tron, EOS, Liquid, Algorand, Bitcoin Cash (BCH), Solana, Polkadot, Kusama, Tezos, and other networks. However, beginning August 17, 2023, Tether closed the minting USD₮-Omni, USD₮-Kusama and USD₮–BCHSLP.

Data source: Tether.to

6. Tether (USDT) Circulation Analysis

In the evolving cryptocurrencies, Tether (USDT) emerges as a notable player, distinguished by its extensive circulation and high trading volume. Renowned for its stability and widespread adoption, Tether's influence in the digital currency market is evident through its ranking among the top cryptocurrencies. Its unique position, supported by a large number of unique addresses holding the token across various public chain networks, underscores its critical role in the realm of digital finance.

Data source: CoinMarketCap

As of 31st December 2023, 24-hour trading volume in Tether (USDT) was $50,757,412,596, ranking it third in the cryptocurrency market based on its market capitalization of $91,698,266,069. This accounts for 5.56% of the total cryptocurrency market. Tether (USDT) holds the distinction of being the most traded cryptocurrency with over 55,631,848 unique addresses holding the token across major public chain networks.

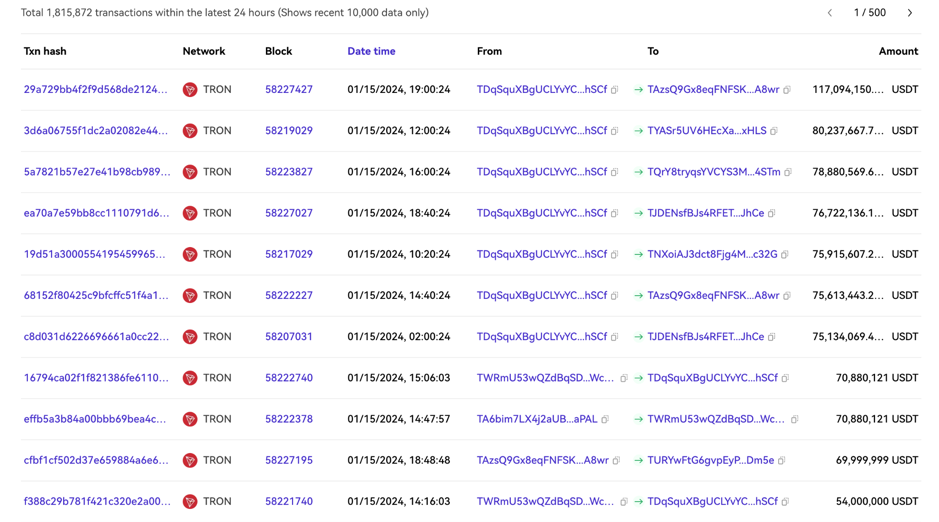

Data source: OkLink

According to OkLink data, there were a total of 1,815,872 transactions on Tether (USDT) in the past 24 hours. This included two transactions exceeding US$100 million, 150 transactions over US$10 million, 2,677 transactions above US$1 million, and 175,020 transactions valued at more than US$10,000 each. The 24-hour transaction volume for Tether surpassed the combined total of Bitcoin, Ethereum, and BNB.

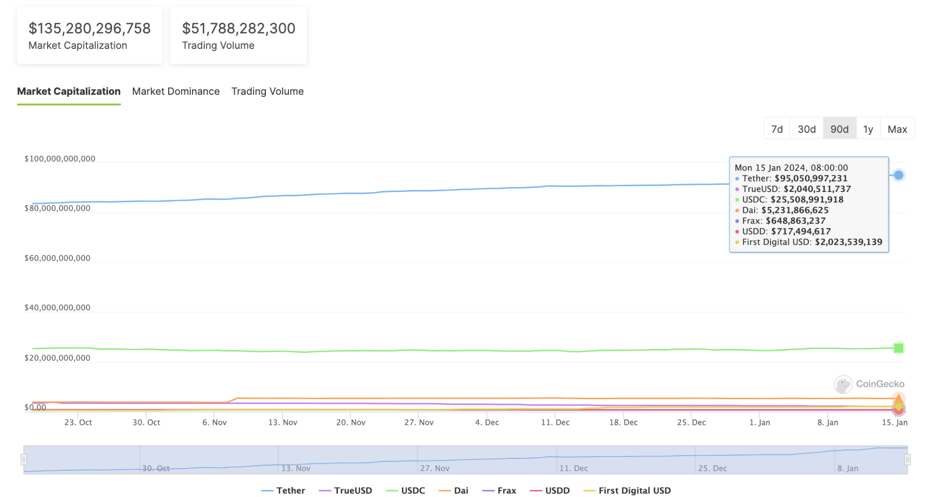

Data source: CoinGeCko

CoinGecko data indicates that, as of now, the total market value of the stablecoin sector is $135 billion. Tether (USDT) leads with a 72% share, which is 3.79 times greater than that of its closest competitor, USDC, almost constituting a market monopoly. From the data mentioned above, it is evident that Tether (USDT), as a bridge between traditional finance and crypto-finance, plays an irreplaceable and significant role both as a pricing unit and a medium of value.

7. Tether (USDT) Security Risks

At the capital level, Tether (USDT) carries a certain redemption risk. This is because Tether Limited, the entity receiving user funds, does not deposit all the US dollars it receives in banks. According to information from the Tether official website, each USDT token is backed by 100% reserve assets provided by Tether Limited. These reserve assets include traditional currencies and cash equivalents and may also encompass other assets and accounts receivable from loans made by Tether to third parties. This implies that, of the more than 90 billion USDT tokens currently issued, only a portion of the U.S. dollars are actually held in banks, with the remainder being in the form of cash equivalents.

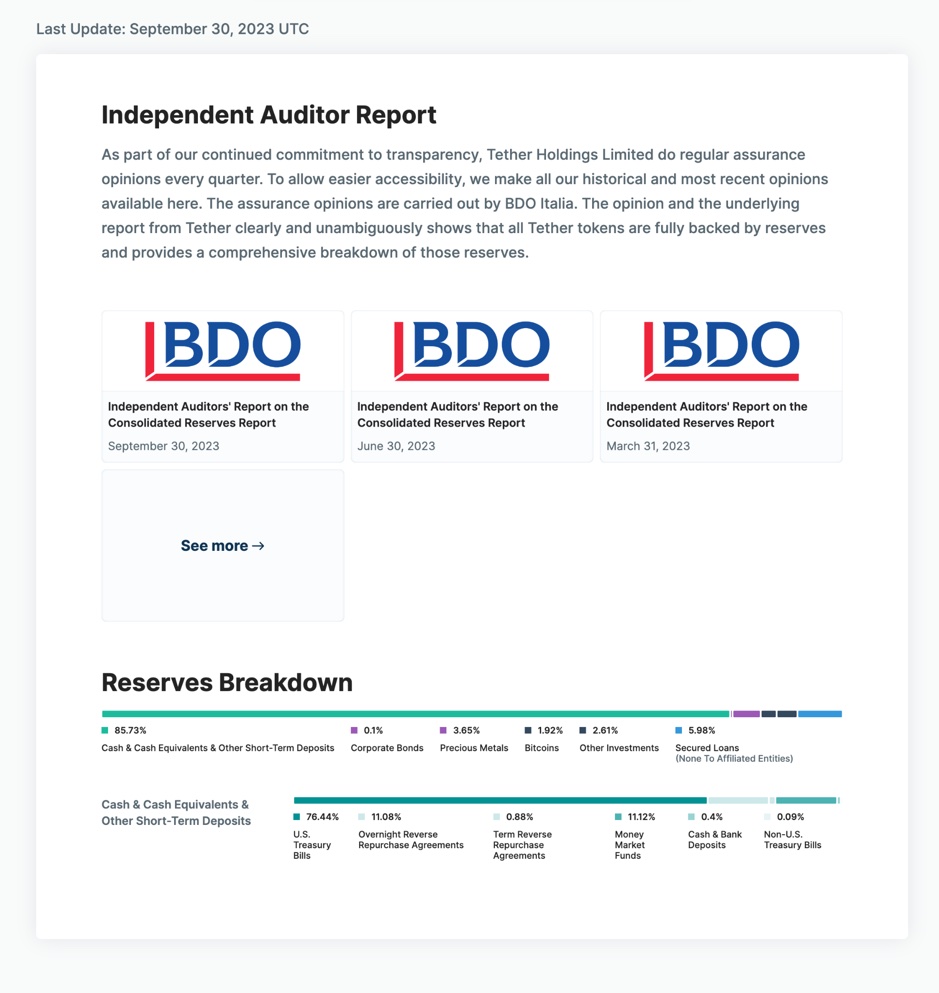

Data source: Tether (USDT) official report

According to the independent audit report published on Tether's official website on September 30, cash, cash equivalents, and other short-term deposits constitute 85.73% of Tether's (USDT) total capital reserves. Specifically, cash & bank deposits represent only 0.4% of these reserves, while short-term U.S. Treasury bonds account for 76.44%. Based on total assets of $95,255,649,665.36, assets that can be readily liquidated by users in the short term amount to $62,749,594,442, representing 65.87% of the total assets.

The other reserve assets include corporate bonds (0.1%), precious metals (3.65%), Bitcoin (1.92%), other investments (2.61%), and secured loans (5.98%). Additionally, there are money market funds, overnight reverse repurchase agreements, term reverse repurchase agreements, and U.S. Treasury bills, which have specific redemption periods. Notably, precious metals (3.65%), Bitcoin (1.92%), other investments (2.61%), and secured loans (5.98%) make up a significant portion and also carry volatility risks. In the event of extreme market conditions, Tether (USDT) could face exposure to risks amounting to tens of billions of dollars.

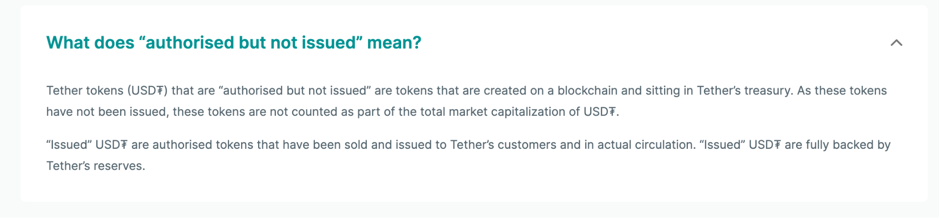

Source: Tether (USDT) official FAQs

From the perspective of the Tether (USDT) issuance mechanism, 'authorized but not issued' USDT tokens are stored in Tether's treasury. These tokens are not in circulation and do not contribute to Tether's market value. Only after receiving user funds can Tether Limited issue corresponding USDT tokens. Furthermore, Tether Limited must ensure that upon receipt of a user's USDT tokens, it will promptly and fully redeem them for U.S. dollars. This implies that users' funds are not used to purchase USDT tokens, but rather are pledged in exchange for them. Tether Limited holds custody rights over these funds but does not have the right to use them. Therefore, the assets that Tether (USDT) can freely utilize are likely limited to transaction fees or the difference between total assets and total liabilities.

Conclusion

In general, Tether (USDT), known for its significant development potential, large user base, and extensive application scope, has played a vital role in boosting the cryptocurrency market toward a bull trend. Its daily trading volume can be seen as an indicator of the market's bullish and bearish tendencies in certain levels. Additionally, as a medium of transaction and value, Tether (USDT) is poised to attract more industries and applications, thereby enhancing the quality of services provided to cryptocurrency users. However, with global cryptocurrency regulations becoming more stringent, it is imperative for Tether (USDT) to manage its funds more judiciously and ensure the compliance and transparency of its financial oversight. This is crucial to prevent it from becoming a major risk in the crypto market under extreme market conditions.

» Further Reading: What Are Stablecoins? Every Crypto Beginner Should Know

FAQ

Q: What is Tether (USDT)?

A: Tether (USDT) is a cryptocurrency stablecoin pegged to the U.S. dollar at a 1:1 ratio. Issued by Tether Limited, it's widely used in the cryptocurrency market as a medium for trading, offering a stable store of value and mitigating transaction volatility. Despite its claim of being fully backed by U.S. dollars, USDT has faced controversy regarding its reserve holdings. Nonetheless, it remains one of the most popular stablecoins in cryptocurrency trading.

Q: Where Can I Buy Tether (USDT) Tokens?

A: USDT tokens can be purchased on various cryptocurrency exchanges, including FameEX. On FameEX, you can buy USDT using a range of fiat currencies in the ‘Buy Crypto’ section. Additionally, you can convert over 100 different cryptocurrencies into USDT through spot trading features.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.