What Is Causing The Fluctuations in Bitcoin's Value Today?

2024-01-10 15:19:20

The Bitcoin market is experiencing increased volatility as investors brace for the SEC's decision regarding spot BTC ETFs on January 10.

Source: moneyandmarkets.com

On January 9, Bitcoin hovered around the $47,000 mark, demonstrating trader uncertainty. Although the market has seen gains due to the potential approval of a spot BTC ETF, some traders believe the outcome might follow the buy the rumor, sell the news pattern.

The Impending Approval of The Spot BTC ETF is Bolstering The Sentiment

Despite various broader economic challenges, Bitcoin's value continues its ascent, marked by heightened volatility and growing open interest. By January 8, all contenders for the spot Bitcoin ETF had completed their submissions, leaving the Securities and Exchange Commission (SEC) poised to potentially greenlight these offerings.

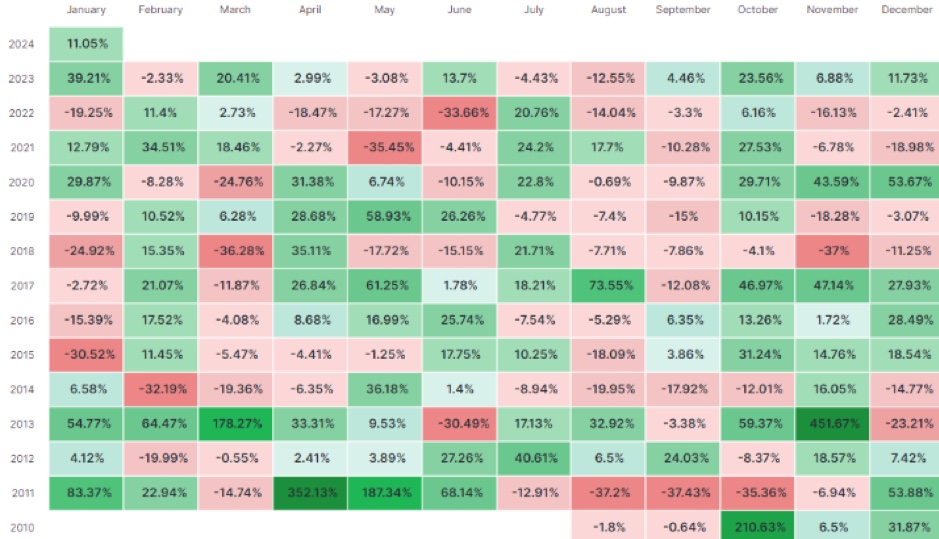

Monthly Bitcoin performance data. Source: Newhedge

Former SEC Chair Jay Clayton emphasized the SEC's apparent readiness to approve, given the influx of updated S-1 submissions on January 9. Some market experts anticipate Bitcoin surging past the $50,000 mark. Remarkably, Bitcoin has outperformed gold's returns from 2023, and this bullish momentum carries into 2024. Michael Saylor, the CEO of MicroStrategy and a prominent Bitcoin advocate, believes a spot Bitcoin ETF would be a game-changer akin to the introduction of the S&P 500.

Bitcoin's rising stature propelled its market capitalization beyond that of Berkshire Hathaway by December 5, 2023, solidifying its position as the tenth-largest asset by that metric. Yet, even with Bitcoin's robust performance, the SEC remains vigilant, issuing cautions about crypto FOMO on January 6 and reiterating concerns on January 8, despite the anticipated approval.

Estimates suggest that an ETF nod could spur a staggering $600 billion influx. Analysts at CryptoQuant project that such approval might escalate Bitcoin's market cap by $1 trillion. Besides, Galaxy Digital anticipates a 74% surge in Bitcoin's value within a year of the ETF's debut. Worth mentioning, traditional financial institutions also appear optimistic, with Standard Chartered projecting a $200,000 valuation for BTC by 2025's end. The latest ETF filings hint at a brewing fee competition, as institutions vie to offer the most competitive rates, with the current lowest fee standing at 0.2% as of January 8.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.