In 2023, Bitcoin Mining Stocks Perform Better Than Bitcoin (BTC)

2023-07-07 15:32:45

An increase in BTC transferred to exchange suggests that the trend may be slowing. Bitcoin mining stocks have been on a triple-digit decline in 2023.

Source: www.toptal.com

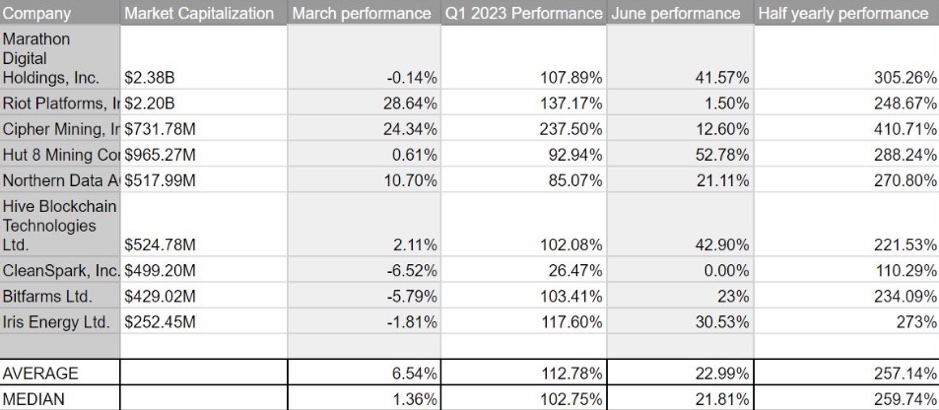

In the midst of the current positive price movement in the leading cryptocurrency, Bitcoin mining businesses exceeded price by a significant margin. The top nine public Bitcoin mining companies by market capitalization had average yearly returns of 257.14% in 2023. The amount is approximately three times greater than the growth of Bitcoin within the same time frame.

The greater returns are an indication of the leveraged beta impact that mining equities experience. Leveraged beta shows that these equities outperform amid a rise in the value of Bitcoin. The negative risk is greater when Bitcoin declines. Bitcoin's price performance will continue to be a key determinant in deciding the direction of mining stocks because of its high levered beta.

Performance of listed Bitcoin mining stocks

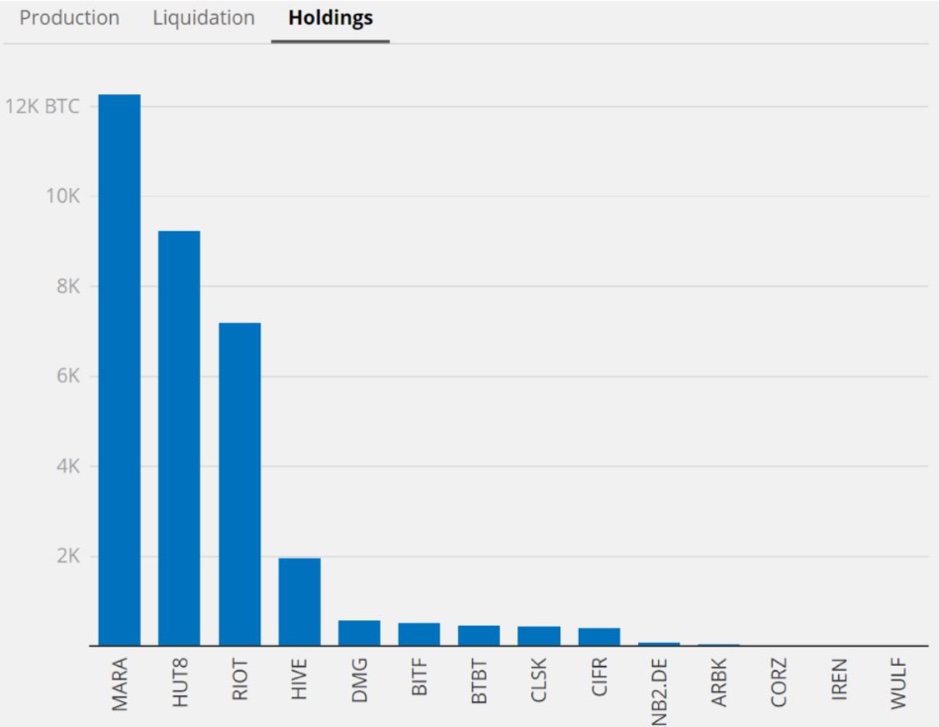

By purchasing additional equipment, miners are positioned themselves for the long run, according to industry trends. The fact that they haven't yet seen accumulation levels consistent with other bull markets raises the possibility that the upward trend in the equities may eventually come to an end. The last month saw growth plans from a number of mining businesses, adding to the optimistic feelings and long-term value of the equities. A decrease in hashrate and a rise in price coincided with better mining circumstances. On-chain data, however, reveals that miners sold off a sizable chunk of their holdings, which may portend a fall soon.

Source: Public mining firms' Bitcoin holdings. Mining magazine

Mining Corporations Take Bold Actions

The U.S. public firms took bold steps in June, indicating the industry's long-term strength. With a total hashrate of 9.8 EH/s following its merger with US Bitcoin Corp. (USBTC), Hut 8 Mining Corp. (HUT8) is now the third-largest publicly traded mining company in the United States. To improve its hashrate by nearly 1 EH/s, Cleanspark (CLSK) spent $9.3 million. At the same time, Riot Blockchain (RIOT) agreed to pay mining equipment maker MicroBT $170 million to roughly quadruple its hashrate capacity by the time it is fully deployed in 2024.

The Mining Sector Is Ready For a Temporary Pinch

According to data from Fintel, 25.06% of the float shares of Marathon Digital Holdings are shorted, making it one of the most shorted companies on the Nasdaq. Values exceeding 10% are regarded as being substantially shorted for comparison's sake. Similar to Cipher Mining, which has 22.32% of its float shares shorted, Riot Platform has 14.54% of its float shares shorted, up from 13.48% in May. The remaining companies have 5% to 10% of their floating shares shorted, which indicates a generally neutral market position.

Rising debt and stock dilution, which have a negative impact on the profitability of current owners, may be the cause of the rising short interest in MARA, RIOT, and CIFR. The Antminer S19, the most popular mining model, costs between $20,000 and $25,000 to produce, depending on the price of energy. Notably, businesses with mining farms in Texas, like Riot Blockchain, may see some losses as a result of the weather. Although it is not the first time, it is probable that the corporation would have taken precautions to reduce the dangers associated with the heatwave.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.