Ethereum Staking Behemoth Lido is Debating Whether to Sell or Stake Its 30 Million Dollars in ETH

2023-02-15 16:34:55

For the time being, LidoDAO's current inflows of roughly 1000 stETH are enough to pay running expenditures, but the organization is concerned that may not continue.

Source: www.theblock.co

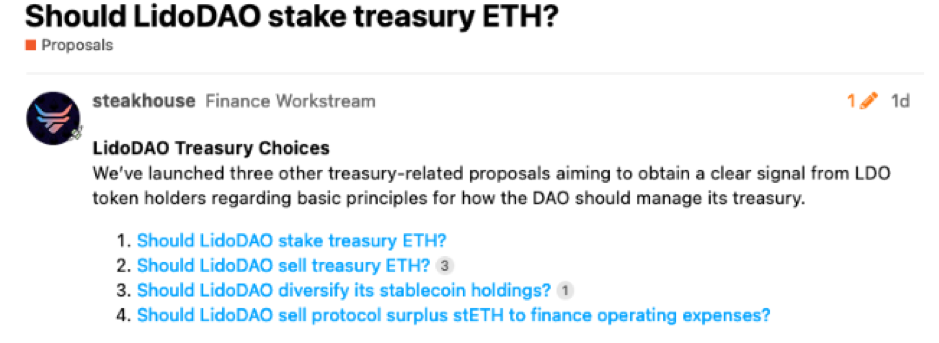

The $30 million in Ether (ETH) from Lido's treasury is being debated by the decentralized autonomous organization (DAO) that runs the biggest Ethereum staking pool. Steakhouse Financial, the DAO's financial arm, filed a proposal on February 14 that examines four options, one of which involves staking some or all of its ETH on Lido in the form of Lido Staked ETH (stETH).

A different scenario would include LidoDAO selling some or all of its 20,304 ETH for a stablecoin in order to increase the DAO's runway.

The LidoDAO received the four recommendations from Steakhouse Financial regarding how to handle its finances (shown). Origin: Lido

The suggestion comes as Ethereum's Shanghai and Capella upgrades, which are anticipated to happen sometime in early 2023, would shortly permit ETH staking withdrawals.

While switching from ETH to Staked ETH may increase protocol benefits, the DAO is cautious about overstaking for fear of running out of Ether "just in case."

Steakhouse Financial argued it could be required to exchange Ether for a stablecoin in relation to running costs in order to "preemptively ensure greater runway."

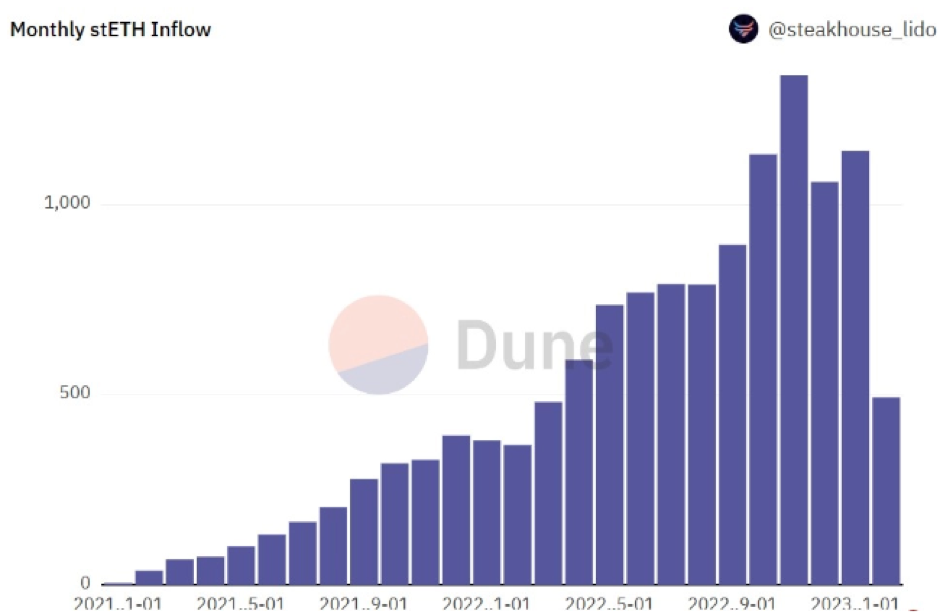

Since the price of ETH has been fluctuating between $1,100 and 1,700 over the past few months, Steakhouse Financial said that LidoDAO is now producing between $1.3 million to $1.5 million per month with inflows of about 1000 stETH every month.

Since January 2021, stETH has steadily climbed in monthly influx on Lido. Origin: Dune Analytics

These numbers should be "adequate to meet monthly operational expenditures," according to Steakhouse Financial.

They are currently debating whether it would be beneficial to convert any extra stETH into a stablecoin, though, in order to be better prepared for any changes in market circumstances that would result in elevated operational costs.

The statement from a business development official at LidoDAO suggests that the stablecoin market is struggling at present. The official raised concerns about the potential risks posed by USDC and DAI, especially if USDC were to be frozen, due to the prevailing "FUD" and suspicions surrounding stablecoins. Despite these concerns, it is worth noting that there are also doubts about the liquidity of LUSD, and USDT is facing its own set of challenges.

It seems that the majority of LidoDAO members support part-selling and part-staking of the 20,304 ETH held in its Aragon smart contract.

Disclaimer: FAMEEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.