FameEX Weekly Market Trend | January 2, 2025

2025-01-02 19:35:35

1. BTC Market Trend

From December 29, 2024 to January 1, the BTC spot price swung from $91,468.59 to $96,306.59, a 5.18% range. In the past three days, the Federal Reserve (Fed) and the European Central Bank (ECB) have made the following important statements:

1) On December 31, 2024, Fed’s Daly stated that cryptocurrencies should be viewed as an independent asset class rather than conflated with gold. She added that cryptocurrencies are complex and not yet ready to serve as “money”.

2) On December 30, 2024, ECB Governing Council member Stournaras mentioned that interest rate cuts should proceed gradually, but the ECB should not rule out the possibility of larger rate cuts.

3) On December 30, 2024, ECB Governing Council member Holzmann emphasized the need for more observation time before any further rate cuts.

4) On January 1, 2025, ECB President Lagarde expressed her hope that the ECB will achieve its 2% inflation target in 2025.

The People’s Bank of China has released the China Financial Stability Report (2024), which includes insights into global cryptocurrency regulatory developments, with a particular focus on Hong Kong’s progress in cryptocurrency compliance. Recognizing the potential spillover risks of crypto assets to financial system stability, regulators worldwide are intensifying efforts to oversee crypto assets. Hong Kong has actively explored a licensing regime for crypto assets, categorizing virtual assets into two groups for regulatory purposes: securitized financial assets and non-securitized financial assets. It enforces a distinctive “dual-license” system for virtual asset trading platform operators under the Securities and Futures Ordinance and the Anti-Money Laundering Ordinance. Entities engaged in virtual asset business must apply for registration and licenses from relevant regulatory authorities to operate. Furthermore, Hong Kong mandates major financial institutions like HSBC and Standard Chartered to include cryptocurrency exchanges in their routine client supervision frameworks.

According to data from Coinglass, Bitcoin’s performance in the first quarter over the past five years shows three gains and two losses, with gains significantly outweighing losses:

Q1 2024: +68.68%

Q1 2023: +71.77%

Q1 2022: -1.46%

Q1 2021: +103.17%

Q1 2020: -10.83%

Since 2013, Bitcoin’s average Q1 growth rate has been 56.47%, with six gains and six losses. For January alone, the average growth rate is 3.35%, with six gains and six losses. Notably, Bitcoin performed well in January over the past five years, with four gains and one loss, including a 29.95% increase in January 2020 and 39.63% in January 2023.

A 2024 Crypto Literacy survey published by Crypto Literacy revealed that 98.6% of respondents who consider themselves highly knowledgeable own cryptocurrencies, compared to only 32% of those with limited understanding. Respondents with advanced knowledge are three times more likely to own crypto than those with limited knowledge. Key findings include:

31.8% of respondents claim a deep understanding of cryptocurrencies, up from 11.0% in 2022. 29% view crypto as a long-term retirement strategy, while 22% use it for daily transactions. 59% see regulatory clarity as a key priority for the new government. The percentage of respondents considering crypto “extremely risky” dropped from 43.1% to 35.2%, while 26.6% still question its value. Despite increased awareness, only 22% correctly identify the importance of private keys, 14% understand DeFi functionality, and 9% know the role of staking. The survey, conducted in October 2024, involved 670 U.S. respondents from diverse age, gender, and income groups, aiming to provide insights for educational and policy initiatives.

From January 2 to January 5, keep the sell order for the BTC spot at $169,400, along with the buy orders at $73,970, $59,935, and $45,900 for bottom fishing. For the ETH spot, keep sell orders at $5,125 and buy orders at $2,040 and $1,730 for bottom fishing. It is also recommended to continue increasing positions in altcoin spot trading!

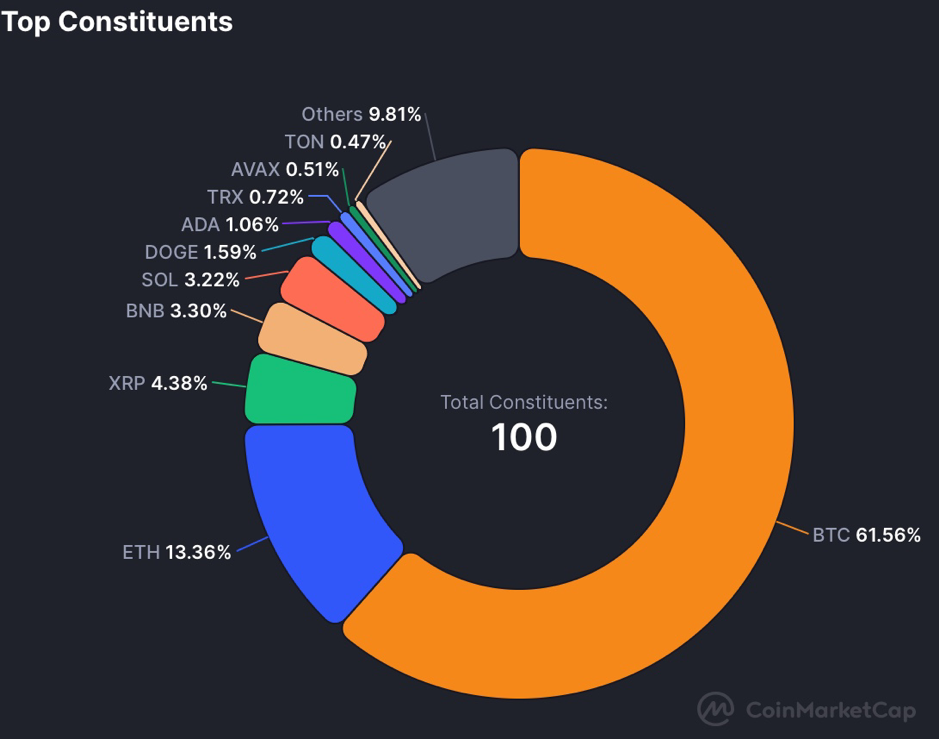

2. CMC 7D Statistics Indicators

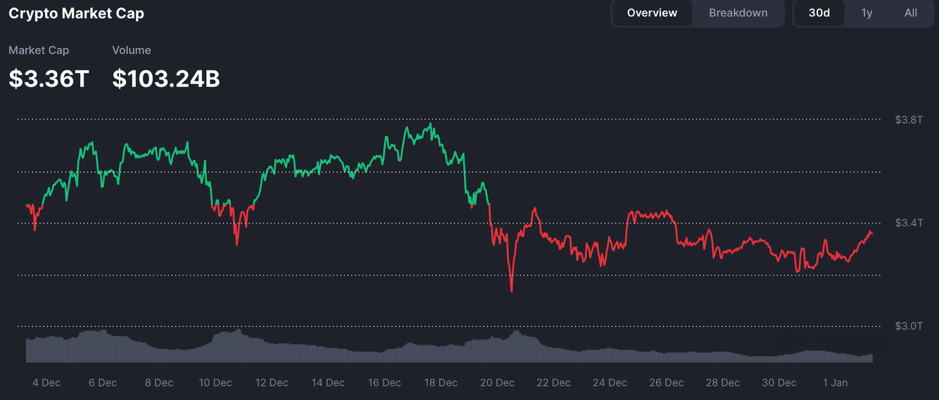

Overall market cap and volume, source: https://coinmarketcap.com/charts/

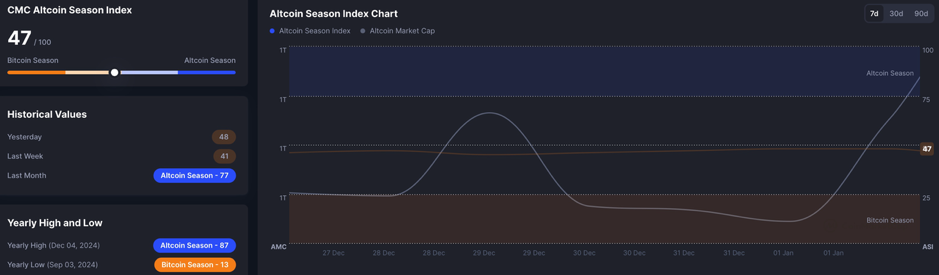

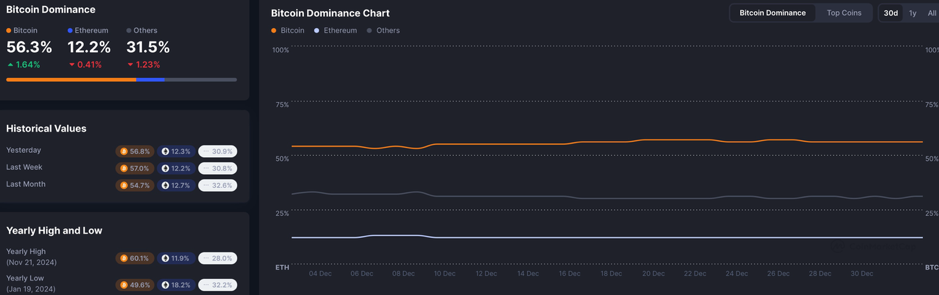

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

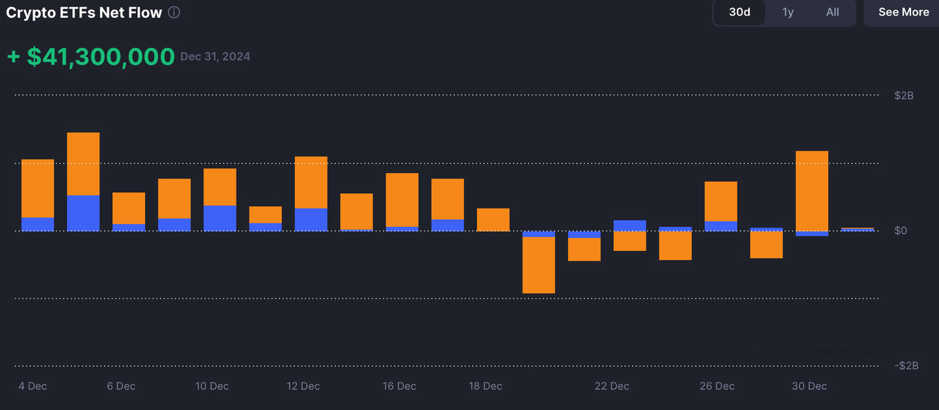

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

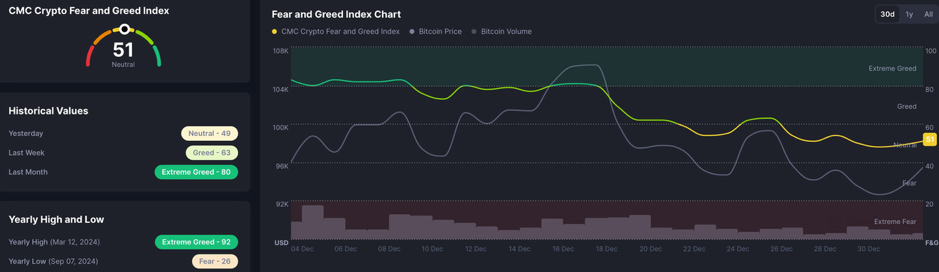

Fear & Greed Index, source:https://coinmarketcap.com/charts/

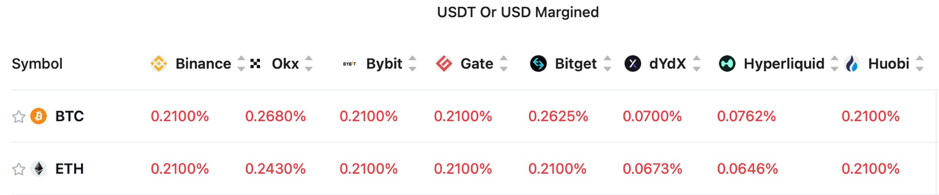

3. Perpetual Futures

The 7-day cumulative funding rates for major exchanges’ mainstream cryptocurrencies are generally positive.

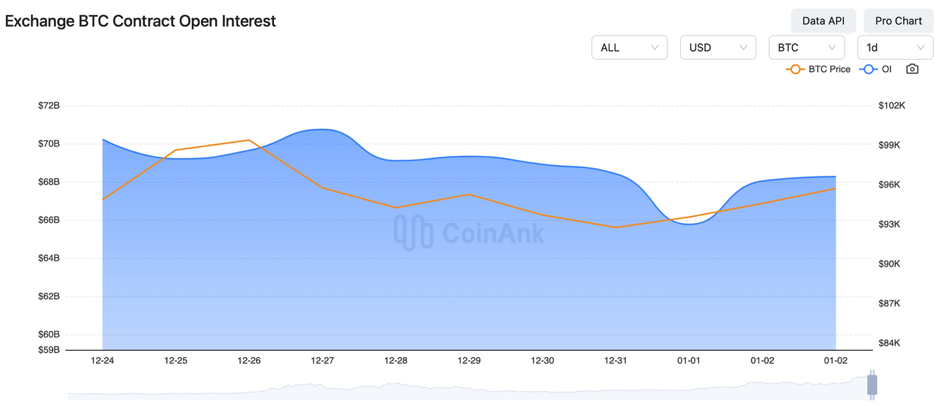

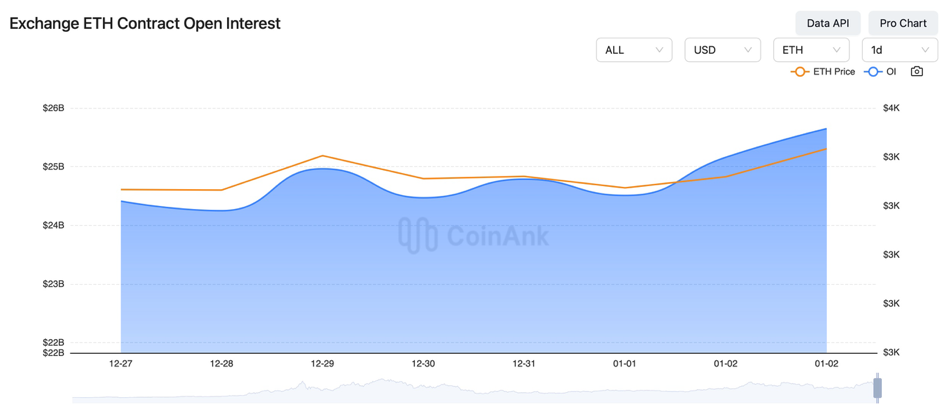

In the past three days, the BTC contract open interest has slightly decreased, while the ETH contract open interest has experienced a little rise.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On Dec 30, 2024, it was reported that Hackers exploit fake job offers to distribute malware and steal cryptocurrencies.

2) On Dec 30, 2024, a study revealed that AI-driven technologies could increase air pollution, potentially causing over 1,000 premature deaths annually by 2030.

3) On Dec 30, 2024, Bitcoin-holding companies with a market value of $250M have been the top performers in 2024.

4) On Dec 30, 2024, crypto trading volume dropped 64% in the past week, with speculative altcoins seeing the largest decline, according to Santiment.

5) On Dec 30, 2024, Italy’s Parliament passed the 2025 budget, raising crypto tax rates to 33% by 2026.

6) On Dec 30, 2024, Warren Buffett increased investment in VeriSign, a company with blockchain domain registration technology.

7) On Dec 30, 2024, the People’s Bank of China announced plans to implement moderately accommodative monetary policies. The goal is to align social financing growth and money supply expansion with economic growth and inflation targets. The central bank also emphasized guiding financial institutions to resolve financing platform debt risks through market-oriented approaches, such as extensions, refinancing, and restructuring. Additionally, steady progress in stock market reform and development was highlighted.

8) On Dec 30, 2024, the U.S. Fed considered removing its “dot plot” projections to improve communication clarity.

9) On Dec 31, 2024, over 50% of Bitcoin mining utilized clean energy, fueling anticipation for Tesla to reinstate Bitcoin as a payment method.

10) On Dec 31, 2024, Binance Labs outlined 2025 focus areas, including AI, crypto, and biotech. It expressed optimism about sectors such as DeSci, RWA/stablecoins, and AI agent ecosystems.

11) On Dec 31, 2024, President Biden announced $5.9B in final aid for Ukraine.

12) On Dec 31, 2024, MoonPay received a license from the Dutch Authority for the Financial Markets under the EU MiCA regulation. Meanwhile, the Jordanian Cabinet approved the 2025 Jordan Blockchain Technology Policy to enhance government services.

13) On Dec 31, 2024, Grayscale updated its list of the top 20 crypto assets for Q1 2025, adding HYPE, ENA, VIRTUAL, JUP, JTO, and GRASS.

14) On Dec 31, 2024, Japan considered reclassifying crypto as financial assets for public investment, and Switzerland began a referendum process to integrate Bitcoin into its constitution.

15) On Dec 31, 2024, the U.S. IRS announced stricter crypto broker reporting rules, facing a lawsuit from the Blockchain Association.

16) On Dec 31, 2024, Vietnamese authorities dismantled a crypto scam worth $1.2M involving fake QFS tokens.

17) On Jan 1, 2025, Elon Musk’s frog-themed tweets pushed PEPE’s market cap to surpass HYPE and UNI, ranking it 24th globally.

18) On Jan 1, 2025, the IRS introduced interim crypto tax relief measures benefiting centralized exchange users.

19) On Jan 1, 2025, the crypto market ends 2024 with a peak valuation nearing $4T, with Bitcoin up 121% for the year.

20) On Jan 1, 2025, the Chinese Supreme Court added crypto-related dispute handling to its 2024 research agenda, while Shanghai police cracked down on a fraudulent crypto trading group.

21) On Jan 1, 2025, Matrixport predicted Ethereum needs a stronger narrative in 2025 to attract institutional investors.

22) On Jan 1, 2025, Messari forecasted AI advancements peaking in Q1 2025, with Ethereum outperforming Solana in the same year.

23) On Jan 1, 2025, crypto funding reached $13.6B in 2024, projected to hit $18B in 2025.

24) On Jan 1, 2025, Bitcoin gained 125% in 2024, peaking at $108K, while Ethereum rose 48%, breaking above $4,100 mid-year.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.