FameEX Weekly Market Trend | December 23, 2024

2024-12-23 19:08:45

1. BTC Market Trend

From December 19 to December 22, the BTC spot price swung from $92,046.28 to $100,878.55, a 9.6% range. The decline during this period was primarily attributed to the Fed’s hawkish rate cuts and Powell's remarks indicating that the Fed has no intention of holding Bitcoin.

Over the past four days, key statements related to the Fed and the European Central Bank (ECB) include:

1) On December 20, Fed’s Daly stated that Current policies and economic conditions are favorable. The latest rate decision is “finely balanced” and can return to a more typical gradual mode. The Fed is very satisfied with its forecast of two rate cuts in 2025. It is hard to say whether tariffs will lead to inflation, as the key lies in their scope, magnitude, and timing.

2) On December 21, Fed’s Goolsbee indicated that the inflation rate is still expected to reach 2%.

3) On December 19, ECB Governing Council Member Patsalides was more inclined toward gradual, small rate cuts.

4) On December 19, ECB Governing Council Member Wunsch indicated that the depreciation of the euro will cushion the impact of tariffs on economic growth while amplifying their effect on inflation. The impact of tariffs depends on exchange rate responses. If the euro remains stable against other currencies, the loss in competitiveness would not be significant. Wunsch estimated that rates might be set around 2%, suggesting that four rate cuts could present a meaningful and appropriate scenario.

Highlights of the Fed FOMC Statement and Powell’s Press Conference

FOMC Statement:

1) Statement Overview: The wording remained largely unchanged, with an 11-1 vote approving a 25 basis point rate cut, while Harker supported pausing rate cuts. The ON-RRP rate was reduced by 30 basis points.

2) Rate Outlook: The Fed will consider the “magnitude and timing” of further rate cuts. The median dot plot projection was revised upward, indicating two rate cuts each in the next two years, though opinions among officials showed significant divergence.

3) Inflation Outlook: The target date for achieving 2% inflation has been pushed back to 2027. Projections for 2024-2026 were comprehensively revised upward, with most officials seeing risks tilted to the upside.

4) Economic Outlook: The unemployment rate forecast was slightly revised downward. The outlook for steady economic growth remained unchanged, while projections for real GDP growth were revised upward for this year and next, with 2024 growth raised significantly from 2% to 2.5%.

Powell’s Press Conference:

1) Rate Outlook: Adjustments to interest rates can be approached more cautiously. Changes in the statement’s wording suggest the Fed is at or near the phase of slowing rate cuts, with rate hikes seeming unlikely next year. If inflation does not consistently move toward 2%, the pace of rate cuts could be further slowed. However, cutting rates too slowly may harm the economy and employment.

2) Inflation Outlook: It may take another year or two to reach the target. Risks and uncertainties remain high, and discussions are ongoing regarding how tariffs influence inflation.

3) Economic Outlook: Overall economic performance remains strong, with growth in the second half of the year exceeding expectations. There is no reason to believe the likelihood of an economic downturn is higher than usual.

4) Employment Outlook: The labor market remains robust and is not a significant source of inflationary pressure. It has not cooled to a concerning degree, and continued monitoring is in place.

5) Other Remarks: Regarding Bitcoin reserve policy, the Fed neither permits nor intends to hold Bitcoin. Today’s rate decision was a particularly challenging choice.

6) Market Reaction: Between the release of the statement and Powell’s speech, spot gold plunged by $56. The dollar index rose by 110 points following the decision, reaching a two-year high. The 2-year U.S. Treasury yield increased by 15 basis points, the Nasdaq saw losses widen to 3%, and Bitcoin dropped over $5,000.

7) Latest Expectations: Traders are pricing in fewer rate cuts by the Fed, now expecting only a 37-basis-point reduction in 2025, significantly below the pre-meeting expectation of 75 basis points.

Key Highlights of the Bank of Japan’s Interest Rate Decision – Keeping Rates Unchanged, One Member Supported a Rate Hike

1) Interest Rate Decision: The Bank of Japan has kept the policy rate unchanged at 0.25%, marking the third consecutive pause in rate hikes.

2) Voting Results: The decision passed with a vote of 8-1, with Committee Member Naoki Tamura supporting a rate hike to 0.5%, which was rejected by the majority.

3) Economic Outlook: Japan’s economy is experiencing a moderate recovery, though some weaknesses persist. Uncertainty regarding both the economic and inflation outlook remains high.

4) Inflation Outlook: Inflation is expected to align with the Bank of Japan’s price target in the latter part of the 3-year forecast period, which extends until fiscal year 2026.

5) Foreign Exchange Impact: The effects of foreign exchange and market movements on Japan’s economy and inflation must be carefully examined. Due to changes in corporate wages and pricing behavior, the impact of exchange rate fluctuations on inflation may be greater than in the past.

6) Monetary Easing Review: The impact of large-scale monetary easing on GDP is estimated to be between +1.3% and +1.8%, with a +0.5 to +0.7 percentage point effect on CPI. The Bank of Japan should continue implementing monetary policy with a focus on achieving stable 2% inflation. When considering future monetary policy actions, no specific measures should be excluded at this point.

From December 23 to December 25, continue to monitor ETH spot trading opportunities, with sell orders at $8,510, $7,840, and $5,040, and buy orders at $2,040 and $1,730. For the BTC spot, keep the sell order at $169,400, and buy orders at $73,970, $59,935, and $45,900.

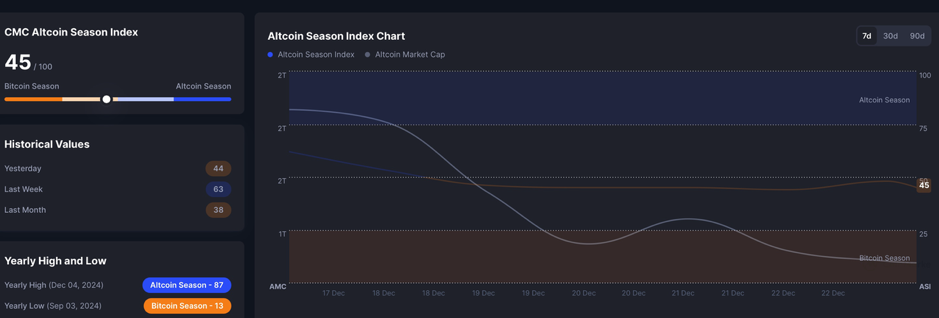

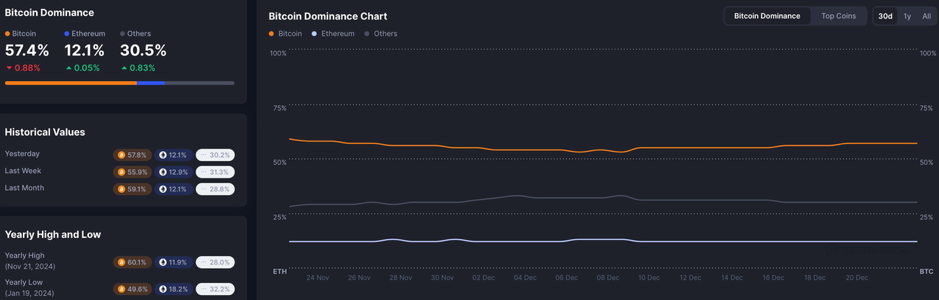

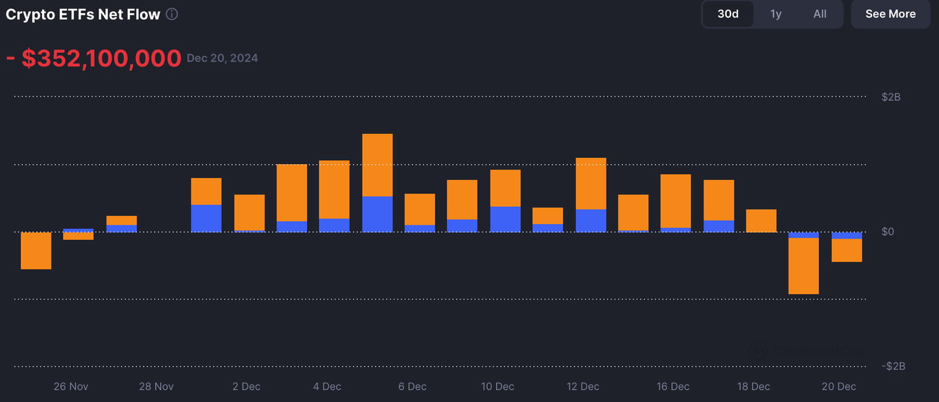

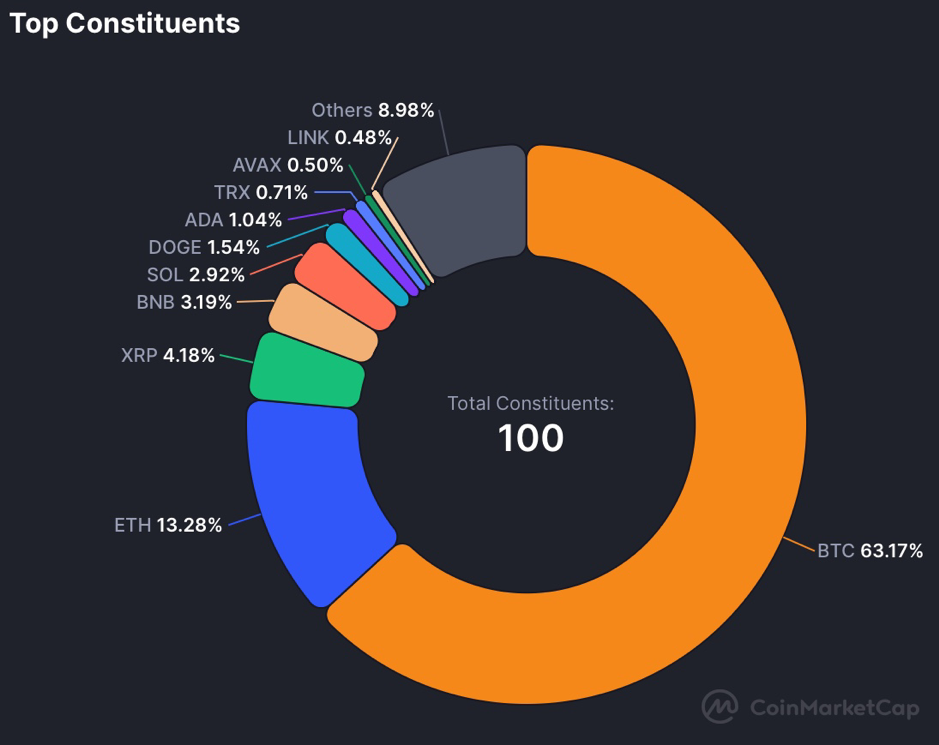

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

Crypto ETFs Net Flow:https://coinmarketcap.com/charts/

CoinMarketCap 100 Index:https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

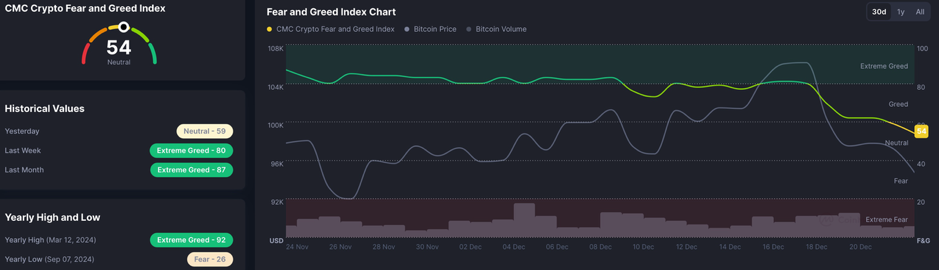

Fear & Greed Index, source:https://coinmarketcap.com/charts/

3. Perpetual Futures

The 7-day cumulative funding rates for major exchanges’ mainstream cryptocurrencies are generally positive, indicating that the current long leverage is high and the overall bullish market expectation remains unchanged.

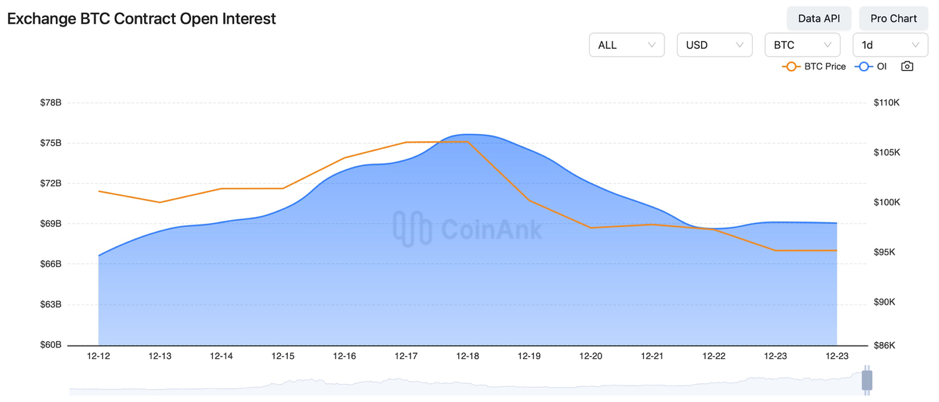

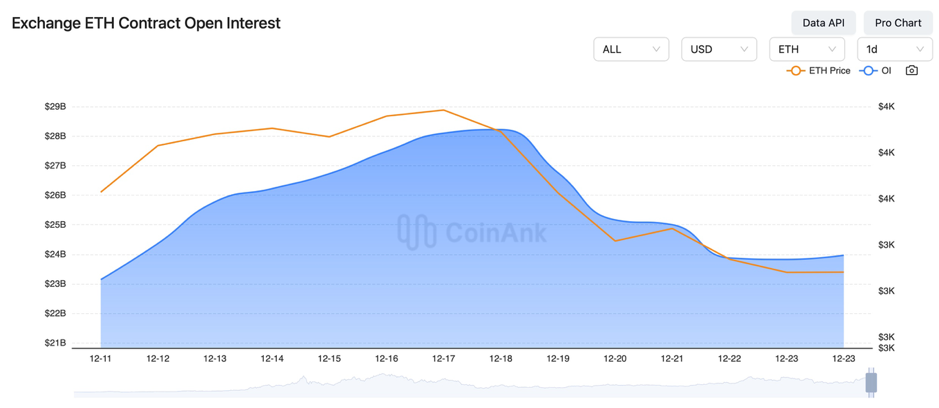

In the past three days, the open interest in BTC and ETH contracts has been decreasing, indicating an overall increase in market risk aversion.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On December 19, the Hamas organization announced significant progress in negotiations for the phased release of hostages and a ceasefire agreement.

2) On December 19, Castle Island Ventures Co-Founder indicated that strategic Bitcoin reserves could undermine global market confidence in the US dollar.

3) On December 19, El Salvador reached a $1.4 billion loan agreement with the IMF. Bitcoin payments will become voluntary. El Salvador has bought 25 BTC since receiving the IMF loan.

4) On December 19, Bank of England maintained the interest rate at 4.75% as expected, with three members voting for a rate cut, more dovish than market expectations.

5) On December 19, US Initial Jobless Claims for the week ending December 14 was 220,000, lower than the expected 230,000 and previous 242,000. The 3Q GDP was revised upward from 2.8% to 3.1%.

6) On December 19, Bank of England Governor Bailey couldn’t commit to when or by how much rates will be cut in 2025, but the direction of rates is downward. The world is full of uncertainties. The market pricing for a rate cut in February is a reasonable starting point.

7) On December 20, China called for enhanced international cooperation on AI governance.

8) On December 20, the IMF stated that a comprehensive assessment would be conducted on Trump’s strategic Bitcoin reserve plan when implemented.

9) On December 20, the Blockaid report indicated that over half of new crypto tokens in 2024 are involved in malicious activities, with fraud losses reaching $1.4 billion.

10) On December 20, data showed that Hong Kong currently has approximately 100,000 active cryptocurrency users.

11) On December 20, according to the Binance user survey, 23.89% of respondents believe AI tokens will lead market growth in 2025, and 16.1% hold meme coins.

12) On December 20, Japan’s November Core CPI year-on-year was 2.7%, higher than the expected 2.6% and previous 2.3%. Japan’s 2025 tax reform proposal mentions “reviewing virtual currency taxation”.

13) On December 21, a Turkish Defense Ministry official indicated that there was no ceasefire agreement between Turkey and the US-supported Kurdish group “Syrian Democratic Forces” (SDF). According to AXIOS, US Senior Diplomat Barbara Leaf will visit Damascus in the coming days.

14) On December 21, the Director of El Salvador’s Bitcoin Office stated that the official Bitcoin wallet, Chivo, would be sold or discontinued.

15) On December 21, a survey showed that Brazilians invest 7% to 35% of their assets in cryptocurrency.

16) On December 21, Beijing Prosecutor’s Office announced the bust of a virtual currency embezzlement case involving 140 million RMB, recovering 89 million RMB in stolen funds.

17) On December 21, US November Core PCE Price Index year-on-year was 2.8% as expected, same as the previous value of 2.8%.

18) On December 21, Zhao Changpeng was unclear how the UAE’s $40 billion Bitcoin holding calculation was derived, the figure is higher than expected.

19) On December 22, the Financial Times indicated that Crypto funds like Brevan Howard and Galaxy Digital outperform traditional funds in annual returns.

20) On December 22, Coinbase released its 2025 Crypto Market Outlook, focusing on stablecoins, RWA tokenization, DeFi, and five other areas.

21) On December 22, the UAE Ministry of Interior and FSRA collaborated to combat virtual asset-related crimes.

22) On December 22, Interpol issued a Red Notice for Richard Heart, founder of the cryptocurrency Hex.

23) On December 22, it was announced that next week, there will be large token unlocks for IMX, DBX, and others.

24) On December 22, it was said that the 13th meeting of the Standing Committee of the 14th National People’s Congress of China would be held in Beijing from December 21 to 25.

25) On December 22, it was announced that next Tuesday, the Bank of Canada would release the minutes from its December monetary policy meeting. Holiday Market Closures: Christmas holidays begin, with Hong Kong and European financial markets closed for two and a half days, and US markets closed for one and a half days starting December 24. Next Wednesday, Bank of Japan Governor Ueda will deliver a speech.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.