FameEX Weekly Market Trend | December 12, 2024

2024-12-12 18:44:50

1. BTC Market Trend

From December 9 to December 11, the BTC spot price swung from $94,052.02 to $101,763.9, an 8.2% range. The key recent statements from the Federal Reserve (Fed) over the past three days are as follows:

1) On December 9: Fed’s Harker stated that it might be time for the Fed to slow down the pace of rate cuts.

2) On December 9, Fed’s Goolsbee mentioned that the neutral interest rate is estimated to be around 3%, hoping to find a point to stop cutting rates next year.

Highlights of the U.S. November CPI Report – Data Meets Expectations, Housing Costs Drive Increase

1. Both overall and core CPI rose 0.3% month-on-month, in line with market expectations. Year-on-year increases also met forecasts, with overall CPI up 2.7% and core CPI up 3.3%.

2. The report indicates that the disinflation process has largely stalled in recent months. For the first time since March, the annual rate of overall CPI accelerated for two consecutive months, while the annual rate of core CPI has remained at 3.3% for three straight months, significantly above the Fed's 2% target for its preferred inflation gauge, the PCE.

3. Housing costs, as usual, accounted for the largest portion of the CPI increase, making up nearly 40%, though growth slowed compared to last month. The closely watched “owner’s equivalent rent” component rose 0.23% this month, marking the smallest increase since early 2021.

4. Food, used car prices, and healthcare subcategories were among the factors driving the November CPI increase. According to the U.S. Bureau of Labor Statistics, few major components showed declines.

5. Following the CPI data release, U.S. stock index futures rose, and U.S. Treasury yields edged up modestly as the data bolstered market expectations that the Fed will cut rates by 25 basis points next week.

From December 12 to December 15, continue monitoring trading opportunities for ETH spot orders. Focus on sell orders placed at $8,510, $7,840, and $5,040, as well as buy-the-dip orders at $2,040 and $1,730. For the BTC spot, maintain sell orders at $169,400, along with buy-the-dip orders at $73,970, $59,935, and $45,900.

2. CMC 7D Statistics Indicators

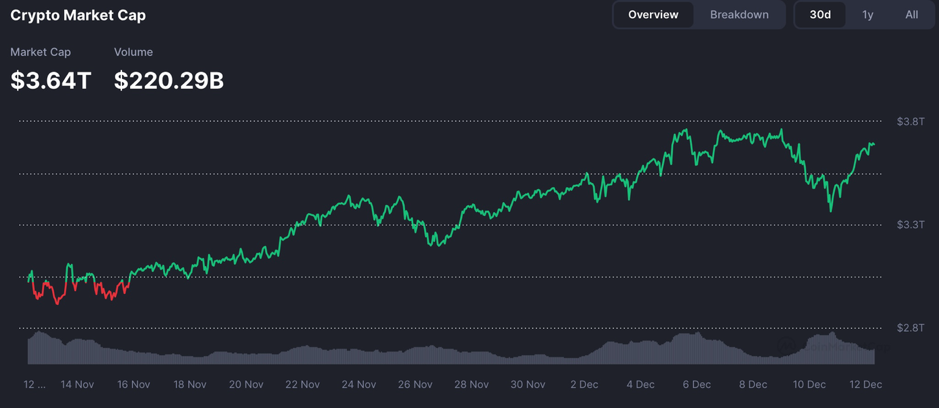

Overall market cap and volume, source: https://coinmarketcap.com/charts/

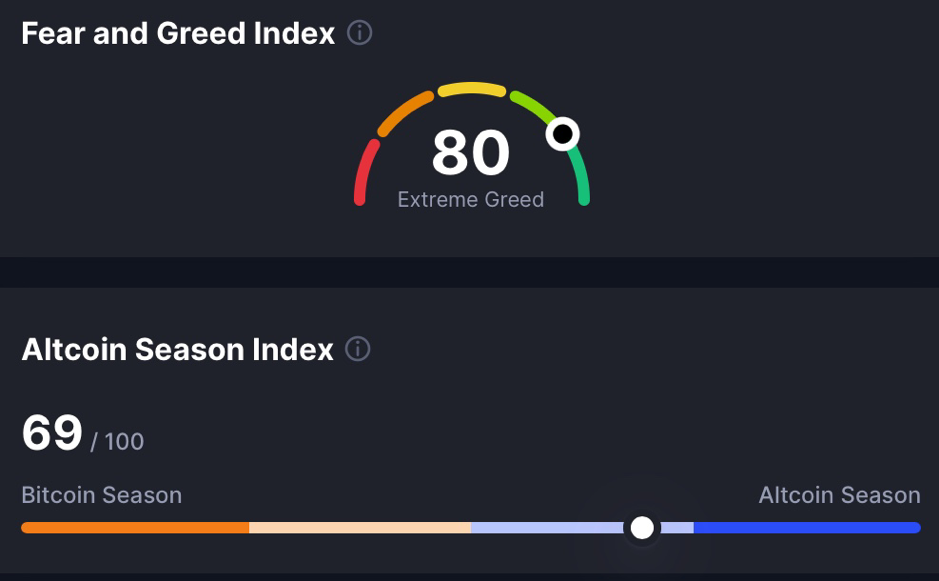

Altcoin Season Index and Bitcoin Dominance:https://coinmarketcap.com/charts/

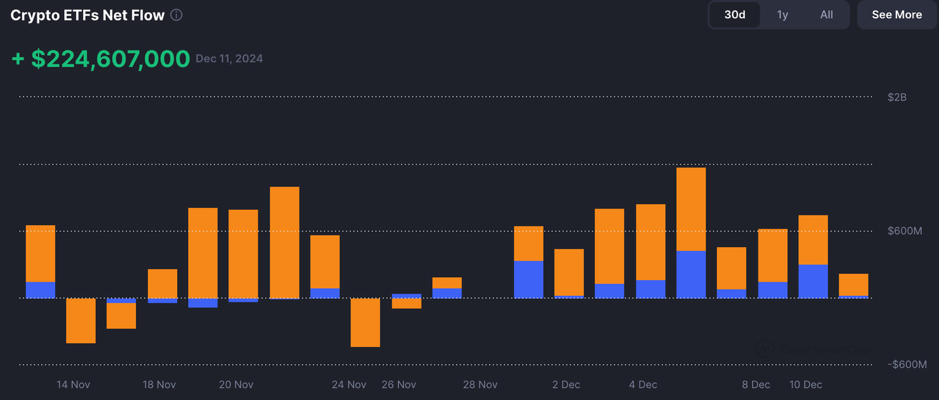

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

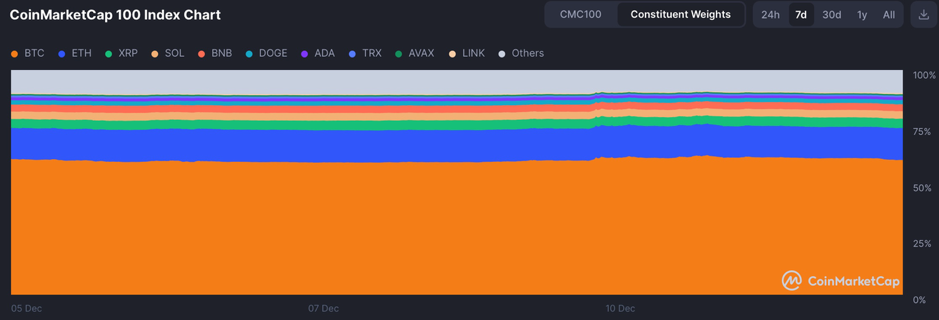

CoinMarketCap 100 Indexhttps://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

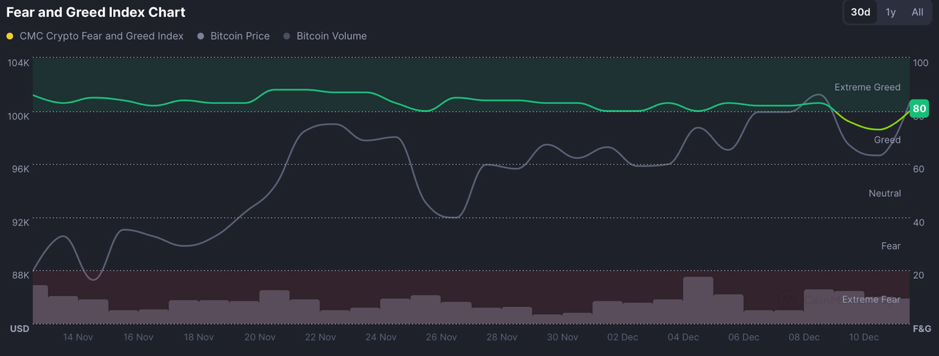

Fear & Greed Index, source: https://coinmarketcap.com/charts/

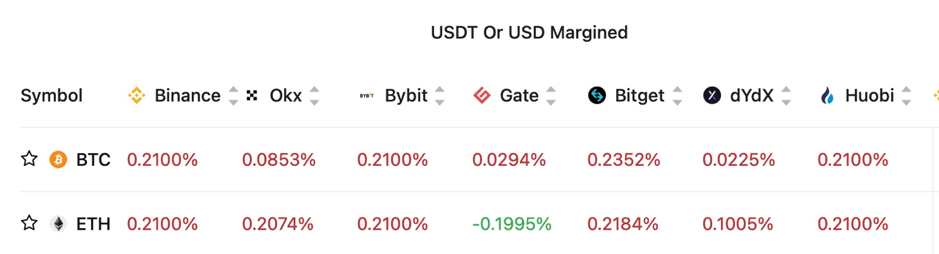

3. Perpetual Futures

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

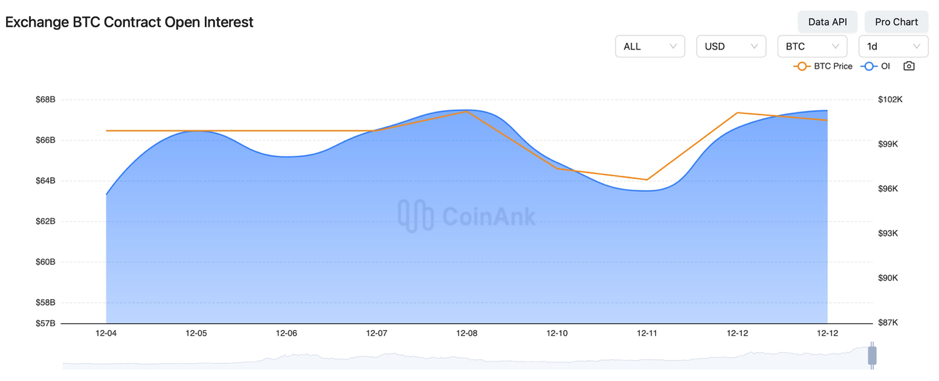

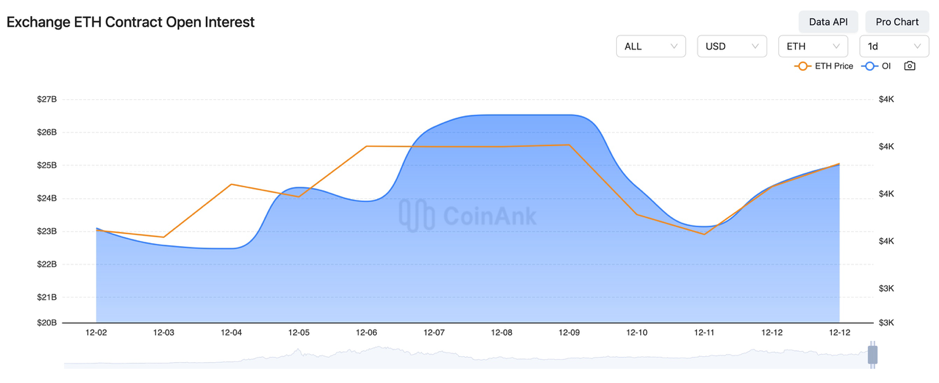

In the past three days, the open interest in BTC and ETH contracts has dropped.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On December 9, Iran announced a shift in its stance on digital currencies, emphasizing regulation over restrictions.

2) On December 9, China’s People’s Court Newspaper indicated that virtual currencies have property attributes, and theft of virtual currencies constitutes theft.

3) On December 9, China’s November CPI year-on-year rate was 0.2%, below the expected 0.5%, and down from the previous 0.30%.

4) On December 9, Japan’s Q3 annualized GDP growth revision was 1.2%, expected 0.9%, previous value 0.90%.

5) On December 9, U.S. November 1-year inflation expectation by the New York Fed was 2.97%, previous value 2.87%.

6) On December 9, the U.S. was reportedly planning to deploy Dark Eagle hypersonic missiles in Eurasia.

7) On December 9, Floki partnered with Mastercard to launch a debit card supporting 13 cryptocurrencies in Europe.

8) On December 10, the South Korean National Assembly passed a resolution calling for the swift arrest of suspects involved in treason, including President Yoon Suk-yeol and former Defense Minister Kim Yong-hyun, among eight others, who were listed for arrest.

9) On December 10, the Eurozone’s December Sentix investor confidence index recorded -17.5, a new low since November 2023.

10) On December 10, the 2024 Bitcoin Act proposed the creation of a U.S. strategic Bitcoin reserve, with funding sources being a key challenge.

11) On December 10, El Salvador might scale back its Bitcoin plan to reach a $1.3 billion agreement with the IMF.

12) On December 10, cryptocurrency theft scams targeted Web3 workers via fake meeting applications.

13) On December 10, the Czech Republic implemented financial reforms to become a crypto hub, allowing crypto companies and investors to open bank accounts.

14) On December 10, Grayscale reported classifying the crypto industry into five sectors: currency, smart contracts, finance, consumer culture, and infrastructure services.

15) On December 11, the Goldman Sachs CEO indicated that the company would consider engaging in cryptocurrency trading if regulations change.

16) On December 11, it was reported that Italy would reduce the increase in cryptocurrency capital gains tax.

17) On December 11, Crypto.com partnered with Deutsche Bank to provide corporate banking services in Singapore, Australia, and Hong Kong.

18) On December 11, sources revealed that Trump wanted Bitcoin to reach $150,000 during his presidency.

19) On December 11, Japan’s cryptocurrency exchange Coincheck was listed on NASDAQ in the U.S.

20) On December 11, El Salvador expected to reach a $1.3 billion loan agreement with the IMF and to eliminate the mandatory acceptance of Bitcoin payments for businesses.

21) On December 11, Canada’s central bank interest rate decision as of December 11 was 3.25%, in line with expectations, down from the previous 3.75%.

22) On December 11, the Shanghai Second Intermediate Court announced that financial platforms have shifted to emerging sectors such as NFTs, with virtual currency cases accounting for 11% since 2019.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.