FameEX Weekly Market Trend | November 18, 2024

2024-11-18 17:33:50

1. BTC Market Trend

From November 14 to November 17, the BTC spot price swung from $87,066.06 to $91,475.13, a 5.07% range.

The key recent statements from the Federal Reserve (Fed) and the European Central Bank (ECB) over the past four days are as follows:

1) On November 15, Fed Chair Jerome Powell indicated that the economy does not indicate an urgent need for the Fed to cut interest rates. Regulated banks are highly cautious about generative AI.

Kugler said if progress on reducing inflation stalls, a pause in rate cuts may be required.

Barkin stated that the Fed is making significant progress but still has more work to do.

2) On November 17, Fed Member Goolsbee expressed that he would continue to refer to the September dot plot for rate cut considerations and emphasized the need to slow down as the neutral rate is approached.

Collins did not rule out the possibility of easing policy in December but saw no urgent need to cut rates while aiming to maintain economic health.

Barkin noted that demand data has exhibited stronger performance since the Fed began cutting rates.

3) On November 15, ECB Meeting Minutes displayed that the process of inflation reduction is on track and may reach the 2% target sooner.

Vice President Luis de Guindos indicated that recent price data is moving toward the 2% target. Monetary policy will adjust if inflation approaches the goal.

4) On November 17, ECB Vice President Luis de Guindos said that the ECB sees a positive inflation outlook but negative economic growth expectations.

Over the past 30 years, the key drivers of the U.S. stock market’s significant surge have approached extreme levels, suggesting that future returns will be substantially lower. This is the view of David Rosenberg, a top U.S. economist and president of Rosenberg Research.

Here are the three factors Rosenberg is concerned about:

Stock Valuation

Rosenberg highlights that the S&P 500’s forward price-to-earnings ratio stands at 22.3x, more than one standard deviation above its historical norm and the highest since the tech bubble peak during the COVID-19 era in 2021.

Higher market valuations largely rely on continued corporate earnings growth, which “has no further room to expand,” he said.

Taxes

For decades, declining corporate tax rates in the U.S. have boosted company profits and stock prices. Rosenberg believes that with the current effective corporate tax rate at 17%, there is little room for further reductions, even under Republican control of the White House and Congress.

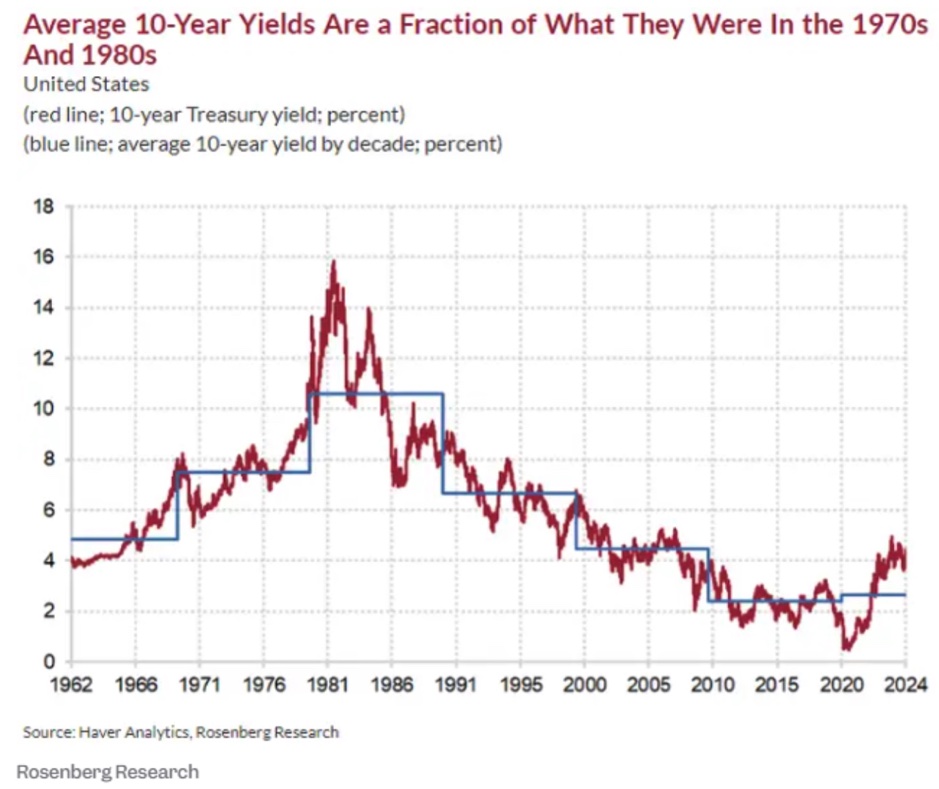

Interest Rates

Falling interest rates have long fueled stock market gains, but this trend may also be nearing its end.

Source: https://www.jin10.com

In summary, Rosenberg stated that unless operating profits, excluding the impact of taxes and interest expenses, increase significantly, it is unlikely that the U.S. stock market will see substantial gains in the future.

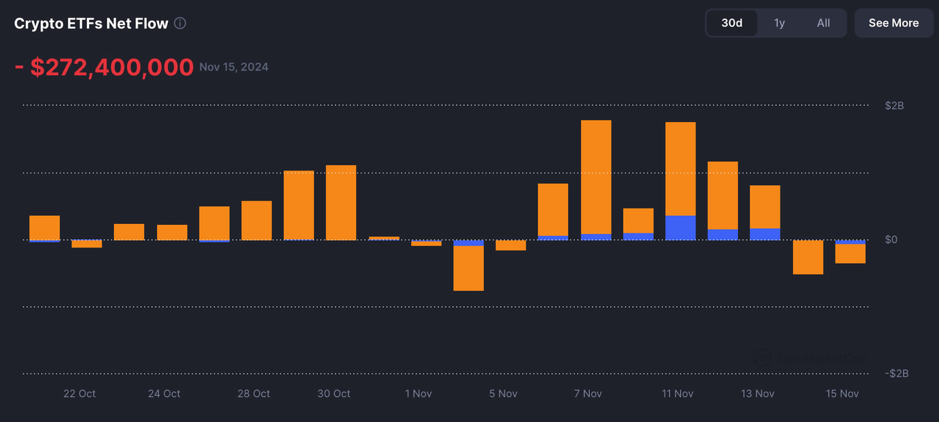

According to a report by DLNews, Kraken’s Head of Strategy, Thomas Perfumo, predicted that cryptocurrency ETF inflows will double to $50 billion by 2025. He stated that “ultimate allocators” such as sovereign wealth funds, endowment funds, and pension funds would gradually enter the market starting next year. Large asset management firms are already considering allocating 1% to 3% of their portfolios to crypto assets.

Data showed that the total amount of Bitcoin held by 11 Bitcoin ETF issuers has exceeded $90 billion, accounting for more than 5% of Bitcoin’s total supply. The entry of mainstream asset managers like BlackRock and Fidelity has not only reduced investment costs and risks but also enhanced the market’s recognition of crypto assets.

Perfumo further noted that Donald Trump’s victory in the U.S. election has boosted market confidence. Trump previously pledged to establish a Bitcoin strategic reserve, dismiss SEC Chair Gary Gensler, and advance stablecoin legislation.

On the afternoon of November 16 (local time), Chinese President Xi Jinping met with U.S. President Joe Biden in Lima. Xi emphasized that China’s stance and actions on the Ukraine issue have always been aboveboard, focusing on shuttle diplomacy, mediation, and promoting peace talks. China is committed to de-escalating the situation and will not allow war or chaos on the Korean Peninsula, nor will it tolerate threats to China’s strategic security and core interests.

From November 18 to November 20, continue monitoring trading opportunities for ETH spot orders. Focus on sell orders placed at $8,510, $7,840, and $5,040, as well as buy-the-dip orders at $2,040 and $1,730.

For the BTC spot, maintain sell orders at $169,400, $102,980, and $96,820, along with buy-the-dip orders at $73,970, $59,935, and $45,900.

2. CMC 7D Statistics Indicators

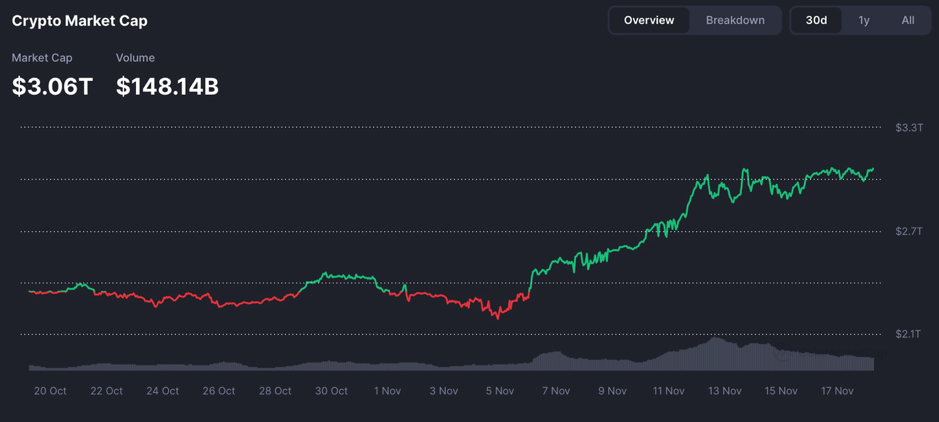

Overall market cap and volume, source: https://coinmarketcap.com/charts/

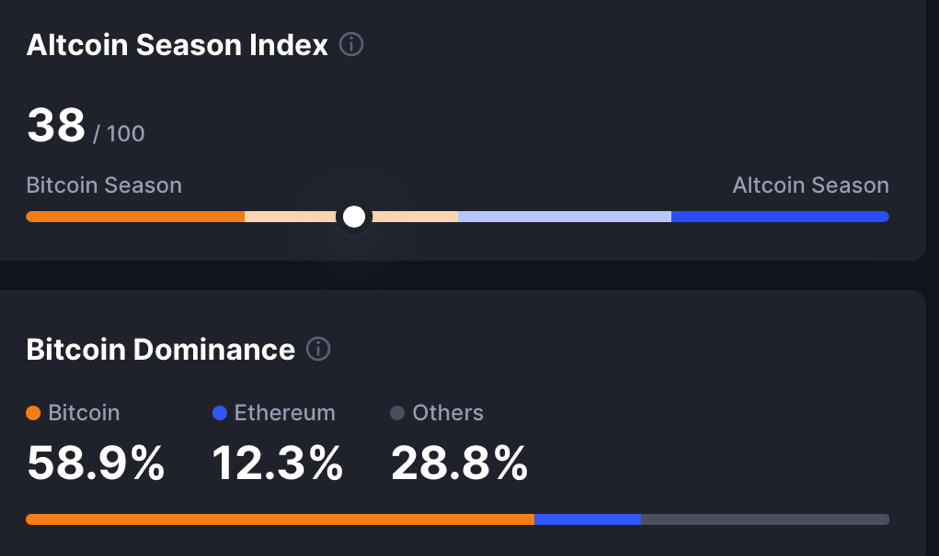

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

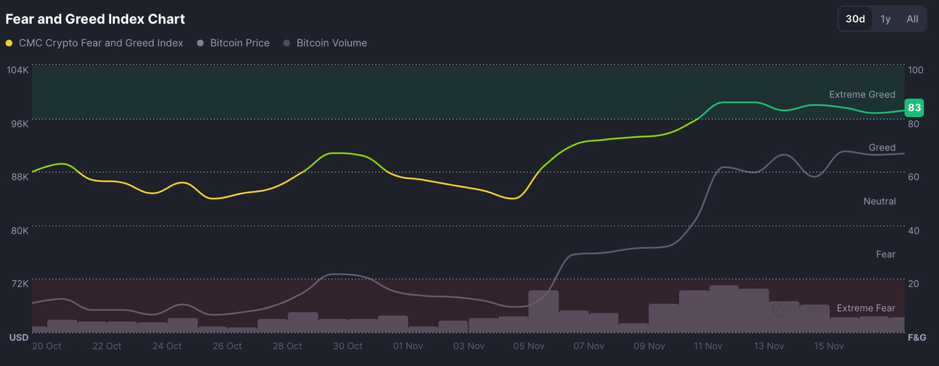

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

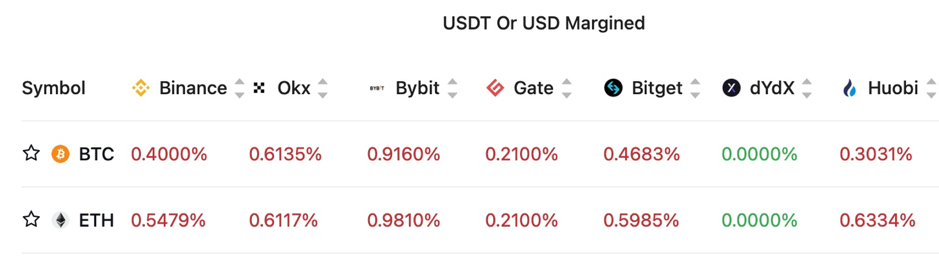

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

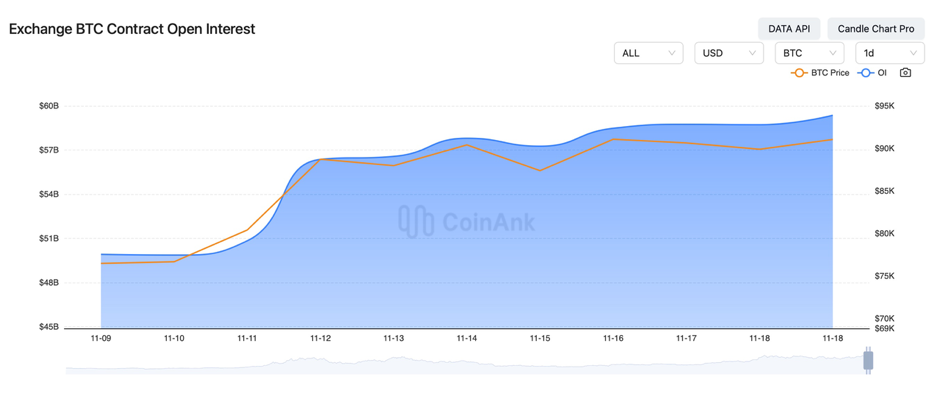

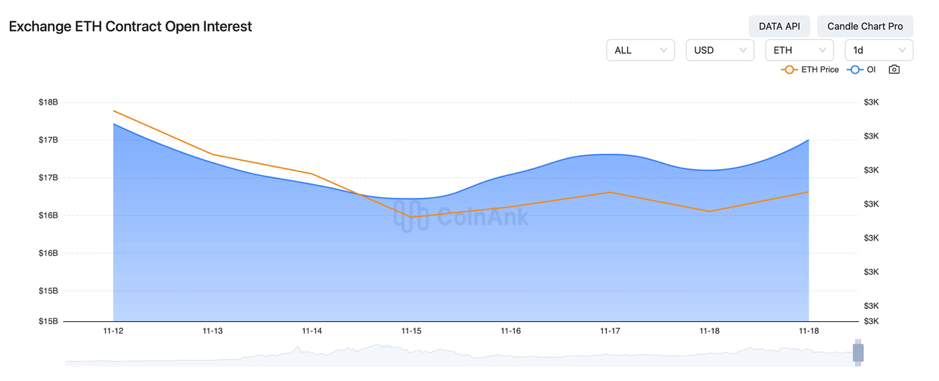

In the past four days, the open interest for BTC and ETH contracts has seen a slight increase.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On November 14, Kraken’s Head of Strategy predicted that the entry of sovereign wealth funds, endowment funds, and pension funds would double the size of crypto ETFs to $50 billion.

2) On November 14, U.S. initial jobless claims for the week ending November 9 recorded 217,000, the lowest since the week ending May 18, 2024.

3) On November 14, the U.S. October PPI annual rate was 2.4% (expected 2.3%), with the previous value revised from 1.8% to 1.9%.

4) On November 15, Hong Kong Exchanges launched a virtual asset index series, with exchange rates calculated daily at 4 PM.

5) On November 15, DOGE surged 128% by November 13 during the U.S. election period, outperforming Tesla and Bitcoin.

6) On November 15, U.S. Republican Senator Cynthia Lummis suggested selling some of the Fed’s gold to purchase Bitcoin.

7) On November 16, Pennsylvania proposed legislation to include BTC as a reserve asset on its balance sheet.

8) On November 16, the U.S. planned to deploy anti-satellite weapons targeting China and Russia. China’s Ministry of Defense responded, accusing the U.S. of reversing the truth and using the so-called “China space threat” as a pretext.

9) On November 16, Bank of England policymaker Catherine Mann indicated that macroeconomic variables are expected to remain highly volatile in the coming years.

10) On November 16, Japan’s Economic Revitalization Minister Akazawa Ryoichi indicated that the Bank of Japan is expected to align its stance with the government on economic policies. Finance Minister Kato Katsunobu said that measures would be taken against excessive foreign exchange fluctuations.

11) On November 17, the European Commission forecasted eurozone economic growth rates for 2024–2026 at 0.8%, 1.3%, and 1.6%, with inflation rates at 2.4%, 2.1%, and 1.9%.

12) On November 17, a Trump ally proposed selling part of the Fed’s gold to purchase 1 million Bitcoin.

13) On November 17, Ukrainian President Volodymyr Zelensky indicated that efforts are being made to end the Russia-Ukraine conflict diplomatically by next year.

14) On November 17, U.S. initial jobless claims for the week ending November 16 will be released next Thursday.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.