FameEX Weekly Market Trend | September 12, 2024

2024-09-12 20:10:05

1. BTC Market Trend

From September 9 to September 11, the BTC spot price swung from $54,590.8 to $58,178, a 6.57% range. The primary factors influencing price changes during this period were the U.S. CPI data from August and the televised debate between Trump and Harris in the U.S. presidential campaign.

The key speeches related to the Federal Reserve (Fed) over the past three days are as follows:

1) On September 9, Fed Governor Waller expressed openness to more substantial rate cuts.

2) On September 9, Fed’s Williams delivered his readiness to begin the rate-cutting process, but was not yet prepared to specify the magnitude of the first rate cut.

3) On September 9, Waller expressed support for preemptive rate cuts if appropriate and indicated willingness to back larger cuts if needed.

4) On September 9, Goolsbee stated that the general consensus within the Fed is to proceed with multiple rate cuts, with the future path of cuts over the next few months being more important.

The cryptocurrency payment aggregation platform Onramper has announced the launch of its crypto-to-fiat solution. This service integrates several leading providers, including MoonPay, Alchemy Pay, and Banxa, aiming to help users securely and conveniently convert cryptocurrency to fiat currency. Onramper’s CEO Thijs Maas stated that the new service can match users with the best conversion providers based on smart routing technology. Offramper is expected to support 46 fiat currencies and over 500 cryptocurrencies, covering 200 countries and offering 39 payment methods, including credit cards, bank accounts, and PayPal. (Source: The Block)

The CPI data released on September 11 shows that the unadjusted U.S. CPI year-on-year rate for August came in at 2.5%, lower than the expected 2.6% and the previous value of 2.90%, marking the fifth consecutive month of decline and the lowest level since February 2021. The unadjusted monthly CPI rate for August was recorded at 0.2%, in line with expectations and the previous value. The unadjusted core CPI year-on-year rate for August stood at 3.2%, also matching expectations and the previous value, after four consecutive months of decline. The core CPI monthly rate was 0.3%, higher than the expected and previous value of 0.20%. According to the CME’s “FedWatch”, the probability of the Fed cutting interest rates by 25 basis points in September is 85%, while the probability of a 50-basis-point cut is 15%, compared to 71% and 29% before the CPI release.

Key Issues and Statements from the Harris-Trump Presidential Debate:

1) Economy: Harris said she believes in the ambition, aspirations, and dreams of the American people, which is why she envisions and has a plan to build what she calls an “opportunity economy”. Trump argued that the U.S. economy is terrible due to inflation, which he called a national destroyer, claiming that the Democrats have ruined the economy.

2) Immigration: Harris noted that Trump would talk a lot about immigration, even though it wasn’t his chosen topic. Trump stated, “Our country is lost; we are a failed nation,” referring to the influx of illegal immigrants into the U.S.

3) Abortion: Harris promised that as president, once Congress passes a bill reinstating protections under Roe v. Wade, she would proudly sign it into law. She also accused Trump of lying about his stance on a national abortion ban, alleging that he would sign one into law if elected.

4) Assassination: Regarding a previous assassination attempt, Trump said, “I might get shot in the head because of the things they (the Democrats) say about me.”

5) Tariffs: Defending his tariff proposals, Trump said, “They won’t raise prices.” Harris countered by saying that Trump started a trade war.

6) Taxes: Harris emphasized that providing a $50,000 tax credit for small business owners is a smart move. She criticized Trump’s proposals, such as corporate tax cuts, arguing that they would hurt middle-class American families.

7) Energy: Harris said her position is to invest in multiple energy sources to reduce dependence on foreign oil, noting that U.S. domestic oil production had seen historic growth. Trump claimed that if Harris were elected, “fossil fuels would disappear.” He promised to repeal the Inflation Reduction Act, which emphasizes clean energy, reclaim unused funds, and declare a national energy emergency to boost U.S. oil and gas production significantly.

8) Israel-Palestine Conflict: Harris stated that a ceasefire agreement is needed in Gaza and called for the release of hostages. She reiterated her commitment to ensuring Israel’s right to self-defense but stressed the need for a two-state solution to the Israeli-Palestinian conflict. Trump warned that if Harris were elected, Israel would cease to exist within two years, criticizing Iran for funding militant groups like the Houthis in Yemen.

9) Russia-Ukraine Conflict: Trump said he would end the Russia-Ukraine conflict before his inauguration, expressing a desire for the conflict to stop. He described the Ukraine-Russia war as a situation that needed resolution, suggesting it could lead to World War III. Stopping the bloodshed is in our best interest. He also suggested that Putin might resort to using nuclear weapons. Harris implied that Trump would abandon Ukraine to appease Putin.

10) Emerging Industries: Both Harris and Trump expressed support for the U.S. technology sector. Harris emphasized the need for the U.S. to “win the AI race”, while Trump said he was a big fan of solar energy.

11) Housing Issues: Harris reiterated her promise to provide a $25,000 down payment assistance for first-time homebuyers. She also pledged to stimulate the construction of over 3 million homes and apartments within four years to address the U.S.’s growing housing shortage and lower costs.

After the U.S. presidential debate, shares of Trump Media & Technology Group (DJT.O) fell 13% in pre-market trading, and blockchain-related stocks generally declined. From the latest debate between Harris and Trump, Harris did not appear to be at a significant disadvantage, coming across as more pragmatic, leaving a favorable impression. It was evident that the Democratic Party had thoroughly prepared for the public debate in the presidential campaign. On the other hand, Trump focused primarily on attacks and criticisms, including belittling the current state of the U.S. He still faces a challenge in securing the final vote from swing states and their voters. A poll showed that 63% of viewers believed Harris won the debate against Trump.

From September 12 to September 15, the sell orders for the ETH spot at $4,700, buy orders at $1,850, and the sell orders for the BTC spot at $72,500, $77,500, and $92,000, along with the buy orders at $42,950, should all remain in place, pending the Fed’s latest interest rate decision on September 18.

2. Blockchain Mastery & Trading Tips

Here’s a brief overview of the fundamentals of various blockchain platforms and cryptocurrencies.

According to third-party statistics from DEXTools, all cryptocurrencies are categorized under 95 different blockchains, such as the well-known Ethereum chain, Solana (SOL), Base chain, BNB Chain, and TON Chain. For a cryptocurrency transaction to be processed, both the sender and receiver need to be on the same blockchain; otherwise, even if the recipient’s address is correct, the funds will be totally lost. Among these, the Ethereum chain has the largest total trading volume and influence (with chains like Optimism also deriving from Ethereum). Due to the recent explosion of memecoins, the Solana chain, which ranks second in decentralized exchanges, has occasionally surpassed Ethereum in trading volume this year.

Each public chain has a core token, which can be considered the leading token for that chain’s fundamentals, such as ETH for Ethereum, SOL for Solana, BNB for BNB Chain, and TON for TON Chain. The core tokens of these major blockchains, combined with stablecoins like USDT, form the top twenty cryptocurrencies by trading volume, commonly referred to as mainstream coins.

According to CoinMarketCap, cryptocurrencies are divided into 246 sectors, such as memecoins, DeFi, metaverse, AI, NFTs, and stablecoins. Tokens in each sector come from different blockchains and share the same functional attributes (uses). For example, the stablecoin sector includes USDT, USDC, and DAI, while the metaverse sector includes SAND, MANA, MASK, and MAGIC.

Tokens within the same sector often experience similar price movements when their core tokens see significant operational developments or when the sector as a whole is subject to market hype (e.g., memecoins during the recent bull market). Unlike stocks that typically belong to a single main business sector, many tokens belong to multiple sectors. For instance, MAGIC is part of the metaverse, NFTs, collectibles, and gaming sectors. Thus, conducting a fundamental analysis on each token is crucial in the research phase.

Factors affecting short-term price fluctuations include Bitcoin’s influence, sector-specific hype, positive or negative news from token projects, and overall community engagement. From a medium to long-term trading perspective, tokenomics is particularly important, especially regarding distribution and unlocking mechanisms, deflationary and buyback/burn practices. Generally, tokens with deflationary features are considered more valuable for long-term investment than those with continuous inflation because scarcity adds value. Tokenomics details can be found on project websites, as well as on professional news platforms like MarsBit, CoinCarp, Token Unlocks, and in the X (formerly Twitter) and Telegram communities created by the token projects themselves.

3. CMC 7D Statistics Indicators

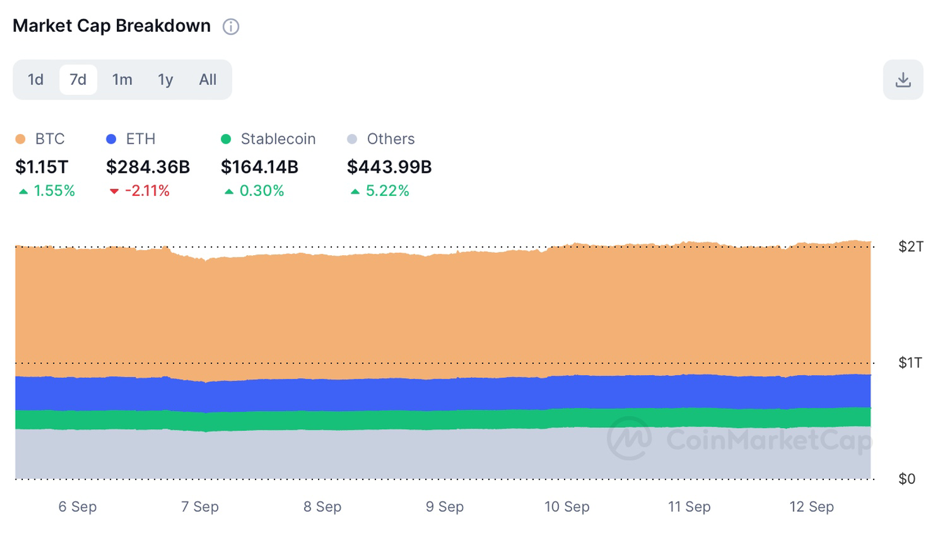

Overall market cap analysis, source: https://coinmarketcap.com/charts/

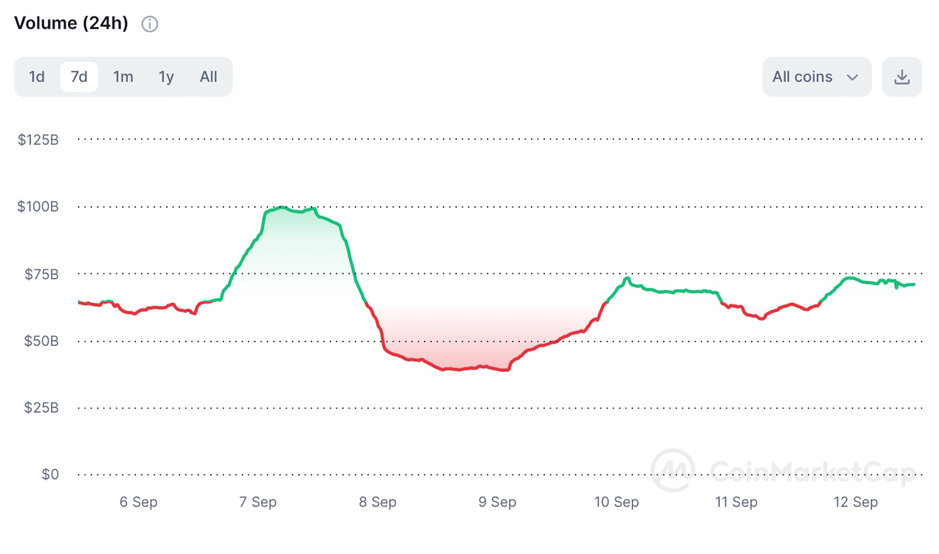

24h trading volume, source: https://coinmarketcap.com/charts/

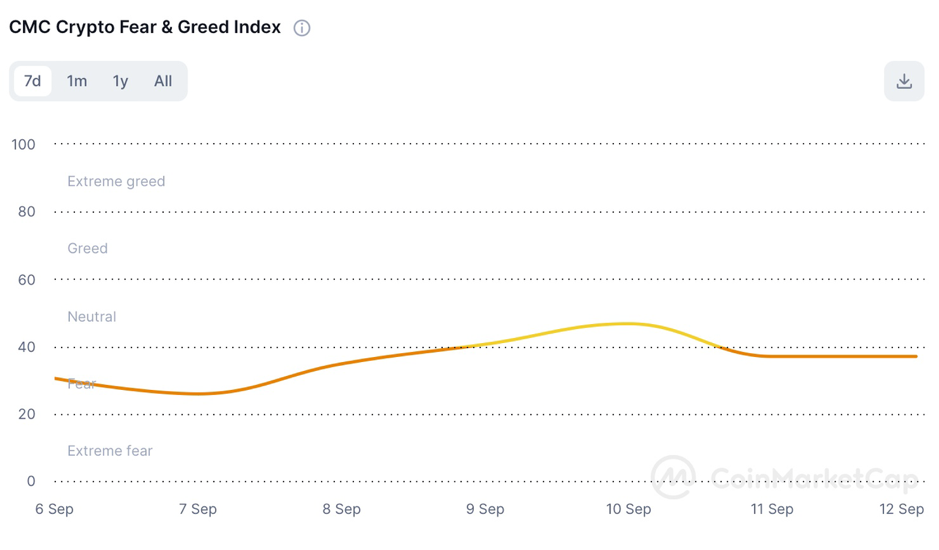

Fear & Greed Index, source: https://coinmarketcap.com/charts/

4. Perpetual Futures

The 7-day cumulative funding rates for major mainstream coins on various exchanges are generally negative, indicating that short positions have slightly higher leverage at the moment.

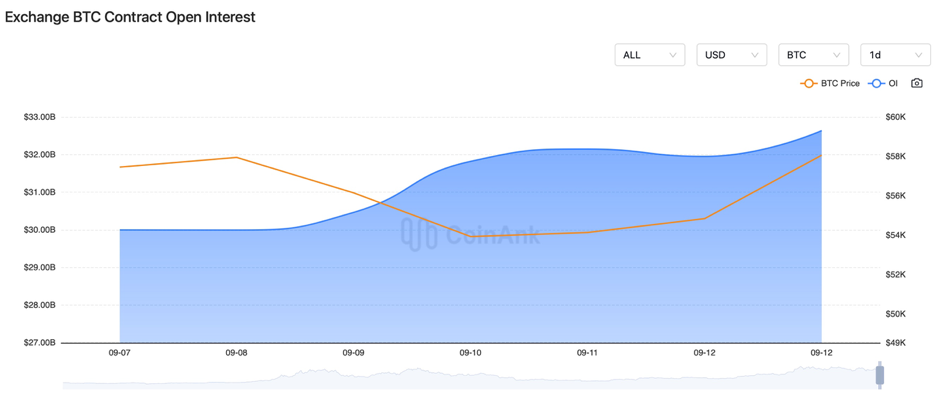

In the past three days, the BTC’s futures open interest has significantly increased, while the open interest in ETH contracts has seen a modest rise.

Exchange BTC Contract Open Interest:

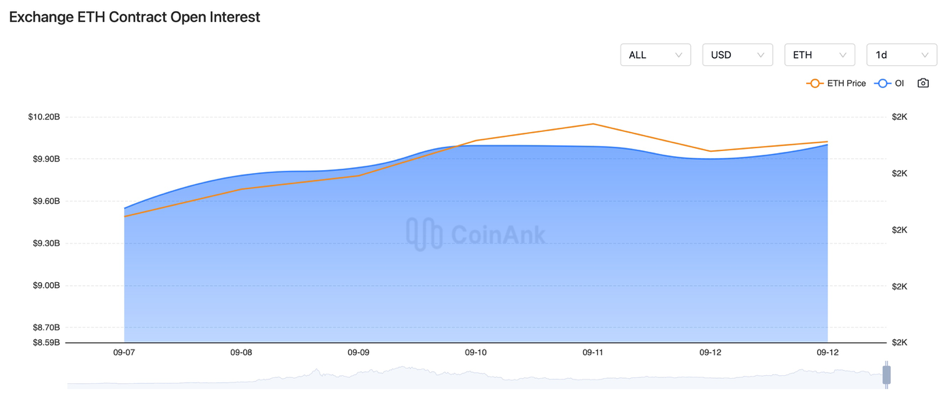

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

5. Industry Roundup

1) On September 9, it was reported that Hong Kong now has over a thousand fintech companies covering virtual banking, virtual insurance, and virtual assets. According to the Chinese Academy of Social Sciences, Hong Kong can help upgrade Africa’s payment systems through blockchain-based financial innovation.

2) On September 9, a Bitwise researcher indicated that the supply shortage of BTC is more severe than most people realize.

3) On September 9, China’s August CPI year-on-year was 0.6%, below the expected 0.7% and previous 0.5%; Japan’s Q2 GDP annualized growth rate was revised to 2.9%, below the expected 3.2% and previous 3.1%.

4) On September 9, Harris released a proposed policy stance list, which did not mention cryptocurrency-related issues. Sources: Harris’s major donors are asking for changes in the heads of the SEC and FTC if she wins.

5) On September 9, eight members of a criminal gang involved in Chinese fraud were arrested in South Korea for money laundering and cryptocurrency exchanges. Beijing police uncovered an underground money laundering case involving over 800 million yuan using virtual currencies.

6) On September 9, it was reported that a subsidiary of Tokyo Electric Power is experimenting with cryptocurrency mining using surplus renewable energy, with potential annual revenue reaching $2.5 billion.

7) On September 9, Russian President Putin stated that Russia is a leader in Bitcoin mining; Moscow Exchange exited Russia’s crypto trading pilot.

8) On September 9, the Nigerian SEC announced it would take strict actions against cryptocurrency exchanges that do not comply with regulatory frameworks.

9) On September 9, Spain’s second-largest bank, BBVA’s Swiss branch, announced plans to include USDC in its cryptocurrency asset services. Additionally, the Bank of Latvia is offering pre-license consultations for cryptocurrency companies.

10) On September 10, a16z Crypto’s startup accelerator launched this week, announcing 21 participating projects. a16z plans to host the HACK UK hackathon next month, focusing on blockchain, digital identity, and other themes.

11) On September 10, a Fed survey indicated that cryptocurrency holdings have not increased with market recovery, but buying interest is rising. A poll showed only 6% of people want to hear Harris and Trump discuss cryptocurrency in debates.

12) On September 10, the North Carolina Senate overturned the governor’s veto, passing the Federal Reserve CBDC ban bill. CleanSpark invested $30 million to acquire seven Bitcoin mining facilities in Tennessee.

13) On September 10, market news indicated that the Fed would reduce the capital requirements for large banks by half, from 19% to 9%.

14) On September 10, DeFi protocol Veda Labs’s official X account was hacked. Hence, do not click suspicious links. Paitaun stated that WazirX hacker laundered 2,100 ETH through Tornado Cash. Vitalik warned us to be cautious of the “smart” label on smart wallets and to verify whether the wallet design genuinely enhances security.

15) On September 10, Accenture strategic investment in Emtech strengthened CBDC and fintech solutions. Meanwhile, Infineo has tokenized $125 million in life insurance policies and plans to establish a secondary market.

16) On September 10, the U.S. Congress held its first hearing on DeFi with mixed opinions among party members. Democratic legislators believed there may not be a “consensus definition” of DeFi from regulators or the crypto industry. Democratic Representative Waters criticized Trump’’ cryptocurrency projects during the hearing. A family member’s X account was hacked, posting fake tokens causing user losses.

17) On September 10, it was reported that Standard Chartered would start offering BTC and ETH custody services in the UAE; Ford and Toyota are significantly increasing their blockchain investments with a surge in patent filings.

18) On September 10, PayPal and Venmo integrated Ethereum Name Service (ENS) to support crypto payments. Mining company Core Scientific planned to achieve a $25-30 billion valuation with a new AI data center contract.

19) On September 11, an Australian court ruled that Kraken’s fiat margin trading is subject to the Corporations Act, while crypto margin trading remains unregulated.

20) On September 11, the Singapore Parliament discussed Worldcoin account abuse and privacy risks. The Singapore police launched an investigation into Worldcoin account transactions, arresting five individuals.

21) On September 11, since 2013, the U.S. SEC has imposed $7.4 billion in fines on the cryptocurrency industry. The SEC Chief Accountant suggested that the SEC’s stance on restricting banks from providing crypto custody services remains unchanged.

22) On September 11, Uniswap’s dominance slipped to 36%, intensifying the DEX competition. Trump-related memecoins experienced a broad decline, potentially influenced by the presidential debate between Trump and Harris.

23) On September 11, the UK proposed a bill to clarify the legal status of cryptocurrencies, classifying Bitcoin and NFTs as personal property. UK regulators accused a man of illegally operating cryptocurrency ATMs.

24) On September 11, U.S. NCUA Vice Chairman Kyle Hauptman supported the development of cryptocurrencies and stablecoins. House Republicans called for a political employment investigation into SEC Chairman Gary Gensler.

25) On September 11, this week, Aptos (APT), XAI, RENDER, and io.net (IO) will see significant one-time token unlocks.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.