FameEX Weekly Market Trend | July 29, 2024

2024-07-29 19:41:40

1. BTC Market Trend

From July 25 to 28, the BTC spot price swung from $63,469.53 to $69,415.67, a 9.37% range. The increase was mainly rooted in Trump’s speech at this year’s Bitcoin conference and the market’s overall expectations regarding this event.

In the past four days, important statements from the Federal Reserve (Fed) and the European Central Bank (ECB) over the past three days are as follows:

1) On July 25, former New York Fed President Dudley (who has a permanent vote on the FOMC and is known as the “third most powerful person at the Fed”) stated: “I’ve changed my mind. It’s time for the Fed to reduce rates without delay.”

2) On July 26, former Fed “hawk” Bullard indicated that the U.S. growth rate in the first half of the year was close to 2%, and the Fed may start hinting at a rate cut in September.

3) On July 26, ECB Governing Council Member Nagel stated that if economic data does not bring unexpected negative impacts, the ECB should be able to cut rates; it is impossible to make pre-commitments about what might happen in September.

Here is the summary of key points from the U.S. Republican presidential candidate Trump’s speech at Bitcoin 2024 Bitcoin: 1) The reason for attending the 2024 Bitcoin conference is to ensure the U.S. maintains its leading position in the cryptocurrency field. The U.S. will become the global capital of cryptocurrencies and the world’s Bitcoin superpower. 2) Bitcoin is a “miracle of cooperation and human achievement”. If the U.S. does not embrace cryptocurrency and Bitcoin technology, other countries will dominate. Bitcoin represents freedom, sovereignty, and money free from government coercion and control. 3) To facilitate crypto mining, efforts will be increased in the power sector, developing fuel power generation, nuclear power, and other environmentally friendly power generation methods. After being elected, the U.S. will become the country with the lowest energy and electricity costs.

4) Trump hopes for cryptocurrency mining in the U.S. 5) On the first day of the election, he will fire SEC Chairman Gary Gensler. 6) After being elected president, he will appoint a Bitcoin/Cryptocurrency Presidential Advisory Committee. 7) If elected, there will never be a Central Bank Digital Currency (CBDC) during the presidential term, and Trump will order the Treasury to stop creating CBDCs. 8) Bitcoin does not threaten the dollar. The current actions of the U.S. government are threatening the dollar. 9) Billions of people will store their savings in Bitcoin. Hence, never sell your Bitcoin. 10) If elected, the government will keep 100% of its Bitcoin holdings and prevent the U.S. government from selling seized Bitcoin.

11) Bitcoin’s market value will surpass gold in the future. Since its inception, Bitcoin’s market value has been rising, and is now the ninth-largest asset in the world. It will soon surpass silver and eventually surpass gold. 12) If elected, Trump will establish a national strategic Bitcoin reserve. 13) Trump once again promises to commute the sentence of Silk Road founder Ross Ulbricht. 14) If elected president, Bitcoin and cryptocurrencies will soar to unprecedented heights. Bitcoin will fly to the moon. 15) Trump assures the Bitcoin community that on the day of inauguration, Joe Biden and Kamala Harris’s anti-crypto campaign will end. 16) Trump stated that he would be the president who supports innovation and Bitcoin that America needs. 17) If elected, Trump will retain all Bitcoin-related jobs in the U.S.

Robert F. Kennedy attended the conference, emphasizing that Bitcoin would play a crucial role in enhancing the stability and strategic position of the U.S. economy. Additionally, Kennedy pledged to issue an executive order making Bitcoin transactions with the dollar exempt from reporting and tax-free, and recognizing Bitcoin as a qualified asset for 1031 exchanges into tangible assets.

Kennedy stated that on his first day, an executive order would direct the Department of Justice and the U.S. Marshals Service to transfer approximately 200,000 Bitcoins to the Treasury, designate them as strategic assets, and instruct the Treasury to purchase 550 Bitcoins daily until a total of 4 million Bitcoins is reached, roughly 20% of the total supply. Kennedy asserted that this policy would make the proportion of Bitcoin held by the U.S. equivalent to its share of global gold reserves.

Kennedy’s plan also included backing U.S. debt with hard assets, including Bitcoin, to stabilize the dollar and control inflation. He believed that leveraging the scarcity and liquidity of Bitcoin, along with gold and other hard assets, would restore the dollar’s dominance in global finance. Kennedy also criticized the Fed’s monetary policy, claiming it has exacerbated wealth inequality and economic instability. He advocated that supporting the dollar with Bitcoin and other hard assets can counteract inflation and enhance the dollar’s value.

CryptoQuant founder and CEO Ki Young Ju posted on the X platform that the current Bitcoin bull market cycle may last until mid-2025. Ki Young Ju explained that “old whales” profit during bull markets, and their selling brings new capital into accumulation addresses, thus raising the realized price. The profit realization period of past cycles was about 18 months, and this period started 4 months ago.

According to a post by Altair Technology on the X platform, a Bitcoin mining device called “Bitaxe”, despite having only a one-in-a-billion chance of mining a block every ten minutes, successfully mined a block worth approximately $206,000. The device, produced by D-Central Technologies, is about the size of a human palm and was showcased by the YouTube channel “How Much?”

The report stated that the device was connected to the Solo CKPool node infrastructure service and successfully mined a block. According to Bitcoin analysis platform CoinWarz, the current total hash rate of the Bitcoin network is 552.49 exahashes (Eh/s), equivalent to 552,490,000,000 gigahashes (Gh/s), about a billion times that of the Bitaxe device. This indicates that the device had approximately a one-in-a-billion chance of mining a block every ten minutes.

From July 29 to July 31, the daily candlestick chart for the BTC spot during these days is expected to follow its own path, influenced by the Bitcoin conference event, similar to the previous two weekend days. As a result, it will not be significantly affected by the trends of major global asset classes.

In terms of the short-term trading strategy, it is viable to patiently hold the sell order for the BTC spot at $72,500, waiting for an opportunity for it to be automatically executed. There is no need to cancel the sell orders at $77,500 and $92,000, or the bottom-fishing buy order at $42,950. Similarly, keep the sell order for the ETH spot at $4,700 and the bottom-fishing buy order at $2,500.

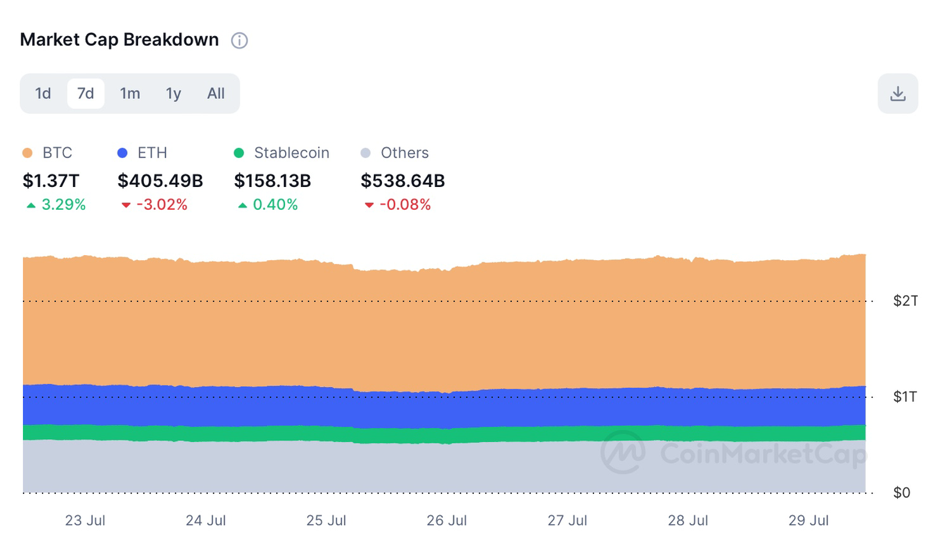

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

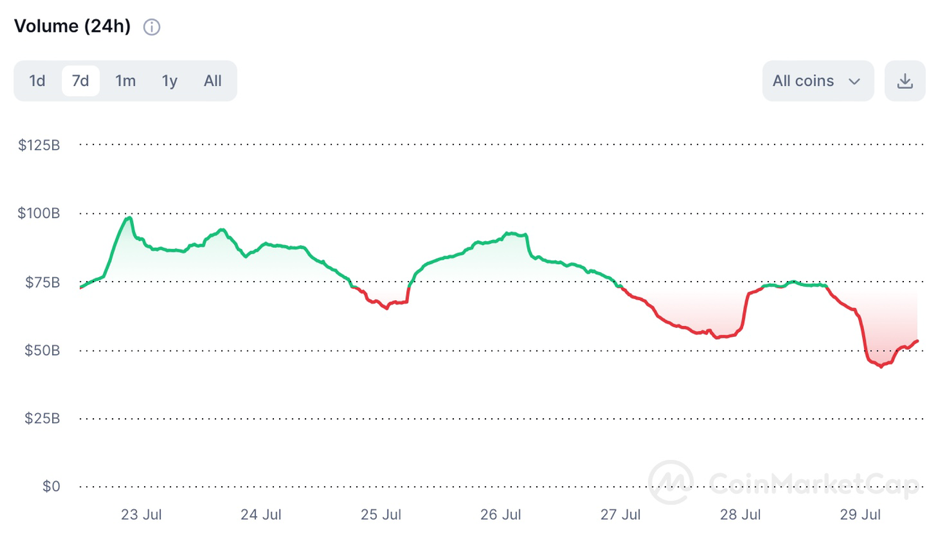

24h trading volume, source:https://coinmarketcap.com/charts/

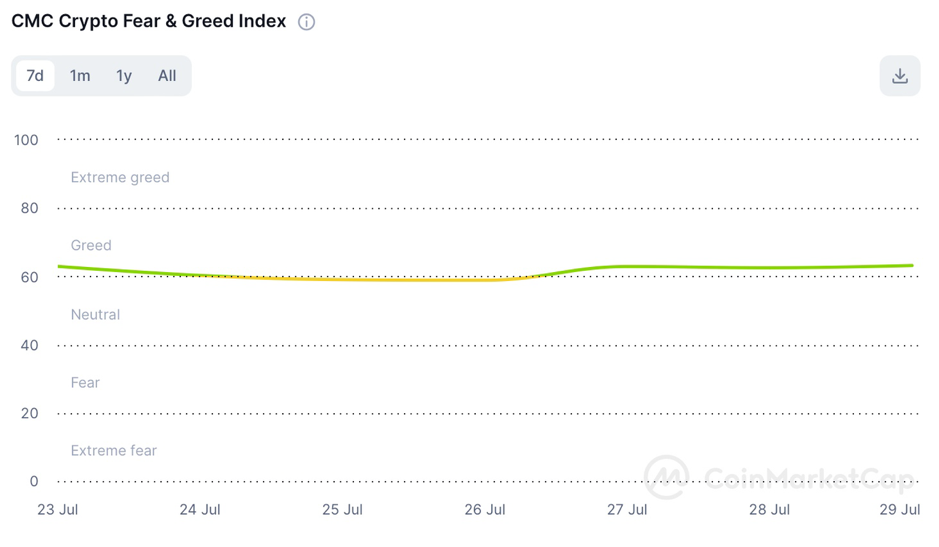

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high and the overall market expectation is that the bull market is continuing to develop.

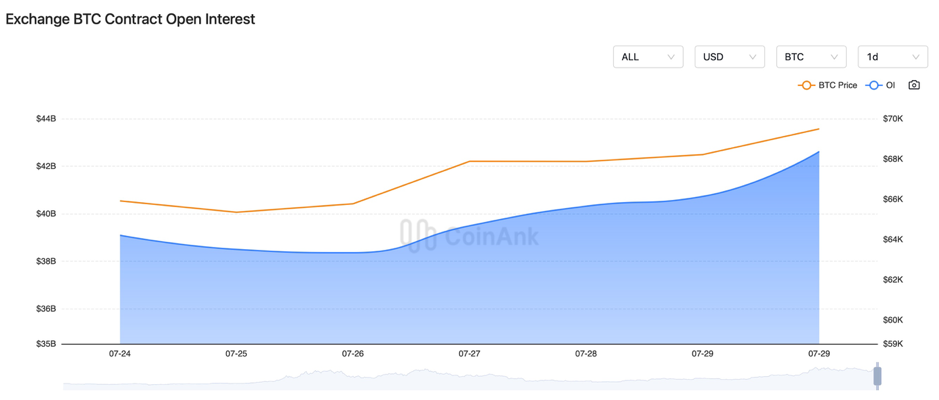

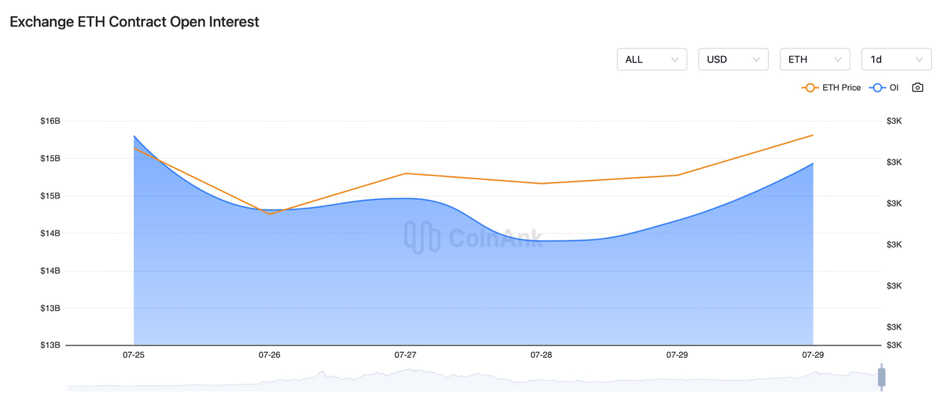

Recently, the BTC contract open interest has increased slowly while the ETH contract open interest has been increasing.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On July 25, all four major state-owned banks in China announced a reduction in deposit rates, adjusting the one-year term deposit rate to 1.35%. Several banks reduced the five-year rate to 1.8%.

2) On July 25, the U.S. Q2 annualized GDP growth rate was recorded at 2.8%, higher than the expected 2%. Initial jobless claims for the week ending July 20 were 235,000, compared to the expected 238,000 and the previous 243,000.

3) On July 25, the Bank of Japan (BoJ) might discuss a rate hike at next week’s meeting. According to minutes from Japan’s highest economic council meeting, some members believed the BoJ must raise rates to prevent excessive yen depreciation.

4) On July 25, the Bank of Canada cut rates by 25 basis points as expected and hinted at further easing. The probability of a rate cut in September in the Canadian money market is about 50%.

5) On July 25, UK interest rate futures indicated a 49% chance of a rate cut by the Bank of England in August, with the market expecting a 52 basis points cut in 2024.

6) On July 25, Hong Kong media reported that Interpol has issued a red notice for “Bitcoin Lord” Huang Zhenjie; a red notice is a request to law enforcement worldwide to locate and provisionally arrest a person pending extradition, surrender, or similar legal action.

7) On July 25, it was reported that Senator Lummis plans to announce legislation at the Bitcoin conference to designate Bitcoin as a strategic reserve asset and introduce a bill for the U.S. Treasury to purchase 1 million Bitcoins.

8) On July 25, it was reported that JD CoinChain would issue a stablecoin in Hong Kong pegged 1:1 with the Hong Kong dollar based on a public blockchain.

9) On July 25, TRM Labs reported that several crypto ransomware attacks in 2023 were led by Russian-speaking groups. Russian cryptocurrency mining is on the brink of legalization, awaiting final approval from the federation.

10) On July 26, Deutsche Telekom announced it would expand its Web3 services to the XDC network.

11) On July 26, Sygnum Bank reported that cryptocurrency spot trading volumes grew by 200% in the first half of the year, with derivatives trading up 500%.

12) On July 26, the Hong Kong Securities and Futures Commission added CoinUnited.io and its related sites to the suspicious virtual asset trading platforms warning list.

13) On July 26, according to news, India would announce its stance on cryptocurrency policy before September after consulting with stakeholders.

14) On July 26, CME FedWatch data showed an 89.6% probability of a 25 basis point rate cut by the Fed in September.

15) On July 26, it was reported that Jersey City, New Jersey, would invest in a Bitcoin ETF for its pension fund. U.S. Republican Senator Roger Marshall withdrew support for the Digital Asset Anti-Money Laundering Act.

16) On July 27, the People’s Bank of China issued the “Implementation Rules for the Supervision and Administration of Non-bank Payment Institutions”, effective immediately.

17) On July 28, several U.S. House Democrats called for a pro-crypto party platform. Vice President Harris might share her views on Bitcoin in the coming weeks, with her husband being a “crypto enthusiast”. An ABC News poll showed Harris’s approval rating rising to 43%.

18) On July 28, Ethereum team leader Péter Szilágyi expressed concerns about the direction of the Ethereum network, feeling that Ethereum is losing its dominance.

19) On July 28, the Central Bank of Russia raised rates by 200 basis points, increasing the benchmark rate from 16% to 18%, in line with market expectations.

20) On July 28, the Block data showed that Base chain transactions and active address numbers reached all-time highs.

21) On July 28, a survey showed one in five Americans own cryptocurrency, with 73% of holders planning to consider candidates’ stances on crypto in the presidential vote.

22) On July 28, a Texas court ordered a man and his company to pay over $31 million in forex and cryptocurrency fraud compensation, triple their illegal gains.

23) On July 2, Hong Kong Legislative Council member Wu Jiezhuang stated that Hong Kong might consider including Bitcoin in strategic fiscal reserves under compliance conditions.

24) On July 28, Token Unlocks data showed significant unlocks next week for W, ZETA, GAL, ENA, PRIME, OP, MANTA, DYDX, and SUI.

25) On July 28, next Thursday, the U.S. would release initial jobless claims for the week ending July 27, the Fed would announce its rate decision, and Chair Powell would hold a monetary policy press conference. The Bank of England would announce its rate decision, and Governor Bailey would hold a monetary policy press conference. Next Friday, the U.S. would release July unemployment and seasonally adjusted non-farm payroll data.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.