FameEX Weekly Market Trend | July 22, 2024

2024-07-22 19:05:16

1. BTC Market Trend

From July 17 to 21, the BTC spot price swung from $63,279.04 to $68,462.65, an 8.19% range. The increase during this period was mainly due to the overall market’s positive expectations regarding the current U.S. President Biden not running for the next term and the listing of the Ethereum ETF in the U.S. next Tuesday, July 23.

Important statements from the Federal Reserve (Fed) and the European Central Bank (ECB) over the past four days are as follows:

1) On July 18, Fed’s Williams stated that it may be necessary to cut interest rates in the coming months, as various inflation indicators are moving in the right direction. More data will be available between July and September. Barkin was confident that the Fed would discuss whether describing inflation as elevated is still appropriate at the July policy meeting. Waller indicated that the timing of rate cuts is getting closer, but the magnitude is still an unresolved issue. The labor market is in a “sweet spot”.

2) On July 19, Fed’s Goolsbee noted that the inflation data has improved over several consecutive months.

3) On July 19, ECB’s Villeroy stated that market expectations for interest rates seem quite reasonable.

Here is the summary of the ECB’s interest rate decision and Lagarde’s press conference:

Interest rate decision: Pause on rate cuts, and refuse to commit to future rate paths.

1) Interest rate levels: Rates remained unchanged as expected, with the refinancing rate, marginal lending rate, and deposit facility rate maintained at 4.25%, 4.5%, and 3.75%, respectively.

2) Interest rate outlook: No pre-commitment to a specific rate path; will maintain sufficiently restrictive policy if necessary.

3) Inflation situation: Some core inflation indicators rose in May, while most remained stable or slightly declined in June. Overall inflation may remain above target for an extended period next year.

4) Quantitative tightening: The reinvestment of the emergency pandemic purchase program (PEPP) is scheduled to stop by the end of 2024, reiterating the plan to reduce PEPP assets by 7.5 billion euros per month in the second half of the year.

5) Market impact: EUR/USD, major European stock indices, and eurozone bond yields fluctuated slightly.

Lagarde’s press conference:

1) Interest rate outlook: The ECB will not pre-commit to a specific rate path. The door is open for rate cuts in September.

2) Inflation risks: Internal inflation remains high, long-term inflation expectations are basically stable, and inflation is expected to fall to target levels in the second half of next year.

3) Economic outlook: Investments in 2024 indicate economic growth will slow, with downside risks to growth.

4) Labor market: The labor market is resilient, wages are still rising rapidly, and wage growth is expected to align with targets by 2025.

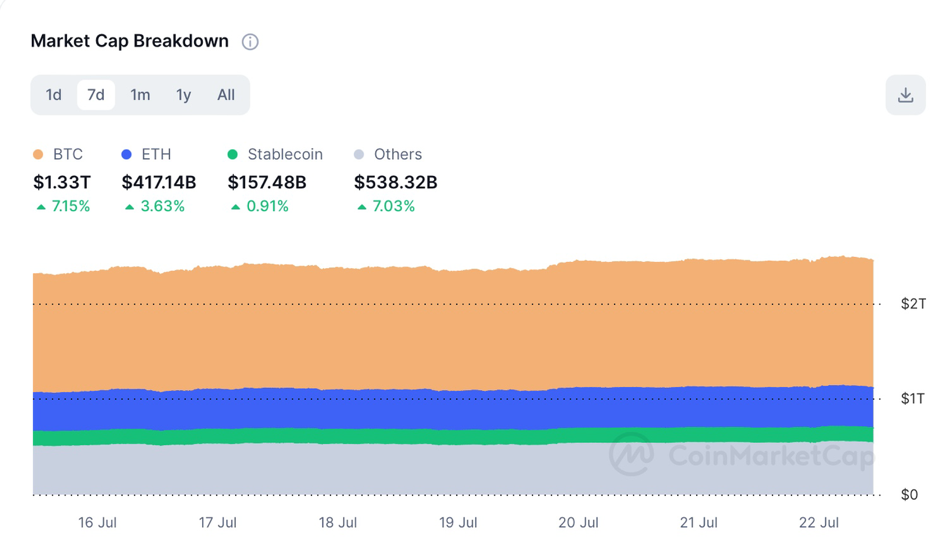

The 2024 Q2 Crypto Industry Report indicated that the total market value of the cryptocurrency market was $2.43 trillion, down 14.4% from the first quarter but striving to grow or at least maintain its level. Bitcoin mining hashrate reached a new all-time high of 721 million TH/s but overall fell by 18.8% in Q2 2024. The total market value of the DeFi market fell by 20.7%, but after the US SEC approved the spot ETH ETF, the DeFi sector bounced back to over $100 billion. NFT trading volume fell by 31.8% quarter-on-quarter, while Layer 2 adoption increased by 37.7%.

Over the weekend, as expected, Biden withdrew from the U.S. presidential race. In response to this positive expectation, the BTC spot price has surged to a high of $68,462.65, getting closer to the first sell order level at $72,500. Meanwhile, the ETH spot price has reached a high of $3,559.19. It is recommended to continue closely monitoring that trading opportunities in the ETH spot continue to be closely monitored. Keep the sell order at $4,700 and the bottom-buy order at $2,500.

For the BTC spot, consider moving part of the sell order from $72,500 to $92,500. While the current surge driven by the U.S. Ethereum ETF listing might not reach this price, the probability of the BTC spot price reaching $92,500 after the U.S. rate cut next year is not low. There’s no need to cancel the sell order at $77,500 or the bottom-buy order at $42,950.

2. CMC 7D Statistics Indicators

Overall market cap analysis, source:https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

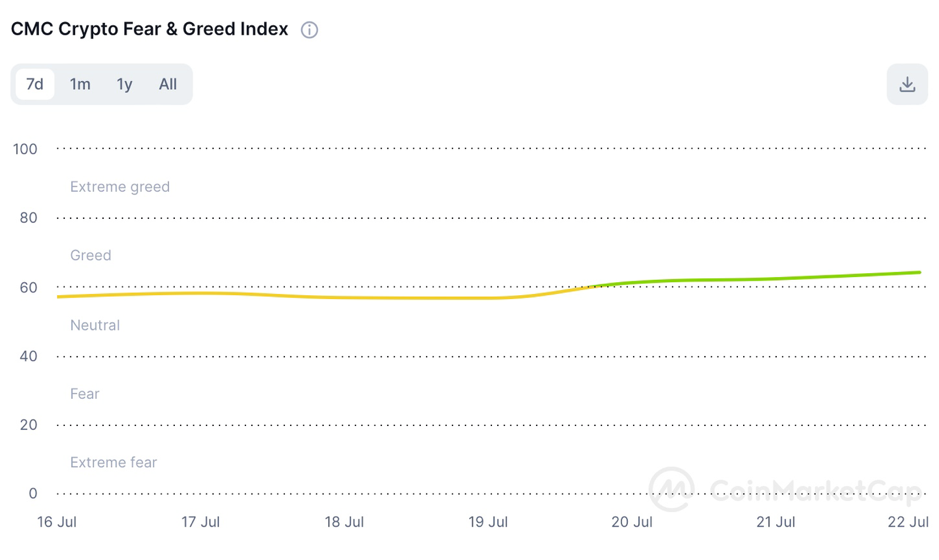

Fear & Greed Index, source: https://coinmarketcap.com/charts/

Based on the current trend and score of the “Fear & Greed Index”, it appears that all participants in the crypto market are becoming more rational. However, many investors are still concerned about a significant downturn in the market in August and September. The extremely pessimistic ones may even mistakenly believe that the recent strong bull market has already come to an end.

3. Perpetual Futures

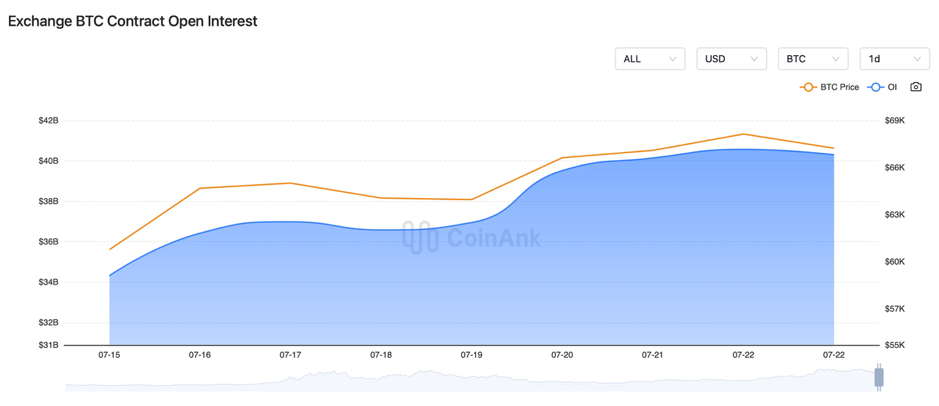

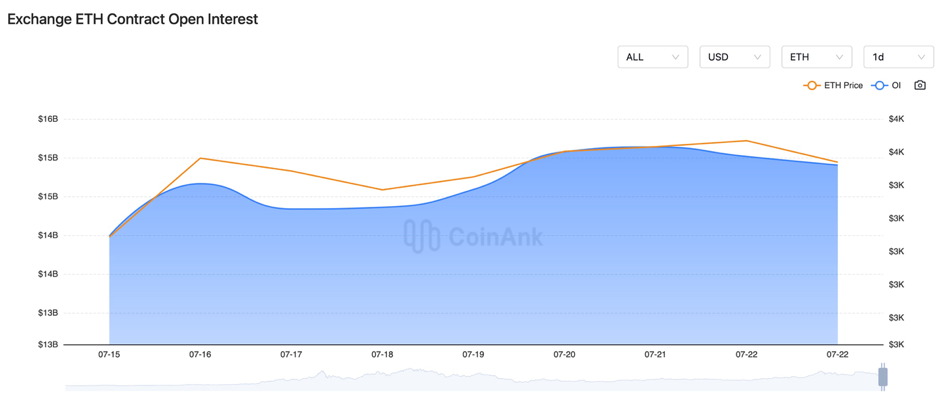

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high. Many investors have already begun to worry about a significant downturn in the crypto market in the second half of this year.

Recently, both the BTC and ETH contract open interest has increased, indicating that the short-term long opportunities in late July have gained consensus among most investors.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On July 18, the IMF indicated that the Fed should wait until at least the end of 2024 to lower policy rates. The U.S. urgently needs to reverse the rising public debt, and high deficits pose increasing risks to the U.S. and the world.

2) On July 18, U.S. initial jobless claims for the week ending July 13 were 243,000, expected 230,000, previous 222,000.

3) On July 18, German law enforcement agencies sold nearly 50,000 Bitcoins, netting approximately $2.88 billion.

4) On July 18, the Basel Committee released the final disclosure framework for banks’ crypto asset exposures and the targeted revisions to crypto asset standards.

5) On July 18, the Fed Beige Book revealed that the economic growth is expected to slow over the next six months.

6) On July 18, South Korea’s first comprehensive cryptocurrency law took effect, focusing on investor protection; South Korea has been one of the largest markets in the cryptocurrency sector since 2017, with the Korean won consistently ranking among the top two fiat currencies in global trading volume.

7) On July 18, it was reported that the Greek government would start taxing crypto in 2025.

8) On July 19, it was reported that China would draft a financial law and an anti-cross-border corruption law.

9) On July 19, Putin warned that the uncontrolled growth of cryptocurrency mining could trigger an energy crisis in Russia and emphasized the practicality of the digital ruble.

10) On July 19, Bloomberg indicated that more new tokens were listed on major crypto exchanges in the first half of this year than in all of last year.

11) On July 19, the Washington State Department of Financial Institutions warned of cryptocurrency scams involving fake “professors” on WhatsApp and Telegram.

12) On July 19, the Bank for International Settlements (BIS) issued new guidelines for banks wishing to hold XRP, ETH, and other crypto assets.

13) On July 19, blockchain analysis company Elliptic stated on the X platform (formerly Twitter) that a North Korean hacker group might be behind the $235 million WazirX hack.

14) On July 20, Ripple CEO said he expects a legal resolution “soon”, with XRP price and activity rising as a result.

15) On July 20, Jordan’s Ministry of Digital Economy and Entrepreneurship, in collaboration with Jordanian blockchain company Blockexe, launched a national blockchain technology network called Modee Dlt.

16) On July 20, Trump promised in the new Republican policy platform to defend rights related to Bitcoin mining, self-custody of digital assets, and free trading. Investment bank Jefferies suggested that Trump’s “public” support for Bitcoin will benefit crypto-related stocks.

17) On July 20, Vitalik Buterin believed that the blockchain could serve as a “truth machine”, but other tools are needed to further uncover the truth.

18) On July 20, the Central Bank of the Philippines warned the public about crypto investment scams using AI technology.

19) On July 20, news revealed that five spot Ethereum ETFs would be listed on the Cboe exchange on July 23.

20) On July 21, Biden withdrew from the presidential race and announced support for Vice President Kamala Harris as the 2024 Democratic presidential candidate. According to a U.S. media report, the Secret Service reportedly denied requests to increase security at Trump rallies.

21) On July 21, Solana’s on-chain DEX trading volume exceeded $1.7 billion yesterday, ranking first for four consecutive days.

22) On July 21, the SEC and 100 institutions formed a committee to combat securities fraud.

23) On July 21, two members of the Lockbit ransomware group pleaded guilty and could face up to 25 and 45 years in prison, respectively.

24) On July 21, it was reported that ALT, ID, YGG, ENA, and AGIX would be unlocked next week from July 22 to 28, with a total value of $132.49 million.

25) On July 21, it was announced that the advance estimate for the U.S. Q2 GDP annualized quarterly growth rate will be released next Thursday, while the June core PCE price index annual rate will be published the following Friday.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.