FameEX Weekly Market Trend | May 16, 2024

2024-05-17 12:09:55

1. BTC Market Trend

From May 13 to 15, the BTC price swung from $60,605.26 to $66,415.2, a 9.59% range. Here are key points from Federal Reserve (Fed) Chairman Powell’s speech:

1) Rate Outlook: Powell reiterated that interest rates may remain high for a while, unlikely to rise further, with the policy rate likely staying at the current level.

2) Inflation Outlook: Confidence in decreasing inflation is lower. Noteworthy is the lack of progress on inflation in Q1. Inflation is expected to decline month-over-month.

3) Economic Outlook: The U.S. economy is performing well, with a strong labor market. GDP is expected to grow at 2% or higher, aided by new labor force participants.

4) Market Reaction: Since Powell’s speech, gold has been stable, peaking at $2,356.72. The three major U.S. stock indices have shown a “V” shaped trend.

5) Latest Expectations: The market anticipates a 40-basis-point rate cut by the Fed this year, with a 50% chance of cuts in June and September, aligning with pre-speech forecasts.

On May 15, the U.S. core CPI saw its first cooling in six months, signaling a gradual easing of price pressures and supporting the Fed’s intention to maintain higher rates for a longer period. The core index, which better reflects underlying inflation than the overall CPI, decreased. U.S. Bureau of Labor Statistics reported a 0.3% month-over-month increase and a 3.4% year-over-year increase in the overall CPI. Housing and gasoline expenses contributed to over 70% of this growth. While these figures may offer some hope to the Fed that inflation is trending downward, officials are awaiting more data to gain confidence in considering rate cuts. Fed Chairman Powell also stated the previous day that the Fed would “need to remain patient and let restrictive policies take effect”, with some policymakers not expecting any rate cuts this year.

Why is the Fed’s policy direction central to trading and research analysis in the cryptocurrency market? Firstly, cryptocurrencies serve as complementary forms of fiat currencies and are integral to the global financial payment and settlement system. Secondly, referring to the latest views of Professor Adam Tooze, Director of the European Institute at Columbia University, the dollar is not only America’s currency but also the world’s currency. Despite the U.S. accounting for about 15.5% of global GDP (in terms of purchasing power parity), the dollar is involved in 88% of all international currency transactions, and around 58% of global reserves are held in dollars.

The reserve currency status of the dollar supports America’s current account deficit, benefits U.S. importers, and creates markets in other parts of the world. However, it also leads to the U.S. economy deviating from trading goods, and the global spread of the dollar unintentionally makes the Fed the world’s central bank. The ubiquity of the dollar also grants the U.S. significant power. Therefore, financial sanctions from the U.S. are akin to a death sentence for businesses. When the dollar is plentiful, U.S. interest rates low, and other currencies strong, the global dollar system functions smoothly, fostering economic activity worldwide.

From May 16 to May 19, there’s a relatively high probability of a slight uptrend in BTC spot daily candles. Subsequently, other top 20 popular coins like ETH should gradually catch up with BTC’s rise from its lowest point on May 15. It’s advisable to maintain the buy and sell orders mentioned in the previous market analysis.

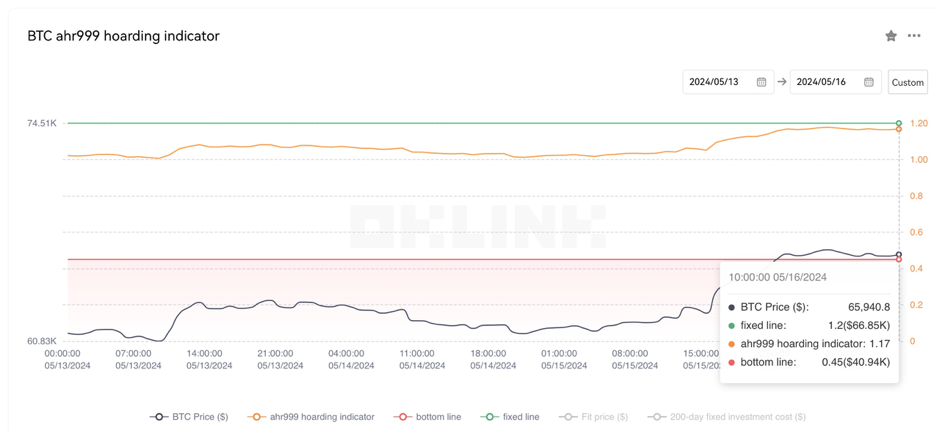

The Bitcoin Ahr999 index of 1.17 is below the DCA level ($66,850) but over the buy-the-dip level ($40,940). Therefore, it may be a good time to put the dollar-cost average into mainstream cryptocurrencies.

2. Perpetual Futures

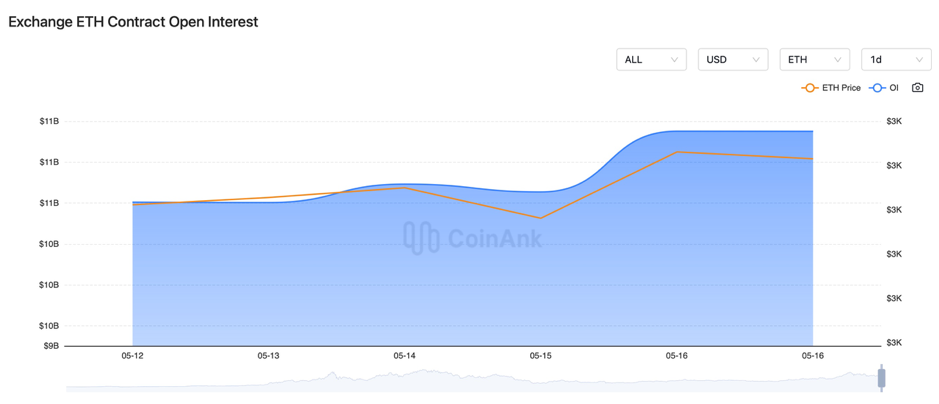

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

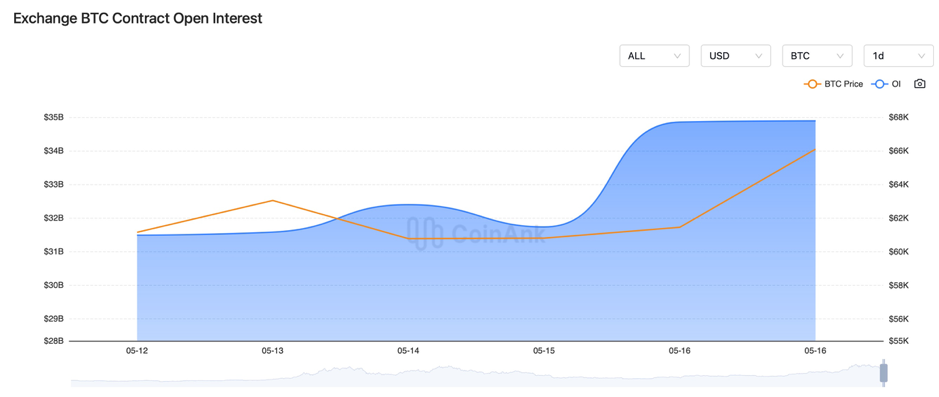

In the recent period, a slow climb has occurred in both BTC contract open interest.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On May 13, Jamie Coutt, the chief crypto analyst at Real Vision, predicted that the comprehensive market value of smart contract platforms could reach $15 trillion to $25 trillion by 2030.

2) On May 13, Fed Vice Chair Jefferson advocated maintaining interest rates until inflation eases.

3) On May 13, data revealed that low-circulating cryptocurrencies account for 21.3% of the market value of the top 300 cryptocurrencies.

4) On May 13, the U.S. Congress might vote on cryptocurrency legislation by the end of May.

5) On May 13, Gas fees on the Ethereum network dropped to 3 gwei.

6) On May 13, Turkey prepared to enact new cryptocurrency regulations to align with international standards.

7) On May 14, Basel banking regulators postponed rules on bank cryptocurrency assets until 2026.

8) On May 14, Fed Chair Powell reiterated the likelihood of maintaining high interest rates for a longer period, with GDP expected to continue growing at 2% or higher and inflation expected to ease.

9) On May 14, ECB board member Nout Wellink suggested June might be a good time for the first interest rate cut; ECB board member Villeroy de Galhau said it’s likely they’ll begin cutting rates in June.

10) On May 14, Fed Governor Jefferson stated that the downward trend in inflation has weakened, and maintaining the policy rate in the tightening range is appropriate.

11) On May 14, former SEC Chair expressed concerns about the return of meme stocks but sees no current legality issues.

12) On May 15, a Bloomberg ETF analyst reported that MSCI has decided to add 42 securities, including Microstrategy, to the MSCI Global Investable Market Index.

13) On May 15, Oklahoma signed a bill protecting cryptocurrency spending, mining, and self-custody.

14) On May 15, a KPMG China’s survey showed 58% of Hong Kong family offices and high-net-worth individuals have invested in virtual assets.

15) On May 15, Fed Chair Powell suggested the next move is unlikely to be a rate hike, with policy rates more likely to stay at current levels.

16) On May 15, U.S. April seasonally adjusted CPI records 3.4% year-on-year, lower than the previous month’s 3.5%, meeting market expectations. April core CPI month-on-month fell as expected to 0.3%, reaching a new low since December last year.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.