FameEX Weekly Market Trend | May 9, 2024

2024-05-09 18:14:10

1. BTC Market Trend

From May 6 to May 8, the BTC price swung from $61,689.9 to $65,554.7, a 6.27% range. The entire cryptocurrency market experienced a V-shaped reversal, with April marking the deepest pullback in nearly a year. This week saw an increase in statements from Federal Reserve (Fed) officials. On May 7, Raphael Bostic, who holds a voting right on the Federal Open Market Committee (FOMC) this year, stated that the robust labor market provides the Fed with time to gain confidence in inflation persistently declining before cutting interest rates. However, he added that sustained inflation in housing and services could continue to push prices higher, as seen this year, and he believes that current interest rates are already sufficiently high.

Another Fed official, Williams, commented at the 2024 Global Conference of the Milken Institute held in Beverly Hills, California, stating, “Ultimately, we will cut interest rates,” but currently, monetary policy is in “a very good place, and we have time to gather more information, so it’s about being steady.” Notably, neither Williams nor Bostic mentioned the prospect of rate hikes in their speeches, providing further assurance to investors who still hope for Fed rate cuts in 2024.

On May 8, Kashkari of the Fed stated: “The most likely scenario is that we keep rates unchanged for a longer period; if we see inflation slowing again, or if we see significant weakness in the job market, this could lead to rate cuts; if necessary, we will raise rates; the likelihood of raising rates is low, but cannot be ruled out.” On the same day, Collins of the Fed also stated: “Achieving the 2% inflation target may take longer than expected, and premature rate cuts carry risks.”

The global situation continues to deteriorate: Israel’s assault on Rafah, the EU’s allocation of frozen Russian assets to Ukraine’s defense, the expulsion of a Russian military attaché by the UK, and planned tactical nuclear drills between Russia and Belarus. The US and Europe are stepping up the pressure, casting a shadow over the possibility of the Russo-Ukrainian war evolving from conventional warfare to light nuclear weapons strikes. Should Russia deploy light nuclear weapons initially, it may lead to a direct clash between NATO and Russian forces, escalating conventional warfare and further destabilizing the Russo-Ukrainian situation. At that time, global asset classes other than gold (including cryptocurrencies) are likely to experience another round of sharp declines. However, it’s important to note that the likelihood of Russia using nuclear weapons presently remains low.

From the daily candlestick chart, the cryptocurrency market has been trading within a narrow range in March, April, and May this year. The CPI data for the US will only be released on May 15. Without significant unexpected news, the cryptocurrency market is unlikely to experience significant fluctuations from May 9 to May 12. It is advisable to maintain a wait-and-see approach with existing positions. For those with relatively low total positions, there’s no need to cancel BTC spot buy orders at $52,800.

The Bitcoin Ahr999 index of 1.13 is below the DCA level ($65,470) but over the buy-the-dip level ($40,090). Therefore, it may be a good time to put the dollar-cost average into mainstream cryptocurrencies.

2. Perpetual Futures

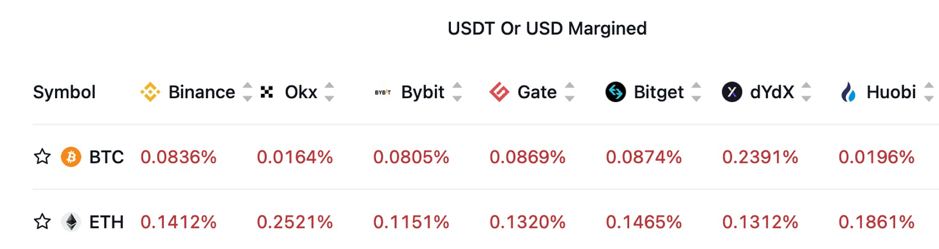

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

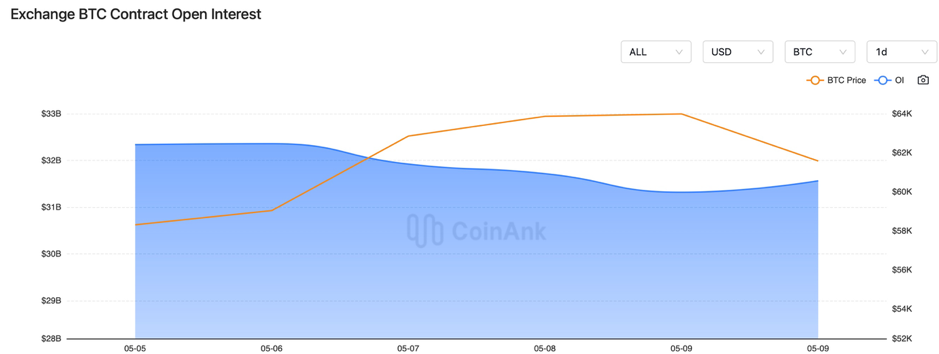

In the recent period, slight fluctuations have occurred in both BTC contract open interest.

Exchange BTC Contract Open Interest:

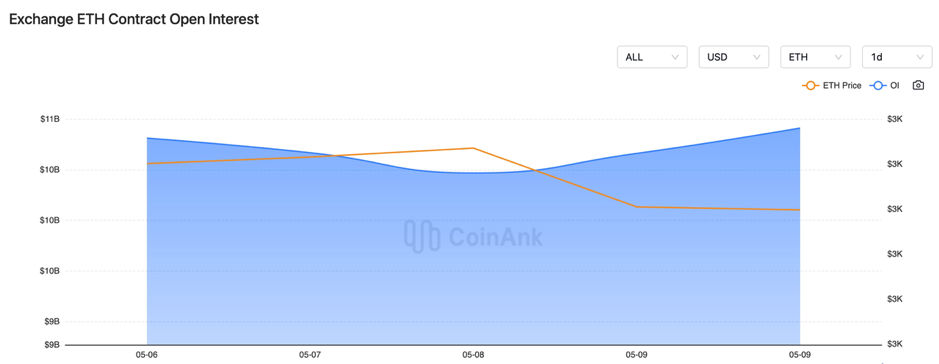

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On May 6, Visa reported that over 90% of stablecoin transactions are not from real users.

2) According to CME’s “FedWatch”, the probability of the Fed maintaining interest rates in June is 91.3%.

3) On May 7, the Hong Kong Monetary Authority announced the trial operation of a blockchain-based cross-border data verification platform between Shenzhen and Hong Kong.

4) On May 7, a member of the European Central Bank stated that the future of central banks depends on modifications to their business models and the rapid adoption of central bank digital currencies (CBDCs).

5) On May 7, data showed that Sui had a daily transaction volume of 40 million, surpassing Solana (27 million) and ranking first.

6) On May 7, the chairman of the CFTC anticipated that US regulators would continue to crack down on more cryptocurrency companies.

7) On May 7, the US SEC postponed its decision on the Invesco Galaxy Ethereum Spot ETF.

8) On May 8, FTX creditors were expected to receive compensation ranging from 142% to 118%.

9) On May 8, cryptocurrency-supporting US presidential candidate Kennedy was scheduled to attend the 2024 Consensus conference.

10) On May 8, the UK Chancellor of the Exchequer mentioned the potential legislation on stablecoins and staking in the coming weeks.

11) On May 8, over 20% of swing state voters in the US considered cryptocurrency a key issue.

12) On May 8, a former chairman of the US CFTC stated that 134 countries worldwide are actively exploring the issuance of CBDCs.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.