FameEX Weekly Market Trend | August 7, 2023

2023-08-07 18:07:40

1. Market Trend

Between August 3 and August 6, the BTC price fluctuated between $28,807.54 and $29,433.33, with a volatility of 2.17%. From the 1-hour chart, the BTC trend has been relatively stable in the past few days, with small fluctuations. The price once dropped below $29,000 but quickly recovered, and the rest of the time, it remained above $29,000. The previous analysis mentioned that $28,500 is a key BTC support level. If it drops below, it could reach $26,500 or lower. Bulls will defend around $29,000 (seen in recent BTC movements). The daily chart shows 15-day stability at $29,000, with 7-day, 25-day, and 99-day MA converging, suggesting potential for momentum buildup and technical adjustments. Typically, the key players often make decisive moves, leading to increased speed and volatility. Previous analysis points remain relevant in the current market, referencing the box range ($28,500-$29,500). It is advised to prioritize trend-following and trade with the overall market direction.

Source: BTCUSDT | Binance Spot

Between August 3 and August 6, the price of ETH/BTC fluctuated within a range of 0.06282-0.06330, showing a 0.76% fluctuation. From the 1-hour chart, ETH/BTC follows BTC’s price movements, awaiting BTC’s direction choice. At the same time, its trading volume and price volatility have significantly reduced. Currently, there is an urgent need for choosing a direction. Such coins often carry higher risks during subsequent market fluctuations, without well-defined support or resistance levels. Therefore, in the current overall market situation, it is advisable to prioritize BTC as an investment target and be cautious with other cryptocurrencies. Preserving capital is of utmost importance.

Based on overall analysis, currently, popular coins have experienced relatively small price fluctuations (following BTC’s trend). Moreover, there has been a further outflow of funds, leading to a significant decrease in trading volume. The market is now in a wait-and-see mode, anticipating BTC to break out of the box consolidation trend and make a directional choice. Only then will the market become active, and funds will start flowing in. It is recommended to use the key auxiliary points mentioned earlier to adapt to the changes in the overall market. This approach will ensure capital safety and potential profits during the oscillating market conditions (currently) and after the directional choice is made.

The Bitcoin Ahr999 index of 0.56 is above the buy-the-dip level ($25,950) but below the DCA level ($42,380). It is viable to purchase popular coins through DCA.

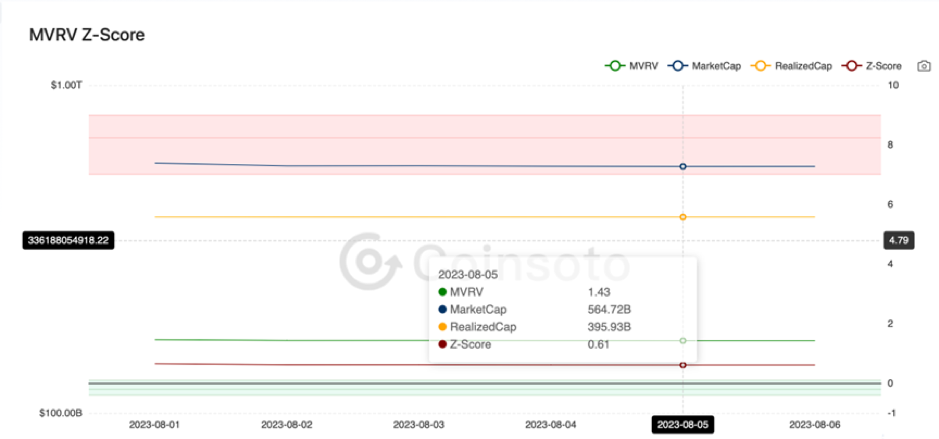

From the perspective of MVRV Z-Score, the value is 0.61. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.42-0.06).

2. Perpetual Futures

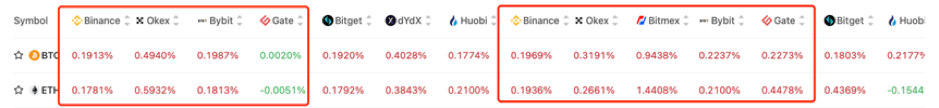

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

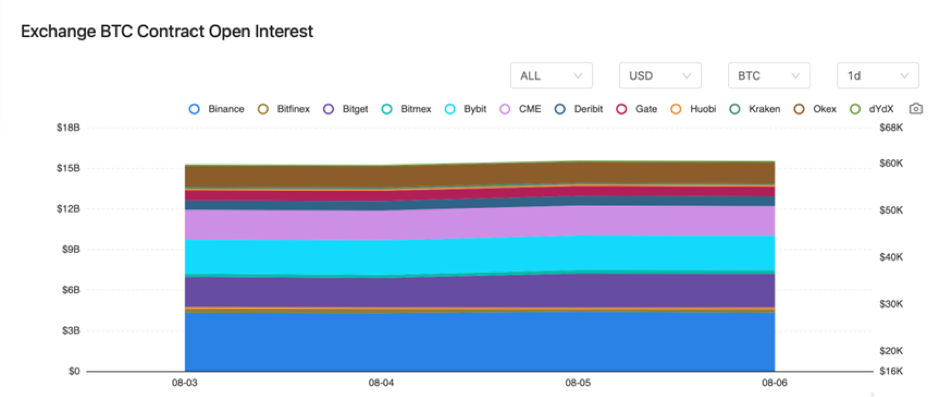

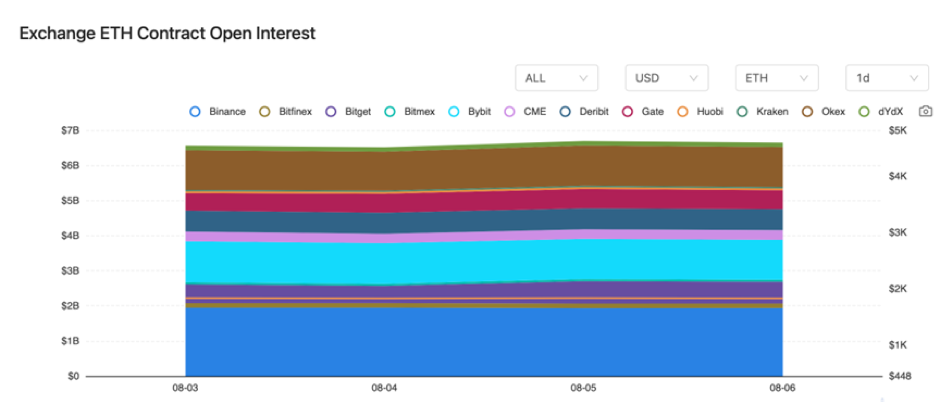

The contract open interest of BTC and ETH remained unchanged from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On August 3, Coinbase announced that its Base mainnet will officially launch on August 9.

2) On August 3, CZ (Changpeng Zhao), CEO of Binance, revealed that Binance has surpassed 150 million registered users.

3) On August 3, OSL obtained approval from the Hong Kong Securities and Futures Commission to upgrade its existing license, enabling the provision of cryptocurrency trading services to retail investors.

4) On August 4, the US non-farm payroll report showed an increase of 187,000 jobs in July, falling below market expectations.

5) On August 4, chat application Discord announced a 4% reduction in its workforce through layoffs.

6) On August 5, the Hong Kong Securities and Futures Commission’s annual report highlighted that virtual asset futures and ETFs are contributing to the development of Hong Kong’s asset and wealth management industry.

7) On August 5, data revealed a decrease of $500 million in the circulating supply of USDC over the past week.

8) On August 6, the founder of Curve Finance sold an additional 28.625 million CRV tokens.

9) On August 6, Grayscale believed that the next US presidential administration will support the development and implementation of Central Bank Digital Currencies (CBDCs).

10) On August 6, China’s Central Political and Legal Affairs Commission warned about fraud groups using new technologies like blockchain, metaverse, and virtual currencies, which possess greater concealment and deceptive capabilities.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.