FameEX Weekly Market Trend | August 3, 2023

2023-08-03 18:47:10

1. Market Trend

Between July 31 and August 2, the BTC price fluctuated between $28,585.7 and $30,047.5, with a volatility of 5.12%. From the 1-hour chart, it failed to hold the $29,000 level. As per the previous analysis, the candlestick pattern suggested a likely break below $29,000 after the upward movement to $29,500. The current trend confirms this view. BTC then dropped below $29,000 and hit a low near $28,500. On the daily chart, a bearish pattern has gradually formed, signaling a decline channel. If the $28,500 support is broken, BTC may test $26,500 or lower. On the evening of August 1, BTC touched the key support at $28,500, causing a strong rebound to resistances at $29,500 and $30,000. BTC retracted from $30,047, implying the importance of the $28,500 support. A potential new range might emerge ($28,500 and $29,500), creating crucial support and resistance levels for trading. Bullish sentiment requires BTC to stabilize above $30,000, and a drop below $28,500 may worsen market sentiment.

Source: BTCUSDT | Binance Spot

Between July 31 and August 2, the price of ETH/BTC fluctuated within a range of 0.06256-0.06401, showing a 2.31% fluctuation. From the 1-hour chart, the ETH/BTC pair has entered a downtrend, being suppressed by the moving average (7-day moving average). However, on higher time frames (4H and 1D), it has not yet fallen below the moving average. As mentioned previously, using the moving average strategy to deal with ETH/BTC remains effective at this point. Given that it has already broken below the moving average on the 1-hour chart, it is even more crucial to pay close attention to managing stop-loss points.

Based on overall analysis, the market has currently made a preliminary direction choice (a downside breakthrough). However, BTC has found strong support at $28,500, which indirectly hindered the retracement of other cryptocurrencies in the market. Currently, many cryptocurrencies have seen gains of 2-3 times compared to their starting points at the beginning of the year. If BTC continues a downward movement, there is no doubt that the retracement of other cryptocurrencies in the market will be deeper. Therefore, it is advisable to observe more and act less. It’s better to wait for BTC to stabilize before making further moves or decisions regarding other cryptocurrencies.

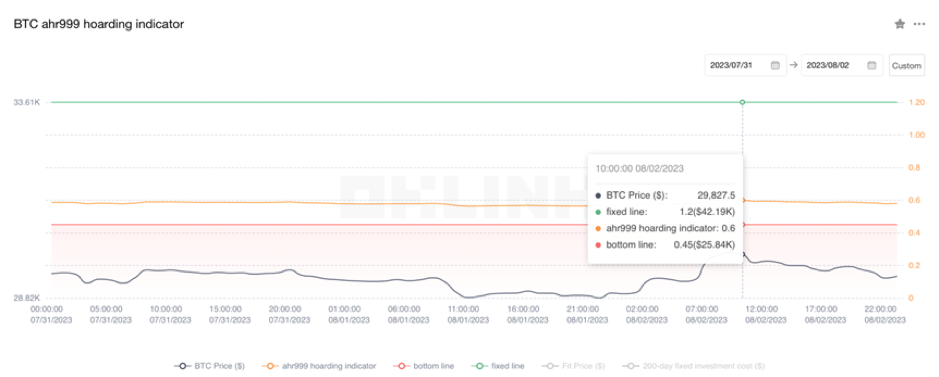

The Bitcoin Ahr999 index of 0.60 is above the buy-the-dip level ($25,840) but below the DCA level ($42,190). It is viable to purchase popular coins through DCA.

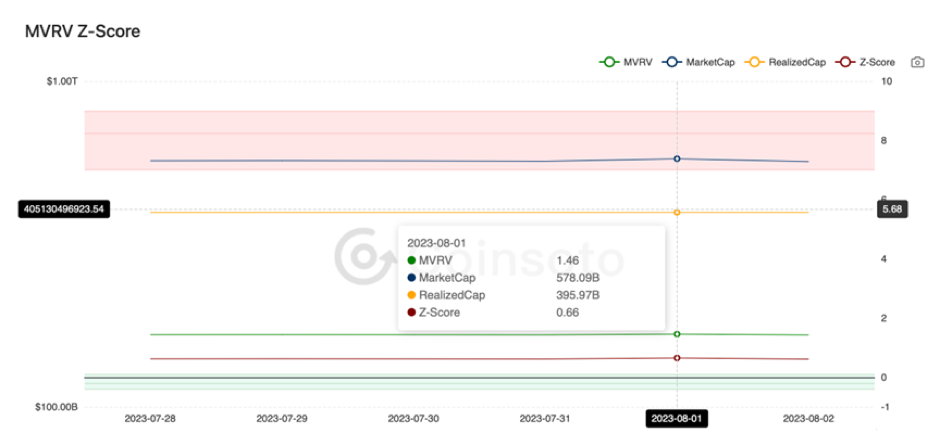

From the perspective of MVRV Z-Score, the value is 0.66. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.33-0.17).

2. Perpetual Futures

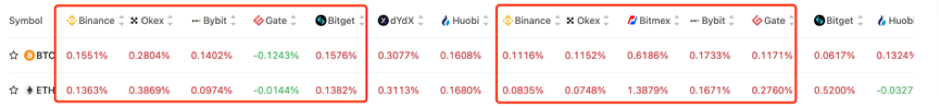

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

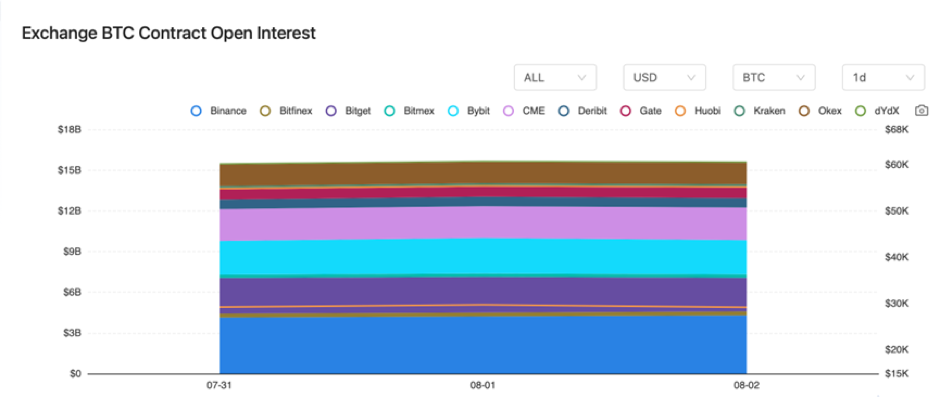

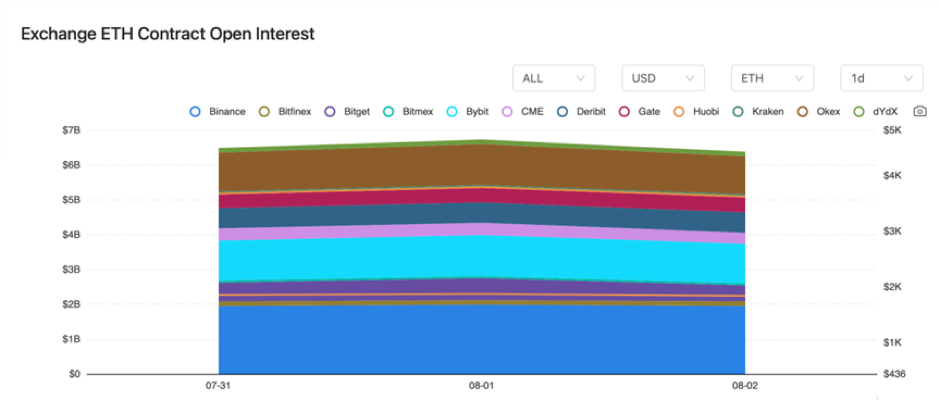

Between July 31 and August 2, the contract open interest of BTC remained unchanged, while that of ETH experienced a slight climb on August 1, but it decreased to the level observed on July 31 on August 2.

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On July 31, Zhao Changpeng (CZ) confirmed that besides FDUSD, there will be an announcement of a new stablecoin partner.

2) On July 31, Tether’s operating profit for the second quarter exceeded $1 billion, and the excess reserve increased by approximately $850 million.

On July 31, according to data, a certain whale retrieved 39,712 locked ETH from an ENS auction.

4) On August 1, a cryptocurrency exchange named ZT Global was suspected to have run away.

5) On August 1, Coinbase stated that the SEC did not request the removal of any assets from its platform.

6) On August 1, FTX submitted a restructuring plan and intended to restart its offshore exchange to compensate for customer losses.

7) On August 1, the founder of Curve sold a total of 54.5 million CRV tokens to obtain $21.8 million in funds.

8) On August 2, U.S. media reported that CZ had attempted to shut down Binance’s operations in the United States.

9) On August 2, KPMG pointed out that Bitcoin has a positive impact on the environment.

10) On August 2, Litecoin (LTC) completed its halving, reducing the block reward from 12.5 to 6.25 LTC.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.