FameEX Weekly Market Trend | May 25, 2023

2023-05-25 17:44:50

1. Market Trend

Between May 22 and May 24, the BTC price fluctuated between $26,080.50 and $27,495,83, with a volatility of 5.42%. According to the 1-hour candle chart, at 9:00 am on May 23, the BTC price started to push towards $27,000 again. It reached a peak of $27,495, which marked the fourth time in the past two weeks that this level was approached ($27,500). Still, the price failed to stabilize and dropped to a low of $26,080. As mentioned before, the market went weak and fell quickly upon touching the resistance level. The price trend also displayed a box range pattern. Therefore, it is recommended to wait and see the market movement and then choose an optimal opportunity to enter the market when the trend has a qualitative change.

Source: BTCUSDT | Binance Spot

Between May 22 and May 24, the price of ETH/BTC fluctuated within a range of 0.0667 to 0.06785, showing a 2.69% fluctuation. Looking at the 1-hour candle chart, since midnight on May 22, the price has steadily risen along the moving average. At 09:00 am on May 23, there was a sharp drop to a low of 0.06670 (observed on Binance, while other exchanges did not experience this). However, it quickly recovered from the decline and continued to maintain an upward trend, resulting in a relatively strong bullish momentum. However, since BTC has not yet shown a clear direction, further observation is required. It is advisable to wait for a clearer market situation before making the next move.

Based on overall analysis, although the BTC price pushes towards the resistance level multiple times, it fails to stabilize and make a breakthrough, showing a significant dispute or conflict between the bulls and the bears. Consequently, the overall market trend is relatively weak. It is recommended to continue to exercise patience and wait for entry opportunities.

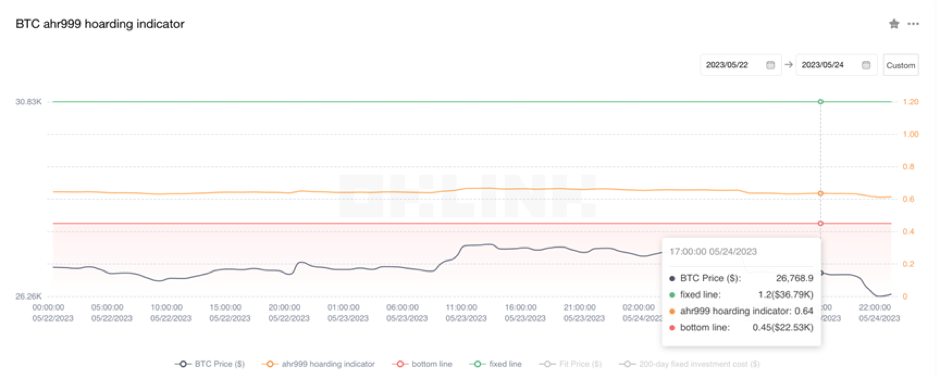

The Bitcoin Ahr999 index of 0.64 is above the buying-the-dip level ($22,530) but below the DCA level ($36,790). It is viable to purchase popular coins through DCA.

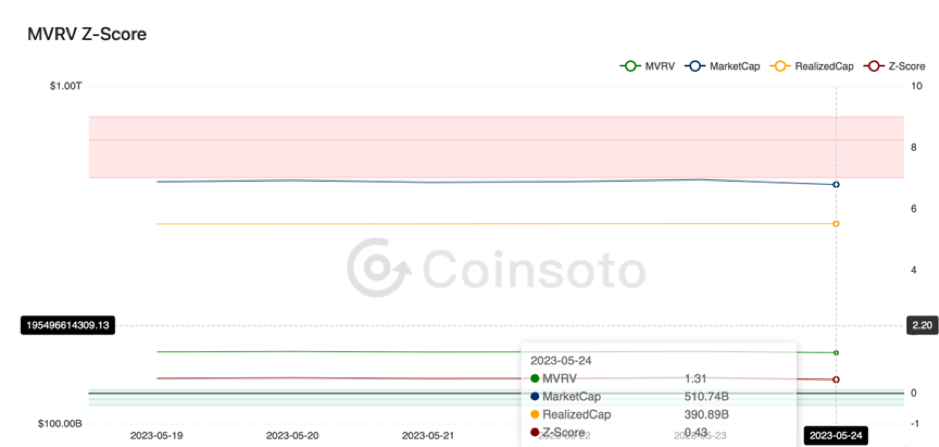

From the perspective of MVRV Z-Score, the value is 0.43. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.33-0.06).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges were positive, indicating that long leverages are relatively high.

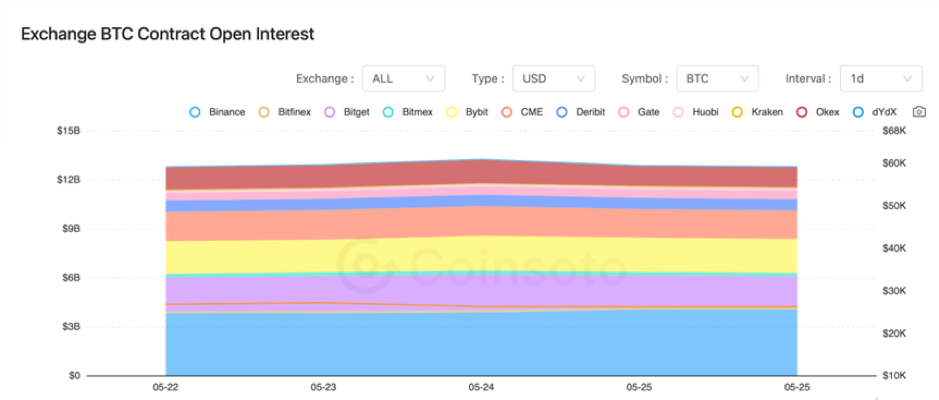

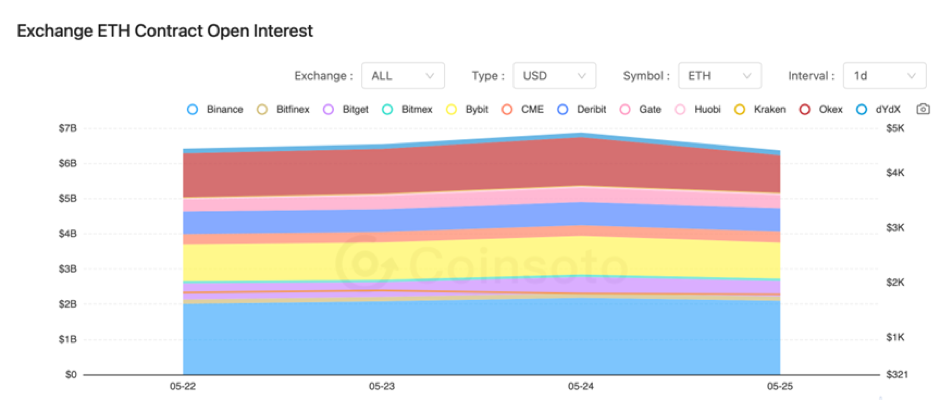

Between May 23 and May 24, there is a slight rise in the contract open interest of BTC and ETH from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On May 22, the total value of MATIC staked on the Lido platform surpassed $100 million.

2) On May 22, according to Fed’s Bullard, there would be a need for an additional 50 basis points of interest rate hikes this year.

3) On May 22, the Hong Kong Securities and Futures Commission (SFC) announced it would hold a media briefing on virtual asset trading platforms on Tuesday.

4) On May 23, Bloomberg reported that Hong Kong’s new regulations on digital assets will allow retail investors to trade cryptocurrencies.

5) On May 23, the Hong Kong Securities and Futures Commission (SFC) announced that it will start accepting applications for virtual asset trading licenses from June 1, 2023.

6) On May 23, the China Metaverse Technology and Application Innovation Platform was established.

7) On May 24, the Hong Kong virtual asset trading platform Gate.HK was officially launched.

8) On May 24, ZA Bank in Hong Kong announced it will offer virtual asset trading services to retail investors under the new licensing regime.

9) On May 24, the major brokerage firm TP ICAP launched the Fusion digital asset trading platform.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.