What is a Solana Spot ETF? Potential Approval, Benefits, and Market Impact Explained

2024/07/24 16:46:10

Key Points:

The recent surge in Solana (SOL) trading activity has led to the submission of applications by VanEck and 21Shares to the U.S. SEC for a spot Solana ETF, highlighting growing institutional interest.

Acknowledgment of these filings by the SEC opens a 240-day decision window, during which the regulatory body will determine the fate of the proposed Solana ETF products.

The potential approval of a Solana spot ETF could enhance the blockchain's credibility, increase market liquidity, and attract significant institutional investment, driving further development within the Solana ecosystem.

On January 10, 2024, the U.S. Securities and Exchange Commission (SEC) approved Bitcoin Spot exchange-traded funds (ETFs), sending waves of excitement through the cryptocurrency community and drawing in billions of dollars in inflows. This pivotal decision has sparked widespread speculation about the possibility of spot ETFs for other major cryptocurrencies, with several issuers already filing applications for Ethereum Spot ETFs. Besides the two mainstream cryptocurrencies mentioned above, Solana (SOL) stands out as a rising star in the blockchain world, making it a strong contender for its own spot ETF.

The recent surge in Solana (SOL) trading activity has garnered significant attention following the submission of applications by VanEck and 21Shares to the U.S. SEC for a spot Solana ETF. This pivotal development, confirmed by filings from the Chicago Board Options Exchange (Cboe) on July 8, 2024, marks a significant milestone in the progression of crypto-based investment products. The Cboe submitted two 19b-4 filings with the SEC, seeking approval to list these Solana ETF products upon regulatory consent.

Upon acknowledgment of the filing by the SEC, a 240-day decision window opens, during which the regulator must determine the fate of these SOL-backed products. This article delves into the feasibility of a Solana Spot ETF in light of Bitcoin’s ETF approval to explore the potential of such an offering while considering the insights gained from Bitcoin’s ETF journey. Additionally, we will examine the unique features of Solana’s blockchain technology that could play a crucial role in influencing the approval of its spot ETF.

What is Solana (SOL)?

Solana is a blockchain platform designed to support decentralized and scalable applications. Launched in 2017, it operates as an open-source project managed by the Solana Foundation in Geneva. Solana stands out for its high transaction speed and low fees compared to other blockchains like Ethereum. The cryptocurrency Solana saw a remarkable rise in value in 2021, increasing by nearly 12,000% and achieving a market capitalization of over $75 billion at its peak, making it one of the most significant cryptocurrencies at the time.

Despite its initial success, SOL was not immune to the broader cryptocurrency market downturn in 2022. By the end of that year, its market capitalization had plummeted to around $3.63 billion. However, by the same time the following year, it had regained nearly half of its lost value. Solana’s unique approach combines proof-of-stake (PoS) and proof-of-history (PoH) mechanisms in order to enable high transaction throughput and quick verification processes. Co-founder Anatoly Yakovenko's background in distributed systems design inspired the development of PoH, which significantly enhances network synchronization and efficiency. This innovative technology allows Solana to potentially process up to 710,000 transactions per second, positioning it as a formidable competitor in the blockchain space.

>> Click here to buy SOL directly <<

What is Solana (SOL) Spot ETF?

A Solana Spot ETF is a regulated financial product that tracks the price of Solana's native cryptocurrency, SOL. It allows investors to gain exposure to Solana without directly purchasing and managing SOL tokens. This ETF holds actual SOL tokens with its value fluctuating based on SOL's market price. It offers benefits such as accessibility through traditional brokerage accounts, diversification, and liquidity since it is traded on major stock exchanges. Overall, a Solana Spot ETF provides a convenient and regulated way to invest in the Solana ecosystem.

Difference Between SOL Spot ETF vs. BTC Spot ETF:

The main difference between a SOL Spot ETF and a BTC Spot ETF lies in the underlying assets they track. A SOL Spot ETF tracks the price of Solana (SOL), a high-performance blockchain known for its fast transaction speeds and low costs, while a BTC Spot ETF tracks the price of Bitcoin (BTC), the first and most well-known cryptocurrency, often considered digital gold.

When you invest in a SOL Spot ETF, you do not need to buy and hold actual Solana tokens, yet you gain direct exposure to Solana's price movements and the growth of its ecosystem. Similarly, investing in a BTC Spot ETF does not involve directly holding Bitcoin. Instead, it means gaining exposure to Bitcoin's price fluctuations and its market dominance.

Both ETFs offer investors a way to gain exposure to these cryptocurrencies without directly managing the digital assets. The choice between them depends on whether an investor prefers the innovative potential and transaction efficiency of Solana or the established value and market leadership of Bitcoin. However, BTC Spot ETFs are already available in the market. Many online brokers that offer ETFs list Spot Bitcoin ETFs. For example, Fidelity has its own spot Bitcoin ETF, the Fidelity Wise Origin Bitcoin Fund (FBTC), which has been approved. On the other hand, a SOL Spot ETF is not currently listed in the market. Despite this, both ETFs share similar features.

Benefits of a Solana Spot ETF:

The potential approval of a Solana spot ETF could bring significant benefits to the cryptocurrency market and Solana itself. Primarily, it would offer a more accessible investment vehicle for both institutional and retail investors seeking exposure to Solana without the complexities of directly purchasing and managing the cryptocurrency. This ease of access could drive increased demand and liquidity for Solana, potentially boosting its market value. Moreover, the introduction of a Solana ETF would validate the blockchain's standing alongside established cryptocurrencies like Bitcoin and Ethereum, fostering further adoption and development within the Solana ecosystem. It would also signal a broader acceptance of diverse digital assets in mainstream financial markets, enhancing Solana's credibility and encouraging a wider range of investors to participate in the crypto economy.

Additionally, the creation of a Solana ETF could catalyze technological advancements and improvements within the blockchain. The influx of institutional capital and increased scrutiny from regulatory bodies would likely push Solana towards greater reliability, security, and scalability. This could lead to a more robust infrastructure and a stronger overall network, benefiting all users and developers. Furthermore, the SOL Spot ETF's approval could pave the way for similar products based on other emerging cryptocurrencies to promote innovation and expanding the investment landscape for digital assets.

How Does Solana Spot ETF Work?

A Solana Spot ETF would function by holding a collection of SOL tokens in secure custody, with the ETF share prices fluctuating based on the real-time market value of these underlying tokens. Investors could buy and sell shares of the Solana Spot ETF on traditional stock exchanges, similar to trading regular stocks, without the need to directly hold the SOL tokens on certain crypto CEX or DEX exchanges.

Is the Solana ETF Approval Possible?

Recent proposals for a Solana ETF have ignited considerable debate within the crypto community. The plan seeks to introduce a spot ETF tracking the performance of Solana, a blockchain celebrated for its high transaction speed and low costs. This initiative is viewed as a significant milestone that could attract more institutional attention and investment to Solana. Following the announcement, Solana’s price surged, reflecting market optimism. However, despite the excitement, the likelihood of the ETF being approved by the U.S. SEC remains low, given the current regulatory environment.

The potential benefits of a Solana ETF are substantial as mentioned above. On the downside, several hurdles stand in the way of a Solana ETF’s approval. The SEC has historically been cautious about approving crypto-based ETFs, primarily due to concerns about market manipulation and the lack of a regulated futures market for Solana. Unlike Bitcoin and Ethereum, which had futures products available before their respective ETFs were considered, Solana currently lacks this infrastructure, complicating its ETF proposal. Additionally, Solana’s past network outages might raise concerns about its reliability and stability, potentially affecting the SEC’s decision.

The overall reaction to the Solana ETF proposal highlights the mixed sentiments within the crypto industry. While some view it as a bullish development that could pave the way for more crypto ETFs, others remain skeptical about its approval under the current regulatory climate. If approved, the ETF could set a precedent, leading to a wave of similar products for other cryptocurrencies. However, this depends on significant regulatory shifts, which might be influenced by political changes in the coming year.

Anticipating the Launch: When Will the Solana Spot ETF Hit the Market?

The highly anticipated Solana Spot ETF is possibly set to be listed in March 2025. This ETF will provide a regulated and secure avenue for institutional investors to gain exposure to Solana without directly purchasing the cryptocurrency. The Chicago Board Options Exchange (CBOE) has filed two 19b-4 forms for the VanEck Solana Trust and the 21Shares Core Solana ETF, underscoring the perceived resilience of Solana to price manipulation. The SEC now has 240 days to deliberate on the rule change proposed by the CBOE, with a final deadline for approval projected for mid-March 2025.

Even with several factors mentioned above that will influence the listing of the Solana ETF, the market prepares for this landmark event. The potential approval of the Solana ETF is poised to attract new institutional investments and increase liquidity, though it may also introduce greater volatility depending on market reactions. Investors are advised to stay vigilant and adapt their strategies accordingly in the lead-up to March 2025.

Exciting Projects to Pay Attention to on the Solana Network

If Solana were to receive ETF approval, similar to what occurred with Ethereum (ETH), it could significantly impact SOL's value. Besides the SOL token itself, the Solana network presents numerous promising opportunities for investors and developers. When speculation about the ETH ETF began, the value of ETH initially rose. This culminated in a 25% surge upon official approval. If SOL were to gain similar ETF approval, it is projected that SOL could experience a substantial increase in value. This approval could also act as a powerful catalyst, driving dramatic growth in the Solana ecosystem. Here are some possible opportunities in the Solana network that you can pay attention to:

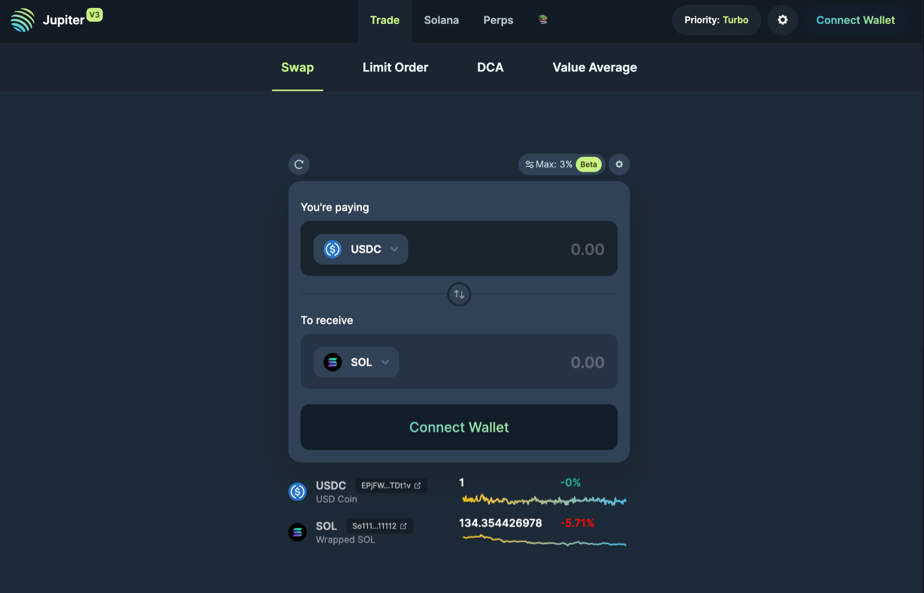

Jupiter (JUP): A Leader in Decentralized Finance on Solana Blockchain

Jupiter is a leading platform in the DeFi sector on the Solana blockchain, renowned as the world's most popular DEX aggregator. Initially focused on aggregating liquidity for token swaps, Jupiter has expanded its offerings to include perpetual futures and plans to launch its own decentralized stablecoin. These developments aim to address custodial and regulatory issues associated with centralized stablecoins like USDC and USDT. Governed by its native JUP token, the platform enables community members to vote on key decisions, including liquidity plans, token issuance, and ecosystem projects, aligning with DeFi’s decentralized ethos.

>> Click here to buy JUP directly <<

JUP Swap, Source:JUP official Website

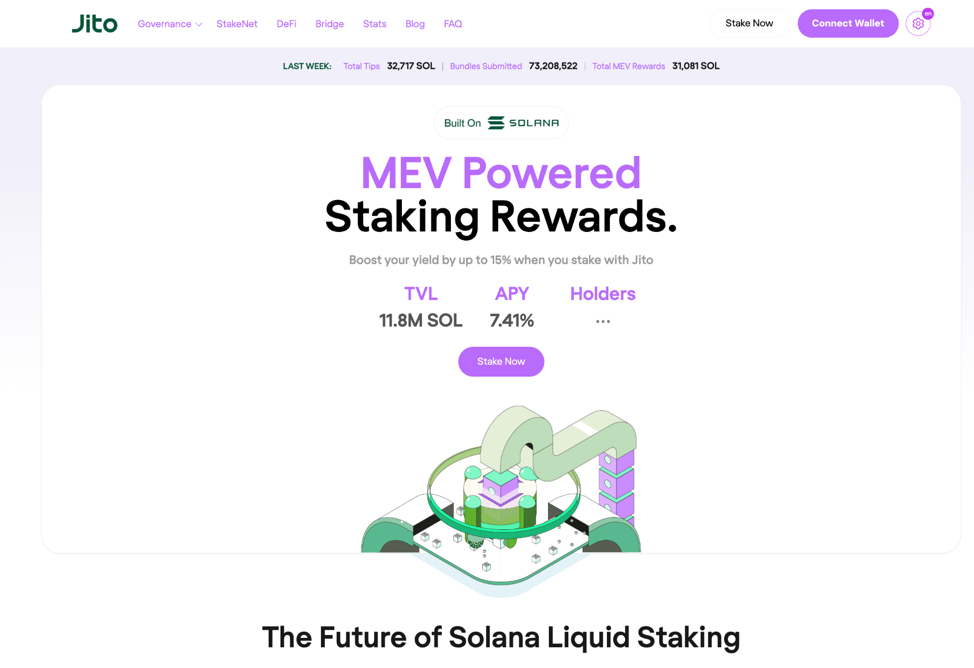

Jito (JTO): A Pioneer in Liquid Staking on the Solana Blockchain

Jito is a liquid staking platform on the Solana blockchain that enhances user returns through Maximum Extractable Value (MEV) rewards. By staking SOL tokens in the Jito Stake Pool, users receive JitoSOL tokens, which provide liquidity and combine both staking and MEV rewards. Jito's approach decentralizes the network by utilizing stake pools made up of multiple validator nodes, optimizing capital efficiency and supporting high-quality network operators. With a focus on security, JTO operates on a non-custodial basis, ensuring users retain control over their assets while benefiting from the integrated DeFi opportunities and contributing to Solana's overall performance and decentralization.

>> Click here to buy JTO directly <<

JTO MEV, Source:Jito official website

Tensor (TNSR): A Leading NFT Marketplace on the Solana Blockchain

Tensor (TNSR) is an innovative NFT marketplace established on the Solana blockchain. Launched in July 2022, it has rapidly gained popularity for its efficient and user-friendly NFT trading experience, capturing between 60% and 70% of the daily Solana NFT trading volume by April 2024, according to CoinMarketCap. The platform offers deep liquidity, real-time updates, and advanced trading instruments, catering to both professional traders and casual collectors. Additionally, creators can manage and launch their own NFTs on Tensor. The native TNSR token plays a crucial role in governance, transaction fee discounts, and community incentives, driving the ecosystem by giving users a stake in its growth and direction.

>> Click here to buy TNSR directly <<

TNSR, Source: TNSR official website

Conclusion

The applications by VanEck and 21Shares for a spot Solana ETF mark a significant development in the cryptocurrency market, reflecting Solana's rising prominence and the increasing institutional interest in its high-performance blockchain. With the SEC's acknowledgment of these filings, a 240-day decision window has opened, during which the regulatory body will evaluate the proposed Solana ETF products. If approved, a Solana spot ETF would provide a regulated and accessible investment vehicle for both institutional and retail investors, allowing them to gain exposure to Solana without the complexities of directly managing the cryptocurrency. This approval could enhance Solana's credibility, increase market liquidity, and attract substantial institutional investment, driving further innovation and development within the Solana ecosystem. The approval of a Solana spot ETF could also signal broader acceptance of diverse digital assets in mainstream financial markets, paving the way for similar products for other emerging cryptocurrencies.

FAQ

Q: What Is a Solana Spot ETF and How Does It Work?

A: A Solana Spot ETF is a regulated financial product that tracks the price of Solana's native cryptocurrency, SOL. It allows investors to gain exposure to Solana without directly purchasing and managing SOL tokens. Investors can buy and sell shares of the Solana Spot ETF on traditional stock exchanges, providing a convenient and regulated way to invest in the Solana ecosystem.

Q: What Are the Potential Benefits of a Solana Spot ETF?

A: The potential approval of a Solana Spot ETF could bring significant benefits, such as increased accessibility for both institutional and retail investors, greater market liquidity, and enhanced credibility for Solana. By offering an easier investment vehicle, it could drive demand and boost Solana's market value.

Q: When Is the Solana Spot ETF Expected to Be Approved and Listed?

A: The Solana Spot ETF is currently under review by the U.S. SEC, following applications submitted by VanEck and 21Shares. The SEC has a 240-day decision window to evaluate the proposal, with a final decision expected by mid-March 2025. If approved, the Solana Spot ETF could be listed shortly thereafter, providing investors with a regulated and secure avenue to gain exposure to Solana.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.