Futures Trading vs. Spot Trading: Understanding the Key Differences

2024/06/25 21:22:20

The financial market is a diverse ecosystem, and traders in Australia have numerous avenues for investment. Two of the most popular methods include futures trading and spot trading. While both are essential components of the financial market, they vary significantly in their mechanics, risks, and potential returns. This article aims to unravel the key differences between futures trading and spot trading, especially within the burgeoning cryptocurrency sector.

The Rise of Crypto Derivatives Trading: How Did It Gain Popularity?

Crypto derivatives trading, a sub-sector within the broader crypto trading landscape, has gained significant traction in recent years. Crypto derivatives, including futures, allow investors in Australia to speculate on the future prices of cryptocurrencies. These instruments became popular as they offered advantages such as hedging against market volatility, leveraging positions for higher potential returns, and providing the ability to profit in both rising and falling markets.

The rising popularity of cryptocurrency derivatives trading in recent years is largely due to a number of factors including record-breaking trading volumes set by established platforms in 2020 and the introduction of innovative products by new market players. Notably, trading volumes for both spot and derivatives were identical in the first half of 2021 until crypto derivatives trading began to surpass spot trading in June. However, it's important to note that crypto derivatives trading, often facilitated by leverage offered on many Australian exchange platforms, is a high-stakes venture suitable for seasoned investors due to the potential for large gains in favorable market conditions and equally substantial losses in the face of rapid downturns. Despite these risks and increased regulatory scrutiny, the momentum of cryptocurrencies and the ensuing investment wave shows no signs of stopping, with more investors in Australia entering the market. For beginners, a key step towards successful trading is understanding the distinction between spot and futures trading.

Introduction to Spot Trading

Spot trading, often referred to as "spot market trading," is where financial instruments like securities, commodities, or currencies are bought or sold for immediate delivery.

What Is Spot Trading In Crypto?

In the realm of cryptocurrencies, spot trading involves the immediate purchase or sale of a particular cryptocurrency at its current market price, known as the spot price. Crypto spot trading allows for the direct ownership and possession of the cryptocurrency, which is typically transferred to the trader's wallet or account after the trade.

What Is A Spot Market?

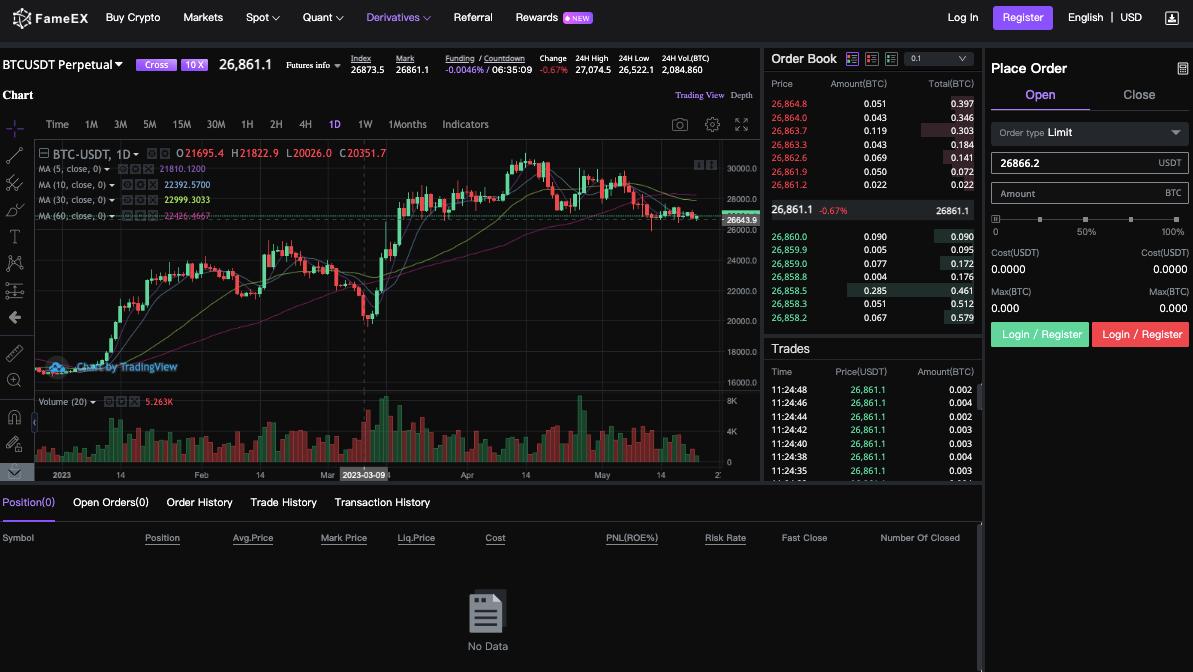

A spot market is a financial market where assets are traded for immediate delivery. In a spot market, transactions are settled "on the spot", meaning the buyer pays the seller, and the seller delivers the assets to the buyer immediately. For instance, in the Bitcoin spot market, investors possess, purchase, and sell actual Bitcoins. Essentially, it is the base market where Bitcoins are traded. The image below illustrates the concept of a spot market, as exemplified through a BTC/USDT spot trading pair on FameEX. In this pair, BTC (Bitcoin) acts as the base currency, being the first currency listed. Subsequently, USDT (Tether) is the quote currency. This market configuration allows traders to exchange Bitcoin for Tether, as they can either sell Bitcoin for Tether or use Tether to buy Bitcoin.

Introduction to Futures Trading

Futures trading, on the other hand, is a form of derivatives trading where traders buy and sell futures contracts. It represents a derivative trading modality where the value of a contract depends on the performance of the underlying entity. This underlying asset could range from financial instruments to an assortment of commodities such as currencies, stocks, and the likes. These derivative instruments typically serve a dual purpose - they act as a hedge against potential risk and are a tool for speculation, allowing traders to gain exposure to certain price movements.

What Is Futures Trading In Crypto?

In crypto futures trading, a futures contract is an agreement to buy or sell a particular cryptocurrency at a predetermined price at a specific date in the future. Unlike spot trading, futures trading does not involve immediate ownership of the cryptocurrency. Instead, it's about speculating on the future price of the crypto asset.

Futures trading in the realm of cryptocurrency involves the procurement and disposal of contractual obligations, mandating either the buyer or seller to transact a specific cryptocurrency at a predetermined price on a pre-set future date. This unique feature enables traders to engage in speculation about the asset's future price, bypassing the necessity of actual ownership of the said asset. Futures is one of derivatives which is defined as a contract predicated on the performance value of an underlying entity, which may be constituted by a financial asset or an array of assets inclusive of commodities, currencies, and equities. The primary use of such derivative products is to alleviate risk or to augment exposure to certain price oscillations, an activity colloquially referred to as speculation.

What Is A Futures Market?

A futures market is a marketplace where futures contracts are traded. These contracts standardize the quality, quantity, delivery time, and price of the asset being traded. Futures markets play a crucial role in price discovery and risk management in the financial industry.

A futures market represents a financial arena where participants engage in the purchasing and selling of futures contracts. This serves a dual purpose: it provides a mechanism to mitigate the risks associated with price volatility and also offers an avenue for speculating on the prospective prices of a diverse array of assets including stock indices, currencies, commodities, interest rates, and others. A futures contract embodies an agreement to transact a specific security at a predetermined price on a stipulated future date. In contrast to options contracts, those acquiring futures contracts typically bear the obligation to fulfill their contractual commitments, including the acceptance of delivery of the underlying asset. Futures markets are integral to many business operations, assisting companies in securing future prices of vital commodities required for their routine operations. This could include resources such as fuel or grain, thereby offering a degree of predictability and stability in the face of potential market fluctuations.

In the Bitcoin derivatives market, investors enter into an agreement or contract to buy Bitcoin at a predetermined price and a specified time in the future. As mentioned above, in this market investors don’t own actual bitcoins but rather trade on Bitcoin’s speculative price. Bitcoin contracts, which can either be futures, perpetual contracts, swaps, or options obtain their value from the value of Bitcoin.

A Side-by-Side Comparison: Futures Trading vs. Spot Trading Similarities

Though they have key differences, futures trading and spot trading do share certain similarities. Both are driven by supply and demand dynamics and both enable traders to speculate on price movements of underlying assets. Additionally, they both offer opportunities for profit, regardless of whether the market is bearish or bullish.

Futures Trading vs. Spot Trading: Examining the Key Differences

Despite these similarities, the key differences between futures and spot trading are significant. Firstly, futures trading involves buying and selling contracts that represent an agreement to buy or sell an asset in the future, while spot trading involves the immediate exchange of assets.

Futures contracts also allow for trading on margin, meaning traders can enter positions larger than their current account balance, which is not typically possible in spot markets. Furthermore, futures trading provides the ability to short sell, enabling traders to profit from falling prices, a feature not available in spot markets.

Comparison of Spot Trading and Futures Trading

Spot Trading | Futures Trading | |

Ownership of crypto | Immediate transactions at the current market price and immediate ownership transfer | Speculate on future prices, permitting leverage use and enabling profit opportunities irrespective of the market's rise or fall |

Profit Opportunities | Pay full value of the asset | Pay the margin for the asset |

Leverage | No | Up to 100X Leverage |

Risk | Lower | Higher |

Evaluating the Risks: Spot Trading vs. Futures Trading

While both futures trading and spot trading come with inherent risks, these risks are different. Spot trading is often seen as less risky as it does not involve leverage, and traders own the assets they purchase. However, they are still exposed to market risk should the spot price of their asset fall.

Futures trading, on the other hand, can be riskier due to the leverage involved. While leverage can amplify profits, it can also magnify losses. Additionally, futures contracts come with an expiry date, adding a time-based risk factor that spot trading does not possess.

Navigating the Trade-offs: Spot Markets vs. Futures Market for Traders

Trading in both spot and futures markets carries inherent risks, but the nature of these risks varies between the two. Spot trading is frequently perceived as less hazardous since it doesn't involve leverage and allows traders to have ownership of the assets they acquire. However, traders are not immune to market risks, as the spot price of their asset could decrease. On the contrary, futures trading carries more risk due to the leverage involved. While leverage has the potential to increase profits, it also escalates the losses.

Pros and Cons Of Spot Markets

Spot markets offer simplicity and direct ownership of assets. Traders can buy crypto and hold onto it as long as they wish, offering a level of control and certainty. However, spot trading lacks the flexibility offered by futures markets in terms of leveraged trading and profit opportunities in bearish markets.

Advantages & Disadvantages Of Futures Markets

Futures markets offer significant leverage, allowing traders to command large positions with a relatively small investment. These markets provide opportunities to profit in both bullish and bearish scenarios and offer a way to hedge against price volatility.

What Is The Benefit Of Trading In The Futures Market?

Futures markets offer high leverage, enabling traders to control large positions with a relatively small amount of capital. They also offer the opportunity to profit from both rising and falling markets, as well as the ability to hedge against price volatility.

What Is The Downside Of Trading In The Futures Market?

The downside of futures trading lies in its complexity and the high risk associated with leverage. Incorrect speculations can lead to substantial losses, especially when trading on margin. Furthermore, some futures contracts come with an expiration date, adding additional considerations for traders.

How to use Crypto Futures to Hedge your Bitcoin & Crypto Holdings?

Crypto futures can serve as a valuable tool for hedging against potential price downturns. By taking a short position in a futures contract, traders can offset potential losses in their spot holdings should the market decline. This allows traders to manage their risk effectively, providing a layer of protection for their crypto investments.

An investor, for instance, who owns 1 Bitcoin (BTC) valued at $26,000 could protect that investment by establishing a short position in the BTC futures market at the same price. The level of leverage used is adjustable based on the investor's comfort.

If the BTC price drops, the investor's loss on the BTC holding would be offset by profits gained from the short futures position due to the leverage. This scenario could even provide the investor an opportunity to further invest in BTC at the lower price, anticipating potential profits when the market rebounds. Alternatively, if the BTC price increases, the gain on the BTC holding would be balanced by a loss on the short futures position, requiring the investor to strategically exit this position with minimal loss. It's essential to note that while high leverage can potentially amplify short-term profits, it can also exacerbate losses if the market moves unfavorably. Hence, careful planning and risk awareness are crucial when employing leverage and hedging strategies in the crypto futures market.

Conclusion

Choosing between futures trading and spot trading depends on a trader's objectives, risk tolerance, and understanding of the markets. While futures trading offers opportunities for leverage and short selling, it also involves a higher degree of risk. Conversely, spot trading is simpler and less risky but lacks the potential for leveraged returns and short selling. Trading platforms like FameEX, known as derivatives exchanges, enable the dealing in derivative assets, including crypto futures. Analogous to spot exchanges, FameEX also operates non-stop, around the clock for both users and traders.

Frequently Asked Questions About Future Trading vs. Spot Trading

Derivatives trading vs spot trading: the differences?

Derivatives trading, like futures trading, involves contracts that derive their value from underlying assets. Spot trading involves the immediate purchase or sale of an asset. Both methods offer different opportunities and risks for traders.

Which is a better spot for futures trading?

The choice between spot and futures trading depends on several factors, including risk tolerance, investment goals, and market knowledge. Futures trading can offer higher potential returns but also carries higher risk. Spot trading is generally less risky but offers lower potential returns.

Can beginners trade in futures?

Yes, beginners can trade in futures. However, it's crucial to have a firm understanding of the mechanics and risks associated with futures trading. Comprehensive research, education, and risk management strategies are essential.

Crypto futures price vs spot price: the differences?

The crypto futures price refers to the price agreed upon in the futures contract for the purchase or sale of the cryptocurrency at a future date. The spot price refers to the current market price of the cryptocurrency. Differences between these prices can offer traders opportunities for arbitrage.

This is not investment advice. Please conduct your own research when investing in any project.